A Reflection of the Global Economy

When performing technical analysis on a monthly chart of AUDJPY, this currency pair stands out as a significant indicator of global economic conditions. The large price movements reflect market dynamics, investor sentiment, and macroeconomic conditions in both Australia and Japan. Generally, the exchange rate fluctuates within a broad range, reaching high levels during periods of high risk appetite and dropping to lower levels during economic crises and uncertainty.

Australian Dollar (AUD) as a Commodity Currency

AUD is known for its volatility and for being a commodity currency closely linked to the raw materials market and the Chinese economy. Demand for Australian commodities such as iron ore and coal is crucial for the exchange rate, making AUD sensitive to economic cycles in China. With China’s current economic slowdown, we are seeing reduced demand for AUD, weakening its position.

The Australian economy has experienced weak growth and stagnation in the production sector over the past year. Inflation has dropped to 2.5%, though it has not yet reached the desired level. The Reserve Bank of Australia (RBA) has maintained relatively high interest rates but may consider rate cuts if economic activity does not improve. Unemployment stands at 4.1%, which is moderate but still higher than in Japan.

Japanese Yen (JPY) as a Safe Haven

JPY is one of the most prominent safe-haven currencies, meaning that investors turn to it during times of increased financial market uncertainty. Japan has long struggled with low inflation and extremely low interest rates, but in January, inflation rose to 4%, the highest level in two years. This led the Bank of Japan (BoJ) to raise interest rates for the first time in 17 years, breaking away from its long-standing zero-interest rate policy. Further rate hikes are expected, which could strengthen JPY even further.

Japan has an extremely low unemployment rate of 2.4%, reflecting a tight labor market. However, the Japanese economy still faces structural challenges, including low productivity growth and an aging population.

Macroeconomic Risk Factors

- China’s Economic Weakness: Lower growth rates and declining demand for raw materials in China put downward pressure on AUD.

- Trade War and Geopolitical Uncertainty: Trump’s recent trade war policies have increased uncertainty, generally strengthening JPY as a safe-haven currency.

- Diverging Monetary Policies: BoJ is moving toward rate hikes, while RBA may be forced to lower rates, potentially weakening AUD further.

Strategic Considerations for AUDJPY

- Although AUD has a higher interest rate than JPY, macroeconomic uncertainty and China’s weakened economy are key factors pushing AUDJPY downward.

- Swap rates make it unattractive to hold short positions in AUDJPY for extended periods, but short-term short opportunities can be exploited.

- In the long term, strategic levels can be identified where AUDJPY may become attractive for buying again, provided market sentiment shifts.

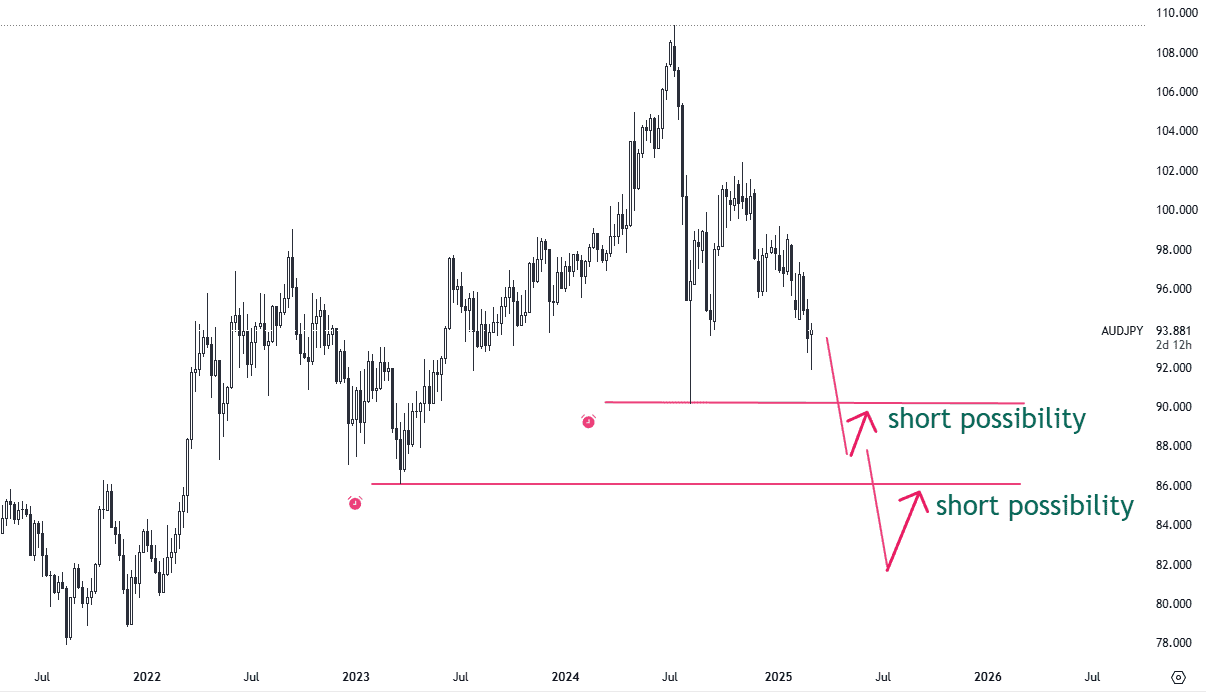

Technical Trading Strategies

- If we drop below 90.00 with strong momentum, there will be a good opportunity to sell AUDJPY on a pullback to 90.00. The target should be 87.300, with a stop loss at 92.000. I would risk between 0.5 and 1% on the trade.

- The same applies to the 86.00 area. Here, I would set a target at 82.700 and a stop loss at 88.300. I would risk between 0.5 and 1% on the trade.

- Buying positions depend entirely on the severity of the crisis we are facing. If the crisis in China or globally worsens, we must be cautious about buying too early. Conversely, we will look to buy around the 82.300 and 78.00 levels if we see growing market stability.

Conclusion

Despite higher interest rates and lower inflation in Australia, macroeconomic conditions favor a stronger JPY in the near future. China’s economic struggles and global uncertainty position the yen as a safe-haven currency, which could lead to further declines in AUDJPY. Traders should focus on short-term short opportunities with quick exits while identifying attractive levels for long-term accumulation of AUDJPY.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.