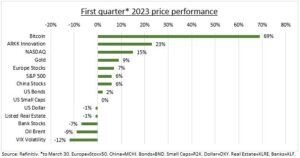

REVERSAL RALLY: Global markets are closing Q1 in green, after a big rebound by the 2022 crypto and tech losers. A volatile quarter saw a dramatic January rally, on less-bad fundamentals and very negative investor positioning. The US consumer stayed strong, Europe’s gas prices plunged, and China reopened. Company Q4 earnings were resilient. February saw an inflation decline reality check, with services and wages sticky. March brought the failures of Silicon Valley Bank and Credit Suisse, which drove crisis fears and pushed growth and inflation forecasts down. We are positive markets into Q2, with a faster growth slowdown pressuring earnings, but earlier rate cuts helping valuations. Our U-shaped recovery narrative is now a V.

ANATOMY OF RESILIENCE: S&P 500 valuations rose modestly to a 17.6x forward P/E, in line with the long-term average. Helped by 10-year bond yields falling 30bps to 3.55%, and headline inflation down for an 8th month to 6%. This supported long duration assets, from crypto to bonds. US earnings growth expectations surprisingly stayed at 4%. Helped by a S&P composite PMI surge to 53 and Q1 GDP growth forecasts at 3%. But the underperformance of cyclicals, from small caps to commodities, highlighted the sharp underlying rise in growth and earnings fears.

STAND-OUT. Tech surged 18% led by semis (36%), and communications by 17%. Financials fell 7%, led by banks (-13%). 2022 defensive winners utilities and pharma also fell. Tech giants NVIDIA (87%), Meta (73%), and Tesla (58%) were the S&P 500 top performers. Losers were regional banks First Republic (-89%) and Zions (-38%). Europe’s Stoxx50 led by luxury Hermes (27%) and Kering (25%) plus ASML (24%). Whilst Glencore (-15%) and other commodity stocks lagged. France, Germany, and Italy all rallied 10%. Taiwan’s 13% rally, driven by TSMC (19%), led major global markets. Baidu (+34%) led Hong Kong, latterly captivated by Alibaba’ breakup.

All data, figures & charts are valid as of 30/03/2023