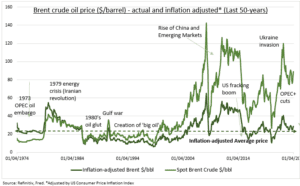

COMEBACK: Brent oil is near a six-month high $90/bbl. and the market is slipping into a deficit. Oil equities (XLE) have started leading all sectors up. OPEC+ is maintaining its big supply cuts even as demand picks up. And geopolitical tensions and investor ‘inflation hedge’ demand add to the mix. It’s a recipe for a grind higher in prices and in inflation concerns, for now. But uniquely among commodities, oil prices may ultimately self-adjust. As OPEC+ unity frays and supply cuts relax. Whilst oil stocks may need a broader turnup in their profits outlook. Macro worries are lessened by falling energy intensity and low inflation-adjusted prices (chart). @OilWorldWide.

OPEC: Yesterday’s oil cartel monitoring meet saw no change to its tough supply curbs. OPEC+ is holding back 3.66mbpd. from the market. With Russia and Saudi making an extra 2.2mbpd of voluntary cuts through June. This is equal to 5.5% of est. 2024 oil supply of 103mbpd. And offsetting surging non-OPEC supply, led by the US that is now by-far the world’s largest producer. This is driving the market into a fundamental deficit. As demand is being revised up with US growth exceptionalism and China’s incremental stimulus. A geopolitical risk premium is also rebuilding with latest surge in Mid-East tensions and Ukraine attacks on Russian refineries.

BIG OIL: Higher Brent, an M&A rebound, and shareholder friendly cash-return policies, made energy the top performing US sector in March and the 2nd best this year. Marathon Petroleum (MPC) is among the top ten US stock gainers this year. Exxon (XOM) up 2x the S&P 500. This has narrowed the sector 13x forward P/E valuation discount to the tech-laden S&P 500 to 40%. And widened the US valuation premium to Europe’s energy majors to 60%. Further sector gains will likely need to see a turnaround in the weakening earnings outlook. As 25-year low natgas prices and a depressed refining crack spread have offset the oil price recovery until recently.

All data, figures & charts are valid as of 03/04/2024.