Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and a weekly ‘special’.

Technicals add to fundamental support

Technical low investor sentiment and seasonality drivers are positive and matter to investors. And add to the still positive fundamental backdrop that should not be forgotten amidst current gloom. All four components of our sentiment indicator have slumped, a contrarian positive. Many investors see technical indicators as important as more traditional fundamentals. Our eToro investor sentiment indicator tracks the VIX, flows, retail sentiment, and put/calls. See Page 4

Caught between geopolitics and bond yields

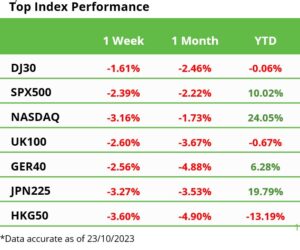

Stocks fell as geopolitical uncertainty and 5% US 10-year bond yield vice tightened. Recession fear eased as China Q3 GDP and US retail sales beat forecasts. Early Q3 results were mixed with TSLA and ASML misses partly offset by NFLX strength. Chip giant NVDA was hit by new curbs on China sales. LULU entered the S&P 500 as ATVI was cut after MSFT deal. See Q4 Markets Outlook HERE and at twitter @laidler_ben. See Page 2

The new normal of high uncertainty

Rising uncertainty saps investor and company confidence at a vulnerable time, But it is increasingly the new normal that markets have begun to successfully adjust to. See Page 2

Countering the oil market’s worst fears

Geopolitical spike may self-correct on demand destruction; economies now less oil dependent; few to follow Iran self-destructive supply threats; history on side of modest disruption. See Page 2

Stock markets Godzilla versus King Kong

Big tech magnificent seven set to grow earnings over 30% this Q3, justifying high valuations and supporting market. In contrast to headwinds that financials facing in the real economy. See Page 2

Crypto shows its hand to catalysts ahead

Crypto the smallest, youngest, most retail-owned asset classes, and is disproportionately sensitive to any of the many coming catalysts. See Page 2

Crypto a rare bright spot

Asset class again bucked downdrafts elsewhere, helped by low interest levels and cross-asset correlation. BTC spiked on wrong spot ETF approval report. SEC decided not to appeal Grayscale case. MS called end to ‘crypto winter’. TSLA held unchanged $185 million BTC position. See latest Weekly Crypto Roundup. See Page 3

Geopolitics keeps oil over $90/bbl.

Oil prices rose as geopolitical risks increased and Iran called for an OPEC oil embargo. Impact was partly offset as US lifted sanctions on Venezuela. US natgas prices fell 10% on higher production and inventories and mild weather. Grain prices were pressured lower by combo of strong harvests and raised crop forecasts.See Page 3

The week ahead: Oil, earnings, GDP, elections

1) Bond yield and oil prices focus, with global PMI (Tue) health check due. 2) Big tech Q3 earnings from MSFT, GOOG, AMZN, META. 3) Data focus on ECB 4.5% rate hold (Thu), and US Q3 GDP 4%+ boom. 4) Argentine and Swiss weekend election reaction after Poland’s surprise. See Page 3

Our key views: Stronger months ahead

See a stronger Q4 and 2024 as summer breather and tall wall-of-worry fades, and investors look ahead to lower inflation and coming rate cuts as growth slows, and earnings outlook firms. Focus defensive growth and long duration assets from healthcare to big tech. Cautious growth exposed cyclicals, commodities, and banks. See Page 5

Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and a weekly ‘special’.

,