Summary

Focus: Which sectors will lead in 2022?

We continue our 2022 outlook, now on sectors. We think ‘cyclicals’ , like commodities, industrials, discretionary, and financials, will lead. They offer the most earnings growth and the cheapest valuations. This provides clear upside, but also protection from the biggest risk – of lower valuations. Tech remains core, but is unlikely to lead. ‘Big-tech’ has good growth supporting very reasonable valuations and fortress balance sheets. Defensives and ‘bond proxies’ are the laggards, unless see a big correction.

Virus fears drive global sell-off opportunities

A surging virus ‘fourth wave’ and new highly contagious variant drove sharply weaker global markets. Growth-sensitive assets like equities and commodities led the falls on new lockdown fears. Safe-haven USD, bonds, and gold gained. See our latest presentation Here.

Impacts of the virus ‘fourth wave’ limited

A virus fourth wave is well-underway. We think this dampens not derails the economic recovery. Economies, companies, consumers are more resilient to each new wave. Vaccination rates are higher. Hospitalizations lower. New treatments available. ‘Reopening’ sectors travel and tourism have already low expectations.

Surviving the Fed ‘stress-test’

Equities passed big stress-test so far, with recent sharp repricing of 3 Fed interest rate hikes next year. Disruptive tech been most impacted, with ARKK -15%, in a rerun of the Q1 bond market tantrum. Our focus on ‘big-tech’, energy (XLE), financials (XLF) to be most resilient.

Supply chain ‘pain’ starting to ease

Signs that supply chains are adjusting to surging demand and dislocations. Our ‘pain’ index is +200% this year, but 20% off highs on lower chip prices and freight rates. Helps hard-hit retail like @ShoppingCart and autos like @ChinaCar. May hurt shippers like MAERSKB and ZIM.

Bitcoin caught in global ‘risk-off’ plunge

Crypto prices plunged as caught up in the global ‘risk-off’ driven by ‘omicron’ virus variant worries. Had previously been resilient to India’s potential ban on private crypto ownership, and with legal tender pioneer El Salvador announcing a bitcoin bond to fund new ‘bitcoin city’. BNB and MATIC amongst those resilient to sell-off.

Double-whammy hits commodities hard

Rising virus worries impacted growth-sensitive commodities, alongside a surging safe-haven USD. This especially impacted oil, coming on the heels of the US-led announcement of oil reserve sales. We are positive the asset class.

The week ahead: Inflation, jobs, and oil

1) Inflation seen rising in Europe (Tue) to 4.5%, pressuring the dovish ECB. 2) Stronger US jobs report (Fri), with 550k new jobs and wages +5% as economy accelerates. 3) OPEC meets (Thu) and may cut production to support oil. 4) Tech led earnings from Salesforce (CRM), Snowflake (SNOW), and CrowdStrike (CRWD).

Our key views: Virus surge resilience, again

We see a positive outlook of 1) vaccine rollout and economic re-opening, and 2) still huge policy support. Risks shifted from Fed tightening to virus ‘fourth wave’. We see economies and consumer as increasingly virus resilient. We like equities, commodities, crypto, and are cautious on fixed income, and the USD.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -2.71% | -2.33% | 16.32% |

| SPX500 | -2.34% | -0.04% | 22.33% |

| NASDAQ | -3.14% | 0.28% | 20.20% |

| UK100 | -2.49% | -2.67% | 9.03% |

| GER30 | -5.59% | -2.75% | 11.21% |

| JPN225 | -3.34% | -0.49% | 4.76% |

| HKG50 | -3.87% | -5.11% | -6.99% |

*Data accurate as of 29/11/2021

Market Views

Virus drives global sell-off

- A surging virus ‘fourth wave’ and new highly contagious ‘omicron’ variant drove sharply weaker global markets. Growth-sensitive assets like equities, commodities, and Europe led the falls on new lockdown fears. Safer-haven USD, bonds, and gold gained. Consumer staple and energy equities were resilient, whilst losses led by the ‘reopener’-heavy consumer discretionary sector. See latest presentation here. REGISTER for our multi-asset 2022 year-ahead webinar.

Impacts of the virus ‘fourth wave’ limited

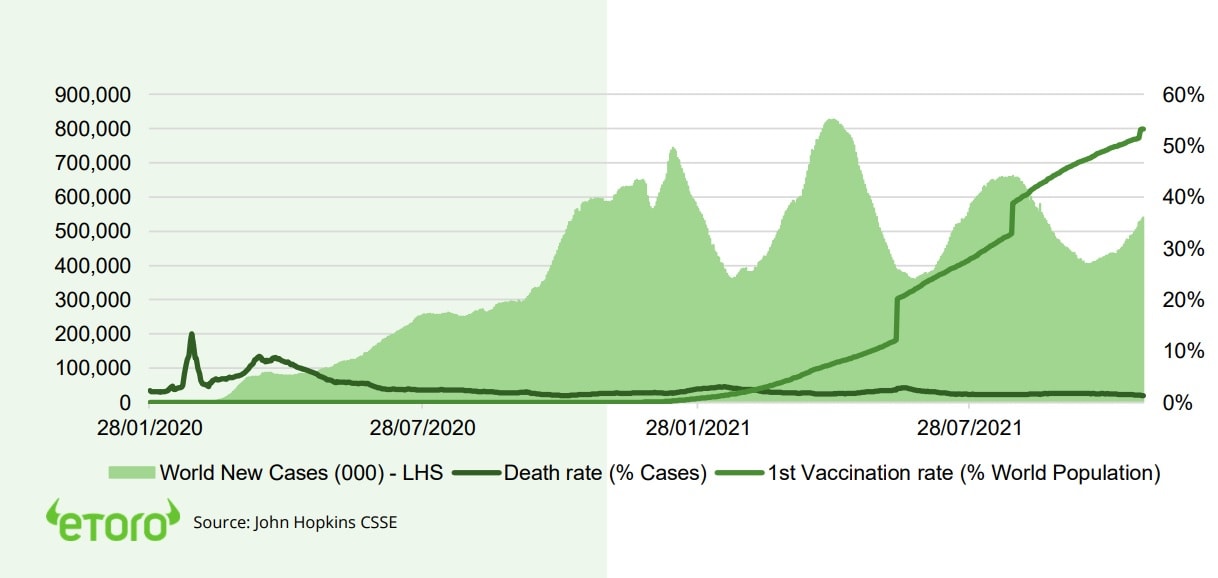

- A ‘fourth wave’ of global virus cases is well underway (see chart) as we head into the northern hemisphere winter. This will dampen but not derail the economic re-acceleration underway. Similarly, we see ‘reopening’ stock themes from travel to tourism as opportunities.

- Economies, companies, and consumers are increasingly resilient to each new wave. More of the population is vaccinated. Death rates low. New treatments available. Whilst expectations are already low for many reopening segments. ‘Zero-tolerance’ areas like China could be hurt the most from tightening lockdown restrictions.

Surviving the Fed ‘stress-test’

- Equities have passed a big stress-test so far, with the recent sharp repricing of Fed interest rate hike expectations. S&P 500 was up 9% this quarter even as investors moved to price in up to 3 rate hikes next year. But below the surface not all has been rosy (or complacent).

- The hit has been on ‘disruptive tech’. Those with the highest valuations and equity funding needs. To use ARK Innovation (ARKK) as a proxy for these, it fell -15% from its recent high. This is similar to the Q1 bond yield tantrum shakeout which the S&P 500 was also resilient to then.

Supply chain ‘pain’ starting to ease

- We see signs of supply chains readjusting to the huge demand and dislocations seen this year. Our supply chain ‘pain’ index is down 20% from early October highs with lower computer chip, bulk and container freight, and energy prices.

- This drop likely broadens next year as supply chains adjust further, helping ease inflation and corporate profit margin worries. This should help the hard-hit retail (@ShoppingCart) and auto (@ChinaCar) sectors. But also trim the upside to shippers like Maersk (MAERSKB.COM), Zim (ZIM), and other dislocation ‘winners’.

US-led oil sales to backfire

- US led a co-ordinated country announcement of oil sales from Strategic Petroleum Reserves (SPR). This is an attempt to further lower oil prices, and cool the recent inflation spike.

- This backfired. The US only has 600 million bbls in its SPR. This is equal to only 6 days of global demand. The SPR release is seen as short-term and desperate, with little follow-through given the relatively small SPR’s and their use-case for ‘real’ emergencies. Additionally, OPEC may respond by cutting back its own production.

- We see high-for-longer oil prices, benefitting smart portfolio OilWorldWide and ETF’s like XLE.

‘Fourth wave’: World new virus cases (LHS) vs death and vaccination rate (RHS)

Bitcoin pressured by global ‘risk-off’ move

- Crypto assets weakened and Bitcoin (BTC) fell sharply, caught up in the wave of global ‘risk-off’ sentiment that surged across asset classes.

- Crypto assets had been resilient to news during the week that India was considering a bill to ban ‘private cryptocurrency’. Whilst El Salvador, where bitcoin is legal tender, announced a unique bitcoin bond to fund a ‘Bitcoin City’.

- Coins resilient to the broader sell off included Binance Coin (BNB) and Polygon (MATIC).

Double-whammy hits commodities hard

- Rising virus worries stoked commodity demand fears, and boosted the USD. These combined to hit commodity prices. Oil prices plunged 11%, after showing prior strength in face of the US led oil sales plan. Similarly, safer-haven gold rebounded, after prior weakness in the face of rising US bond yields. Iron ore and coal prices both bucked the broad-based 2.4% sell-off in the Bloomberg Commodity Index last week.

- We see commodities in a ‘sweet spot’ of rising and resilient demand, and tight supply after over a decade of under-investment. Investor demand is also being boosted by demand for assets that provide inflation protection.

- Supply concerns again in focus with political and local community mine disruption in Peru, worlds 2nd largest silver and copper producer.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -3.63% | 1.74% | 24.41% |

| Healthcare | -1.37% | -1.53% | 12.24% |

| C Cyclicals | -3.32% | 1.94% | 19.48% |

| Small Caps | -4.15% | -2.18% | 13.73% |

| Value | -1.08% | -1.57% | 18.73% |

| Bitcoin | -6.20% | -12.51% | 89.25% |

| Ethereum | -4.85% | -3.16% | 444.90% |

Source: Refinitiv

The week ahead: Inflation, jobs, and oil

- Inflation focus shifts to Europe (Tue), where EU prices are seen accelerating to +4.5%. Pressuring the dovish ECB stance that has contributed to recent sharp EUR weakness.

- US jobs report (Fri) with non-farm payrolls forecast stronger at 550,000, with 5% wage growth. Highlights the economic rebound and supports the Fed’s policy tightening plans.

- Oil market in focus as OPEC meets (Thur) with headwinds of rising virus demand risks and US-led oil reserve sales. Increases chance they may cut supply increases to support prices.

- Tech-heavy earnings week with cloud stocks Salesforce (CRM) and Snowflake (SNOW), cyber security CrowdStrike (CRWD), chip designer Marvell (MRVL). Also all Canadian banks report.

Our key views: Virus surge resilience, again

- A positive scenario of 1) global vaccine rollout and economic re-opening, 2) still large support of low interest rates and fiscal spending.

- Markets have been resilient to rising Fed interest expectations. The risk focus is quickly shifting to surging ‘fourth wave’ virus cases. New variants are driving new lockdowns. This likely dampens not derails the GDP recovery.

- We focus on cyclical assets that benefit most from the rebound: commodities, crypto, small cap, and value. We are more cautious on fixed income, the USD, defensive equities and China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -2.39% | -4.02% | 28.25% |

| Brent Oil | -11.41% | -14.42% | 38.82% |

| Gold Spot | -3.67% | -0.46% | -5.75% |

| DXY USD | 0.04% | 2.07% | 6.83% |

| EUR/USD | 0.33% | -2.12% | -7.35% |

| US 10Yr Yld | -6.97% | -8.10% | 56.01% |

| VIX Vol. | 62.71% | 73.14% | 25.80% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Sector investment outlook for 2022

Cyclical sectors to lead in 2022, but technology will remain core

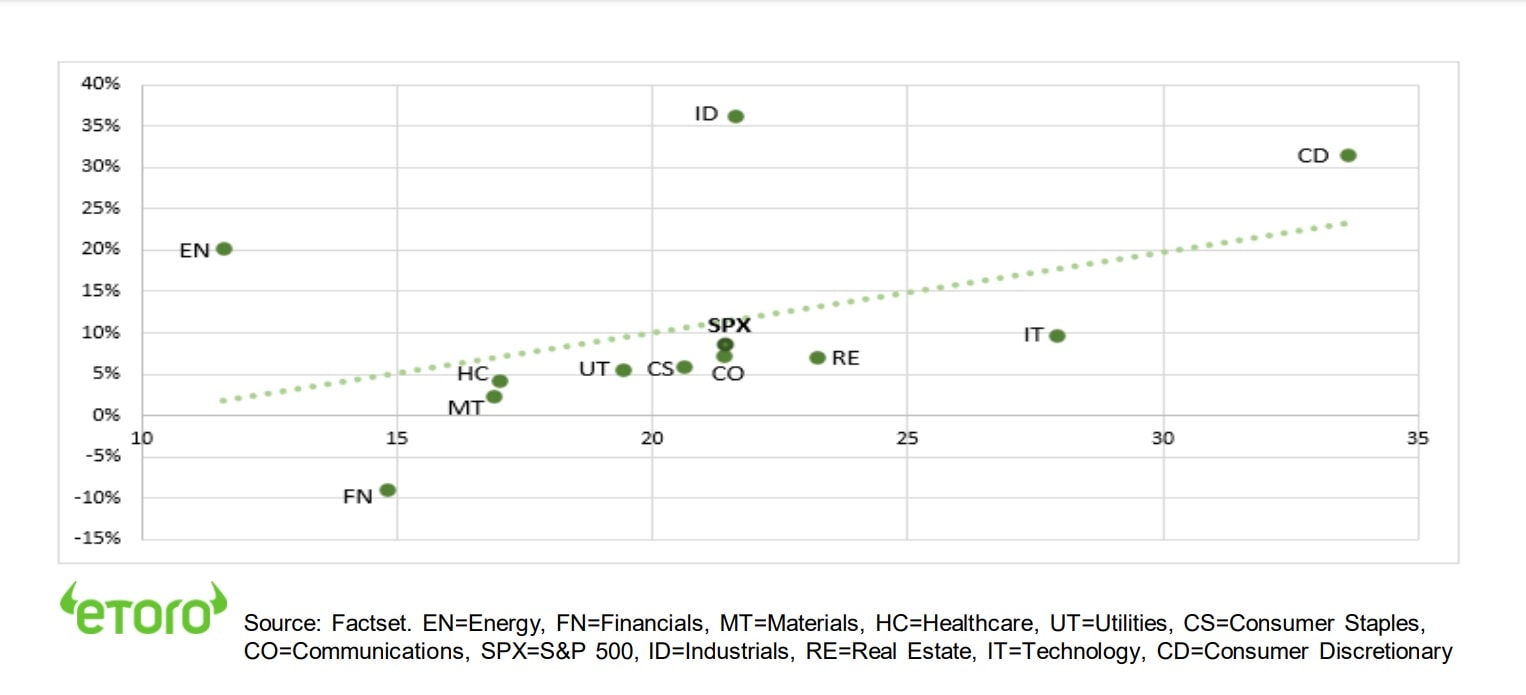

We continue our year-ahead outlook series, in conjunction with our ‘Catch 22’ webinars. Near all equity industries have seen positive price performance this year. But the dispersion has been huge. Energy has led, up 50%, but still unjustifiably underperforming the higher oil price in our view. Whilst telecoms has been the laggard, falling 10% as sector competition has intensified. Looking into 2022 we are focused on three issues. 1) Who benefits most from the still very strong GDP growth outlook, as lockdown restrictions ease and policy stimulus still significant? 2) Whose earnings outlook could see the greatest surprise versus consensus estimates (see chart)? 3) How can we minimise the risk of rising bond-yields and high valuations in many sectors? We focus on cheaper cyclicals, like energy, financials, and industrials. Have a neutral tech allocation and are cautious on defensive and ‘bond-proxy’ segments like staples, utilities, and healthcare.

The cheaper cyclicals offer the most earnings growth and the cheapest valuations

We forecast high-for-longer oil prices, with demand robust for now and with low new supply additions. This supports strong oil profits and dividends and helps them fund their pivot to renewables. It is by far the cheapest sector. See @OilWorldWide. Similarly, industrials and consumer discretionary have many of the travel and tourism ‘re-openers’ sectors we like. Their combination of newly lowered cost bases, sensitivity to strong GDP growth, and lesser lockdown restrictions will drive very strong growth. See @TravelKit. Financials is the 2nd cheapest sector and earnings expectations are too low. They benefit from higher bond yields, recovering loan growth, and strong capital positions will allow for big dividends. See @TheBigBanks.

Big-tech remains core with good growth supporting valuations and fortress balance sheets

Tech will continue to benefit from secular increase in tech adoption, led by the software industry. Current consensus earnings growth rates seem too low to us, even with headwinds from a stronger US dollar. We do see a greater gap within tech itself though. Early-stage ‘disruptive tech’, with its higher valuations and greater reliance on equity market funding, will likely face headwinds from lower GDP growth and higher interest rates. By contrast, we see ‘Big-tech’ as more resilient to the 2022 macro environment. They have lower valuations, stronger cash flows, and fortress balance sheets. They are not as sensitive to rising bond yields as perceived and are the ‘new’ defensives. See @Four-Horsemen, @Chip-Tech, @CloudComputing

Defensives and bond proxies the laggards, unless we see a big correction

We see the defensive healthcare, consumer staples, and utilities sectors continuing to underperform, and real estate having a less positive year in 2022. Their combination of low earnings growth and high sensitivity to rising bond yields makes them likely laggards. However, there defensive cash flows along with generally reasonable valuations – especially for healthcare – make them defensive to a market correction and worth considering by anyone with a less positive view than us. See @Utilities and @FoodDrink

US Sectors: 2022e Price/Earnings Valuation (x, Horizontal axis) vs Earnings Growth (%, Vertical axis)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Positive scenario of 1) global vaccine rollout and economic re-opening, 2) support from low interest rates and government spending. Main risk is from US Fed monetary policy tightening, but will be well-signalled and very gradual. Economies are increasingly resilient new virus case ‘waves’. Focus on most growth sensitive assets: equities, commodities, crypto, small cap and value. Relative caution on fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | Equity markets helped by 1) a greater weight of cyclical sectors, and lack of tech, 2) 25% cheaper valuations vs US, 3) decade of under performance made under-owned by global investors. Helped by a dovish ECB to hold rates ‘lowfor-longer’, and multi-year €750bn ‘Next Generation’ fiscal support. A weaker EUR helps many companies, with 50%+ company revenues from overseas. ‘4th wave’ virus resurgence may provide additional buying opportunities. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China equities hurt by tech regulation crackdown, property sector debt, and slower GDP growth. But this is increasingly well-priced. LatAm and Eastern Europe have more upside to global growth recovery, a weaker USD, and higher commodities. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | The broad ‘tech’ sector of IT, communications, and parts of consumer discretionary (Amazon, Tesla), dominates US and Chinese markets. Expect a more subdued 2021 after dramatic 2020 rally. But are structural stories with good growth, high profitability, and clean balance sheets that justify high valuations, and should continue to rise. |

| Defensives | Healthcare, consumer staples, utilities, and real estate sectors traditionally offer more defensive cash flows, less exposed to changes in economic growth. This has also made them more sensitive to rising bond yields. We expect them to relatively underperform in a more cyclicals focused environment with earnings strong and yields rising. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | We see recent USD strength easing as the rest-of-world GDP growth recovery accelerates, and fears over a virus ‘third wave’ ease. A stable or weaker USD traditionally supports Emerging Markets, commodities, and large US foreign earners, such as the tech sector, and could be a modest headwind to large exporters, such as Europe. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Supported by GDP growth rebound, ‘green’ industry demand, years of supply under-investment. China GDP and property sector are short term concerns. Industrial metals and battery materials seem best positioned, whilst oil price supported by only slow return of OPEC+ supply. Gold hurt by outlook for higher bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.