Summary

Navigating the rising recession risks

Recession risks are now soaring as Central Banks prioritise curbing inflation over all else. Has been a unique cycle so far, with US equities and bonds lagging vs many prior slowdowns. Defensives like consumer staples, utilities, healthcare are our focus, to stay invested for the eventual upturn. Similarly, investment styles like high dividend yield. These are most resistant to risk of the average S&P 500 -20% EPS fall during recessions. This is the ‘shoe that is still to drop’.

Bad news is now good news

Recession risks soared after Powell Congress testimony and the poor global PMIs. But markets saw bear market rally with ‘bad news’ now ‘good’. A growth slowdown eases inflation and bond yield pressure. Markets are forward looking and down a lot. But focus on high earnings risk. See U-shape recovery. See latest presentation, video updates, and twitter @laidler_ben.

Recession fears in context

Recession risks spiking, but is neither inevitable (11 since WWII), global, nor likely big, whilst much is already discounted by markets that may be in ‘bad news is good news’ mode as a slowdown cools inflation and interest rate fear.

Economies are not stock markets

Stock markets are larger cap, more global, goods focused, and forward looking than economies. Short term divergences can be large. See 2020 Covid rebound and FTSE 100 today.

Gold coming in from the wilderness?

Gold (GLD) and their equities (@GoldWorldWide) disappointed, despite inflation and risk-aversion. But valuations are now better, whilst bond yield and US$ pressures are likely to ease.

Crypto capitulation in context

Despite recent price fall, Bitcoin network stats continue to grow strongly, confirming crypto building adoption and use cases.

The crypto asset perfect storm eased

Bitcoin (BTC) stabilised around $20,000 after the prior week ‘perfect storm’ of equity weakness, Celsius halt, and contagion. UNI, AVAX and memecoins DOGE, SHIBxM surged but MATIC led with its Green Manifesto progress and positive Coinbase (COIN) announcement.

Commodity fall is easing inflation outlook

Brent oil prices eased toward $110/bbl. on rising recession and demand risks, and still-strong US dollar, ahead of OPEC meeting. Industrial metals and ag were also weaker. The silver lining is it is easing inflation outlook. See continued medium term commodities ‘sweet spot’.

The week ahead: Ending a difficult quarter

1) End of difficult Q2 (Thu) and 1H. Look ahead to a ‘less bad’ rest of year. 2) Eurozone inflation up to 8.3% to keep pressure on ECB. 3) Key earnings from NKE, MU, GIS, STZ with earnings ‘recession’ risk rising. 4) OPEC likely keeps output increase when meets Wed. To pressure prices.

Our key views: Managing recession risks

Markets seen the biggest sell-off since 2020 covid crash, as aggressive central banks are raising recession risks, to slow inflation. See a ‘less bad’ gradual easing of inflation risks, and a slowdown not recession driving ‘U-shaped’ rebound. Focus on cheap and defensive assets to be invested in ‘new’ world but manage rising risks. See Value, commodities, and high dividends.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 5.39% | -5.16% | -13.31% |

| SPX500 | 6.45% | -5.93% | -17.93% |

| NASDAQ | 7.49% | -4.32% | -25.81% |

| UK100 | 2.74% | -4.97% | -2.38% |

| GER30 | -0.06% | -9.29% | -17.42% |

| JPN225 | 2.04% | -1.08% | -7.99% |

| HKG50 | 3.06% | 4.94% | -7.17% |

*Data accurate as of 27/06/2022

Market Views

Bad news is now good news

- Recession risks soared last week after Fed Chair Powell Congress testimony and the poor global PMIs. But markets saw a ‘bear market rally’, with bad news seen as good, as growth slowdown and falling commodities ease inflation and bond yield pressures. Plus, markets are forward looking and discounted much bad news. Focus on still high earnings risk. See U-shape recovery. Page 6 for Resource reports, presentations, videos, twitter.

Recession fears in context

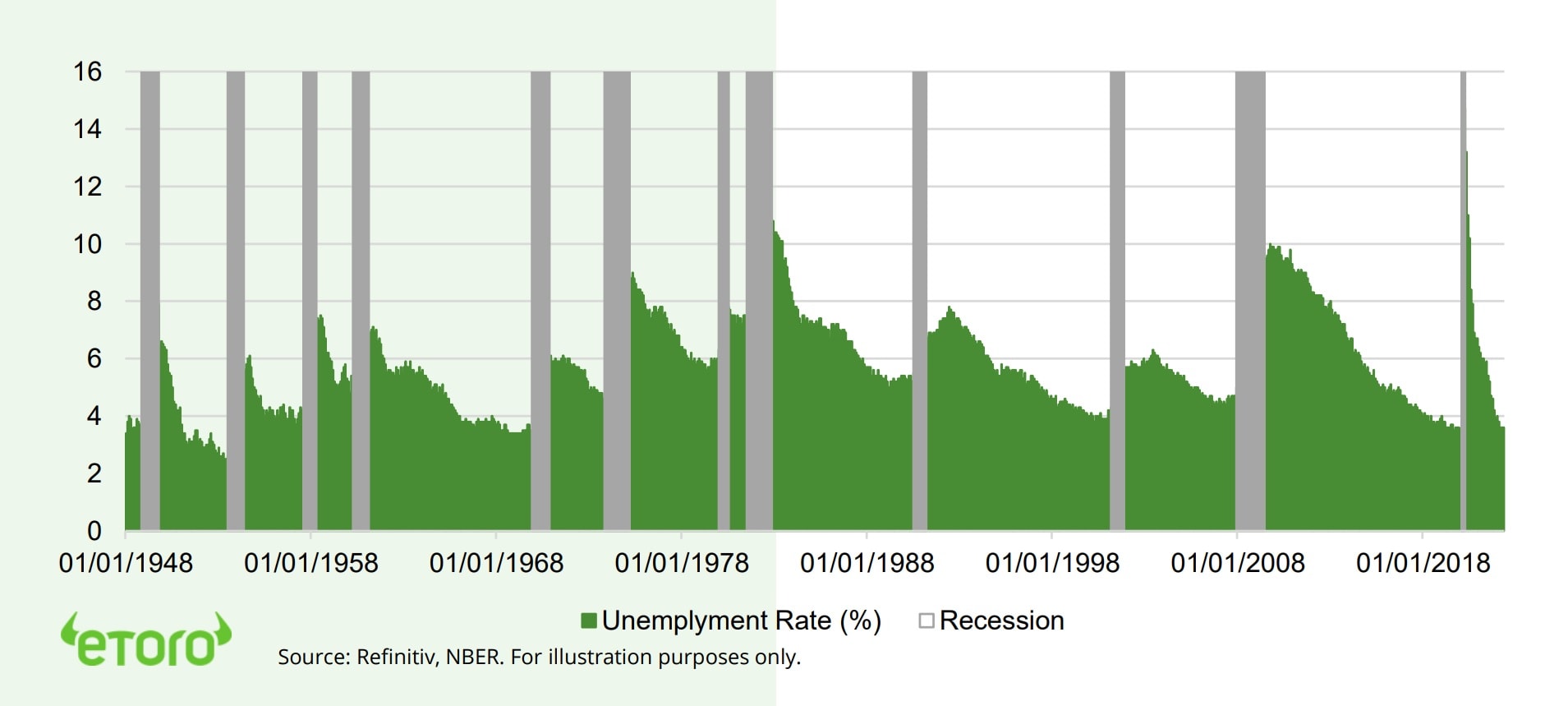

- Recession risks are spiking as Central Banks prioritise the inflation fight. There have been 11 US recessions since WWII. They have lasted an average 10 months, and mostly caused by the Fed. vs average 5 years for economic expansion.

- But recession is neither inevitable, global, nor likely big, and much is already discounted by markets. They may be in ‘bad news is good news’ mode as a economic slowdown cools high inflation and interest rate fears.

Economies are not stock markets

- Stock markets are an imperfect proxy for economies. This is important to understand when facing rising US recession risks but a still resilient +10% S&P 500 profits growth outlook.

- Markets are larger cap, more global, goods focused, and forward looking than economies. Short term divergences can be large. See 2020 Covid rebound and FTSE 100 today. Even though long term economic correlation is inescapable.

- Whilst the UK has some of the poorest macro indicators currently, with 9% inflation and economy teetering on edge of recession. The cheap and high dividend yield FTSE 100 (ISF.L) is the world’s best performing large market this year.

Gold coming in from the wilderness?

- Gold (GLD) and related equities (@GoldWorldWide, GDX) disappointed this year, despite traditional inflation and risk-aversion catalysts spiking.

- But valuations are now better, with the gold-oil ratio back at average levels for the first time in 8 years. Whilst US 10-year bond yields and US dollar strength pressures are likely to ease from here.

- Whilst oil prices are under pressure now, we see support from 1) recovering China, 2) tight supply, 3) still high inflation, and 4) a ‘backwardated’ futures market. See @OilWorldWide and XLE.

Crypto capitulation in context

- Despite recent dramatic price fall, Bitcoin network statistics continue to grow strongly, up between 20%-90% vs last year. Alongside rising merchant digital payment traction, and regulation guardrails, it helps confirm crypto’ building adoption and use cases. See @CryptoPortfolio to @DeFiPortfolio.

- The average of the 16th bitcoin price pullbacks over the last decade has been -51%, making this only the 4th largest fall. Whilst the amount of market value lost is dwarfed many times over by the $12 trillion in US equities alone this year.

US economic recessions since WWII vs Unemployment rate (%)

Crypto perfect storm eased

- Recent ‘perfect storm’ in crypto of sharp equity falls, Celsius withdrawal halt, and contagion fears, eased with Bitcoin (BTC) near $20,000.

- Relief was led by Polygon (MATIC), Uniswap (UNI), and Avalanche (AVAX), as well as meme coins Shiba Inu (SHIBxM) and Dogecoin (DOGE).

- Ethereum scaling and infrastructure platform Polygon (MATIC) led price gains, up near 50% the past week. Drivers included Coinbase (COIN) now letting users transact crypto on Polygon, and the Polygon announcement it has reached ‘carbon neutrality’, a key part of its Green Manifesto.

Commodity fall is easing inflation outlook

- Brent crude oil eased back toward $110/bbl. As rising recession risks and still-strong US$ hurt demand outlook. Whilst the Biden administration stepped up its efforts to curb recent rises, and even proposed a US federal gasoline tax holiday, ahead of this week’s latest OPEC meeting.

- Demand concerns also impacted the broader asset class, from industrial metals like copper and nickel, to ag heavyweight wheat, also seeing significant price falls. The silver lining of this is a lessening of inflation and rate hike expectations.

- We think commodities remain in a medium term ‘sweet spot’ of resilient demand, with no1 importer China now recovering, along side supply side constraints, and sticky inflation.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 7.85% | 1.36% | -26.00% |

| Healthcare | 8.47% | -0.21% | -10.91% |

| C Cyclicals | 7.54% | 2.42% | -28.59% |

| Small Caps | 6.01% | -1.86% | -21.36% |

| Value | 5.26% | -4.60% | -11.78% |

| Bitcoin | 3.27% | -29.03% | -55.49% |

| Ethereum | 13.12% | -37.99% | -67.41% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Ending a tough quarter

- See end of very tough Q2 and 1H (Thu), with S&P 500 down over 15% in Q2 and Bitcoin – 55% vs 5% rally for commodities and US dollar. Look to ‘less bad’ 2H with risks better priced.

- Focus is back on high inflation pressure. EU June prices set to rise to 8.3%, whilst the ECB meets at its Sintra ‘offsite’. Meanwhile, the Fed’ favoured PCE measure set to be up to 6.7%, as Central Banks been getting more aggressive.

- US earnings from sportswear Nike (NKE), tech Micron (MU), food staple General Mills (GIS), brewer Constellation (STZ). S&P 500 earnings in focus. Average recession see’s -18% EPS fall.

- Oil down as demand risks rise. OPEC meet (Wed) likely to keep plans for more output, to extra 0.648mbpd, from prior 0.432mbpd. Likely to keep pressure on near-term prices.

Our key views: A ‘U-shaped’ recovery

- Saw biggest sell-off since the 2020 covid crash. Concerns balanced between bond yields and valuations, and recession risk and earnings. See fundamentals stressed but secure, with slowdown not recession, on resilient corporates and consumer. But recovery U, not V, shaped.

- Focus on cheap and defensive assets, to be invested in ‘new’ world, but manage rising risks. Value, commodities, and high dividends and healthcare. Cautious on bonds, and ease back on Financials given rising recession risk.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -4.31% | -9.38% | 22.33% |

| Brent Oil | -4.07% | -5.49% | 39.84% |

| Gold Spot | -0.73% | -1.22% | -0.13% |

| DXY USD | -0.55% | 2.41% | 8.50% |

| EUR/USD | 0.57% | -1.67% | -7.18% |

| US 10Yr Yld | -10.03% | 39.07% | 162.21% |

| VIX Vol. | -12.53% | 5.87% | 58.13% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: The recession playbook

Recession risks are soaring as Central Banks prioritise curbing inflation over all else

There have been eleven US recessions since WWII. They last an average 10 months from peak to trough. The most common cause is the Fed raising interest rates, as now. This drives the adage that ‘bull markets don’t die of old age but are killed by the Fed’. This leads to a shallower and less damaging recession than one driven by financial crisis and high leverage, like 2007. This will still see a fall in so-far resilient company profits. But bull markets are built on the shoulders of recessions and bear markets. These cut inflation, interest rates, and investor excess. Bull markets are near four times longer and larger than bear markets. We are defensively positioned heading into the downturn and run through our ‘recession playbook’ below.

This has been a different cycle so far, with US equities and bonds both lagging

Historically equities have performed worst of the major asset classes in recessions. Now, new-kid on the asset class block, Crypto, has performed this role. Whilst Defensive equities, like consumer staples and healthcare, have done less-poorly, as usual. International stocks have usually lagged, but markets from UK to China are benefitting this time from cheaper valuations and counter-cyclical policies, respectively. Also, different from history, Treasury and investment grade bonds have done badly now, with the Fed raising interest rates into this possible recession – rather than easing as it would normally be considering now.

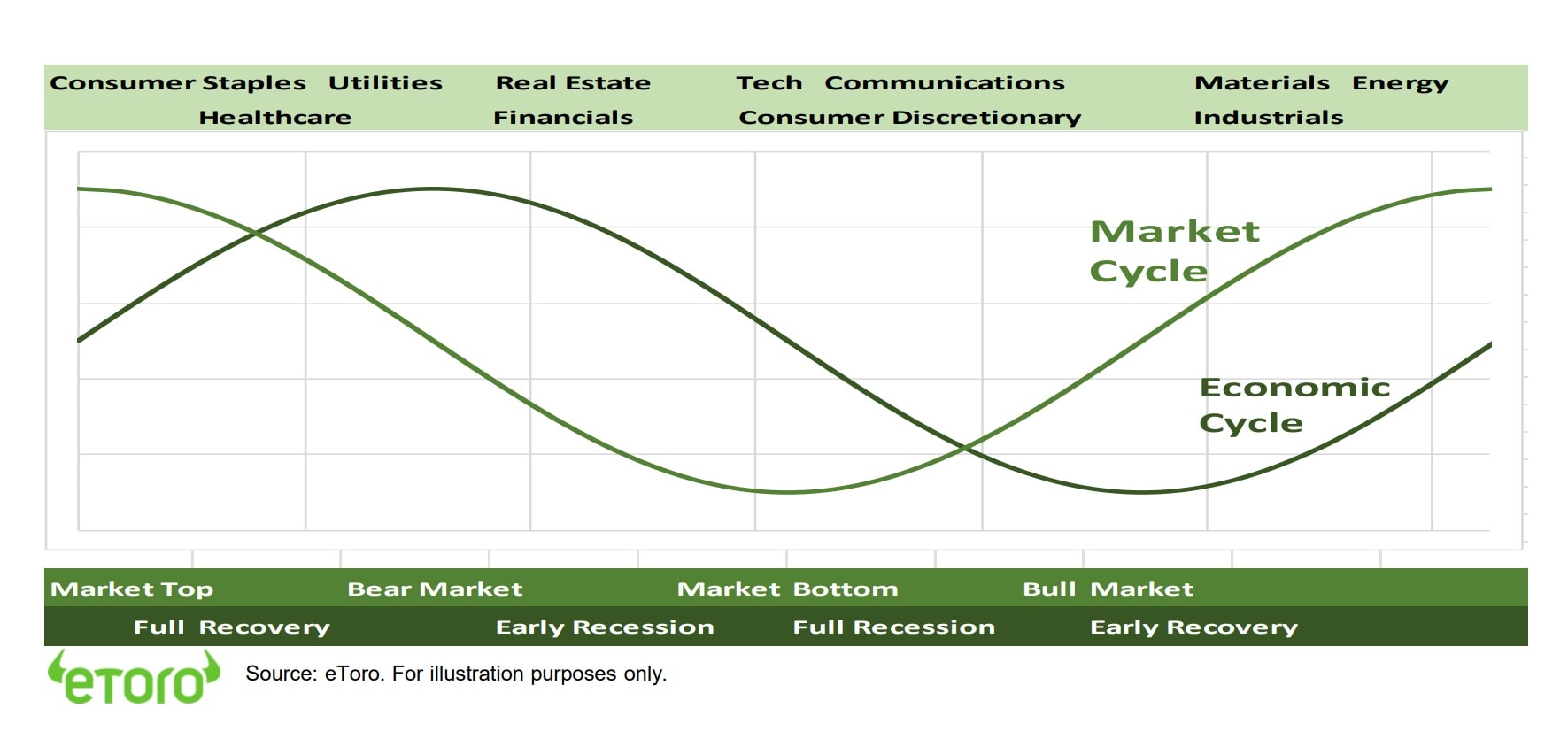

Defensive sectors like consumer staples, utilities, and healthcare are focus for now

This late Fed policy response is also distorting the traditional sector cycle (chart). This favours traditional ‘defensives’ as a bear market starts. Interest rate sensitives, like real estate and financials, as central banks cut interest rates as recession deepens. Recovery cyclicals, like technology and consumer discretionary, do well as the economy gets set to recover. Whilst later-cyclical commodities with the recovery well-underway.

Similarly, defensive investment styles like high dividend yield

‘Defensive’ styles like high dividend yield and Quality (high profitability and low debt) typically do better as economies weaken. Whilst Growth, like Technology, leads as central banks cut interest rates. More cyclical Value and Small Cap as the economy begins to recover. As this accelerates Momentum tends to do better.

These defensive sectors have the least sales volatility, making resilient to a recession

Sectors have different sensitivities to economic activity. Energy and materials high sales volatility is driven by commodity prices. Communications by sensitivity to advertising spending. Financials by leveraged exposure to the credit cycle. Consumer staples has the least volatile revenues. We always need to eat.

Key Views

| The eToro Market Strategy View | |

| Global Overview | Geopolitical risks alongside the Fed hiking cycle is boosting uncertainty and weakening markets. We see this as slowly fading, the global growth outlook secure, and valuations more compelling. Focus on cheap cyclical and defensive assets within equities, like Value, plus commodities, crypto. Relative caution on fixed income and the USD. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing strong c4% GDP growth and resilient earnings growth outlook. Valuations have now fallen back to average levels, and are supported by peaked bond yields and high company profitability. Fed interest rate risks are now well-priced. See cyclicals and value catch-up, after lagging for a decade, whilst big-tech supported by structural growth outlook. See overseas markets leading in global ‘U-shaped’ rebound. |

| Europe & UK | Favour defensive and cheap UK equities (‘Economies are not stock-markets’) over high risk/high return continental Europe. Recession risks rising with Russia and energy crisis, threatening to overwhelm ‘buffers’ of rising fiscal spending (defence and refugees), low interest rates (slow to raise ECB), and weak Euro (50%+ sales from overseas). Equities cushioned by greater weight of cheap cyclical sectors, lack of tech, and 25% cheaper valuations versus US. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. More cautious rest of EM on rising rates and strong USD. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Core positions as macro risks rise and bond yields are better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | Cyclical sectors, like consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, are cheap and attractive in a ‘slowdown not recession’ scenario. Are sensitive to re-opening economies, resilient GDP growth, and higher bond yields, with depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Benefits from higher bond yields, charging more for loans than pay for deposits. Also one of cheapest P/E valuations, and room for large dividend and buyback yields. But is being outweighed by rising recession risks, with lower loan demand and higher defaults. Banks most exposed. Insurance and Diversifieds (like Berkshire Hathaway) least. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech themes. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | In ‘sweet spot’ of robust GDP growth, ‘green’ industry demand, years of supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply and Russia 10% world supply problems. Gold helped by risk-aversion but held back by rising bond yields. |

| Crypto | Volatility very high, and correlation with weak equity prices risen. Asset class seeing 16th -50% pullback of last decade. Upside from 1) continued Institutionalization of cryptoassets, from allocations, to investment products, and regulation. Also, 2) the steady broadening of the use cases and market development, from Ethereum PoS, to DeFi to payments |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.