Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and ‘special’ focus on tracking institutional and retail investor ideas.

Tracking what world’s best investors doing

Many world’s most accomplished investors, from Warren Buffett to Bridgewater and Duquesne, must disclose their portfolios every quarter. These 13F’s are published 45 days after quarter end and are a source of new ideas and insights. The latest from Feb. 14 show broad embrace of tech stocks but caution on the consumer. Whilst retail investors can also hold heads high, with Q4 positioning very long tech and successful picks from long NVO to cautious SNAP. See Page 4

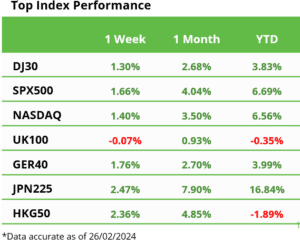

A positive week of new stock market records

Strong NVDA results and AI ‘tipping point’ drove biggest increase in stock market cap. ever and new US index records. All-time-highs also Europe’ Stoxx 600 and Japan Nikkei 225, after 34 years. China stocks rose after surprise rate cut as reopened after its NY holiday. Beats from WMT, MRNA and big misses PANW to HSBC, RIVN. COF buying DFS in large M&A See our 2024 Outlook HERE and twitter @laidler_ben. See Page 2

NVIDIA versus market bubbles and CISCO

Semis and AI giant NVDA beats and raises again, lifting whole market. It’s not a bubble. Only 1 of 3 ‘bubble’ indicators are in place, and it’s still 1/3 valuation of dot-com peer CISCO. See Page 2

Dollar well-priced as macro differences rise

Dollar (DXY) won from US macro exceptionalism, with Sterling (GBP) close behind and Yen (JPY) laggard. But DXY is now better priced and the macro divergence is just starting. See Page 2

Super-sized Switzerland due a catchup

A world-leading 85% sales from abroad, makes super-sized and consumer (NESN.ZU) and healthcare focused Swiss market (EWL) a winner from the weak Franc (CHF) outlook. See Page 2

A lithium price turnaround may take time

‘White gold’ plunge -80% hit ALB to SQM with a supply glut as EV demand growth stalls, but battery benefit for TSLA and others. See Page 2

Ethereum leading up versus Bitcoin

The 2nd largest crypto near $3,000 as Dencun upgrade and SEC spot ETF deadline near, as catches up with BTC recent outperformance. BTC consolidating above $50,000 as spot ETF inflows top $5 billion and futures open interest$6.5 billion. ECB publishes downbeat BTC view. See latest Weekly Crypto Roundup. See Page 3

Commodities sees some rare relief

As China stepped up macro policy stimulus and strong US dollar eased. China-focused industrial metals benefitted the most. Dramatic US natgas plunge stabilised as top producers CHK and EOG reigned in their production outlook. Nickel off lows on new Russia supply sanctions. Miners GLEN.L to AAL.L Q4 results plunged. See Page 3

The week ahead: Inflation, earnings, March

1) Fed favourite PCE inflation (Thu) est. pick up vs EU est. fall to 2.5% (Fri). 2) End of strong +10% S&P 500 earnings w/ CRM, DELL, AMT, BUD, LOW. AMZN into DJIA (Mon). 3) Borderline 50 China PMI (Fri) with stimulus rising and ‘Two sessions’ ahead. 4) End of strong Feb (Thu) led by tech and crypto, with politics the March focus. See Page 3

Our key views: Outlook for a different 2024

We see a stronger but very different 2024. Lower inflation and coming interest rate cuts as growth slows, and the earnings outlook idiosyncratically accelerates. Will drive an investor rotation from 2023 US and big tech winners to rate sensitive losers from Europe to real estate. See Page 5