Summary

Bears capitulation stokes the rally

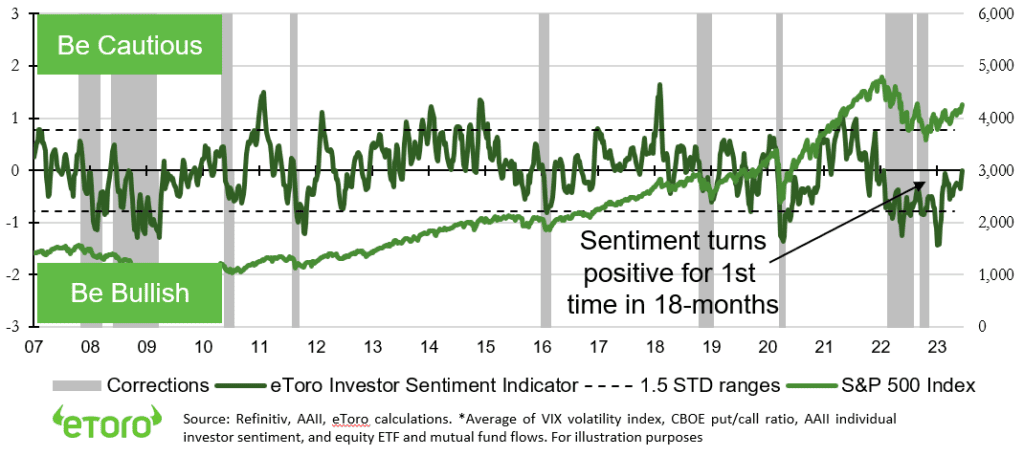

Positive fundamentals drove this year’s rally, but very poor investor sentiment has also been important. We are now in a positive ‘pain trade’, as previously bearish investors capitulate and chase stocks higher. Poor sentiment has had two benefits, protecting on the downside and is now magnifying the upside. Our investor sentiment indicator, tracking fund flows, VIX, put/call, retail sentiment, has turned positive for first time in 18-months. This is good for now.

June’s melt-up stock market rally

Stocks extended bull-market gains, after the Fed’s ‘hawkish skip’ on interest rates and China’s long-awaited cuts. Hong Kong has led ‘melt-up’ June gains, with broadening US markets not far behind. The dollar fell, and commodities rose, on this optimism. M&A and IPO optimism saw $10bn buy by NDAQ, VOD/Hutchison UK merger, CAVA IPO doubling. See Q2 Outlook HERE. Video updates, twitter @laidler_ben.

The US inflation two-step

US headline inflation fell for 11th time to 4%, but with core prices at a stickier 5.3%. Our tracker shows easing underlying pressures, opening way for consumer relief and rate cuts.

Wage growth benefits outweighing costs

US wage growth running at multi-decade high 6%. Been net benefit for stocks. Rising wages boost consumer, offsetting margins pressures, and drive productivity investments.

Land of the rising Nikkei

Japan (EWJ) best performing major stock market this year, with the world’s top 3 economy, market and especially FX, often overlooked.

No relief from higher breakfast costs

Commodities worst performing asset YTD. But ‘breakfast’ commodities bucked weakness. Sugar is up a third and orange juice near highs, on supply shortfalls and bad weather.

Bitcoin decouples and falls under $25,000

Asset class under pressure from SEC crackdown on Binance and COIN with altcoin ‘securities’ SOL, ADA, MATIC, leading weakness, and the no.1 $85 billion stablecoin Tether ‘breaking the buck’. Has seen the crypto correlation with rallying tech and equities collapse. World’s largest asset manager BLK readying bitcoin ETF application.

China stimulus helps commodities

Industrials metals, from copper to nickel, led commodity prices higher on boost from Chinese interest rate cuts and US dollar falling to 4-week low. Oil also helped by US strategic reserve (SPR) buy. EU natgas soared by 50% on Groningen field Oct 1 shutdown. Soybeans and wheat led Ag up on dry weather and coming El Nino.

The week ahead: Juneteenth, Powell ,BoE, PMI

1) US closed for ‘Juneteenth’ holiday (Mon) ahead of Powell ‘hawkish skip’ Congress testimony (Wed).

2) UK 8%+ inflation and BoE 13th hiking (Thu) double-bill.

3) PMI growth and price health-check (Fri) for US, EU, UK, JP, AU.

4) Earnings from trade giant FDX, CAN, KBH, DRI, KMX.

Our key views: A goldilocks moment

Markets boosted by resilient economic growth and gradually easing inflation pressure, and now capitulating investor sentiment. Coming growth slowdown hurts earnings. But low yields help valuations. Focus on cheap and defensive assets from healthcare to big tech. More cautious on growth exposed cyclicals and banks.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 1.25% | 2.61% | 3.48% |

| SPX500 | 2.58% | 5.19% | 14.85% |

| NASDAQ | 3.25% | 8.15% | 30.79% |

| UK100 | 1.06% | -1.47% | 2.56% |

| GER30 | 2.56% | 0.51% | 17.48% |

| JPN225 | 4.47% | 9.41% | 29.17% |

| HKG50 | 3.35% | 3.03% | 1.31% |

*Data accurate as of 19/06/2023

Market Views

June’s melt-up stock market rally

- Stocks extended bull-market gains, after the Fed’s ‘hawkish skip’ on interest rates and China’s long-awaited cuts. Hong Kong led ‘melt-up’ June gains, with broadening US markets not far behind. The dollar fell, and commodities rallied, on this new optimism. M&A and IPO optimism saw $10bn NDAQ buy, VOD/Hutchison UK mobile merger, and the CAVA IPO doubling. See our Q2 Outlook HERE.

The US inflation two-step

- US headline inflation fell for 11th time to 4%, but with underlying core prices a stickier 5.3%. The US is seeing a two-speed economy, and inflationary dichotomy, between manufacturing and goods versus services and jobs. But our inflation tracker clearly shows easing underlying price pressures. Which the coming growth slowdown will further dampen and open the door to interest rate cuts.

- Lower prices are also now starting to return some consumer purchasing power, seen in latest retail sales. and be a relief to corporate profit margins. A long-duration and tech focused stock market will also continue to reward this.

Wage growth benefits outweighing costs

- US wage growth been running at multi-decade highs of over 6% since March 2022. It’s led by the younger, the less qualified, and the lower paid. Leisure and hospitality, and education and health, have been amongst the biggest beneficiaries. This has been a net benefit for companies. Rising wages support consumer spending, by far the biggest proportion of the economy.

- And real wages now rising, with headline inflation down to 4%. But rising labour costs have hurt profit margins. It’s also keeping core inflation stickier than hoped. But so far, the demand boost is offsetting any hit to margins, and driving investment in productivity, AI and automation.

Land of the rising Nikkei

- Japan is best performing major stock market this year, up 23% in US dollar terms, doubling from its pandemic low, and closing on all-time-high from 1989 when its epic property bubble burst. Whilst often overlooked it is a top 3 global economy, stock market, and FX, and home to many world-beating stocks from Sony (SONY) to Toyota (TM).

- The benchmark Nikkei 225 been boosted by low interest rates and weak Yen, a better economy, corporate governance reforms, and returning foreign interest led by Warren Buffett. Is more than enough for now but faces risk of global slowdown and longer-term challenges of tighter policy and structural headwinds. @AsianDragons.

No relief from higher breakfast costs

- Commodities worst performing asset class YTD. But smaller ‘breakfast’ commodities bucked weakness and rallied. Sugar is up a third and orange juice near highs, on supply shortfalls and bad weather.

- This may worsen as the El Nino builds and piles more pressure on consumers reeling from supermarket food rises of 7% in US, 15% in EU, and 19% in UK. All above headline inflation rates and headache for policymakers.

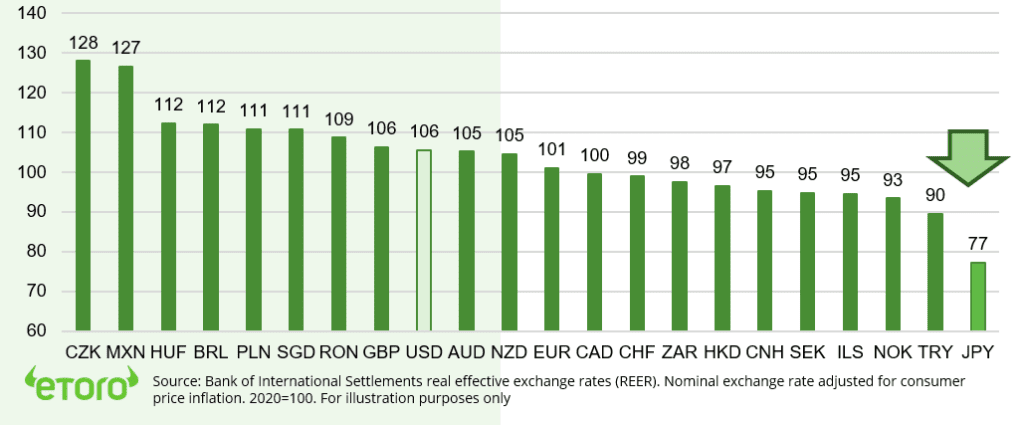

Global currency relative valuations (REER, 2020=100)

Bitcoin decouples and falls under $25,000

- Crypto assets stayed pressured, with BTC briefly falling under $25,000 for first time since March SEC regulatory crackdown, including suits against exchanges Binance and COIN, sapped sentiment.

- Price weakness was led by altcoins recently classed as regulated ‘securities’ by the SEC, like SOL, ADA, and MATIC, all down around 20%.

- The largest $83 billion market cap. stablecoin Tether (USDT) ‘break the buck’ and fall to $0.99.

- Reports that world’s largest asset manager, BLK, was to seek SEC approval for a bitcoin ETF.

China rate cuts drive commodity relief

- Commodities markets saw further relief on the combination of long-awaited interest rate cuts by dominant importer China, alongside further weakness in the US dollar. Industrial metals, from copper to nickel, were the main beneficiaries.

- Oil eased on fear higher-for-longer Fed interest rates would weaken global growth, and oil demand. This was cushioned by US plans to start rebuilding its Strategic Petroleum Reserve (SPR).

- European natgas soared 50% on supply concerns as Norway suffers production outages and Holland to close Groningen field from Oct. 1st.

- Soybeans and wheat led Ag. prices higher on dry conditions and rising El Nino weather concerns.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 3.86% | 11.90% | 38.31% |

| Healthcare | 1.39% | 1.19% | -1.82% |

| C Cyclicals | 2.74% | 10.01% | 23.98% |

| Small Caps | 0.52% | 8.02% | 6.49% |

| Value | 1.85% | 4.76% | 0.25% |

| Bitcoin | -0.32% | -2.46% | 59.30% |

| Ethereum | -6.42% | -5.84% | 43.70% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Juneteenth, Powell, BoE, PMIs

- US closed for Monday’ ‘Juneteenth’ holiday ahead of Powell’s testimony to the US Congress Banking Committee (Wed). Comes after last week ‘hawkish skip’ FOMC meet of pause but still hikes to come.

- Double-bill in UK with est. fall in some of world’s highest inflation (Wed), to 8.5%. Likely forcing BoE to hike interest rates aggressively for 13th time (Thu), by 0.25% to 4.75, and with more to come.

- Global macro health-check with US, EU, UK, JP, AU flash PMI (Fri) insights on two-speed economy of manufacturing recession but still strong services, alongside the slowly easing inflation outlook.

- Q1 corporate earnings from global trade giant FDX, professional services CAN, homebuilder KBH, restaurant chain DRI, and used car retailer KMX. Ahead of Q2 earnings season start on June 14th.

Our key views: A goldilocks moment

- Markets being boosted by combination of resilient economic growth, helping earnings, and slowly easing inflation, helping valuations. The capitulation of very bearish investor sentiment is an additional, and recent, big technical driver.

- See a V-shaped market recovery with plenty bumps in road. Faster slowdown hurts earnings. But lower bond yields helps valuation. Focus on cheaper and more recession defensive assets, from healthcare to derated big tech. More cautious on assets most exposed to recession risk, like cyclicals, small caps, and commodities. Or lower yields, like banks.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 4.14% | 4.02% | -6.79% |

| Brent Oil | 1.63% | -0.89% | -11.32% |

| Gold Spot | -0.25% | -0.46% | 7.68% |

| DXY USD | -1.21% | -0.87% | -1.18% |

| EUR/USD | 1.81% | 1.29% | 2.26% |

| US 10Yr Yld | 2.67 | 8.59 | -11.05 |

| VIX Vol. | -2.10% | -19.45% | -37.52% |

Source: Refinitiv. * Broad Bloomberg index. * Basis point

Focus of Week: Bears capitulation drives the rally

Fundamentals rule but investor sentiment also matters. We are in a positive ‘pain trade’ now

The fundamentals drive markets, and they have been improving. Resilient economies combined with less inflationary profit margin pressures have seen earnings forecasts rising. Not plunging as many thought. Lower bond yields and AI growth justify higher valuations. Poor investor sentiment also been a powerful contrarian and technical driver. Most have been too cautious this year, making the rally a ‘pain trade’. They are now rushing to invest. Our sentiment indicator is positive for the first time in 18-months (See Chart).

Bad investor sentiment has had two big advantages, protecting downside and magnifying upside

Poor investor sentiment has been a double benefit to stocks. When everyone is bearish the impact of bad news is lessened, and good news is magnified. Less-bad news will do. This has been the recipe for this year’s ‘surprise’ rally. And is now forcing cautious investors to capitulate and add money into the market.

Bad investor sentiment has had two big advantages, protecting downside and magnifying upside

We are now in a sweet spot when previously bearish investors ‘capitulate’ and invest money in the market. Effectively chasing it higher. This can be powerful and last for a while. It was most recently seen in the post-pandemic market rally, and prior to that from 2016 to 2018. Ultimately sentiment becomes too bullish, and markets sensitive to disappointment and the dynamic reverses. But we are not at this point yet.

Our investor sentiment indicator has turned positive for the first time in 18-months

Our long-running, and contrarian, investor sentiment indicator (see chart) has turned positive for the first time in 18-months. VIX volatility is now well-below average levels. The American Association of Individual Investors (AAII) survey swung to 45% bullish, up fifteen points in only two weeks. Mutual fund outflows have swung to modest inflows. A still high equity put/call ratio shows appetite for downside protection remains. Whilst not part of our indicator, the NAAIM hedge fund exposure to US equities index jumped to 90% long vs a prior of only 54% long. Even sell-side strategists median S&P 500 target is 7% below current.

We track equity volatility, fund flows, retail investors, demand for index protection

Our proprietary sentiment indicator is made up of 1) equity mutual fund and ETF flows. 2) The long running American Association of Individual Investors (AAII) sentiment survey. 3) VIX index of expected 30-day S&P 500 volatility. 4) S&P 500 put/call ratio, measuring proportion of put buying (option to sell) vs calls (to buy). A lower number is more contrarian bullish, with more investors left to buy or to turn positive.

eToro Investor Sentiment Indicator* vs S&P 500 index)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Aggressive Fed interest rate hiking cycle, stubborn inflation, financial sector and debt ceiling concerns accelerating our 2023 view. Of a quicker GDP slowdown, lower inflation, and a peaking Fed interest rate cycle. Will pressure earnings further but also lower bond yields and take pressure off de-rated valuations. We are invested, believing Oct 2022 was the low, and focus on cheap and defensive assets for a faster ‘V-shaped’ market recovery.See our Q2 Outlook HERE |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing but resilient GDP and earnings growth. Valuations led the rebound this year and are supported high company profitability and peaked bond yields. Focus on cash-flows defensives, like healthcare and high dividend. And Big-tech supported by defensive growth, cost cutting, and AI. See gradual ‘U-shaped’ rebound as inflation slowly falls and de-risks market and boosts tech and crypto appetite. |

| Europe & UK | Favour defensive and cheap UK (‘Economies not stock-markets’) and continental European equities. Recession risk easing with lower natgas prices and reopening China with high ‘buffers’ of rising fiscal spending (defence and refugees) and weak Euro (50%+ sales overseas). Even as ECB hikes aggressively. Equities cushioned by lack of big tech sector and 30% cheaper valuations vs US. Banks better capitalised and regulated but loans/GDP much higher. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive China as economy reopens, supports property sector, eases tech regulation pressure. Valuations 30% cheaper than US and markets out of favour. Recovery helps global sectors from luxury to materials. EM needs weaker USD and peak US rates catalyst. |

| Other International (JP, AUS, CN) | Canada and Australia have benefitted from strong equity market weight in commodities and financials, as global growth resilient and bond yields risen. Now could be becoming headwinds. Japanese equities among worlds cheapest with own and China-proxy growth and governance improving but threats of tighter monetary policy and stronger Yen. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Expect better performance as 1) lower bond yields take pressure off valuations and 2) high profit margins and fortress balance sheets make defensive to recession risks. 2) Cost cuts and AI add to growth. ‘Disruptive’ tech much more vulnerable. |

| Defensives | More attractive as recession risks rising and bond yields have peaked. Consumer staples, utilities, (some) real estate attractive with defensive cash flows, less exposed to rising economic growth risks, and with robust dividends. Healthcare is the most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | High risk cyclical sectors – like discretionary (autos, apparel, restaurants), industrials, energy, materials, and small caps – have cheap valuations, many with depressed earnings, and have been out-of-favour for many years. But they are significantly exposed to rising recession risks. Some especially cheap (energy) or see growth recovery (airlines). |

| Financials | Current stresses likely individual not systemic. Post GFC reforms boosted capital and size/speed of authority’s response. But outlook for 1) less GDP growth, 2) lower bond yields and interest rates, and 3) valuation sensitivity after recent surprises, worsens outlook. Insurance and Diversifieds (like Berkshire Hathaway) more defensive. |

| Themes | Dividends and buyback themes attractive with resilient cash flows, rising pay-outs, and investor search for defensives. Power of compounding dividends under-estimated, at up to 1/2 of total long-term return. Small caps pressured by rising recession risk. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ driven by Fed interest rates and ‘safer-haven’ bid. DM currencies hurt by still low interest rates and struggling growth. Strong USD hurt EM, commodities, US foreign earners like tech. But helps big EU and Japan exporters. See a stabler USD outlook in 2023 as near top of the Fed cycle and global risks remain high. |

| Fixed Income | US 10-yr bond yields supported around 4% by higher Fed rate hike and stickier inflation expectations. Set to ease as recession risks slowly build and inflation expectations gradually fall. US has widespread to other market bond yields, and headwinds of high debt, poor demographics, and low productivity. 5% bill yields an attractive cash alternative. |

| Commodities | Strong USD and rising recession fears hit commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, Russia supply crisis. Oil helped by slow return of OPEC+. But commodities not to repeat their 2021 and 2022 performance leadership. Gold benefits from safer haven demand. |

| Crypto | Potential ‘surpsise’ after dramatic and early asset class sell-off and later specific risk events from Luna to FTX. See long term asset class development with small size $1 trillion, correlations low, regulation growing, development/catalysts continuing – Ethereum merge to proof-of-stake and coming BTC halving. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Nordics |

Jakob Westh Christensen |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

eToro CLUB members can join our live Weekly Outlook webinars every Monday at 1pm GMT. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.