Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and a weekly ‘special’.

Stocks in the Christmas stocking for 2024

We are positive global stocks for 2024 with interest rate cuts and double-digit earnings growth coming. See a soft economic landing with inflation back into rate cutting zone in 1H. The sector and style call will be the most important of the year. Rotating from US and big tech defensive growth winners today to Europe/EM and real estate/small cap cheap rate sensitives later. Risks high but manageable, from elections to data dependent central banks. See Page 4

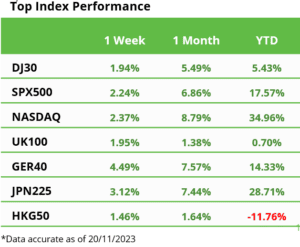

Fear-of-missing-out extends relief rally

A cooler 3.3% US inflation surprise extended the global stocks rally, with US 10-year bond yields falling below 4.5%, oil under $80, and the US dollar weakening. US government shutdown was avoided, and China tensions cooled. Solar, REITS, and small caps led stocks relief. WMT slumped after Q3 results and TGT soared. BABA scrapped its biggest spin off. See Q4 Markets Outlook HERE and at twitter @laidler_ben. See Page 2

Santa coming early this year, again

Seasonal Santa rally started early, as last year, with November and December typically two of strongest months globally, driven by improving fundamentals and also technicals. See Page 2

The Magnificent 7 and AI adoption

Big tech continued to outperform and helped by AI adoption, with half investors now comfortable it managing their portfolios. NVDA’s forecast 170% sales growth the last Q3 test. See Page 2

Renewable hopes for COP 28

World’s biggest climate conference starts Nov. 30th, with another push to accelerate needed 3-6x investments, that may help renewables sector derated stocks out of their funk. See Page 2

The coming election traffic-jam

40% world economy go to polls next year, book ended by crucial Taiwan and US elections, with everyone from Russia to EU between. See Page 2

Bitcoin hits $37,000 but Solana steals show

BTC touched $37,000, up an asset class leading 120% this year, on continued spot ETF approval optimism. Altcoin SOL led gains, surging again and up 500% this year, with XRP a rare decliner. BLK filed a spot ETH ETF. Tether to mine BTC. Wallets holding over $1m BTC hits 80,000. See latest Weekly Crypto Roundup. See Page 3

Brent below $80/bbl. ahead of OPEC meet

Broad commodities fell, taking -10% for year, the worst of all asset classes. Brent crude fell for a 4th week on US inventories surprise rise, ahead of this weekend’s OPEC meeting. Silver and Platinum among biggest gainers as US dollar fell. Lithium giant SQM profits halved with lithium prices now -75% in the past year. See Page 3

The week ahead: Thanksgiving, NVDA, PMIs

1) US Thanksgiving holiday (Thu) and Christmas spending kick off. 2) Semis giant NVDA leads end of good earnings season, with LOW, DE, NIO. 3) Argentine election reaction, Netherland poll, UK budget. 4) Global flash PMI macro check, FOMC minutes, OPEC meet (Sun) outlook. See Page 3

Our key views: Looking to a positive 2024

See a stronger Q4 and 2024 as summer breather and tall wall-of-worry fades, and investors look ahead to lower inflation and coming rate cuts as growth slows, and earnings outlook firms. Focus defensive growth and long duration assets from healthcare to big tech. Cautious growth exposed cyclicals, commodities, and banks. See Page5