Summary

Focus: The big investment themes ahead

Interest in thematic investing, unconstrained by sector or geography, is booming. Crypto, energy, vaccines, and big-tech led this year. Online retail, gene editing, cannabis, and China lagged. We focus on six themes for next year. Renewables (investment needs to triple) to EV’s (only 1% cars electric today). Re-opening (40% world now fully vaccinated) to China (the worst performing big market this year). Alongside crypto (accelerating adoption) and the metaverse (see gaming early adopters). See 45 smart portfolios.

Market relief as Fed tapering finally starts

Equity markets saw new all-time highs last week, with relief as the Fed started its long-awaited bond tapering. US Q3 earnings stayed strong, up 41% versus last year, and GDP forecasts are now rebounding. This boosted tech, consumer, small cap stocks and also the USD. Commodities and bitcoin took a breather after recent strength. See our latest presentation here.

Small caps to ride economic rebound

Small caps (IWM, IJR) rebounding. They benefit from the virus-driven economic rebound, with valuations at decade lows, and profits strong. US GDP growth forecasts have surged to 8.2% this quarter, up from 0% in Q3. Growth next year will be 4%, near double the average.

Revisiting the re-opening stocks

‘Re-opening’ stocks, from hotels to cruises, should accelerate. Avis (CAR) price doubled after strong results. But all should benefit as virus cases have plunged and is room for lockdowns to ease. Out 15-stock re-opening index runs from Boeing (BA) to Marriot Hotels (MAR).

Stand-off between stockand bond investors

We see equities supported by robust profits growth, with bond yields to stay low. Our cyclicals sector focus (such as XLE, XLF) provides the protection of lower valuations and exposure to the near-term growth pickup.

Altcoin catch up and Stablecoin regulation

Bitcoin (BTC) held near $60,000, whilst alt-coins saw sharp performance catch ups. Solana (SOL), Polkadot (DOT), and Avalanche (AVAX) amongst those with 20% or more gains. By contrast, meme dog coins, DOGE and SHIBAxM, fell after dramatic surges. The long-awaited US stablecoin report urgedmore regulation.

Commodity cross-currents

Commodities eased after strong rally this year. Oil saw cross-currents of rising US inventories but OPEC+ maintaining gradual supply increases. Aluminium weak as Russia may remove export tax in supply boost to global markets.

The week ahead: Big consumer week

Inflation focus in the US (est. 5.5%) and China (1.4%), as central banks look to tighten policy. 2) End of COP26 UN climate conference focus on net-zero implementation, coal, and carbon taxes. 3) China’s Singles Day, the world’s largest retail event. Important for BABA and JD US. 4) Wind down of US Q3 earnings season includes reports from PYPL, COIN, DIS, and AMC.

Our key views: Growth is rebounding

We see a positive outlook of 1) vaccine rollout and economic re-opening, and 2) still huge policy support, offsetting ‘stagflation’ and Fed risks. We see the ‘wall of worry’ giving way to a ‘Santa rally’. We like equities, commodities, crypto, and are cautious fixed income, and the USD.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 1.42% | 4.55% | 18.69% |

| NASDAQ | 2.00% | 6.97% | 25.07% |

| SPX500 | 3.05% | 9.55% | 23.92% |

| UK100 | 0.92% | 2.94% | 13.06% |

| GER30 | 2.33% | 5.58% | 17.02% |

| JPN225 | 2.49% | 5.57% | 5.28% |

| HKG50 | -2.00% | 0.13% | -8.67% |

*Data accurate as of 08/01/2021

Market Views

Market relief as Fed tapering finally starts

- Equity markets saw new all-time highs last week, with relief as the Fed started its long awaited bond tapering and jobs growth picked up. US Q3 earnings stayed strong, up 41% versus last year, and GDP forecasts are now rebounding. This boosted tech, consumer, small cap stocks and the USD. Commodities and bitcoin took a breather after recent strength. See our latest presentation here.

Stand-off between stockand bond investors

- Bond investors have been expecting high levels of volatility. By contrast equity investors see little volatility. Bond investors expect Central Banks to raise interest rates faster than previously expected. Whilst US and European equity markets are both hitting new highs.

- We see equities supported by robust profits growth, with bond yields to stay low. Our cyclicals sector focus (such as XLE and XLF) provides the protection of lower valuations and exposure to the near-term growth pickup.

Revisiting the ‘re-openers’

- ‘Re-opening’ stocks, from hotels to cruises, should accelerate. Attention focused on car rental this week, as Avis (CAR) share price doubled after strong results. But all should benefit as 1) virus cases have plunged 55% from September peak. 2) There is plenty of room for lockdown restrictions to ease. 3) The economy is rebounding. Out 15-stock re-opening index runs from Boeing (BA) to Marriot Hotels (MAR).

What Holland’s rally tells us about Europe

- Holland (EWN, IAEX) is the best performing major market this year. On the face of it the driver is clear. Dominant semiconductor stock ASML (ASML) is up 75%. But the performance also speaks to four themes that all support our broad bullish European equities (EZU) view.

- 1) The overlooked European tech sector. This is relatively small but also the best performing tech segment globally, with the highest valuation. 2) Holland is a new tech listing hub, from Adyen (ADTEN.NV) to Just Eat (TKWY.NV), InPost and Allfunds. 3) Europe has very high global revenues. 80% of Dutch company revenues are from overseas. 4) The banks sector is recovering, as bond yields rise and regulations allow more dividends and share buybacks.

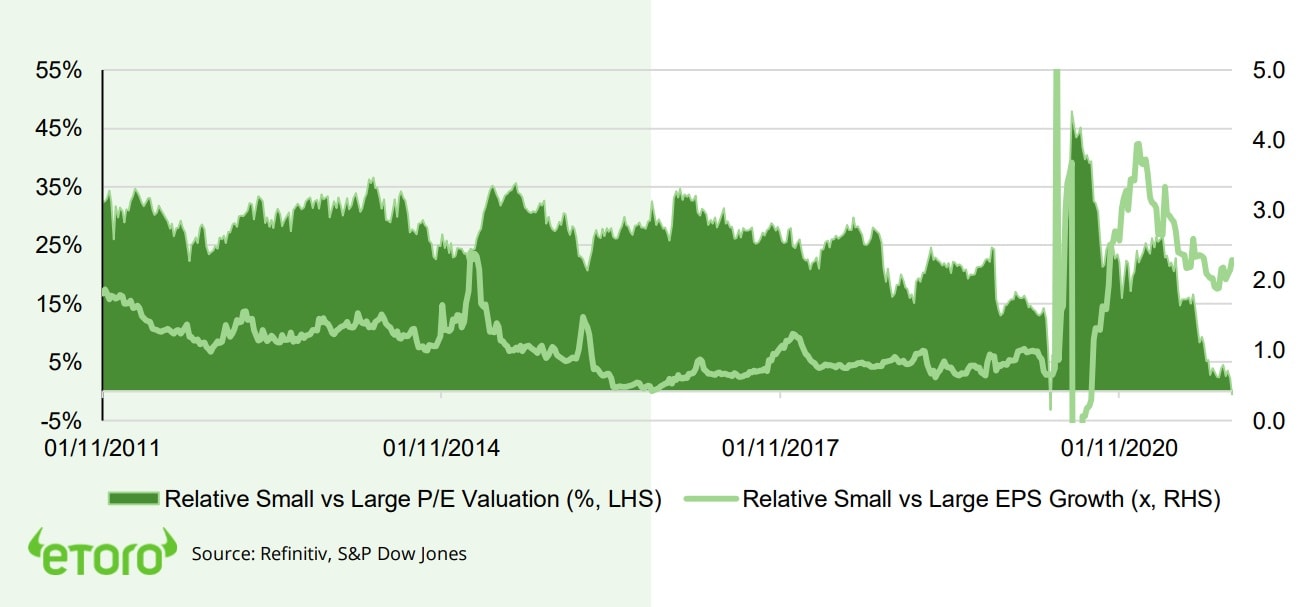

Small Cap to ride the economic rebound

- Small caps are recovering after going nowhere for six months. They will benefit from the virus driven economic rebound, valuations are at decade lows, and profits growth strong (see chart). US GDP forecasts rebounded to 8.2% this quarter, up from 0% in Q3. Growth next year will still be around 4%, near double the average.

- Small caps are very different from large caps. They are more sensitive to US economic growth. They are smaller, with less diversification, or overseas operations. They are more focused on commodity sectors and financials, and less tech.

- Broad small cap (IWM, IJR) gives the most diversification. Value small cap (IWN, VBR) the most bang. Both have more growth exposure and cheaper valuations than large caps.

US Small vs Large cap valuation (LHS) and earnings growth (RHS)

Alt-coin catch up and Stablecoin regulation

- Bitcoin (BTC) held its own around $60,000, whilst many alt-coins saw sharp catch ups to its recent performance. Solana (SOL), Polkadot (DOT), and Avalanche (AVAX) amongst those seeing 20% or more weekly gains. By contrast the meme dog coins, DOGE and SHIBAxM, saw modest declines after dramatic recent surges.

- The US government published its long-awaited report on stablecoins. It recognised the beneficial use cases for coins such as Tether, USDC, and Binance USD. But also argued for increased oversight and regulation, including issuers becoming federally insured banks.

Commodity cross currents

- Commodity prices eased after their strong rally this year. Oil prices saw cross-currents of rising US inventory levels but OPEC+ maintaining its gradual supply increase at its monthly meeting. Aluminium was one of the major price losers, as Russia may remove its export tax and boost supply to global markets. The country has a 15% tax on aluminium, copper, nickel, steel.

- The UN warned on the impact of decade-high food prices, led by cereals and vegetable oils. Their food index is up 31% versus last year.

- We see commodities asset class well-supported by robust demand, tight supply, and more demand from investors looking for more diversification or increased inflation-protection.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 2.67% | 8.59% | 27.41% |

| Healthcare | -0.02% | 5.54% | 15.03% |

| C Cyclicals | 4.87% | 13.03% | 24.30% |

| Small Caps | 6.09% | 10.03% | 23.41% |

| Value | 1.37% | 5.23% | 21.62% |

| Bitcoin | -1.88% | 11.23% | 112.06% |

| Ethereum | 2.25% | 24.84% | 496.52% |

Source: Refinitiv

The week ahead: Big consumer week

- The economic focus is US and China inflation (Wed). US seen high but stable at 5.5%, and China picking up to 1.4%. See also producer prices as a guide to company profit margin pressures. US at around 8.5% and China 12%.

- End of UN Climate Conference, COP26 (Fri) will see how successful governments have been in accelerating 2050 net-zero plans and funding commitments. Is key for renewables outlook.

- The world’s single biggest retail spending event is China’s Singles Day (Thur). Alibaba (BABA) and JD.com (JD US) saw $130 billion sales last year Expect more restraint this year with the authorities ‘common prosperity’ drive.

- The end of US third quarter earnings see’s Paypal (PYPL), Coinbase (COIN), Disney (DIS), and meme-stock AMC Entertainment (AMC), among those reporting. Profits have been 11% above forecasts in another strong US season.

Our key views: Growth is rebounding

- A positive scenario of 1) global vaccine rollout and economic re-opening, 2) still large support of low interest rates and fiscal spending.

- The main risk is Fed policy tightening, which is gradual and well-communicated so-far.

- We focus on cyclical assets that benefit most from the rebound: commodities, crypto, small cap, and value. We are more cautious on fixed income, the USD, defensive equities and China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -0.60% | 0.11% | 31.62% |

| Brent Oil | -1.17% | -0.04% | 59.61% |

| Gold Spot | 1.96% | 3.57% | -4.29% |

| DXY USD | 0.10% | 0.16% | 4.77% |

| EUR/USD | -0.10% | -0.22% | -5.44% |

| US 10Yr Yld | -10.69% | -15.95% | 53.42% |

| VIX Vol. | 1.35% | -12.20% | -27.56% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Focus on the big themes ahead

Interest in thematic funds is strong, and likely here to stay so

Thematic investors look for secular growth themes, unconstrained by sectors or geography. The industry has seen dramatic growth, from tech adoption to carbon transition. See over 45 smart portfolios.

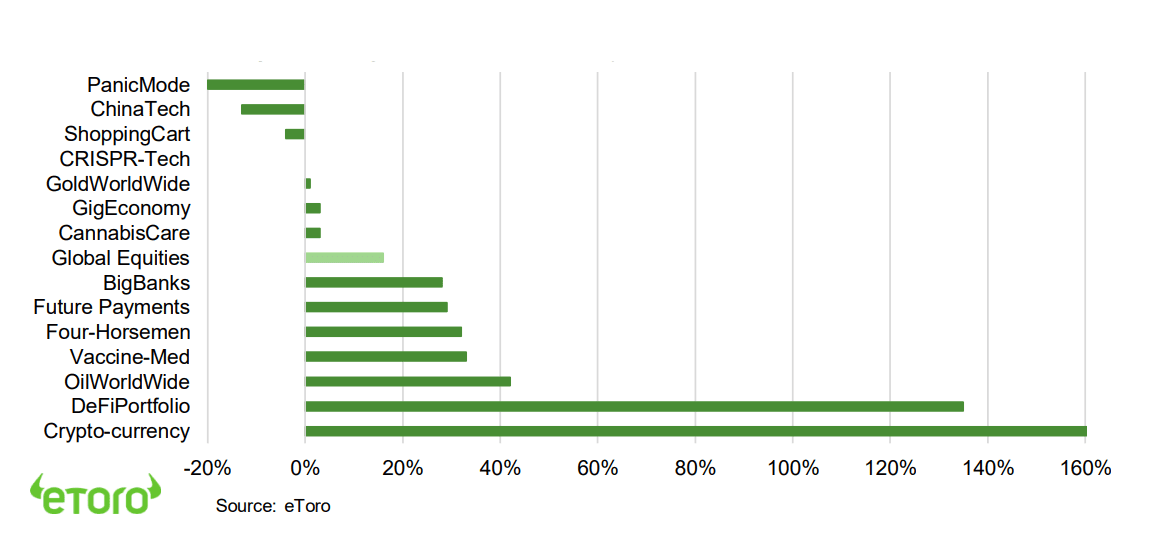

Crypto themes lead the winners this year, followed by energy, vaccines, and big-tech

Crypto dominated this year (see chart), as use cases accelerated. Energy performed well, and we see higher-for-longer oil prices. Vaccine stocks benefited from need for virus booster shots and child vaccinations. Banks helped by higher bond yields and regulatory relief, allowing buybacks and dividends.

The performance laggards have been led by defensive themes and China

Contrarian and defensive themes have led the performance losers this year. @PanicMode, which shorts stocks, has been the largest in the face of rallying global equities. Similarly, gold has struggled as traditional inflation-hedge demand was taken by crypto. @ChinaTech suffered from the local regulatory crackdown.

Looking ahead we see six themes in focus – from renewables and EV’s to re-opening and China

As we look ahead, we see several key themes, such as renewables, EV, and crypto growth, along with shorter-term cyclical themes, such as economic re-opening, China, and maybe the metaverse.

- The carbon transition. Renewable’s investment needs are over three times current levels, and to be accelerated by a relentlessly increasing cost of carbon, and investor preferences. See @Renewables.

- Electric vehicles. Only 1% of the installed global vehicle fleet is electric today. Adoption rates are now sharply accelerating, and the further direction of travel is clear. @Driverless is geared to this trend.

- Crypto assets. Adoption by the $250 trillion of liquid institutional investments has barely started. Will also benefit from the developing the regulatory environment. See @Crypto-curency and @DeFiPortfolio.

- Metaverse. We are seeing huge new investments from Facebook (FB) and other big tech names like Apple (AAPL). Thismay drive a focus on the early-adopters in the gaming industry. See @InTheGame.

- Re-opening. We should see sectors from travel to hotels benefit as vaccine rates pick up and economies re-open further, whilst they benefit from newly lowered cost bases. See @Travelkit.

- China. We see the tech regulation and economic growth risks as now better priced. The country remains a leader in many emerging technologies, from 5G to drones. See @ChinaTech and @ChinaCar.

Select best and worst performing SmartPortfolios this year

Key Views

| The eToro Market Strategy View | |

| Global Overview | Positive scenario of 1) global vaccine rollout and economic re-opening, 2) support from low interest rates and government spending. Main risk is from US Fed monetary policy tightening, but will be well-signalled and very gradual. Economies are increasingly resilient new virus case ‘waves’. Focus on most growth sensitive assets: equities, commodities, crypto, small cap and value. Relative caution on fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | Latest to benefit from vaccination surge and much more economic re-opening to go. Equity markets helped by 1) a greater weight of cyclical sectors, and lack of tech, 2) 25% cheaper valuations vs US, 3) decade of under performance made under-owned by global investors. A robust EUR a help for investors, as is multi-year €750bn ‘Next Generation’ fiscal support. With 50%+ company revenues from overseas is exposed to global trends. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China equities hurt by tech regulation crackdown, property sector debt, and slower GDP growth. But this is increasingly well-priced. LatAm and Eastern Europe have more upside to global growth recovery, a weaker USD, and higher commodities. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | The broad ‘tech’ sector of IT, communications, and parts of consumer discretionary (Amazon, Tesla), dominates US and Chinese markets. Expect a more subdued 2021 after dramatic 2020 rally. But are structural stories with good growth, high profitability, and clean balance sheets that justify high valuations, and should continue to rise. |

| Defensives | Healthcare, consumer staples, utilities, and real estate sectors traditionally offer more defensive cash flows, less exposed to changes in economic growth. This has also made them more sensitive to rising bond yields. We expect them to relatively underperform in a more cyclicals focused environment with earnings strong and yields rising. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | We see recent USD strength easing as the rest-of-world GDP growth recovery accelerates, and fears over a virus ‘third wave’ ease. A stable or weaker USD traditionally supports Emerging Markets, commodities, and large US foreign earners, such as the tech sector, and could be a modest headwind to large exporters, such as Europe. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Supported by GDP growth rebound, ‘green’ industry demand, years of supply under-investment. China GDP and property sector are short term concerns. Industrial metals and battery materials seem best positioned, whilst oil price supported by only slow return of OPEC+ supply. Gold hurt by outlook for higher bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.