Summary

Focus: Positive on Europe in 2022

We are positive in Europe in 2022. It’s stronger than-US GDP growth and cyclical stock market makeup, will drive double digit earnings growth. Valuations are 30% cheaper than US. It has four growth buffers to slowdown risks: a strong start point, more government spending, a dovish ECB, and a weak Euro. Modest event risks range from Germany’s new government to French elections. What to own? Germany and Spain benefit from rare GDP rebounds. Italy and Portugal offer the best value. Also @EuropeEconomy.

Virus fears and the Fed whip-saw markets

Global markets were whip-sawed by new virus variant worries and with the Fed turning more hawkish, now recognising inflation is no longer just ‘transitory’. November was a negative month for equities, led by Dow Jones, Europe, China, falls, despite normally strong seasonality. Tech was the exception, rising over 4%, led by semi stocks. See latest presentation here.

Sentiment indicator turns bullish

Warren Buffett said to ‘be greedy when others are fearful’. We have seen a sharp fall in investor sentiment. This is contrarian positive. If everyone is bullish, then who is left to buy?

Surviving the macro health-check

OECD macro update is a timely reminder the global GDP growth outlook is strong and likely resilience to virus worries. We see opportunities in depressed ‘reopeners’. Also ‘new defensive’ big tech and cheap @Vaccine-Med stocks. More than ‘work-from-home’ (WFH) stocks.

Thanksgiving retail relief

Thanksgiving retail sales a relief, given labour and supply chain disruption. Forecasts were raised. US consumer drives 70% the economy, helped by 5% wage growth, higher housing and equity values, and $2 trillion ‘excess savings’. See consumer discretionary (XLY), @ShoppingCart and @FashionPortfolio beneficiaries.

Bitcoin pressures continue. New eToro assets

Bloomberg commodity index is 10% off highs, on virus worries and the stronger USD. Mild winter weather has driven a 30% US Natgas price fall since October. EU carbon credits bucked the downtrend and are +140% this year.

All eyes on energy. Carbon buck’s downtrend

Rising virus worries impacted growth-sensitive commodities, alongside a surging safe-haven USD. This especially impacted oil, coming on the heels of the US-led announcement of oil reserve sales. We are positive the asset class.

The week ahead: inflation, debt, and the virus

1) US inflation (Fri) forecast to accelerate to 6.9%, a new 30-year high, and reinforcing the Fed’s more hawkish stance. 2) $28.9 trillion US debt ceiling to be breached around Dec. 15 unless politicians agree to raise or risk a debt default. 3) Consumer focused earnings focus with LULU, CHWY, GME, as well as AVGO, PATH.

Our key views: Caught between virus and Fed

Still positive outlook of 1) vaccine rollout and economic re-opening, and 2) still huge policy support. Markets are caught short-term between virus worries and a more hawkish Fed. We see these risks as overdone and economies resilient. We like equities, commodities, crypto. Cautious on fixed income, and the USD.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -0.21% | -4.46% | 13.37% |

| SPX500 | -1.22% | -3.39% | 20.83% |

| NASDAQ | -2.62% | -5.55% | 17.05% |

| UK100 | 1.11% | -2.49% | 10.24% |

| GER30 | -0.57% | -5.51% | 10.58% |

| JPN225 | 2.51% | -5.34% | 2.13% |

| HKG50 | -1.30% | -4.44% | -12.72% |

*Data accurate as of 06/12/2021

Market Views

Virus and Fed whip-saw markets

- Global markets were whip-sawed by new virus variant worries and with the Fed turning more hawkish and recognising the inflation upturn was no longer ‘transitory’. US 10-yr yield fell to 1.35% and VIX volatility surged. November was a negative month for markets, led by the Dow Jones, Europe, and China. This was despite normally strong seasonality. Tech was the exception, rising over 4%, led by semiconductor stocks. See our latest presentation here.

Sentiment indicator turns bullish

- Warren Buffett said to ‘be greedy when others are fearful’. The weekly American Association of Individual Investors shows a collapse in bullish views, and a surge in bearishness. This is a contrarian positive. When everyone is bullish, who is left to buy? Similarly VIX volatility was above 30, a level not seen since January.

- Our proprietary investor sentiment indicator is now well below average, with investor sentiment plunging in the last week. This supports our fundamental bullish view. Economies are increasingly resilient to the virus, and Fed rate hike expectations have adjusted.

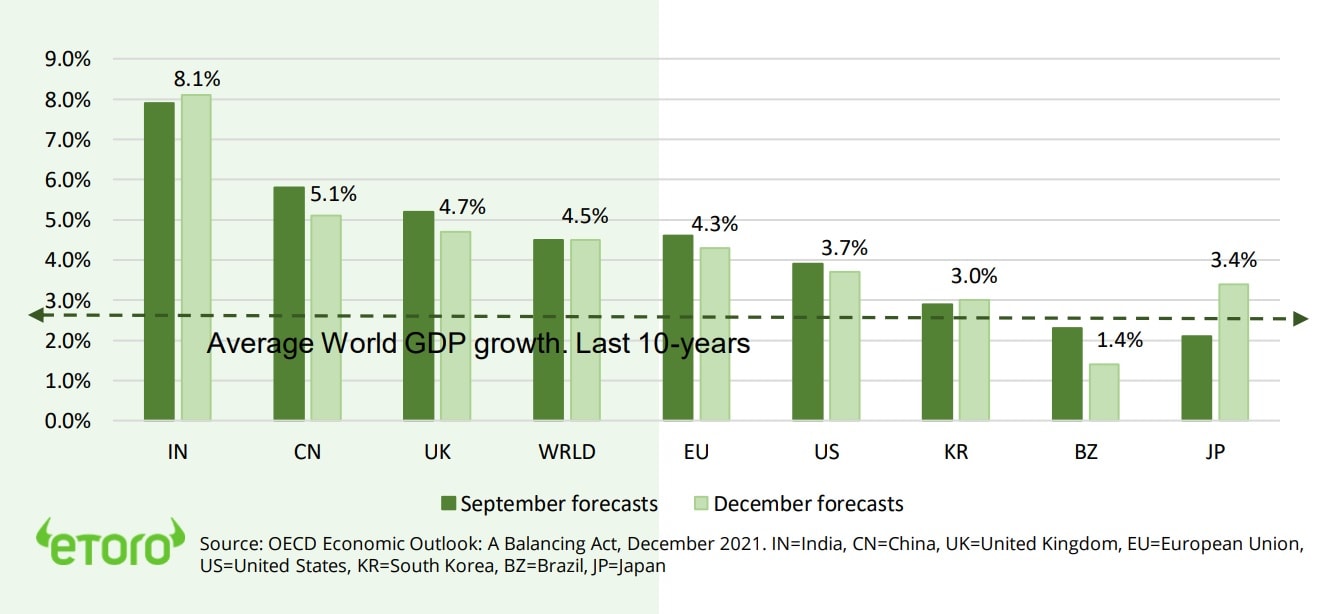

Passing the macro health-check

- 39-member OECD ‘rich country’ club kept its GDP growth outlook at 4.5% for next year, despite rising virus risks. Pandemic resilience is rising, and monetary and fiscal policies to stay supportive. There is a slowdown from this year’s extraordinary 5.6% rebound, but growth still be well-above average next year (see chart).

- Consensus 7% earnings growth forecasts are too low with this. Global inflation is peaking at 5% now and to ease. This will see interest rates rise only slowly from low levels, and help reflation assets like commodities (DJP), equities (ACWI), crypto. See our multi asset webinar.

The Omicrom investment risk/reward

- Economies, consumers, companies are more resilient to each virus wave. We are in a fourth virus wave, regardless ‘omicrom’ details. It’s a position of relative strength. US Q4 GDP NOWCast is 9.7% growth. Europe’s PMI a robust 56 even after a five-fold case surge. 54% world received a vaccination. 2% hospitalization rates. mRNA reformulations are more flexible.

- We see opportunities in depressed ‘reopeners’’ and proxies like Spain and JETS. Also ‘new defensive’ big tech and cheap @Vaccine-Med. More than ‘work-from-home’ (WFH) stocks.

Thanksgiving retail relief. Outlookraised

- Thanksgiving weekend retail sales were solid, a relief, but we did see covid disruptions. Stronger numbers are forecast ahead. Supply chain disruptions meant less inventory, and 8% less discounts to attract shoppers. Inventory and labour disruptions saw an earlier shopping start.

- US consumer drives 70% of the economy and is supported by 5% wage growth, higher housing and equity values, and $2 trillion ‘excess savings’

- This supports the consumer discretionary (XLY) outlook, focused on specialty retail and e commerce. See thematic Smart Portfolio’s @ShoppingCart and @FashionPortfolio.

Major global economies 2022 GDP growth forecast, and versus 3 months ago

Bitcoin pressures ease. New eToro assets

Crypto pressures resumed with global cross asset sell-off. Bitcoin, Polkadot, Doge most hurt. Terra and Polygon able to stay in green.

- Square (SQ) renames itself Block as broadens services to focus on the blockchain. Whilst Facebook (META) reversed its long-standing ban on crypto ads.

- Open-source altcoin Celo (CELO) and crypto exposed stock Silvergate Capital (SI) were added to the eToro platform. This brings the number of offered coins to over 40.

All eyes on energy. Carbon bucks downtrend

- Commodity markets remained under pressure from virus-driven growth slowdown fears and the strong USD. Energy prices bore the brunt of weakness. The few commodities seeing gains included iron ore, lumber, and EU carbon credits. Lumber is still half of its $1,700/000 board feet May price, whilst EU carbon credits are at new all-time-highs, and +140% this year.

- US natural gas prices fell to three month lows, down 30% from recent highs. Milder US weather in October and November has allowed a rebuilding of domestic inventories, whilst higher prices stimulated more production. Forecasts for a continued mild winter, and new variant virus worries, have dampened demand expectations for now. European prices have been more resilient, with colder weather.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -2.00% | -2.82% | 21.92% |

| Healthcare | -2.12% | -6.05% | 9.86% |

| C Cyclicals | -2.57% | -4.47% | 16.41% |

| Small Caps | -3.86% | -10.19% | 9.34% |

| Value | -0.79% | -3.06% | 17.80% |

| Bitcoin | -8.05% | -18.04% | 71.74% |

| Ethereum | 4.23% | -4.56% | 475.14% |

Source: Refinitiv

The week ahead: Inflation, debt, and the virus

- US inflation (Fri) focus as Fed set to accelerate move to tighten monetary policy. Estimates are for a pick up to 6.9% inflation, setting a new 30 years high. Fed next meets Dec. 14-15.

- The $28.9 trillion US debt ceiling needs to be raised by around Dec. 15 to avoid an (unlikely) selective debt default. This also follows last week’s renewed US fiscal budget battle.

- Consumer-focused earnings week with athle leisure Lululemon (LULU), pet food Chewy (CHWY), retail meme-stock GameStop (GME), and tech Broadcom(AVGO) and UiPath (PATH).

- Other important corporate events to watch include Morgan Stanley’s Space summit (Tue). Participants include Virgin Galactic (SPCE), Iridium(RDM), Maxar (MAXR), Palantir (PLTR).

Our key views: Caught between virus and Fed

- Still positive scenario of 1) global vaccine rollout and economic re-opening, 2) still large support of low interest rates and fiscal spending.

- Markets in a short-term ‘vice’ of surging fourth wave virus cases and new variant fears versus a more hawkish Fed interest rate outlook. The virus dampens not derails the GDP recovery. Fed rate hikes are to be small and gradual.

- We focus on cyclical assets that benefit most from decent growth: commodities, crypto, small cap, and value. We are more cautious on fixed income, the USD, defensive equities and China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -4.30% | -6.76% | 22.73% |

| Brent Oil | -2.31% | -15.03% | 35.61% |

| Gold Spot | -0.47% | -1.98% | -6.19% |

| DXY USD | 0.06% | 1.94% | 6.92% |

| EUR/USD | -0.04% | -2.20% | -7.38% |

| US 10Yr Yld | -12.18% | -9.59% | 43.83% |

| VIX Vol. | 7.16% | 86.10% | 34.81% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Europ in the spotlight

Positive Europe. Stronger-than-US GDP growth and cyclical indices drive double digit earnings

European earnings have seen a dramatic bounce-back, up 60% in Q3, outpacing the 40% US rise. We think this continues next year. European GDP growth is set to be stronger than the US, which is very rare. European stock markets are more cyclical, focused on our favoured financials, commodities, industrials. This makes them more exposed to strong growth and higher bond yields than the tech-centric US. Valuations are also 30% cheaper, giving more room to expand (and less room to fall). We think European consensus earnings expectations are too low at only 8%. GDP growth is set to be strong, and companies have shown the ability to maintain all-time high 11% profit margins in the face of rising inflation pressures.

Europe’s has four growth buffers: good start, government spending, dovish ECB, weak Euro

Europe is the centre of virus ‘fourth wave’, with half global cases, and up five times since the summer low. But Europe has significant ‘buffers’ to this growth headwind. 1) A solid start point. Q3 GDP rose 3.7%, and latest PMI was 56, resilient to the case surge. 2) Government spending helps, with EUR750 billion of ‘NexGen’ funds is to be disbursed. 3) European Central Bank (ECB) remains dovish and unlikely to raise interest rate next year. 4) The EUR has been weak, supporting the competitiveness of Europe’s globalised economies and companies. Think Airbus (AIR.PA), LVMH (MC.PA), or Remy Cointreau (RCO.PA), for example.

Modest event risks from Germany’s new government, French elections, and path to ECB tightening

Germany has a new SPD-led ‘traffic-light’ coalition government, that will see a modest fiscal expansion and green-policy slant. France faces April elections that likely see centrist Macron defeating hard-right in a second-round runoff. Rising inflation will keep pressuring the ECB’s dovish stance, especially early in the year. The ECB balance sheet is equal to 80% of EU GDP, twice the proportionate size of the Fed’s.

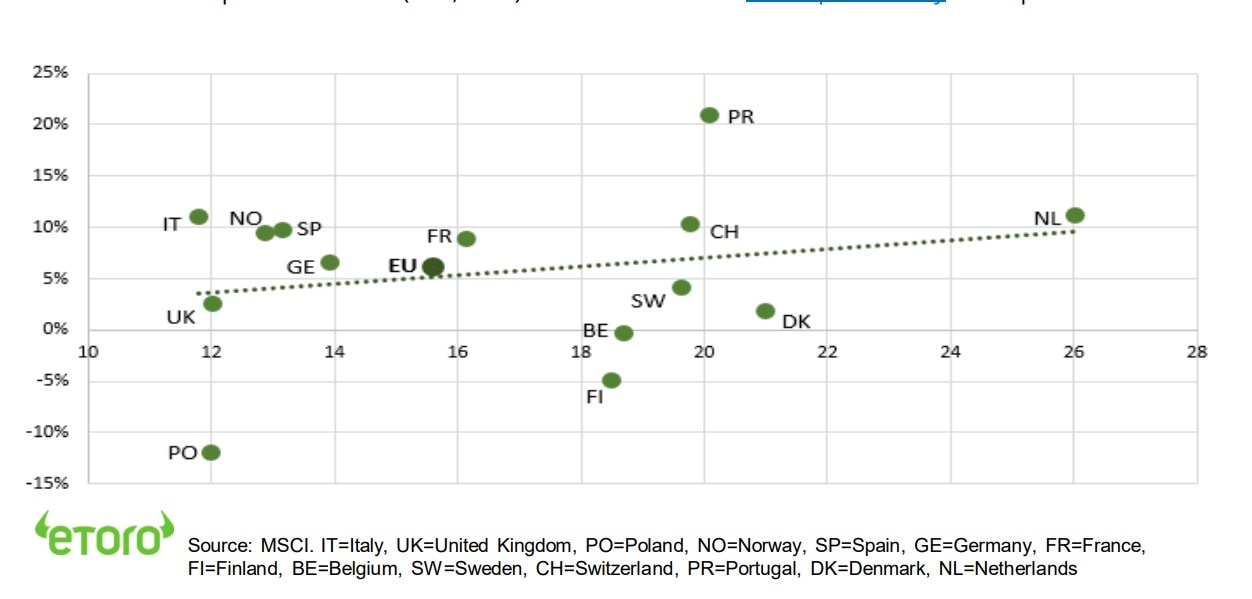

What to own? Germany and Spain GDP rebounds. Italy and Portugal well-placed. Netherlands OK

Germany (EWG) and Spain are two of the few economies globally set to see higher GDP growth next year, driven respectively by a recovering auto and tourism industries. Their sub-10% earnings growth outlooks look particularly low. The cheapest markets, with the lowest valuations compared to earnings growth, are Portugal and Italy (see chart). Leading Portuguese stocks include utility EDP (EDP.LSB) and retailer Jeronimo Martins (JMT.LSB). In Italy, utility Enel (ENEL.MI), bank Intesa (ISP.MI), and car maker Stellantis (STLA.MI) are largest. The world’s best performing major market, Netherlands, is still OK value given its continent-leading profits outlook. By contrast, Poland’s weak 2022 earnings outlook is driven by the high base-effect of its dramatic 60% commodity-driven earnings recovery this year. Similarly, UK equities are cheap, and earnings outlook flattered lower by this year’s big rebound. It’s 3.7% dividend yield is amongst the highest. For continent-wide exposure see ETFs (EZU, IEUR) or the new 40-stock @EuropeEconomy smart portfolio.

Europe: 2022e Price/Earnings Valuation (x, Horizontal axis) vs Earnings Growth (%, Vertical axis)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Positive scenario of 1) global vaccine rollout and economic re-opening, 2) support from low interest rates and government spending. Main risk is from US Fed monetary policy tightening, but will be well-signalled and very gradual. Economies are increasingly resilient new virus case ‘waves’. Focus on most growth sensitive assets: equities, commodities, crypto, small cap and value. Relative caution on fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | Equity markets helped by 1) a greater weight of cyclical sectors, and lack of tech, 2) 25% cheaper valuations vs US, 3) decade of under performance made under-owned by global investors. Helped by a dovish ECB to hold rates ‘lowfor-longer’, and multi-year €750bn ‘Next Generation’ fiscal support. A weaker EUR helps many companies, with 50%+ company revenues from overseas. ‘4th wave’ virus resurgence may provide additional buying opportunities. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China equities hurt by tech regulation crackdown, property sector debt, and slower GDP growth. But this is increasingly well-priced. LatAm and Eastern Europe have more upside to global growth recovery, a weaker USD, and higher commodities. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | The broad ‘tech’ sector of IT, communications, and parts of consumer discretionary (Amazon, Tesla), dominates US and Chinese markets. Expect a more subdued 2021 after dramatic 2020 rally. But are structural stories with good growth, high profitability, and clean balance sheets that justify high valuations, and should continue to rise. |

| Defensives | Healthcare, consumer staples, utilities, and real estate sectors traditionally offer more defensive cash flows, less exposed to changes in economic growth. This has also made them more sensitive to rising bond yields. We expect them to relatively underperform in a more cyclicals focused environment with earnings strong and yields rising. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low producitivity. |

| Commodities | Cross-currents of rising global growth conern on virus fourth wave, and stronger USD. But remain in ‘sweet spot’ of above-average GDP growth, ‘green’ industry demand, years of supply under-investment. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply. Gold hurt by likely rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.