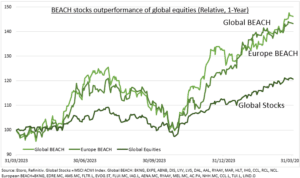

HORIZON: Summer holidays are on the horizon and travel & tourism BEACH stocks soaring. Our global and European leisure baskets of booking sites, entertainment, airline, cruise, and hotel stocks are beating even high-flying big-tech stocks (See chart). The industry is enjoying a ‘new normal’. Volumes have regained pre-pandemic levels but now lag a global economy a quarter bigger. Whilst limited new capacity keeps pricing power high. From chronic Boeing (BA) plane and RTX (RTX) engine backlogs. To high interest rates curbing new hotel build and rising restrictions hitting short-term rental supply. Whilst 5% cruise capacity growth lags pre-covid.

BEACH: This is an acronym of Booking sites (like BKNG, EXPE, ABNB), Entertainment (DIS, LYV, LVS), Airlines (DAL, RYAAY, AAL), Cruise Lines (CCL, RCL, NCL), and Hotels (MAR, HLT, IHG) stocks. We created equal-weight 15-stock BEACH baskets to track the theme. One for US-focused global players (above) and another for European focused stocks, from AMS.MC to AC.PA. The 46% global BEACH basket gain the past year is double that of global equities and even outpaced the high-flying NASDAQ-100. Its European version is not far behind. Airlines, hotels, and Disney led recent share price gains with booking sites lagging. See @TravelKit.

TRENDS: Travel has seen three back-to-back years of 20%+ recovery growth rates. This has returned it to pre-pandemic volumes. But now set for a further catch up to a global economy 25% larger by end of this year than 2019. Air traffic boomed 37% last year, led by international, and has returned to pre-pandemic levels. Hotel bookings surged 80% but remain lower. Whilst the cruise industry saw a 50% passenger rebound to slightly over 2019 levels. The global travel & tourism industry represents c. 8% of the global economy and tourism is over 50% of GDP in small economies, like Maldives and Macau, and 15% from Greece to Portugal and Mexico.

All data, figures & charts are valid as of 27/03/2024.