Summary

Focus: Understanding retail crypto investors

Retail investors lead ownership of crypto, with institutions lagging. Crypto has grown into 3rd most-owned asset class, in our global survey results. This happened in under a decade. Crypto owners own a lot of it (26% of portfolios), led by younger investors. But the wide owning reasons provide a solid foundation. And there is room for more. Greater knowledge, regulation and less volatility will drive more adoption.

Ever more hawkish Fed drives volatility

A dramatic week of intra-day volatility as markets digested an ever-more hawkish Fed. 5 rate hikes are now expected this year. Geopolitical tensions added to the uncertainty. MSFT and AAPL were bright-spots in a so-far uneven earnings season. The USD rallied, bitcoin fell, and commodities were resilient. See our latest presentation, video updates, and twitter @laidler_ben.

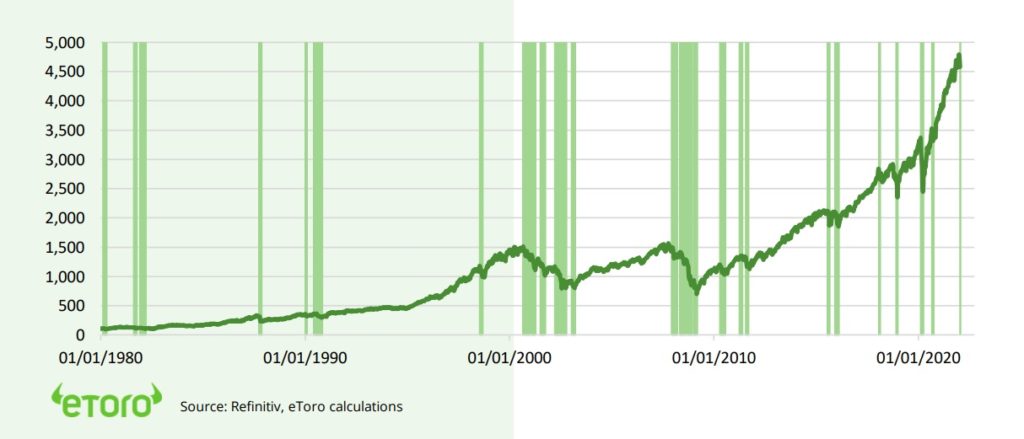

Corrections happen, and it pays to buy them

S&P 500 corrections are rare, with only 25 the past 40 years. They cluster around crises, which we do not see now. it pays to buy them, with markets usually higher a year later.

A terrible January does not define the year

January performance does not make the year. A down January leads to a down S&P 500 year 1/3 the time. And is even rarer outside recessions. The reality is sell-offs come anytime.

Does geopolitics matter to markets?

Russia-Ukraine tensions are stoking geopolitical concerns. They matter less than perceived for global markets. But specific impacts are clearly greater, from Russia (RSX) to oil (XLE).

Europe’s luxury success story

Luxury stocks had a strong pandemic. A better China, weak EUR, and embrace of online and young consumers helps outlook. It’s a European story, from LVMH to Richemont.

Crypto assets remain under pressure

Bitcoin (BTC) pressured by continued global markets volatility, in its 16th major correction of the last decade. SOL, AVAX, and SHIBxM have led crypto asset weakness this year. Silvergate (SI) bought Diem’s crypto payments tech. The SEC again rejected a physical bitcoin ETF.

Commodities only asset class up this year

Broad-based Bloomberg commodity index is up 8% this year, unique among asset classes. GDP growth is strong, supply tight, and geopolitical concerns rising. Russia-Ukraine tensions boosted natgas and oil last week, with oil at levels not seen since its 2011-14 super-cycle.

The week ahead: Earnings and central banks

1) Big Q4 earnings reports from GOOGL, META, AMZN, PYPL, XOM. 2) Bank of England to raise rates again (Wed), whilst ECB to stay on side-lines at its meeting. 3) US employment report (Fri) with Fed focus on tight labour market. 4) China closed for holidays. Winter Olympics starts.

Our key views: Look through the volatility

We see a positive 2022, but with lower returns and higher volatility than last year. Economic growth is strong and earnings forecasts too low. Valuations should stay high as interest rates rise from still very low levels. We focus on cheaper and cyclical assets that have strong growth and offer defence to valuation risks: like Value equities, small caps, commodities.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 1.34% | -4.44% | -4.44% |

| SPX500 | 0.77% | -7.01% | -7.01% |

| NASDAQ | 0.01% | -11.98% | -11.98% |

| UK100 | -0.37% | 1.10% | 1.10% |

| GER30 | -1.83% | -3.56% | -3.56% |

| JPN225 | -2.92% | -7.20% | -7.20% |

| HKG50 | -5.67% | 0.65% | 0.65% |

*Data accurate as of 31/01/2022

Market Views

More hawkish Fed sees huge intra-day volatility

- US equity markets saw a week of dramatic intra-day volatility as investors digested an ever more hawkish Fed. Markets are now forecasting 5 interest rate hikes this year. Russia-Ukraine geopolitical tensions added to the uncertainty. MSFT and AAPL were bright spots in an uneven earnings season so far. The USD rallied, bitcoin stayed under pressure, and commodities are the only asset class up this year. International markets and Value sectors were more resilient. See Page 6 for our Resources guide of reports, webinars, presentations, videos, and twitter.

Anatomy of market corrections

- NASDAQ is well into a -10% ‘correction’, and the S&P 500 near. A more hawkish Fed has been exacerbated by a mixed Q4 earnings start, and Russia-Ukraine geopolitics. This has been a ‘triple-whammy’ for investors to absorb.

- S&P 500 corrections are rare, with only 25 the past 40 years, clustered around crises. It pays to buy them, with markets typically higher on a 12- month view. The key is avoiding ‘crashes’, which are much fewer (tech bubble, global financial crisis), but deeper and longer lasting. We do not see a crash, with low recession risk. It always pays to be diversified, with a 16pp gap between best (utilities) and worst (tech) sectors.

What a terrible January means

- The ‘January Barometer’ says ‘as goes January, so goes the year’. Meaning the performance in the first month of the year determines the year. We would not take that a face value, even after one of the worst January’s for the S&P 500 ever.

- In the last fifty years a positive January led to a positive year 58% the time. But a down January only equals a down year ⅓ the time. And those times have mainly been in US recessions, that we do not expect now. The most recent comparison, 2019’s -6% January fall, ended with a +15% year. The reality is big market sell-offs can happen at any time during the year.

Does geopolitics matter to markets?

- Russia-Ukraine tensions are stoking geopolitical concerns, adding to the risk-off tone in global markets. These should not be overdone.

- Geopolitical risk is low, relative to the 2000’s Iraq War and 9/11. History shows limited long lasting global market impacts from most geopolitical crises. Local impacts are greater.

- Russia (RSX) is worst equity performer this year. Show’s even world’s cheapest market (5.3x P/E ratio) can get cheaper. Conflict could worsen Europe’s (EZU) energy crisis and boost oil (OIL).

Europe’s luxury success story

- Luxury stocks have had a strong pandemic. Both ‘narrow’ luxury like fashion, leather goods, beauty, or ‘broad’ plays including cars, spirits, sportswear. They enjoy strong brands, big profit margins, non-cyclical growth drivers of status and exclusivity. This supports high valuations.

- These trends will endure regardless of volatility. This European-focused sector will benefit from a stabilizing China, a weak EUR, and its embrace of online sales-channels and younger consumers. See LVMH (MC.PA), Hermes (RMS.PA), Dior (CDI.PA), Kering (KER.PA), Richemont (CFR.ZU).

S&P 500 10%+ market ‘corrections’ (last 40 years)

Crypto assets remain under pressure

- Bitcoin (BTC) remained pressured by global markets volatility, below $40,000. This is its 16th major price correction of the past decade. But weakness this year been led by Solana (SOL), Avalanche (AVAX), and Shiba Inu (SHIBxM).

- The US SEC rejected Fidelity’s spot bitcoin ETF proposal in the latest sign of its preference for those tracking the regulated futures market.

- Meta (FB) admitted defeat in its crypto payment ambitions. Diem Association (previously known as Libra) is selling its technology to crypto-bank Silvergate Capital (SI) for $200million.

Commodities the only asset class up this year

- Commodity prices inched higher, led by natural gas and oil. Brent crude oil rose over $90/bbl. to levels not seen since 2011-14 when it averaged over $100/bbl. Demand is firm, supply tight, inflation stubborn, and geopolitical tensions rising. This week’ OPEC meeting will be under political pressure to be seen to do something, but has little spare capacity to boost supply.

- Many commodities have been boosted by rising Russia-Ukraine tensions. Any disruption would be short-term, with commodities fungible and can be sold anywhere, but it is a reminder how tight supply is across the asset class. Russia is the world’s largest producer or exporter of oil, palladium, wheat, and Europe’ largest source of natural gas. Ukraine is a top-5 wheat producer.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 1.46% | -11.56% | -10.57% |

| Healthcare | 0.52% | -8.96% | -9.23% |

| C Cyclicals | -0.61% | -12.91% | -12.62% |

| Small Caps | -0.98% | -12.37% | -12.33% |

| Value | 0.38% | -3.36% | -3.56% |

| Bitcoin | -1.28% | -21.61% | -21.10% |

| Ethereum | -8.89% | -34.86% | 33.56% |

Source: Refinitiv

The week ahead: Earnings and Central Banks

- Company Q4 earnings stay in the spotlight. GOOG, META, AMZN, PYPL, and XOM are amongst heavyweights reporting. 1/3 S&P 500 reported so far. 80% above forecast, by 4pp.

- Global central banks remain in the spotlight with Bank of England likely to raise interest rates again (Wed), whilst the European Central Bank stays dovish despitemoves by its peers.

- Focus on the US labour market with non-farm payrolls (Fri) to decelerate. The latest ISM PMI data is likely to show a sharp, but temporary, omicron-driven slowdown to start the year.

- Big week in China with the markets closed all week for their new year holidays. Also see start of the Beijing Winter Olympics (Feb. 4-20).

Our key views: Lookthrough the volatility

- We see a positive 2022, but with lower returns and higher volatility than last year. Earnings forecasts are too low, with GDP growth strong. Valuations should stay supported by still low bond yields and record company profitability.

- US Fed has turned hawkish, with markets now expecting 5 rate hikes this year to combat 7% inflation. This has now been largely priced-in. The omicron virus is dampening near-term growth but economies are increasingly resilient.

- Focus on cheap and cyclical assets that benefit from good growth and stubborn inflation: Value, commodities, crypto. Cautious on bonds.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 1.70% | 8.05% | 8.05% |

| Brent Oil | 1.11% | 14.04% | 14.04% |

| Gold Spot | -2.39% | -2.09% | -2.09% |

| DXY USD | 1.65% | 1.30% | 1.30% |

| EUR/USD | -1.74% | -1.97% | -1.97% |

| US 10Yr Yld | 0.87% | 25.78% | 25.78% |

| VIX Vol. | -4.12% | 60.63% | 60.63% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Taking the pulse of retail investors

Retail investors have led development of the crypto asset class, with institutions lagging

To understand the emerging crypto asset class, we need to understand its dominant retail investor base. We look at the anatomy of retail crypto investors using data from our latest global retail investor beat survey, of 8,500 investors in 12 countries. It shows a surprisingly high level of ownership, wide diversification in reasons why, and room for more as education and regulation builds. See full results here.

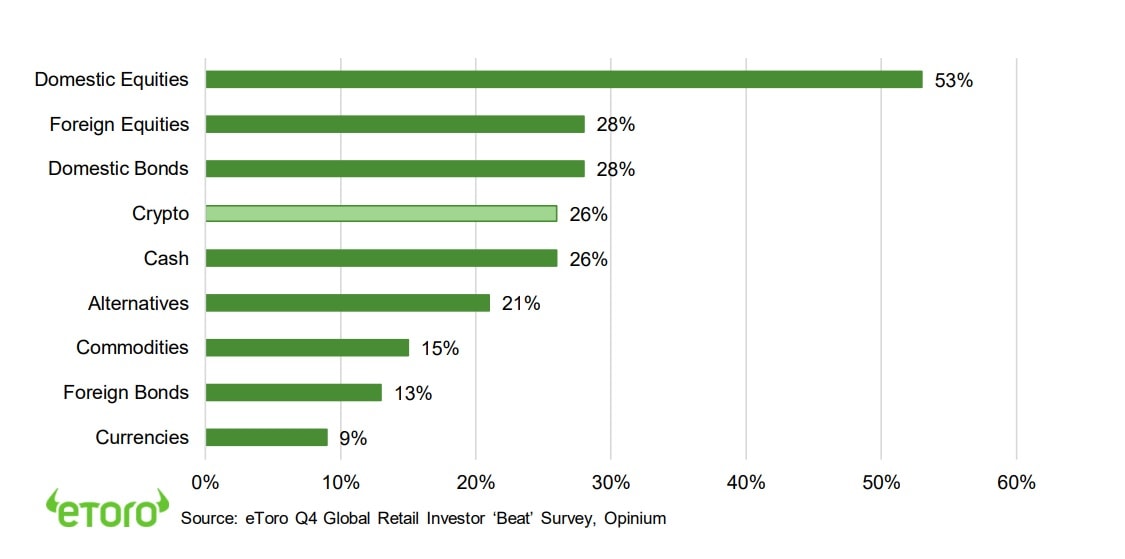

Crypto has grown into the third best-owned asset class, after equities and bonds, in under a decade

26% of surveyed retail investors own crypto assets today. This has kept growing, up 2 percentage points from our prior quarterly survey. Younger investors are twice as likely to own, with 49% of 18–34-year-olds holding. This makes crypto the 3rd best owned asset, after equities and bonds. This places it way ahead of larger and much longer-established assets like currencies (9% own), commodities (15%), or alternatives like real estate (21%). This is a remarkable achievement in less than a decade of mainstream development.

Those who own crypto, own a lot of it. This is led by younger investors

The average crypto owner has 26% of their total portfolio in the asset class, a very significant concentration for such a volatile asset. This rises to 36% amongst younger investors and compares to 6% for the oldest (55+). Men are more invested (36%) than women (26%). Overall allocations vary from 16% in Germany to a high of 46% in Czech Republic. A small minority (7%) are ‘true believers’ with over 80% allocations to crypto.

The wide variety of reasons for owning crypto provides a solid foundation

Investors have a reassuringly wide range of reasons for owning, that will support its development over time. 28% are focused on making big and quick returns. 27% see it as a transformative asset class. 24% as a store of value, whilst 17% see as an inflation hedge. Additionally, most are doing significant in-depth research before investing. This ranges from reading the whitepapers, to exploring the use cases, and discussion in crypto communities. Only 17% confess to doing no research and buying on hype alone. Interestingly this proportion that is ‘speculating’ is as high among young investors as amongst the 55+!

Room for more. What is holding adoption back? Knowledge, volatility, and regulation

Crypto is already very well owned for such as young asset class, but their seems room for more. The main issue holding back ownership is a lack of knowledge (36%). This is followed by high price volatility (25%) – evident in the current 50% bitcoin correction, its 16th of the last decade alone. Lack of regulation holds others back (15%), whilst some (13%) consider it as too small an asset class. All these should ease in future.

I am currently invested in (% of respondents)….

Key Views

| The eToro Market Strategy View | |

| Global Overview | Forecast a very rare fourth consecutive positive year in 2022, with naturally lower returns and more volatility than last year. Main drivers of 1) GDP growth to remain well-above average, and supported by further vaccine-driven reopening. 2) Monetary policy tightening to be relatively gradual from very low levels, and inflation pressures to ease during the year. Focus on reflation and cyclical assets: equities, commodities, crypto, small cap, value. Relative caution on fixed income, USD, and defensive equities. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | Equity markets helped by 1) a greater weight of cyclical sectors, and lack of tech, 2) 25% cheaper valuations vs US, 3) decade of under performance made under-owned by global investors. Helped by a dovish ECB to hold rates ‘lowfor-longer’, and multi-year €750bn ‘Next Generation’ fiscal support. A weaker EUR helps many companies, with 50%+ company revenues from overseas. ‘4th wave’ virus resurgence may provide additional buying opportunities. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China outlook improving as cuts interest rates (opposite of rest of world) reducing slowdown and property sector risks, focuses on stability ahead of 20th Party Congress, and with valuations now 45% cheaper than US and market heavily out of favour. Will support EM, but is exposed to Fed tightening. China recovery also helps global sectors from luxury to materials. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Consumer staples, utilities, real estate offer more defensive cash flows, less exposed to economic growth. Makes them more sensitive to rising bond yields. Expect them to underperform in a more cyclicals focused environment with earnings strong and yields rising. Healthcare is more attractive, with cheaper valuations and more growth. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Cross-currents of rising global growth conern on virus fourth wave, and stronger USD. But remain in ‘sweet spot’ of above-average GDP growth, ‘green’ industry demand, years of supply under-investment. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply. Gold hurt by likely rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| Italy | Gabriel Dabach |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.