Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and a weekly ‘special’.

A resilient but different consumers Christmas

The Christmas consumer spending test is about to start. This spending is the biggest driver of all economies, dominates retailer profits, and likely is staying resilient. US Christmas spending seen growing 3-4% to $875 per family, focused on gift cards and clothing and with electronics and jewellery lagging. Online is the focus, followed by department and dollar stores, with growth surging, penetration low, but consumers more cost conscious, and trading down. See Page 4

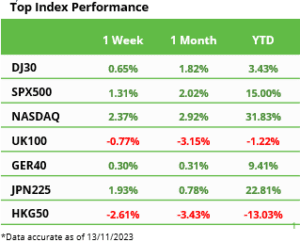

Markets rebound showed it had legs

Tech and crypto assets continued markets sharp recovery rally, resilient to a firmer dollar and higher bond yields as Fed’s Powell pushed back on extent of the dramatic twin bonds and stocks surge. Australia RBA forced to hike again. China’s deflation returned. US actors strike ended. DIS results beat, WE went bankrupt, and LLY weight loss drug approved. See Q4 Markets Outlook HERE and at twitter @laidler_ben. See Page 2

Groundhog Day for US government shutdown

Markets become immune to recurring shutdown threat, even as lengthened and politics more divisive, but with a silver lining that it may cool the strong economy and bond yields. See Page 2

Dividends now and forever

2023’s high dividend underperformance to end as central banks near rate cuts and slowdowns build. Long term, dividends beaten inflation and driven huge 58% of market returns. See Page 2

Four reasons to focus on Singles Day

China’s 11/11 shopping extravaganza gives a key read on economic recovery, world-leading online penetration, discounted local internet retailers and many exposed foreign stocks. See Page 2

Commodities set for a less-bad year

Asset laggard set for slightly better 2024 as China grows, supply tight, US$ eases. See ‘breakfast’ and ‘transition metal’ commodities. See Page 2

Crypto rally continues

Rally continued, with BTC now nudging $37,000 on 15th anniversary of Nakamoto white paper and as FTX’s SB-F found guilty. Latest gains led by altcoins LINK, ADA, MATIC, as expectations build on SEC spot ETF and Blackrock ETH trust plans. Miner MARA saw 670% Q3 revenue surge. See latest Weekly Crypto Roundup. See Page 3

Oil leads commodity slump

Oil led commodities slump to worst performing asset this year, as geopolitical premium faded, and US demand outlook cut. Precious metals safer haven cooled, and platinum fell <$1,000. Cocoa hit 45-year high on weather disruption, and El Nino seen lasting into mid 2024. Oil major OXY beat and outlined big CCS plans. See Page 3

The week ahead: Inflation, shutdown, WMT

1) US core inflation (Tue) est. <4% as Nov. 17 (Fri) Federal shutdown looms. 2) China focus as Xi and Biden meet at APEC, after giant Singles Day consumer test. 3) US ‘big retail’ WMT, HD, TGT Q3 earnings and Christmas view. 4) Argentina runoff (Sun) outlook and REITWorld event. See Page 3

Our key views: Stronger Q4 and 2024

See a stronger Q4 and 2024 as summer breather and tall wall-of-worry fades, and investors look ahead to lower inflation and coming rate cuts as growth slows, and earnings outlook firms. Focus defensive growth and long duration assets from healthcare to big tech. Cautious growth exposed cyclicals, commodities, and banks. See Page 5