Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and a weekly ‘special’.

The supports out there for markets

Storm clouds have regathered over global stock markets, which are flirting again with a 10% correction. But the glass-is-half-full and some supports are rebuilding. Tightening financial conditions is pulling forward interest rate cuts, with ECB near front of the queue. This is market insurance. Q3 ending the US ‘earnings recession’ and ‘biggest buyer’ buybacks restarting. Investor sentiment is depressed, a contrarian positive, and seasonality now in your favour. See Page 4

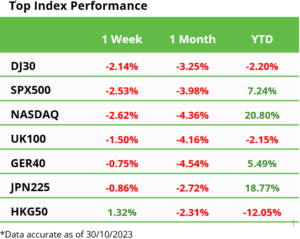

S&P 500 falls into -10% correction

S&P 500 fell to -10% correction on combo of high bond yields and oil, and unforgiving to earnings weakness. October set for declines, led by China and small caps. US Q3 GDP surged 4.9%, and China launched more spending. US 10-year yields hit 5%. Gold $2,000. JPY 150. BTC $35,000. GOOG slumped after earnings. MSFT and AMZN rallied. CVX spent $53bn on HES. F made UAW strike deal. See Q4 Markets Outlook HERE and at twitter @laidler_ben. See Page 2

Worries that things could break

Commercial real estate, high yield bonds, small banks in cross-hairs of US bond yield surge, but are already well known, uncertainty already high, and central bank ‘puts’ returning. See Page 2

Risks to the gold rally

Shows safer haven bona fides, with lack of credit risk, negative risk asset correlation, and long record, but vulnerable to easing geopolitical risks and bond yield relationship rebound. See Page 2

Big oil is doubling down on fossil fuels

US majors unleash one of largest takeover waves in history, at some of highest oil prices. A gutsy bet on high-for-longer fossil fuels and widens gulf with derated European peers. See Page 2

The rise of fractional share ownership

A driver of rise of younger investors, by boosting accessibility and diversification, with greatest impact US, Swiss, France, Germany. See Page 2

Crypto’s big breakout

BTC soared to $35,000, taking its ‘dominance’ of asset class to 50%, extending leading return this year. Driven by combo of optimism on potential SEC spot ETF applications and ‘flight to quality’ relative safe haven flows. Related assets from MSTR to MARA and especially GBTC have soared. See latest Weekly Crypto Roundup. See Page 3

Oil prices lead commodities down

Brent oil fell below $90 as geopolitical tensions did not escalate and big oil consolidation surged with CVX buy of HES, following XOM of PDG. Renewables slump got even worse from SEDG to ENR1n.DE. Uranium and especially orange juice, at twice prior all-time-high, showed small commodities the price standouts. See Page 3

The week ahead: Apple, Fed, Jobs, November

1) Peak earnings season from APPL (Thu) to ABNB and SBUX. 80% S&P 500 ‘beats’ so far. 2) Fed (Wed), BoE, BoJ meet, and set to keep interest rates on hold. plus US bond sale plans. 3) Data focus US jobs (Fri) slowdown and EU GDP and inflation fall. 4) End of tough Oct. and November start. See Page 3

Our key views: Stronger months ahead

See a stronger Q4 and 2024 as summer breather and tall wall-of-worry fades, and investors look ahead to lower inflation and coming rate cuts as growth slows, and earnings outlook firms. Focus defensive growth and long duration assets from healthcare to big tech. Cautious growth exposed cyclicals, commodities, and banks. See Page 5

,Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and a weekly ‘special’.