Summary

Big tech are getting stronger in the pullback

The silver lining to the tech sell-off is that the big tech ‘strong are getting stronger’. The cooling of last year’s tech IPO and M&A boom is cutting disruption risk and boosting big tech acquisition opportunities. Disruption, not regulation, is the biggest threat to todays tech’ titans. This year has seen a healthy valuation and expectations reset, and refocus on the protection offered by the tech incumbents. See @BigTech.

Equities relief as bonds throw a tantrum

The global equities ‘relief rally’ continued, sensitive to ‘less-bad’ Fed, China, and Ukraine news. This has halved equities YTD losses the past two weeks. The focus was on the US bond tantrum as 10-year yields rose to 2.5% on more hawkish Fed, and as oil neared $120. March 23 was 2nd birthday of covid-crash low. S&P 500 up over 100% since. See latest presentation, video updates, and twitter @laidler_ben.

Weak bond markets and recession risks

A sharp US bond tantrum is tightening financial conditions and boosting perceived recession risks. This is critical for investors but the risks are overdone. It favours cheaper sectors.

The continued case for banks

Sticky inflation and higher bond yields are relative positives for financials (XLF), the largest Value sector, and no.2 performer this year. They are cheap with strong capital levels.

LatAm is in from the investment wilderness

LatAm spent a decade in investment wilderness, But is top performer in a miserable Q1 for global equities, helped by high commodities and cheap valuations. There is room for more.

Retail investors helping anchor the market

US household’s equity ownership levels are at record levels, and are a key unsung foundation to the resilient equity markets.

Crypto backoverkey levels

Was a better week for crypto assets with BTC and ETH back over key price levels. Cardano (ADA) was the standout performer on network upgrade and the Grayscale fund launch. Goldman Sachs (GS) continues to push institutional adoption. ApeCoin (APE) was added to eToro.

High oil prices the focus

Brent crude neared $120 as Western countries considered further Russia energy sanctions. This put more focus on oil supply risks, with OPEC+ meeting and more potential IEA oil sales from strategic petroleum reserve sales. Aluminium surged on Russian related disruption.

The week ahead: A busy end to the quarter

1) Ukraine peace talks and commodity impact, with OPEC under pressure to boost production.

2) Friday’s US payrolls report key as Fed prepares to hike by 0.5% at next meeting.

3) EU inflation to hit a new record high 6.5% as ECB turns more hawkish.

4) Tech earnings from MU, PAYX, PATH and consumers WBA, LULU, CHEWY.

Our key views: The recovery ‘pain’ trade

Equities have discounted much bad news, and sentiment is negative. Stubborn inflation, a more hawkish Fed, China weakness, Ukraine war. Has made markets sensitive to any ‘less bad’ news. We focus on cheap and cyclical assets to benefit from growth and inflation: Commodities, Value, and crypto. We are cautious on bonds

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 0.31% | 2.36% | -4.06% |

| SPX500 | 1.79% | 3.47% | -4.68% |

| NASDAQ | 1.98% | 2.55% | -9.43% |

| UK100 | 1.06% | -0.08% | 1.34% |

| GER30 | -0.74% | -1.79% | -9.94% |

| JPN225 | 4.93% | 6.32% | -2.23% |

| HKG50 | -0.04% | -5.98% | -8.52% |

*Data accurate as of 28/03/2022

Market Views

Equities relief as bonds throw a tantrum

- Global equities continued their relief rally, on ‘less-bad’ Fed, China, and Ukraine news. They are up c10% from Q1 correction lows. Focus was the bond market tantrum as 10-year yields rose to 2.5% on the more hawkish Fed, and oil regained $120. March 23rd was 2nd anniversary of the covid-crash low. S&P 500 is up over 100% since. See Page 6 for our Resources guide of reports, presentations, videos, and twitter.

The bond tantrum and recession risks

- The US 10-year bond yield, which helps price everything from mortgage rates to company bond issues, has soared to 2.5% given the more hawkish Fed rhetoric. This bond tantrum is tightening financial conditions and boosting perceived recession risks. This is critical for investors but we think the risks are overdone.

- Cheaper sectors, with higher near-term growth, like commodities (XLE) and financials (XLF) are the investment antidote to these higher bond yields. Whilst tech (XLK), especially long duration ‘disruptive’ tech, and pricey ‘bond proxies’ are most pressured as bond yields rise.

The continued case for banks

- Sticky inflation and higher long term bond yields are relative positives for financials, the largest Value sector, and no.2 performer this year. They benefit from recovering loan volumes and being able to charge more for them. This offsets cooling capital market activity that investors have never valued highly.

- Financials are being supported by some of S&P 500’s best dividend and buyback cash returns and amongst the cheapest valuations, strong capital positions, and still low recession risks. See broad based ETFs for US financials (XLF), banks (KBE), or regional banks (KRE) and smart portfolio @TheBigBanks for exposure.

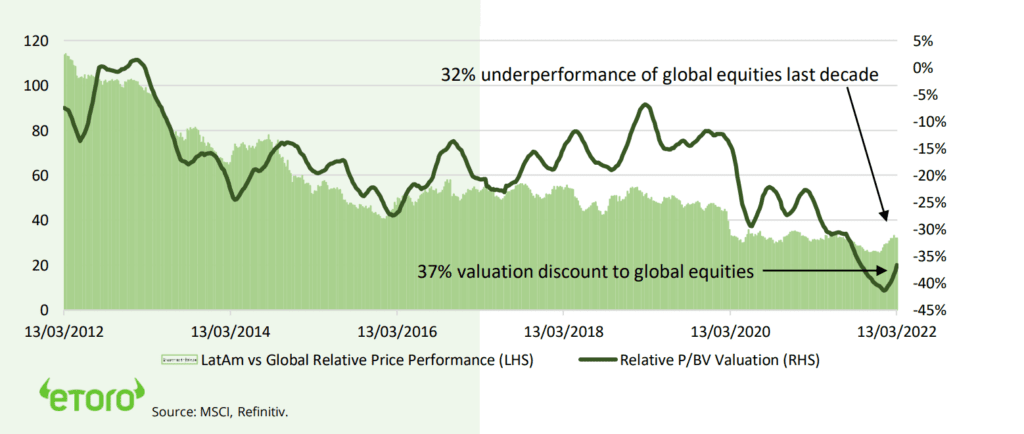

LatAm in from the investment wilderness

- LatAm has spent a decade in the investment wilderness, shrinking to only 8% of EM and 1% global equities. But is the world’s top performer in an otherwise miserable Q1 for equities.

- Boosted by soaring commodities (35% its equity markets), valuations at 40% discount, hiking rates to beat inflation and boost FX, some political relief, and long distance from Ukraine.

- With outlook for high-for-longer commodities and Brazil world’s 2nd cheapest market the rally could have further to go despite upcoming leftist election risks in both Colombia and Brazil.

Retail investors helping anchor the market

- Latest data from the US Federal Reserve shows US household’s equity ownership levels holding at record levels. Equites are 29% of their total assets, and near double the long-term average. Similarly, equities are 42% of financial assets.

- These levels are likely more structural than thought and been a key factor in the market resilience of recent months. 24% are new to investing and many been ‘buying the dip’. But individual investors remain overlooked by many traditional participants, despite importance.

LatAm versus Global equities: Relative performance (LHS) and Valuation (RHS) 120

Crypto backoverkey price levels

- It was a more positive week for crypto assets with both Bitcoin (BTC) and Ethereum (ETH) regaining key $40,000 and $2,900 price levels.

- Cardano (ADA) the standout performer, soaring after its network upgrade and with the largest weight in new Grayscale Smart Contract fund.

- Goldman Sachs (GS) announced its first over the-counter crypto trade since establishing a stand-alone trading desk, in a positive sign of broadening institutional crypto adoption.

- eToro added culture and gaming token ApeCoin (APE) as the 58th crypto asset on the platform.

Oil grind higher continues

- Brent crude neared $120/bbl. level as Western countries considered a further tightening of Russia energy sanctions. This puts more focus on oil supply, with the upcoming OPEC+ meeting and more further potential IEA oil sales from strategic petroleum reserve sales.

- Germany reached a LNG deal with major exporter Qatar in first concrete step since the EU announced an aggressive ambition to cut its Russian gas exposure by 2/3 by end this year.

- Aluminium prices rose sharply on fear of further Russia supply disruption. After Australia banned the export of key ingredient Alumina to Russia. It supplied 20% of Russian needs.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 2.15% | 2.60% | -10.59% |

| Healthcare | -0.47% | 3.71% | -5.27% |

| C Cyclicals | 0.29% | 2.62% | -10.18% |

| Small Caps | -0.39% | 1.82% | -7.45% |

| Value | 1.40% | 3.02% | -1.11% |

| Bitcoin | 5.75% | 14.40% | -6.32% |

| Ethereum | 5.13% | 15.74% | -16.69% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: a busy end to the quarter

- Slow-moving Russia-Ukraine peace talk focus as West tightens sanctions and with oil over $100/bbl. OPEC meeting (Wed) under pressure to boost oil production to calm sky-high prices.

- Big US week with employment report (Fri), set to see lower new jobs growth (450k) and low unemployment (3.9%). Also PCE inflation (est. up to 6.5%) and ISM PMI (est. stable at 58).

- Also EU inflation, estimated to increase to new high 6.5%, as the ECB is being forced to slowly turn more hawkish despite the rising risks to Europe’ economic recovery from Ukraine crisis.

- The earnings highlights are from chipmaker MU, outsourcer PAYX, and robotic software PATH. Also pharmacy giant WBA, leisurewear LULU, pet stock CHWY, and meme-stock BB.

Our key views: The recovery ‘pain’ trade

- Equities have discounted a lot of bad news this year, and sentiment turned negative. Stubborn inflation, a more hawkish Fed, China weakness, Ukraine war. This has made markets sensitive to any ‘less bad’ news. This is happening now.

- Economies are reopening and growth robust. Q4 company profits strong. Valuations more attractive. Fed hiking cycle well-priced. Investor sentiment near attractive capitulation levels.

- Focus on cheap and cyclical assets that benefit from good growth and stubborn inflation: Value, commodities, crypto. Cautious on bonds.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 5.26% | 15.53% | 30.94% |

| Brent Oil | 7.98% | 23.55% | 49.90% |

| Gold Spot | 1.88% | 3.57% | 6.94% |

| DXY USD | 0.58% | 2.27% | 2.96% |

| EUR/USD | -0.62% | -2.58% | -3.44% |

| US 10Yr Yld | 32.57% | 51.02% | 96.52% |

| VIX Vol. | -12.82% | -24.57% | 20.85% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Big tech strong to get stronger

Silver lining to the tech sell-off. Strong are getting stronger

The tech-heavy NASDAQ fell into a ‘bear’ market this year after a 20% price fall. The ‘disruptive’ tech stocks proxied by the ARK Innovation ETF (ARKK) have done even worse, halving since their 2021 highs. With tech the world’s largest sector, this has been a key headwind for global equities. But we see a silver lining for ‘big tech’. They are now cheaper, with less competition, and new avenues for growth. Investors are refocusing on their oft overlooked combination of growth, cash generation and fortress balance sheets. They are an attractive counter-weight to our focus on cheaper cyclicals like commodities and financials.

Tech led the initial public offering (IPO) and acquisitions boom. This is now slowing

Last year set a lot of new records, including for the number of companies listing on the stock exchange for the first time. This was over 3,000 firms globally, raising $600 billion of capital. Similarly for mergers and acquisitions, which saw 62,000 deals totally over $5.1 trillion, propelled by a confluence of special purpose acquisition companies (SPACs), cashed-up private equity firms, and acquisitive strategic acquirers. Tech companies led this boom. But with markets and valuations now lower, and volatility and interest rates higher, these activity levels have been fading fast this year. This is a silver lining for big-tech incumbents.

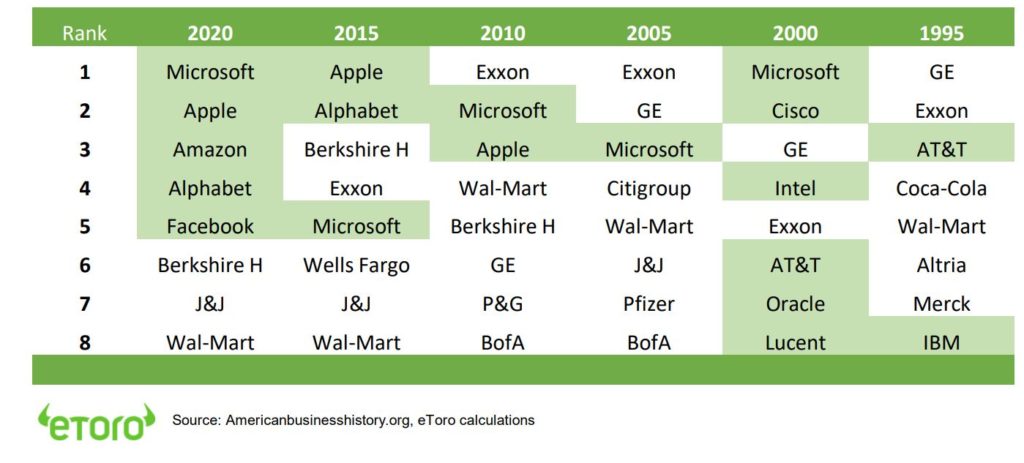

Disruption, not regulation, is the biggest threat to todays ‘big tech’ titans

This tougher market outlook is cutting off some of the oxygen to the big-tech competitors and opening more opportunities for them to make acquisitions to accelerate growth. Even as they continue to ride the tailwinds of pandemic accelerated tech adoption. This year has seen Microsoft (MSFT) bid for gaming leader Activision Blizzard (ATVI) for $69 billion, the biggest US tech deal ever. Also, Intel (INTC) bid for Tower Semiconductor. This comes as big tech saw more acquisitions in 2021 than any year the past decade, with Microsoft $19 billion Nuance deal and Amazon’s $8.5 billion for MGM. Even as Europe readies sweeping new tech regulations, we see disruption as the greater threat to dethroning today’s ‘big tech’ names. This is exacerbated by the speed of the tech transition and ‘winner-takes-most’ economics. Only two of the eight biggest US stocks were there a decade ago (see table below), and only one the decade before that.

The year seen a valuation and expectations reset, and a refocus on downside protection

FAANGM valuations have fallen by a third from peak levels, even as their sales and earnings growth outlook has accelerated. Their profit margins are double that of the index, representing a big ‘competitive moat’. They are the biggest buyers of their own shares in the S&P 500. Their fortress balance sheets, and high profitability allows a combination of strong capital expenditures, selective acquisitions, and sizeable cash returns to shareholders. See smart portfolios such as @BigTech and @Four-Horsemen.

Changing history of the largest US listed companies (‘Tech’ in Green)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Geopolitical risks alongside the Fed hiking cycle has boosted uncertainty and weakened markets. We see this ultimately fading, and the global growth outlook secure, and valuations more compelling. This still supports a rare consecutive double-digit positive return outlook for the year despite the weak start. Focus on reflation and cyclical assets: equities, commodities, crypto, small cap and value. Relative caution fixed income, USD, defensives. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing strong c4% GDP growth and with room for more earnings upside surprises. Valuations have now fallen back to average levels, and are well supported by still-low bond yields and high company profitability. Fed interest rate risks are now well-priced. See cyclicals and value catch-up, after a decade of underperformance, whilst big-tech is supported by its structural growth outlook. Now see overseas markets leading. |

| Europe & UK | Region is being buffeted by proximity and exposure to the Ukraine crisis. See secure outlook with 1) Europe’s strong macro ‘buffers’ of rising fiscal spending (defence and refugees), zero-bound interest rates (‘dovish’ ECB), and a weak Euro (50%+ company sales from overseas). Equity markets helped by 2) a greater weight of cyclical sectors, and lack of tech, 3) 25% cheaper valuations vs US, 4) decade of underperformance make under-owned by global investors. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China outlook improving as cuts interest rates (opposite of rest of world) reducing slowdown and property sector risks, focuses on stability ahead of 20th Party Congress, and with valuations now 45% cheaper than US and market heavily out of favour. Will support EM, but is exposed to Fed tightening. China recovery also helps global sectors from luxury to materials. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Consumer staples, utilities, real estate offer more defensive cash flows, less exposed to economic growth. Makes them more sensitive to rising bond yields. Expect them to underperform in a more cyclicals focused environment with earnings strong and yields rising. Healthcare is more attractive, with cheaper valuations and more growth. |

| Cyclicals | We expect cyclicals – industrials, energy, and materials, to lead performance. Are most sensitive to re-opening economies, still strong GDP growth, and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and been out-of-favour for many years. Consumer cyclicals face commodity headwinds. |

| Financials | Financials will benefit from strong GDP growth, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators giving flexibility to pay large 8-10% dividend and buyback yields. Most have zero Russia exposure. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | In ‘sweet spot’ of robust GDP growth, ‘green’ industry demand, years of supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply and Russia 10% world supply problems. Gold helped by risk-aversion but held back by rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.