Summary

It’s not all bad news

The S&P 500 has seen a $7 trillion fall in market capitalisation this year. This has been painful, but is not all bad. Froth has come out of valuations, raising the long term returns outlook. Stock opportunities being thrown up amid correction. Sector outlooks improved, from renewables to ‘big-tech’. Tax write offs stockpiled. Inflation will fall, setting up for more sustainable growth. We see fundamentals as secure, with ‘less bad’ news to come. Be invested but defensive.

Market pressure-valve eases

S&P 500 saw its first gain in 8 weeks, with ‘less bad’ news from resilient global growth PMI’s, new Chinese fiscal stimulus, and pragmatic Fed minutes. The dollar fell, bond yields stabilised, commodities rose. Blockbuster AVGO $61bn VMW bid shows company ‘animal spirits’. But brutal SNAP fall reminder investors nervous. See U-shape recovery. See latest presentation, video updates, and twitter @laidler_ben.

The $25 trillion US recession question

Whether we see a slowdown or recession in the $25 trillion US economy is the biggest market question today. We see buffers as large, and fear overdone. Be humble but invested.

Record housing affordability ‘misery’

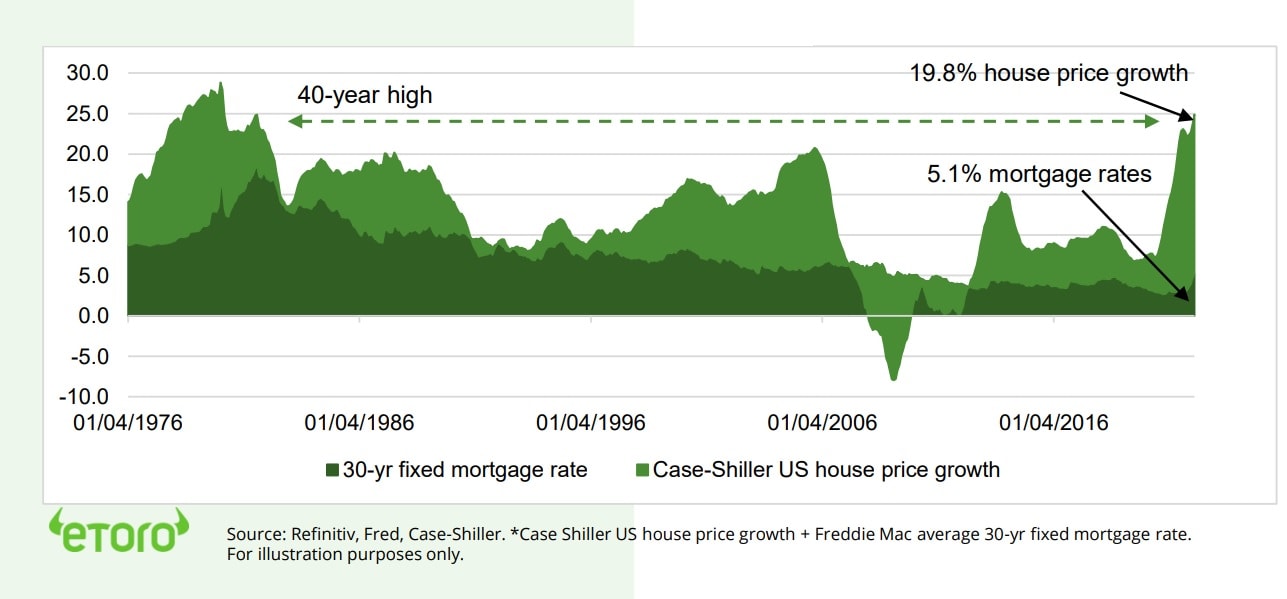

Our US housing ‘misery’ index is at 40-yr highs and driving weakness from homebuilders to lumber prices. But these higher prices and mortgage rates double-hit is global.

The food price fright

Wheat (WEAT) led food shock, boosting inflation and food security fears, led by emerging markets (EEM). But markets may be sniffing a ag market top with our ‘Breakfast’ index easing.

The ‘Nordic model’ opportunity

A Scandinavian market been top performer 7 of 15 years. See its quality cyclicals on recovery shopping lists. @NordicEconomy

Crypto prices stay under pressure

Crypto pressured despite equity relief. Ethereum (ETH) led a DeFi sell-off, with Bitcoin (BTC) ‘dominance’ rising. Tron (TRX) bucked downtrend with high burn rate and its new stablecoin. JP Morgan (JPM) published positive bitcoin outlook, and we saw $4.5bn VC fund launch.

Windfall taxes to pay for energy crisis relief

Commodities boosted by China fiscal stimulus and easing US dollar. Energy led, ahead of OPEC+ meeting. Wheat eased on Ukraine supply talks, and lumber collapsing on cooling US housing. UK latest to impose an energy windfall tax to fund support for squeezed consumers

The week ahead: The start of summer

1) Short week with US memorial and UK jubilee holidays. 2) Macro data see’ rising EU inflation, recessionary China PMIs, and cooling US payroll data. 3) Tech earnings CRM, AVGO, HPE, CRWD. And GME. 4) OPEC+ to keep oil market tight, with its only 0.4mbpd new supply pace.

Our key views: Focus on the growth risks

Markets biggest sell-off since 2020 crash. Risks switch from valuations to lower earnings. We see fundamentals as stressed but secure, and ‘less bad’ peaked inflation and interest rate fears. But recovery U, not V, shaped. Focus on ‘barbell’ of cheap Value cyclicals and ‘defensives’: Value, commodities, alongside healthcare, and high dividends. We are cautious on bonds.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 6.24% | 0.71% | -8.61% |

| SPX500 | 6.58% | 0.64% | -12.76% |

| NASDAQ | 6.84% | -1.65% | -22.46% |

| UK100 | 2.65% | 0.54% | 2.72% |

| GER30 | 3.44% | 2.58% | -8.96% |

| JPN225 | 0.16% | -0.25% | -6.98% |

| HKG50 | -0.10% | -1.86% | 11.54% |

*Data accurate as of 30/05/2022

Market Views

Market pressure valve eases

- S&P 500 saw its first gain in 8 weeks, with ‘less bad’ news from resilient global growth PMI’s, new Chinese fiscal stimulus, and pragmatic Fed minutes. The dollar fell, bond yields stabilised, commodities rose. Block buster AVGO $61bn VMW bid shows company ‘animal spirits’. But brutal SNAP fall reminder investors nervous. See a U-shape recovery. Page 6 for Resources guide of reports, presentations, videos, twitter.

The $25 trillion US recession question

- Whether we see a slowdown or recession in $25 trillion US economy is the biggest market question today. A slowdown would leave corporate profits intact and set scene for a sustainable market recovery later this year, with valuations already significantly adjusted down.

- Recession would undermine the profits anchor, drive another market leg down, and delay a rebound. This tug-of-war is driving volatility. Recession buffers big but not unsurmountable, fears overdone, and markets sensitive to ‘less bad’ news ahead. Be invested, for coming upturn, but defensive, to manage the high risks.

Record housing affordability ‘misery’ bites

- US housing is its least affordable in forty years, per our new US housing ‘misery’ index (see chart). This combines the 20% surge in average house prices with the over decade high 5%+ 30- year fixed mortgage rate. This affordability double-whammy is increasingly global, and hitting housing activity today.

- The lumber price ‘lead indicator’ is -35% past month (90% US houses timber), new home sales -17%, and US homebuilders (DHI, LEN, PHM) falling. But systemic risks are low, with consumer balance sheets strong, A slower economy and inflation will calm Fed fears.

The food price fright may have peaked

- Food fears are high, with wheat 20% total global calories, and prices up 40% (WEAT) this year. Many see the food shock as bigger than the oil spike, feeding global inflation and emerging market risks. The latest Economist magazine was entitled ‘coming food catastrophe’. Bank of England Governor calls situation ‘apocalyptic’.

- This reminds of the irreverent ‘’magazine cover’ contrarian indicator. Because our ‘Breakfast’ commodity price index has recently eased (see chart) and lags the broader index, along with ag producers. We see ‘high-for-longer’ commodity prices, but markets may be sniffing an ag top.

The ‘Nordic model’ opportunity

- Nordic equities have a good record, with a Scandinavian market the top developed world performer 7 of past 15 years. This punches way above their weight, at only 2% of global GDP and market capitalisation, and 0.3% population.

- This outperformance comes with higher risk, seen this year with Nordics 20% price fall, given global cyclical focus and Russia proximity. But if global recession is avoided, these quality cyclical, and cheaper, markets should be on the shopping list to lead an eventual markets recovery, as before. See @NordicEconomy

eToro US housing ‘misery’ index (house prices + mortgage rate)

Crypto prices stay under pressure

- Crypto stayed under pressure, despite some signs of relief in hard-pressed equity markets. Ethereum (ETH) fell sharply ahead of its planned August proof of stake ‘merge’. Bitcoin ‘dominance’ is now 46% on flight to quality.

- 13th largest market cap. coin TRON (TRX) was an exception to the crypto downdraft, with a high ‘burn rate’ cutting supply, and with demand for its new algorithmic USDD stable coin.

- JP Morgan (JPM) published $38,000 bitcoin (BTC), fair value and see as preferred alternative asset, after ‘capitulation’ of prices this year. Also, Andreessen Horowitz launched $4.5 billion crypto fund in a sign of continued strong venture capital funding for the asset class.

Windfall taxes to ease the energy crisis

- Another positive week for commodities, helped by lessened China growth fears and the weaker USD. Energy prices were again on the front-foot ahead of this week’s OPEC meeting. High-flying wheat prices eased back on talks to resume Ukraine exports, whilst lumber prices continued their plunge on the cooling US housing market.

- The trend to energy ‘windfall’ taxes to help fund support for squeezed consumers in the current energy crisis gained further ground with the UK the latest to follow Italy and Spain in imposing. This will cut the 80% profits growth that was forecast from the UK oil sector this year.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 6.77% | -5.20% | -22.70% |

| Healthcare | 3.18% | -0.27% | -8.55% |

| C Cyclicals | 8.64% | -9.63% | -24.98% |

| Small Caps | 6.46% | -1.57% | -15.92% |

| Value | 5.94% | -0.60% | -4.61% |

| Bitcoin | -1.74% | -28.75% | -39.84% |

| Ethereum | -11.26% | -41.55% | -53.77% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: The start of summer

- It’s a short week with US memorial day (Mon), the traditional start of summer, and the UK’ ‘Jubilee’ celebration holiday starting Thursday.

- Global economics see’s 1) EU inflation to rise over 7.4% as ECB considers starting rate hikes in July. 2)China PMI’s focus after last month recessionary levels in 40’s. 3) US payrolls to ease to est. 320k and unemployment rate at 3.5%, near record low, with Fed on 0.5%/meet hiking path to cool inflation and the economy.

- Q1 earnings reports from heavyweight techs like CRM, AVGO, HPE, plus recent ‘disruptors’ CRWD, PATH, and meme-stock GME.

- See OPEC+ meeting, to continue only gradually adding 0.4 million barrels/day new production to keep Brent crude prices high at $110/bbl.

Our key views: Focus on the growth risks

- Markets saw the biggest sell-off since the 2020 covid crash. Concerns switch from bond yields and valuations, to recession risk and earnings. See fundamentals stressed but secure. GDP supported by corporates and consumer and peaked inflation. But recovery U, not V, shaped.

- Economies are reopening and growth robust. The aggressive Fed hiking cycle is increasingly well-priced and inflation starting to peak.

- Focus a ‘barbell’ of cheap cyclicals and select ‘defensives’: Value, commodities, and high dividends and healthcare. Cautious on bonds.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 2.55% | 3.39% | 34.99% |

| Brent Oil | 2.13% | 8.71% | 47.96% |

| Gold Spot | 0.30% | -2.44% | 1.10% |

| DXY USD | -1.47% | -1.29% | 5.91% |

| EUR/USD | 1.56% | 1.71% | -5.65% |

| US 10Yr Yld | -10.92% | -18.87% | 123.14% |

| VIX Vol. | -12.61% | -22.91% | 49.36% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Silver linings of the sell-off

It’s not all bad news, despite how much the correction hurts

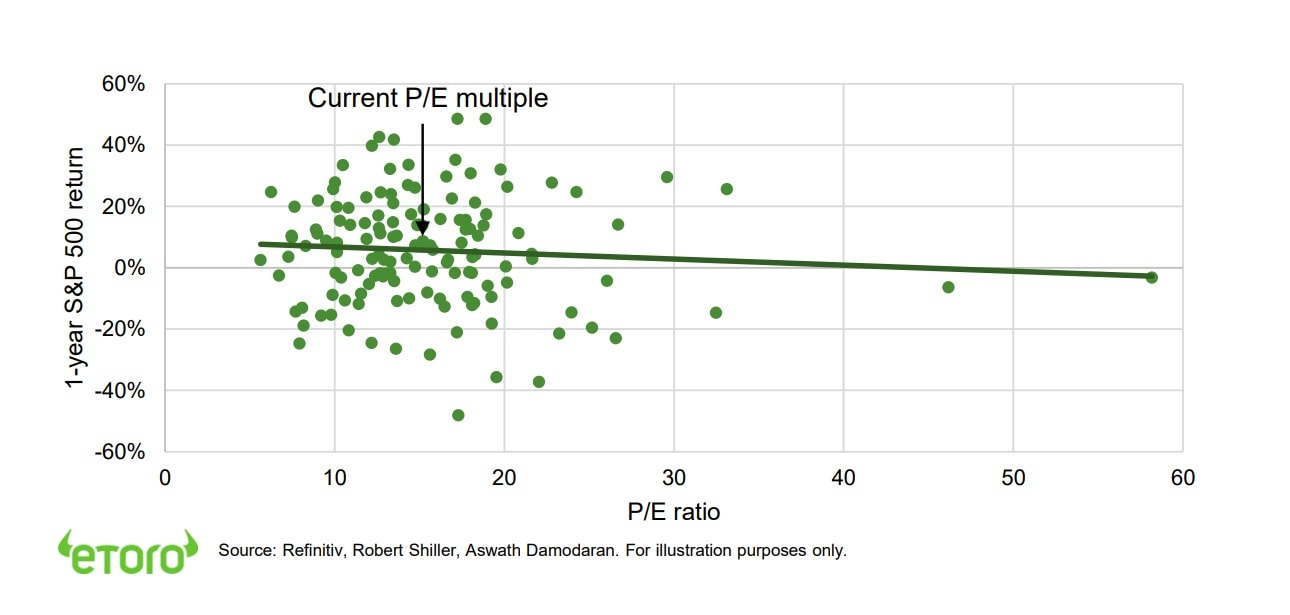

An estimated $7 trillion has been wiped off the market capitalisation of the S&P 500 index alone this year. Whilst most households have never owned so much equities as they do today. Therefore, the financial pain of this sell-off has been significant, and there have been few places to hide. But there are several silver linings. Slowing economic growth will cut inflation, see the Fed step back, and allow a more sustainable growth recovery. The sharp equity sell-off is throwing up stock opportunities and lower valuations are setting us up for higher returns in the future (see chart). If nothing else, you can write your tax losses off.

Froth has come out of valuations, raising long term returns

Markets have been on a vicious rotation, cutting back all themes and stocks where valuations are high, especially across tech and the US. Anybody that misses earnings expectations, from Netflix (NFLX) to Snap (SNAP), has sold off sharply. This is throwing up individual stock opportunities but has also brought overall S&P 500 price/earnings valuations back to 10-year averages. This raises the market return outlook from here (see chart). We are also seeing a healthier investor focus on diversification, including forgotten segments like commodities and international markets. There are also sector silver linings, from the accelerated renewables transition to more flexible supply-chains, and the big-tech ‘strong-getting-stronger’.

Froth is also coming out of economies, setting up for more sustainable growth

Hawkish Fed speak has quickly tightened financial conditions and started to cool the economy with only two interest rate rises. This will lessen how high interest rates need to be raised to the so-called ‘terminal rate’. This has eased back from 3.50% to 3.25%. Slowing goods demand and a cooling housing market should both ease inflation. Similarly, lower asset price gains may encourage people back into the very tight labour market and cool wages. The economic growth slowdown is already easing inflation expectations, the ‘peak’ of the Fed rate hike cycle, and 10-year bond yields. These are all necessary conditions for markets to eventually recover and set the US economy up for more sustainable growth in the future.

Secure fundamentals with ‘less bad’ news to come. Be invested but defensive

Market sell-offs are always uncomfortable but are an integral part of much of investing. Without risk there can be no reward. We continue to see the fundamentals as stressed but secure, and sensitive to the ‘less bad’ news we see in coming months from inflation, China, and geopolitical risks. We remain invested, for the eventual markets upturn, but defensively positioned, to manage the still high risks. We are focused on cheaper assets, from commodities to financials, and ‘defensives’ with secure cash flows, like healthcare and much of ‘big-tech’. Many of these can be found in cheaper international markets, from UK to Japan.

S&P 500 price/earnings ratio and 1-year forward return (1872-2021)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Geopolitical risks alongside the Fed hiking cycle is boosting uncertainty and weakening markets. We see this as slowly fading, the global growth outlook secure, and valuations more compelling. Focus on cheap cyclical and defensive assets within equities, like Value, plus commodities, crypto. Relative caution on fixed income and the USD. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing strong c4% GDP growth and with room for more earnings upside surprises. Valuations have now fallen back to average levels, and are well supported by still-low bond yields and high company profitability. Fed interest rate risks are now well-priced. See cyclicals and value catch-up, after a decade of underperformance, whilst big-tech is supported by its structural growth outlook. Now see overseas markets leading. |

| Europe & UK | Pressured lower by proximity and exposure to Ukraine crisis. Recession risks rising with Russia impacts and energy crisis. But 1) macro ‘buffers’ of rising fiscal spending (defence and refugees), zero-bound interest rates (‘dovish’ ECB), and weak Euro (50%+ sales from overseas). Equities helped by 2) greater weight of cyclical sectors, and lack of tech, 3) 25% cheaper valuations vs US, 4) decade of underperformance made under-owned. UK favoured over continent. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China outlook improving as cuts interest rates (opposite of rest of world) reducing slowdown and property sector risks, focuses on stability ahead of 20th Party Congress, and with valuations now 45% cheaper than US and market heavily out of favour. Will support EM, but is exposed to Fed tightening. China recovery also helps global sectors from luxury to materials. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | More attractive as macro risks rise and bond yields better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. But also sensitive to bond yields. Healthcare most attractive, with cheaper valuations, more growth, some cost protection. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead performance. Are most sensitive to re-opening economies, resilient GDP growth, and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and been out-of-favor for many years. |

| Financials | Financials will benefit from resilient GDP growth, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech themes. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | In ‘sweet spot’ of robust GDP growth, ‘green’ industry demand, years of supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply and Russia 10% world supply problems. Gold helped by risk-aversion but held back by rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.