Bitcoin ($BTC) has gradually established itself as a standalone asset within the framework of asset allocation.

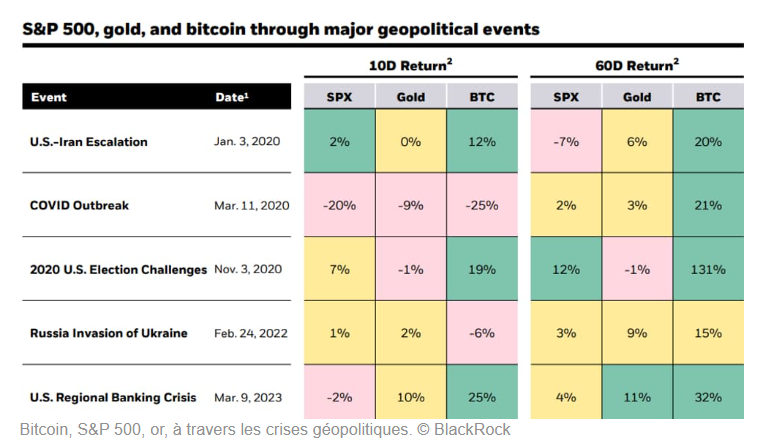

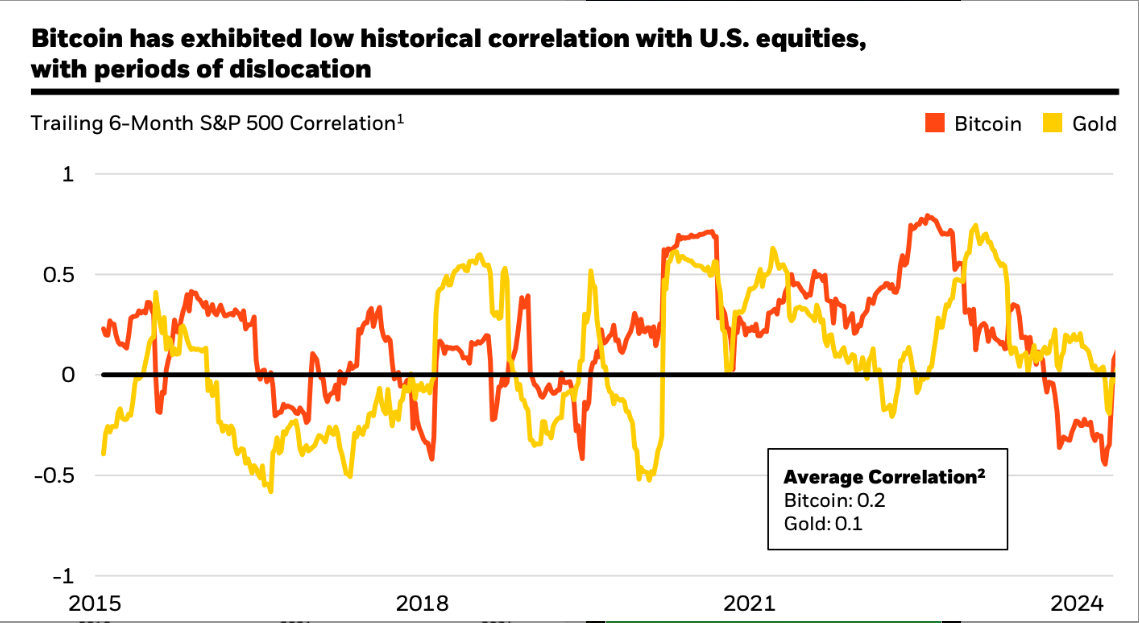

Considered by institutions such as BlackRock as an excellent diversification tool due to its low correlation with traditional asset classes (stocks, bonds), Bitcoin is attracting an increasing number of investors.

Below, we can see how Bitcoin has behaved during different crises compared to other assets.

However, investing directly in cryptocurrencies involves significant challenges: high volatility, managing digital wallets, and the administrative complexity of tax reporting for gains or losses. An interesting solution to benefit from the advantages of this market while bypassing these obstacles is to invest in cryptocurrency-related stocks. These stocks offer an indirect alternative to Bitcoin while playing a diversifying role in an investment strategy.

Why Are Cryptocurrency-Related Stocks Diversification Tools?

Stocks of cryptocurrency-related companies occupy a unique position in the investment landscape. They allow investors to benefit from the growth trends of the crypto market without directly investing in digital assets. Like Bitcoin, they exhibit characteristics that make them attractive in a diversified asset allocation:

- Moderate Correlation with Traditional Assets: Although some of these stocks are traded on exchanges, they do not always follow the movements of traditional indices (S&P 500, Nasdaq). Their performance depends more on crypto market fluctuations and blockchain technology adoption.

- High Growth Potential: Companies operating in the crypto ecosystem (mining, trading platforms, blockchain technologies) are positioned in rapidly expanding markets. This growth is independent of traditional economic cycles.

- Indirect Exposure to Crypto Volatility: Unlike directly purchasing Bitcoin, these stocks can offer reduced risk through the diversification of companies’ revenue streams (e.g., NVIDIA or PayPal derive significant income from other sectors).

Main Categories of Cryptocurrency-Related Stocks

- Cryptocurrency-Specialized Companies

These companies are directly exposed to cryptocurrency performance. They include trading platforms like Coinbase Global (COIN), whose revenues increase with transaction volumes, or mining companies such as Marathon Digital Holdings (MARA), Riot Platforms ($RIOT), and Hut 8 Mining ($HUT).

These stocks are ideal for investors seeking a high correlation with Bitcoin while diversifying their portfolios. - Hardware Manufacturers

Companies like NVIDIA ($NVDA) and $AMD benefit from the growing demand for mining equipment. While their activities are influenced by the crypto market, they also profit from other growth drivers, such as artificial intelligence, video games, and cloud computing. These companies provide partial exposure to the crypto market with a more diversified risk profile. - Blockchain-Driven Companies

Tech giants such as Block, Inc. (SQ) or MicroStrategy ($MSTR) use blockchain to develop innovative financial solutions. PayPal (PYPL) and Visa (V) also integrate blockchain to facilitate digital payments. These companies offer indirect exposure to the crypto sector while capitalizing on broader blockchain opportunities.

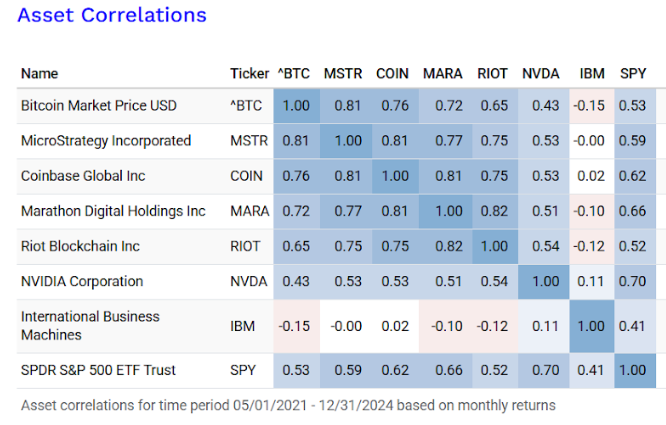

Which Stocks Are Most Correlated with Bitcoin?

Certain stocks have a stronger correlation with Bitcoin due to their direct dependence on its performance. For example:

- MicroStrategy (MSTR): This company holds significant Bitcoin reserves, making its valuation highly linked to BTC price movements.

- Marathon Digital Holdings (MARA) and Riot Platforms (RIOT): These mining companies rely directly on the profitability of operations, which is influenced by Bitcoin prices.

Coinbase (COIN): The trading volumes on its platform vary according to overall interest in cryptocurrencies.

Conversely, companies like NVIDIA or IBM have a lower correlation with Bitcoin as they diversify their activities beyond the crypto market.

It is even possible to closely mimic Bitcoin’s performance by combining several stocks. For instance, a portfolio comprising (MSTR0.3 + MARA0.3 + COIN*0.7)/1.3 closely tracks Bitcoin’s movements.

How to Integrate These Stocks into Asset Allocation

- Define Your Investment Goals

Before investing, it is essential to set your objectives. Do you want to maximize portfolio diversification, reduce volatility, or capitalize on crypto growth? These goals will determine which types of stocks to prioritize. - Diversify Within the Crypto Sector

Combine companies directly correlated with Bitcoin (like MicroStrategy or Riot) with diversified companies (like NVIDIA or PayPal).

Consider ETFs such as the Grayscale Bitcoin Trust (GBTC) or Amplify Transformational Data Sharing ETF (BLOK) to spread investments across multiple sector players. - Adopt a Gradual Approach

Given the volatility of crypto-related stocks, it may be wise to invest gradually. A strategy like Dollar-Cost Averaging (DCA) can help mitigate the effects of market fluctuations. - Regularly Reevaluate Your Allocation

Crypto-related stocks are sensitive to technological innovations and regulatory changes. Regularly reviewing your allocation ensures alignment with your objectives.

Crypto Stocks as a Complement to Bitcoin in a Diversified Portfolio

Incorporating cryptocurrency-related stocks into an asset allocation can enhance portfolio diversification. While Bitcoin serves as an uncorrelated asset relative to traditional markets, these stocks offer hybrid exposure. They combine the potential growth of the crypto market with more stable fundamentals, thereby reducing some of the risks associated with direct crypto investment.

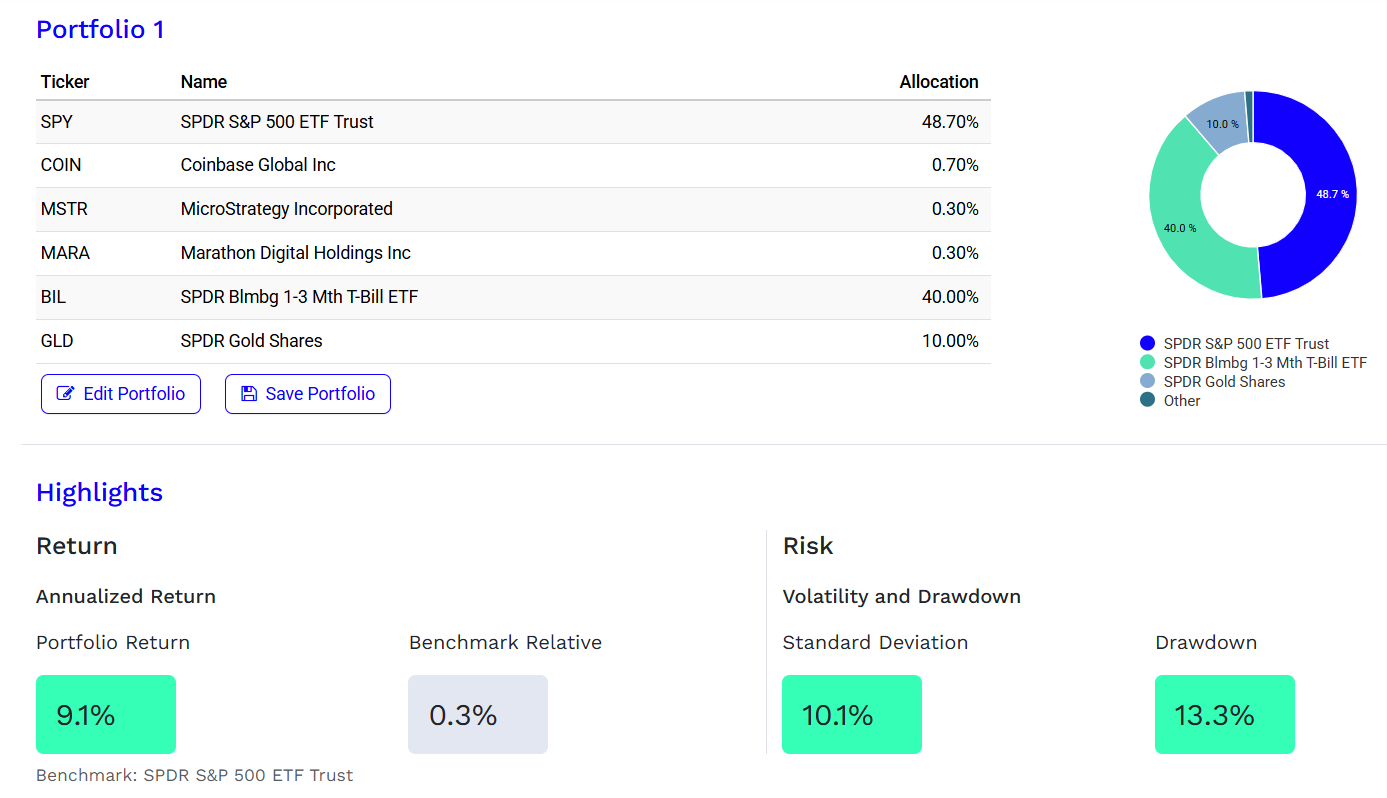

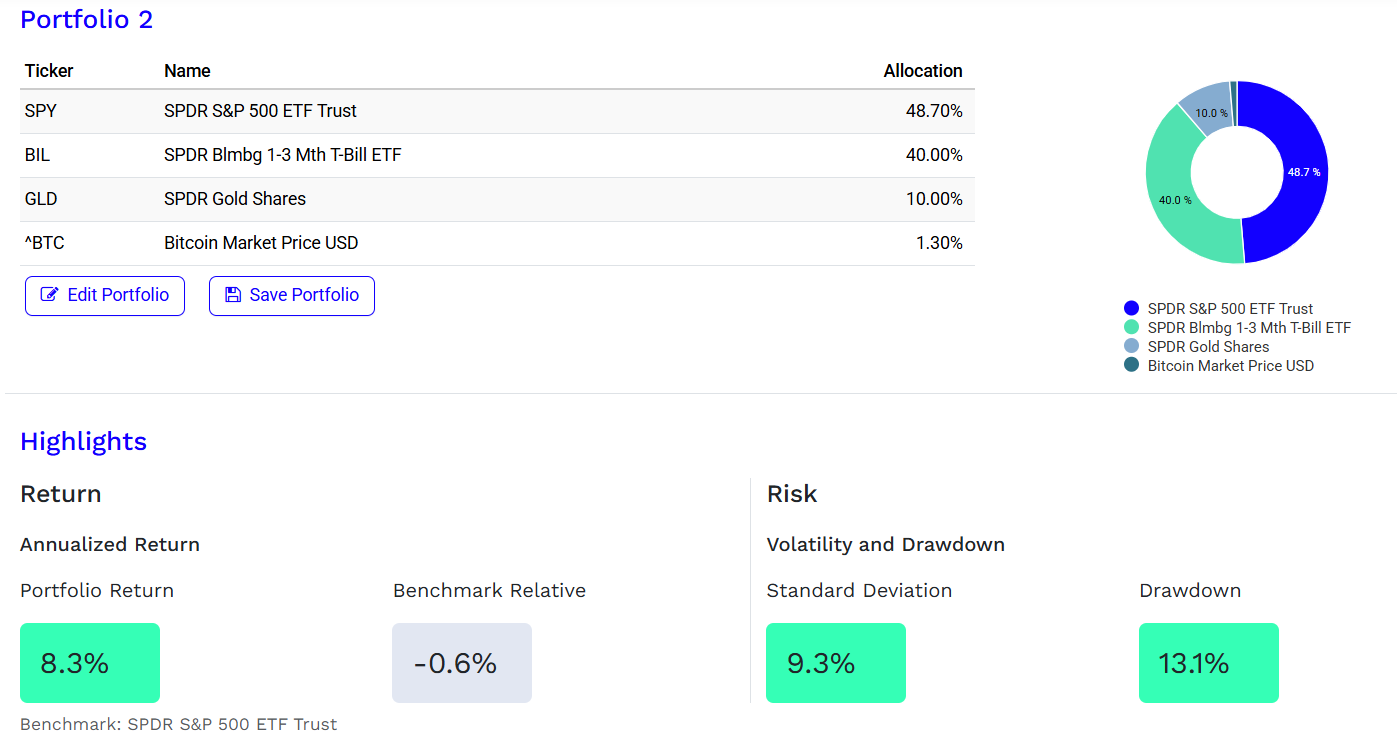

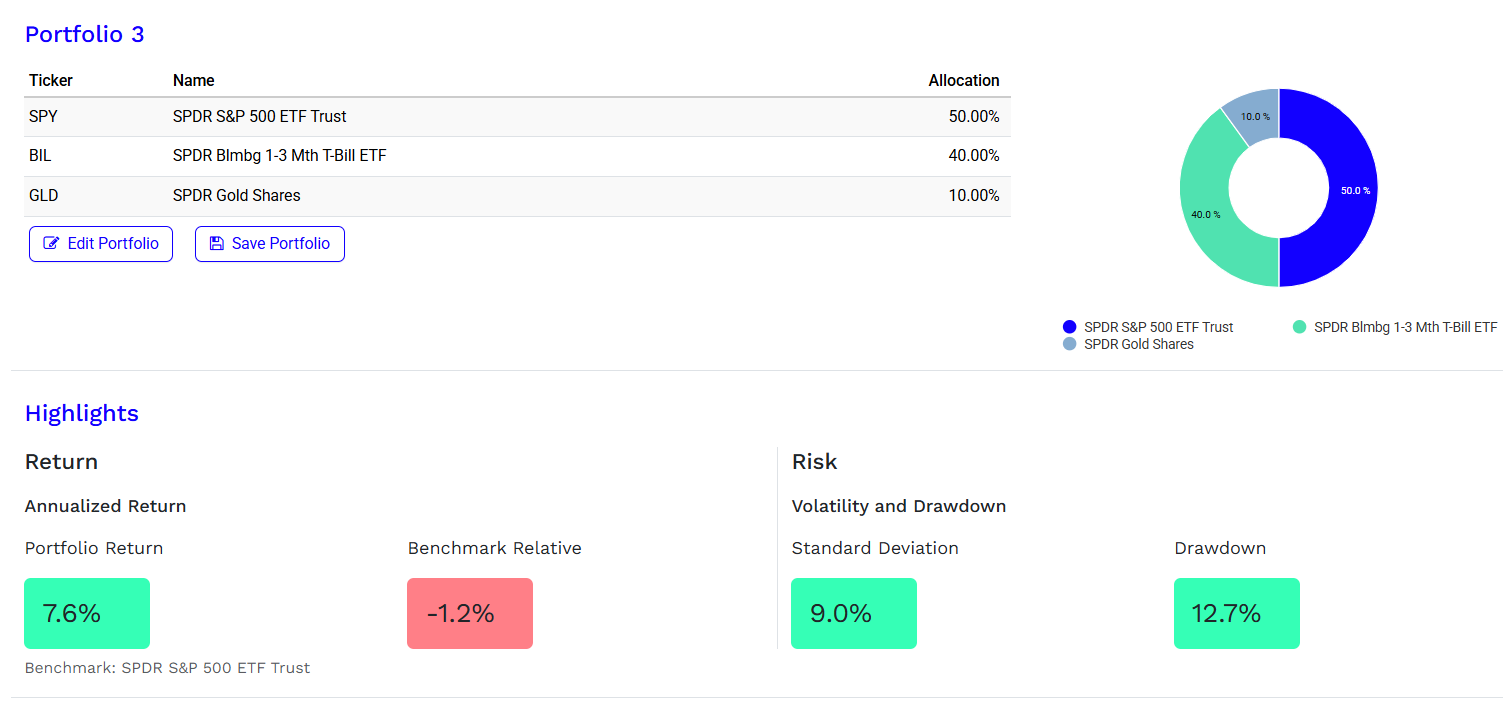

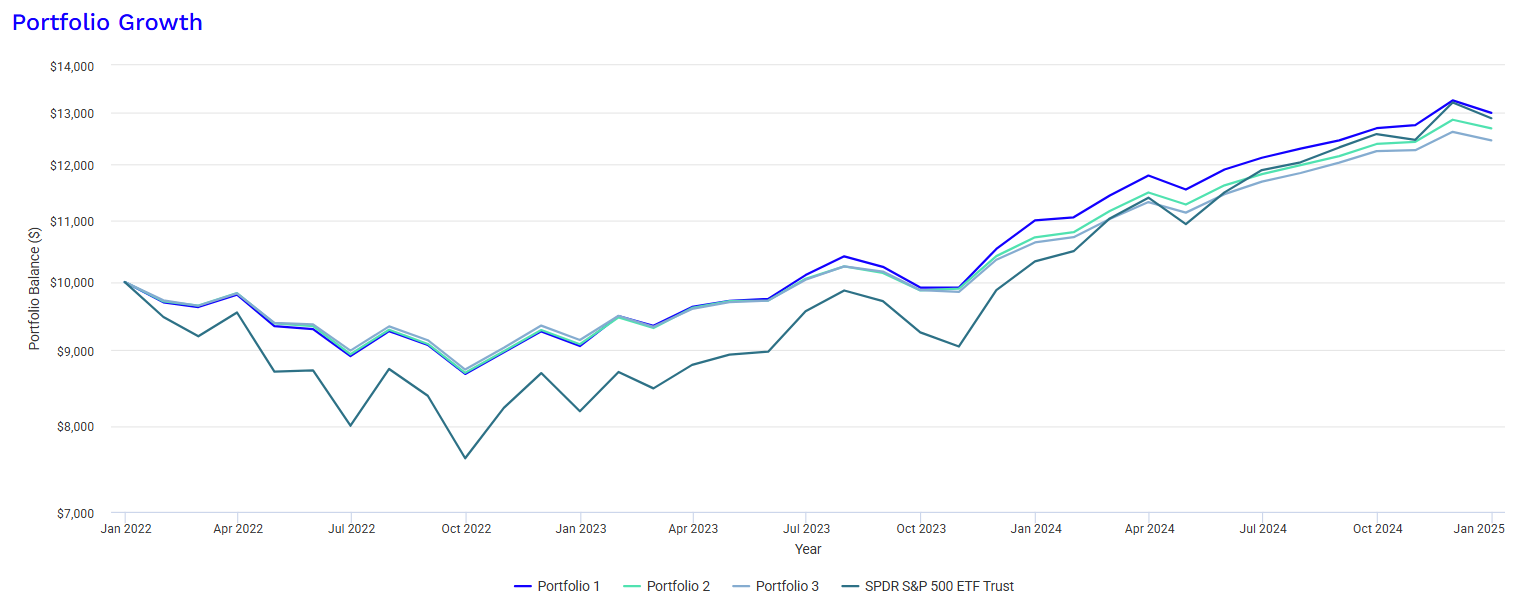

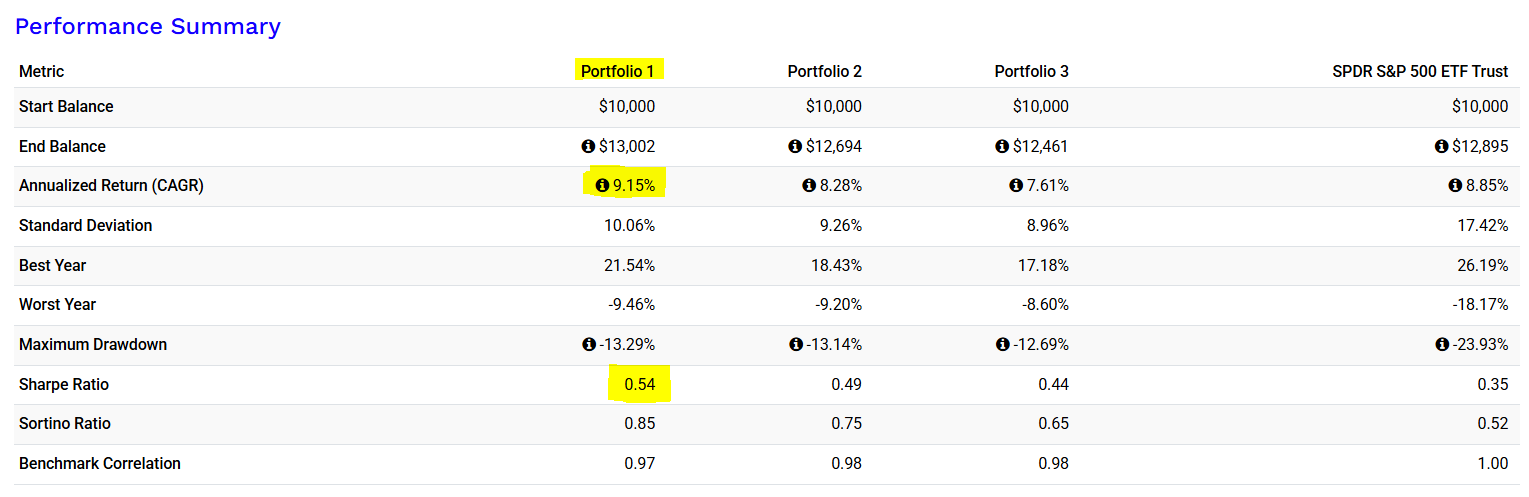

Our three-year analysis of a balanced portfolio reveals that adding 1.3% Bitcoin had a positive impact on risk-adjusted performance. However, replacing Bitcoin with a basket of three cryptocurrency-related stocks yielded even better results. On the other hand, completely excluding cryptocurrencies led to a significant decline in performance.

- Portfolio 1: With cryptocurrency-related stocks

- Portfolio 2: With Bitcoin

- Portfolio 3: Without Bitcoin or cryptocurrency-related stocks

Risks of Investing in Cryptocurrency-Related Stocks

Investing in cryptocurrency-related stocks, such as those in mining, exchanges, and blockchain technologies, offers potential rewards but also significant risks:

- High Volatility: Cryptocurrency prices fluctuate wildly, impacting the value of related stocks.

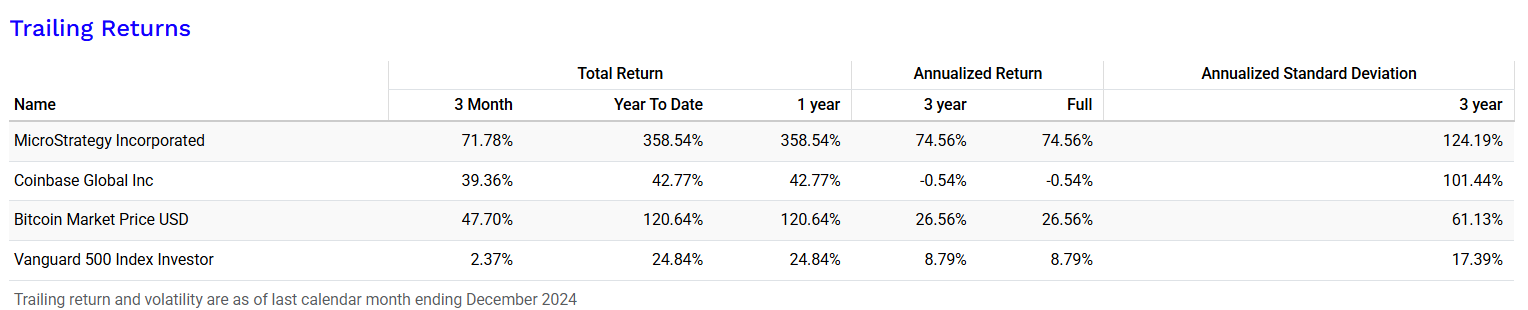

We can see below that the assets related to crypto are much more volatile than Bitcoin itself and even the S&P 500. In fact, for MSTR, the standard deviation over the last three years is 124.19%, compared to 17.39% for the S&P 500 and 61.13% for the Bitcoin.

- Regulatory Risks: Changing government regulations could harm the profitability of companies in this sector.

- Security Risks: Cyberattacks and technical failures can lead to significant losses for companies and investors.

- Liquidity Risks: Low trading volumes in some stocks can make buying or selling difficult, with higher transaction costs.

- Adoption and Technology Risks: Slow adoption or disruptive technologies could reduce the value of cryptocurrency-related companies.

- Market Manipulation: The unregulated nature of the market increases the risk of price manipulation.

While offering strong growth potential, these risks require careful consideration and diversification for effective risk management.

Conclusion

Investing in cryptocurrency-related stocks is a smart strategy to benefit from the rise of this sector while diversifying your portfolio. These stocks provide exposure to the opportunities offered by crypto without the complexities of direct management. As a complement to Bitcoin, they strengthen the diversification role of a portfolio and offer attractive growth potential in a rapidly evolving financial environment. However, it is important to consider the risks associated with these investments. Price fluctuations in cryptocurrencies, uncertain regulation, and market volatility can lead to significant losses. Investors should therefore be aware of these risks and proceed with caution when adding these stocks to their portfolio.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.