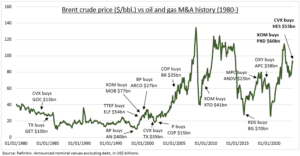

CONSOLIDATION: Exxon (XOM) and Chevron (CVX) are doubling down on fossil fuels, widening the gap with European peers, and turbocharging the industry with some of the largest M&A activity, at some of the highest oil prices, in its history (see chart). This reflects 1) a confidence that oil prices will stay high-for-longer, justifying mergers and acquisition (M&A) at these unprecedented prices. 2) A preference for buying vs drilling that should contribute to further supply restraint. And 3) a focus on growth exposure, from Permian shale to offshore Guyana. It’s a dramatic turnaround as the US leads oil M&A activity off a 17-year low. And similar in pace and scale to the turn of century consolidation wave that created today’ oil majors.

US: US oil majors are using their re-rated valuation currency to buck the decarbonisation pivot and make these big all-stock deals. Their price/earnings ratios are up 50% the past year to 12x. Benefitting from high oil prices, supply restraint, and strong shareholder cash returns. This has come with the highest dividend and share buyback yields in the S&P 500, nudging a combined 8%. These stock deals protect their balance sheets and cash piles but come at 30-40% higher inflation adjusted oil prices than the last big merger wave 20 years ago. This latest deal wave may not be over, with reports Devon (DVN) talking to Marathon (MRO), on a c. $20 billion deal.

EUROPE: European energy major peers like BP (BP.L) and Shell (SHEL.L) are being left out in the cold. Shell has already retreated from US shale, leaving just BP. Whilst both their P/E valuations are around a third less than US peers, held back by windfall taxes, greater government intervention, and Europe’s broader chronic valuation discount. This gives them less room for consolidation maneuver, even if they wanted to. They are more focused on their future-proofing renewables pivot, and should be eyeing the now depressed valuations there.

All data, figures & charts are valid as of 23/10/2023.