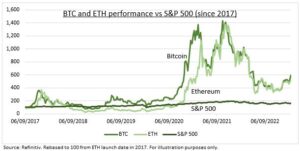

BEST PERFORMER: Bitcoin (BTC) soared 70% this year and our related equity basket 45%. Crypto is the world’s best performing asset class, for the 11th time in its 14 year existence. The surge came as scares over the centralized banking system drove confidence in decentralized crypto. And as risk assets boosted by the outlook for a quicker fall in inflation and interest rates. Even if the wilder hopes of a QE resumption are misplaced. Short covering also played a part. BTC may be due a breather after its sharp sentiment recovery, but we expect the good macro to be more important than micro and the asset class to be one of the positive wild cards of 2023.

FEAST VS FAMINE: Since its founding thirteen years ago, Bitcoin has been top of the annual asset class performance tables in ten years. It has also been the worst performer in three years (2014, 2018, 2022). It is either feast or famine for the famously volatile asset. The current rally has seen Bitcoin’s asset class ‘dominance’ rise over 40%, and its correlation to S&P 500 and NASDAQ fall back. But this still leaves it under half its $64,000 peak. Whilst our related equity basket, from Coinbase (COIN) to NVIDIA (NVDA), is 30% off highs. Support has been driven by retail investors, with a huge 29% owning, per our global retail investor beat survey. Whilst institutional investors, the traditional early adopters, have been slow to return. @CryptoPortfolio.

FUNDAMENTALS: We believe the top-down macro outlook remains the main crypto driver for now. And the lower inflation and interest rate outlook is supportive. But the bottom up drivers are positive. From ecosystem development, to firm retail interest, the coming Ethereum Shanghai upgrade (next month), Bitcoin ‘halving’ (April 2024), and more regulation (after global FSB and BCBS crypto frameworks, and EU MiCA passage) plus eventual institutional adoption catalysts.

All data, figures & charts are valid as of 23/03/2023