Summary

Focus: The resilient retail investor

Retail investors are more important than ever. Our Q3 12-country survey shows inflation leads the perceived risks, but investors are sitting tight – a big positive. Their focus is on equities and US, but crypto adoption is significant, and now more than commodities, currencies, and alternatives. Tech leads the sector preferences everywhere, but defensives and commodities are rising. New, younger, and female investors are increasingly changing the face of investing.

Closing the best month in nearly a year

Strong earnings drove a solid week for markets, and closed the best month in 11. S&P 500 saw its 57th all-time-high of year. Tesla (TSLA) joined the $1trn market cap. club. But growth fears remain after US GDP rose only 2% and bond yields repriced upcoming rate hikes globally ahead of Fed tapering this week. Crypto a focus as SHIBA soared. See our presentation here.

‘TIM’ leads the earnings surprises

Halfway through US Q3 earnings and it’s been all about ‘TIM’. Resilience of Tech earnings, despite Apple (AAPL) and Amazon (AMZN) misses. The strength of International earnings. And revenues offsetting the cost-pressures on profit Margins. This will drive increases to low earnings forecasts, and more market upside.

What now after the rebound?

The inevitable question is what now? Investor worries are still high, from Fed tapering (Nov. 3) to debt ceiling (Dec. 3). But we see ‘stagflation’ risks as overdone, Fed tapering well-priced, and GDP to re-accelerate. Seasonality now positive. Our 2022 S&P 500 target is +11%.

Looking again at China

It’s time to look again at China, with its tech and growth risks now well-priced. Valuations are at a 30% discount. Largest stocks are Alibaba (BABA), Tencent (0700.HK), Meituan (03690.HK). Themes @ChinaTech to @ChinaCar

New Ethereum high. Crypto goes ‘woof-woof’.

Bitcoin (BTC) stable after recent all-time-high, whilst Ethereum (ETH) saw a new one, at $4,400. But focus was on meme-coin Shiba (SHIBxM), up over 100% on the week and now a top-10 coin. We are seeing increasing acceptance of bitcoin as an inflation-hedge, as CPI expectations soar and with gold seeing lower demand.

Commodities stabilise. Sugar turn in limelight

Commodities stabilised after blistering rally. Oil eased on rising inventories and upcoming Iran talks. Sugar stood out, up 25% this year, on stronger consumer demand and weather-driven supply issues in no.1 producer Brazil.

The week ahead: Tapering to finally arrive

1) Fed to finally announce tapering its $120bn/m bond purchases (Wed). Bank of England to likely raise rates for first time. 2) China and US PMI reports and US employment (Fri) rebound from last 194,000 jobs shocker. 3) OPEC meeting (Thur). No new supply to support prices. 4) US Q3 earnings shifts to healthcare, with vaccines Pfizer (PZE) and Moderna (MRNA) focus.

Our key views: Growth to re-accelerate

We see a positive outlook of 1) vaccine rollout and economic re-opening, and 2) still huge policy support, offsetting ‘stagflation’ and Fed risks. We see the ‘wall of worry’ giving way to a ‘Santa rally’. We like equities, commodities, crypto, and are cautious fixed income, and the USD.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 0.40% | 4.35% | 17.03% |

| NASDAQ | 1.33% | 5.70% | 22.61% |

| SPX500 | 2.70% | 6.40% | 20.25% |

| UK100 | 0.46% | 3.00% | 12.03% |

| GER30 | 0.94% | 3.51% | 14.36% |

| JPN225 | 0.30% | 0.42% | 5.28% |

| HKG50 | -2.87% | 3.26% | -6.81% |

*Data accurate as of 01/01/2021

Market Views

Closing the best month in nearly a year

- Strong earnings reports drove a positive week for equity markets, and closed the best month in 11. The S&P 500 saw its 57th all-time-high of the year, the 4th most ever. Tesla (TSLA) joined the exclusive $1 trillion market cap. club. But economic growth fears remained after US Q3 GDP rose only 2% and long-term bond yields fell ahead of Fed tapering decision this week Crypto drew much attention as SHIBA soared. See our globalmarkets presentation here.

What now after the October rebound?

- The S&P 500 rose 5.7% in its best monthly return since the 10% vaccine-driven boom of last November. Driven by strong Q3 earnings and an easing ‘wall of worry’ – from China property to US tax rises. The new all-time-highs have cut back the overly bearish prior narrative.

- The inevitable question is what now? Investor worries remain high, from Fed tapering (Nov. 3) to a new debt ceiling (Dec. 3). But we think Inflation risks are overdone, Fed tapering well priced, and GDP to re-accelerate. Seasonality is positive. Our 2022 S&P 500 target is +11%.

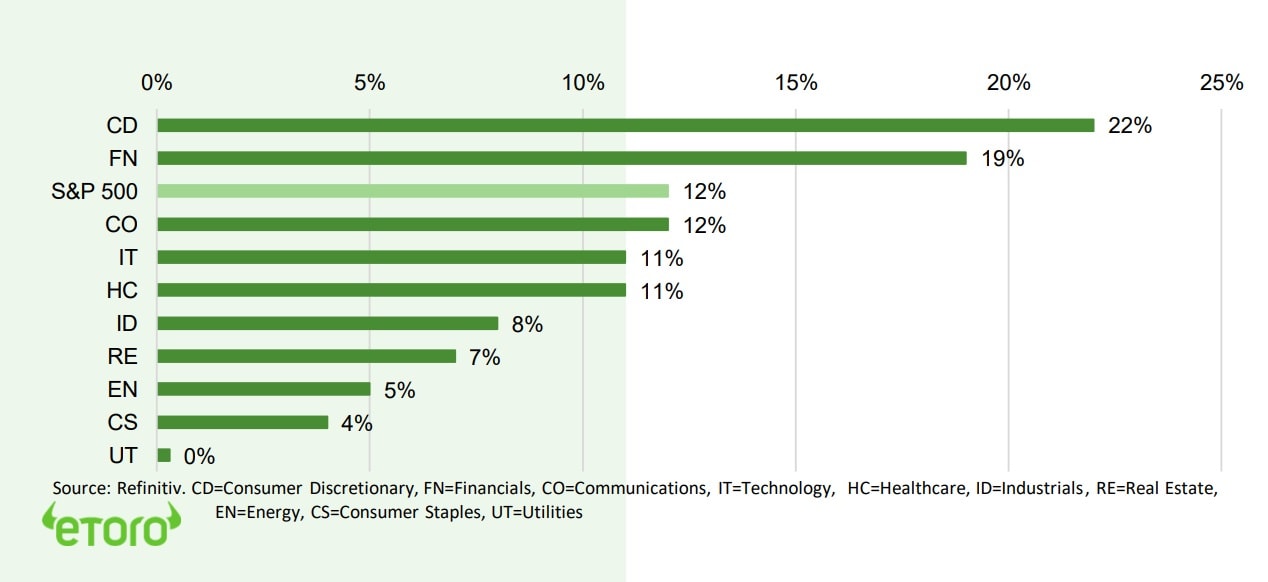

‘TIM’ leads the earnings surprise

- We are over halfway through US Q3 earnings and it’s been all about ‘TIM’: Tech, international, and margins. ‘Tech’ has been very strong, and every sector is ahead (see chart). International and Europe have led growth. Strong sales have outpaced cost-pressure and kept margins near all-time highs. This will drive increases to low earnings forecasts, and more market upside.

- The tech earnings surprise has been remarkable given the already strong growth seen and high expectations, and despite the mixed numbers from Apple (AAPL) and Amazon (AMZN).

Not even close to ‘stagflation’

- Markets are obsessed with ‘stagflation’, the toxic combo of higher inflation and lower growth. It’s Google searches are four times average. This would hurt valuations and earnings. But it’s an overreaction. The ‘misery index’, a stagflation proxy, is reassuring. We are not even close.

- Inflation is stickier than hoed but extrapolating forward is a mistake. Goods demand will slow, and supply chains and labour adjust. Central Banks will tap-the-brakes, and expectations quickly adjusted for two Fed hikes next year.

Looking again at China

- It’s not just the US hitting new highs. India (INDA) is the 2nd best performing market this year (+30%), on lower covid and re-allocations from China. Asian peer China (MCHI) is the 2nd worst (-11%). This outperformance has taken India’s valuation premium to 20% over long term average, just as its big exposure to high oil and a tighter Fed is set to be tested.

- It’s time to look again at China, with its tech crackdown and economic slowdown risks well priced. Macro policy support is also likely set to rise. Valuations are a 30% global discount and its growth still strong, with 5.5% GDP and 16% EPS forecast for next year. Largest stocks are Alibaba (BABA), Tencent (0700.HK), Meituan (03690.HK), and JD.COM (JD.US). We also see themes such as @ChinaTech, @ChinaCar as interesting.

Q3 earnings ‘surprise’ versus consensus forecasts (S&P 500 sectors)

Source: Refinitiv. CD=Consumer Discretionary, FN=Financials, CO=Communications, IT=Technology, HC=Healthcare, ID=Industrials, RE=Real Estate, EN=Energy, CS=Consumer Staples, UT=Utilities

Crypto goes ‘woof-woof’

- Bitcoin’s (BTC) stabilised after its recent all-time high, but Ethereum (ETH) set a new price record. Dog themed coins were the focus. Ethereum-based meme-coin Shiba Inu (SHIBxM) surged over 100% last week, and is up over 1,000% in only three months, making one of the top-10 largest coins by market cap, surpassing fellow dog-themed Dogecoin (DOGE).

- Bitcoin (BTC) is seeing more inflation-hedge acceptance, rallying as inflation expectations saw new highs in recent weeks, and seeing consistent inflows. Comes as gold (GOLD) has lagged, and World Gold Council reported 7% lower demand in Q3, led by investor interest.

Commodities take a breather. Sugar rally

- Commodity prices eased back last week, after there blistering 32% overall rally higher this year. Crude oil prices softened 2.6% as US inventories rose and nuclear talks with sanctioned oil producer Iran are set to restart. Sugar (SUGAR) prices stood out, are now near $0.20/lb, and up 25% this year. The rally has been driven by a rebound in consumer demand as economies re-open, alongside weather related supply concerns in top-producer Brazil.

- We see the commodity complex as well supported by robust demand, tight supply, and with increased demand from investors looking for more diversification or increased inflation protection.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 1.85% | 6.45% | 24.10% |

| Healthcare | 1.47% | 3.29% | 15.06% |

| C Cyclicals | 2.96% | 6.84% | 18.53% |

| Small Caps | 0.26% | 3.23% | 16.32% |

| Value | -0.38% | 3.87% | 19.97% |

| Bitcoin | 2.53% | 50.39% | 116.13% |

| Ethereum | 10.49% | 55.37% | 483.40% |

Source: Refinitiv

The week ahead: Fed tapering finally arrives

- Central Banks in focus with US Fed (Wed) to announce start of tapering its $120 billion/ month bond purchases. Whilst the Bank of England (Thur) is set to be the first of the top central banks to actually raise interest rates.

- Major economic data has forward-looking PMI’s in China, seen at only a breakeven 50, whilst the US ISM manufacturing PMI forecast at still-strong 60. Similarly the US employment report (Fri) seen part-recovering from last month’s weak 194,000 jobs shock.

- Surging energy in focus as OPEC meets (Thur) and start of UN climate conference (COP26). OPEC likely to keep plan for extra 0.4mmbl/m oil supply, even as prices have surged higher.

- US third quarter earnings shifts from tech to healthcare, including the leading Covid vaccine makers Pfizer (PFE) and Moderna (MRNA). 55% S&P 500 reported so-far, 80% above forecasts.

Our key views: Growth to re-accelerate

- A positive scenario of 1) global vaccine rollout and economic re-opening, 2) still large support of low interest rates and fiscal spending.

- The main risk is Fed policy tightening, which we see as gradual and well-flagged.

- We focus on cyclical assets that benefit most from the rebound: commodities, crypto, small cap, and value. We are more cautious on fixed income, the USD, defensive equities and China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -0.38% | 2.41% | 32.42% |

| Brent Oil | -2.61% | 5.41% | 61.50% |

| Gold Spot | -0.45% | 1.35% | -6.13% |

| DXY USD | 0.53% | 0.11% | 4.67% |

| EUR/USD | -0.72% | -0.27% | -5.35% |

| US 10Yr Yld | -7.60% | 9.67% | 64.11% |

| VIX Vol. | 5.38% | -23.12% | -28.53% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Investing in the climate transition

Results from our latest global retail investor survey are more important than ever

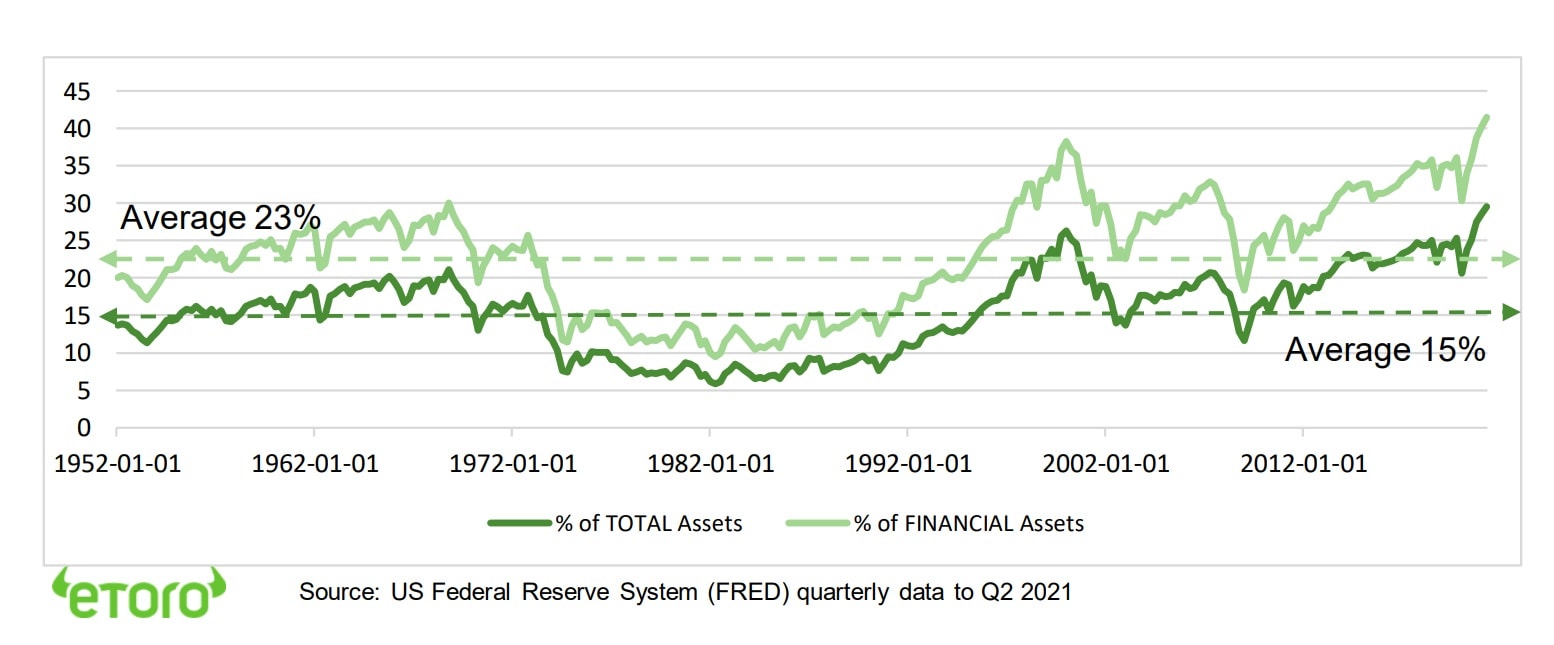

We surveyed 6,000 self-directed investors in 12 countries, from Australia to Romania, in our latest survey. This is important with retail investors never more key. US household investments in equities are at a record, near double long term average levels, whilst online investment platforms continue to see strong growth. The drivers here are largely structural. The rise of online community and investment platforms, and of free equity trading and fractional ownership. This has come as household finances strengthen and interest rates stay very low. A summary presentation of the full survey results can be seen here.

Inflation leads perceived risks, but retail investors are sitting tight – a big positive

Current market risks are seen as significant, but investors not in a hurry to reposition. They seemingly take the long view and look through current concerns. Risks are led by inflation and the global economic outlook, but surprisingly not by the risk of higher interest rates. The biggest risk increase was over taxes, as national governments increasingly look to repair their damaged finances. Over 40% are looking for a market correction – and 55% of US investors – whilst European investors seem the most confident.

The allocation focus is on equities and the US, but crypto adoption is significant

Retail investors are well-diversified, with 52% owning domestic equities, 29% domestic bonds, 26% cash, and 24% crypto assets. More people now own crypto than commodities, currencies, or alternatives like real estate. This is a further sign of the asset class strong adoption. The outlook for US equities is the most positive consensus among the major markets, with China a surprise second choice – as the worst performingmajor market this year. Japan and UK equities were unloved and ranked last in preferences.

Tech leads sector preferences everywhere, but defensives and commodities are rising

Tech unsurprisingly leads sector preferences in every market, but this has been easing back. Commodities and traditional defensive sectors, like utilities and real estate, are especially popular for such small sectors, and have been becoming more so as a significant minority of investors have been diversifying and becomingmore defensive in the face of the rising macro and market correction risks.

New, younger, and female investors are significant

The number of self-directed investors has grown strongly, with 23% new in the last two years, and this rises to near 50% of those under 35. This is hugely positive. The key to wealth generation is the compounding of returns over an extended period. Unsurprisingly younger investors have a higher risk appetite – owning more equities, tech, and crypto – and invest differently – using more online platforms, social media, and a greater ESG focus. Contrary to some perceptions retail investors are well-diversified, do not over-trade, and use a wide range of information sources in making investment decisions.

US Households equity ownership at all-time-highs (% of assets)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Positive scenario of 1) global vaccine rollout and economic re-opening, 2) support from low interest rates and government spending. Main risk is from US Fed monetary policy tightening, but will be well-signalled and very gradual. Economies are increasingly resilient new virus case ‘waves’. Focus on most growth sensitive assets: equities, commodities, crypto, small cap and value. Relative caution on fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | Latest to benefit from vaccination surge and much more economic re-opening to go. Equity markets helped by 1) a greater weight of cyclical sectors, and lack of tech, 2) 25% cheaper valuations vs US, 3) decade of under performance made under-owned by global investors. A robust EUR a help for investors, as is multi-year €750bn ‘Next Generation’ fiscal support. With 50%+ company revenues from overseas is exposed to global trends. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China equities hurt by tech regulation crackdown, property sector debt, and slower GDP growth. But this is increasingly well-priced. LatAm and Eastern Europe have more upside to global growth recovery, a weaker USD, and higher commodities. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | The broad ‘tech’ sector of IT, communications, and parts of consumer discretionary (Amazon, Tesla), dominates US and Chinese markets. Expect a more subdued 2021 after dramatic 2020 rally. But are structural stories with good growth, high profitability, and clean balance sheets that justify high valuations, and should continue to rise. |

| Defensives | Healthcare, consumer staples, utilities, and real estate sectors traditionally offer more defensive cash flows, less exposed to changes in economic growth. This has also made them more sensitive to rising bond yields. We expect them to relatively underperform in a more cyclicals focused environment with earnings strong and yields rising. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | We see recent USD strength easing as the rest-of-world GDP growth recovery accelerates, and fears over a virus ‘third wave’ ease. A stable or weaker USD traditionally supports Emerging Markets, commodities, and large US foreign earners, such as the tech sector, and could be a modest headwind to large exporters, such as Europe. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Supported by GDP growth rebound, ‘green’ industry demand, years of supply under-investment. China GDP and property sector are short term concerns. Industrial metals and battery materials seem best positioned, whilst oil price supported by only slow return of OPEC+ supply. Gold hurt by outlook for higher bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.