SECTOR: The global listed auto industry is the most divided of any we have seen. From Tesla’s (TSLA) still-giant $800 billion market cap and 70x price earnings valuation, to luxury Ferrari’s (RACE) 50x. Down to the US ‘big-3’ General Motors (GM), Ford (F), Stellantis (STLAM.MI) on barely 5x. The EV growth story has barely begun (see chart), the industry rapidly consolidating, and its current ‘winter’ will ease. Investors are taking the long view. Tesla is the most owned stock on eToro. NIO (NIO) is also in the top ten. With the nearest legacy auto outside the top 30. At other extreme, a big valuation rerating awaits the legacy maker that can make the transition.

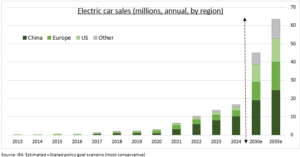

EV: The ‘death of EV’s’ story is wrong. Global sales grew 25% in Q1 this year and near 20% of all cars sold globally last year were electric. High growth expectations are being tested by less government policy support and consumer growing pains, from charging to range anxiety and resale values. But new vehicle offerings are broadening and prices falling fast. China has led adoption, accounts for 60% global sales, and is the only market where EV prices are lower than ICE. The global adoption story has barely begun. With under 3% of the 1.5 billion cars on road today EV’s, focused on China and Europe. With a major rest of world and US catch up to come.

ICE: Global industry volumes boomed 9% last year as normalised supply chains and restocking outweighed surged interest rates and lower consumer confidence. A car is a consumer’s 2nd biggest purchase, after a house, averaging $47,000 new in US. Volumes likely slow to steadier state 3% growth this year of 88 million cars. The legacy sector is on a low valuation, given a twin threat. Of slower consumer and rising Chinese competition. And high EV adoption costs with legacy assets and outsourced supply chains. Holy grail is a legacy leader like Volkswagen (VOW3.DE), no3 in global EV sales, threads the transition needle and see’s a rerated valuation.

All data, figures & charts are valid as of 01/05/2024.