Summary

Focus: Rise of the female investor

The steady rise of female investors is under appreciated, alongside the rise of both more self directed and younger investors. More women are now investing, with 26% new to investing, and are controlling more wealth. They also invest differently, for the longer term, with lower risk, and different priorities, according to our global retail investor survey. This rise has broad implications for everything from diversification, to ESG and financial education.

Strong earnings offset ‘stagflation’

Nervous markets faced cross-currents. With high and sticky 5.4% US inflation and more growth concerns (‘stagflation’), and the Fed set to taper soon. But offset by a strong Q3 earnings start, as the ‘big 4’ US banks beat estimates by 24%, and Chinese export growth rebounded 28%. US bond yields fell back, helping the tech sector, but was a headwind to financials. Chinese ADRs continued to stabilise after heavy losses this year. See our global markets presentation here.

Resilient GDP growth and higher bond yields

The IMF trimmed its global GDP outlook, but growth rates remain more than twice the ten year average, supporting strong earnings. This growth, along with nearing Fed tapering, argues for higher 10-year bond yields. The copper/gold ratio supports this. This favours an investment rotation to so-called Value; cyclical sectors such as financials (XLF) and energy (XLE).

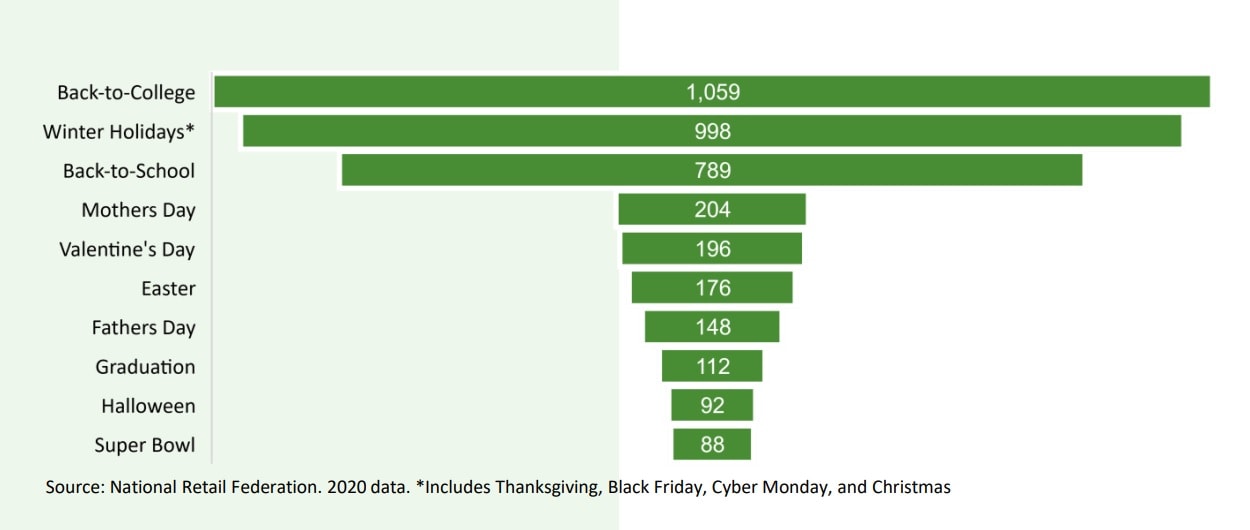

Energy ‘everything’ rally, and holiday retail

We see ‘higher-for-longer’ energy prices as structural under-investment supports fossil fuel prices, but also incentives a dramatic renewables investment catch up. This ‘everything’ rally helps both @OilWorldWide and @RenewableEnergy. The strength of the consumer is a key market support. Rising wages, asset prices, and ‘excess’ savings offset inflation and likely drive a strong holiday season, benefiting those from consumer ETF’s like XLY, to @FashionPortfolio.

Bitcoin touched $60,000. Polkadot focus

Bitcoin (BTC) touched $60,000 and closing on all time-high as ETF launch and ‘taproot’ upgrade nears. Polkadot (DOT) saw strong gains, setting Nov. 11 for hotly anticipated parachain auction. Solana (SOL) was added to the eToro platform, becoming the 32nd listed coin.

Broadening commodity rally

The rally is broadening from the much-focused energy price surge. Commodities as diverse as uranium, zinc, palladium, and lumber all rallied strongly last week. The asset class is enjoying a ‘sweet spot’ of both strong demand and increasingly tight supply. The CRB commodity index is now 150% from covid lows.

The week ahead: Earnings season accelerates

1) US earnings accelerate with Netflix (NFLX) and Tesla (TSLA) among those to report Q3, as banks started strong last week. 2) Purchasing manager indices in US, EU, UK, and Japan a timely global growth snapshot. 3) UK inflation in focus as Bank of England prepares to be the first major central bank to raise interest rates.

Our key views: Climbing the ‘wall of worry’

We see a positive outlook of 1) vaccine rollout and economic re-opening, and 2) still huge policy support, offsetting ‘stagflation’ and Fed risks. We see the ‘wall of worry’ giving way to a ‘Santa rally’. We like equities, commodities, crypto, and are cautious fixed income, and the USD.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 1.58% | 2.05% | 15.32% |

| NASDAQ | 1.82% | 0.87% | 19.04% |

| SPX500 | 2.18% | -0.97% | 15.59% |

| UK100 | 1.95% | 3.88% | 11.97% |

| GER30 | 2.51% | 0.63% | 13.62% |

| JPN225 | 3.64% | -4.69% | 5.29% |

| HKG50 | 5.69% | 1.19% | -6.98% |

*Data accurate as of 11/10/2021

Market Views

Strong earnings offset ‘stagflation’ concerns

- Nervous markets faced cross-currents of high and sticky US inflation and growth concerns (‘stagflation’), and Fed set to taper soon, but led up by a strong earnings start, as the ‘big 4’ US banks beat Q3 estimates by 24%, and Chinese export growth rebounded 28%. S&P 500 rose 1.8%. US bond yields fell back to 1.7%, helping the tech sector (+2.2%) but less for financials (+1.4%). Chinese ADR’s continued to stabilise. See our global markets presentation here.

The world’s economic health-check

- The International Monetary Fund (IMF) has published its latest global economic outlook. Behind the various forecast changes is a message of still strong economic recovery, that is near twice as strong as long term averages. This should continue to drive higher earnings.

- Their 8% China GDP growth forecast matches our view. That it has the policy flexibility to manage its property challenges. Whilst their crypto asset and carbon transition deep-dives are clear signs of surging investor interest.

Messages from the copper/gold ratio

- US 10-year bond yields have been rising (prices falling), and have more to go. The Fed is to buy less bonds and inflation and growth are rising. This will drive more investment rotation to so called Value (IWF) from Growth (IWD), and help sectors like financials (XLF) and energy (XLE). There are many things to cap this rise, from debt to demographics, but the copper/gold ratio points firmly to higher yields ahead.

The holidays consumer test

- The strong consumer is a key market support, and to come into their own this holiday season. US retail sales again surprised last month, up 0.7%. Jobs and wage growth are helping. The ‘wealth effect’ from higher housing, equities, and crypto values is big. The ‘excess’ savings built up over the crisis huge. This helps offset a ‘fiscal cliff’ of less government support, and the 5% inflation that is hurting consumer confidence.

- The start of the holiday spending season with Halloween on October 31, and $115 billion China ‘Singles Day’ on November 11, are upcoming sector catalysts. This is good for retail themes, like smart portfolios @FashionPortfolio, @TravelKit, and consumer ETFs like XLY.

The energy ‘everything’ rally to continue

- Surging natural gas (+130% this year) and coal (+200%) prices are feeding the oil rise, as users look for lower priced fuel substitutes. Higher prices also boost renewables competitiveness.

- Prices from uranium (nuclear power), up 57% this year, to lithium (batteries), up 255%, are soaring. This ‘everything’ energy rally is set to continue. Structural under-investment supports higher-for-longer fossil fuel prices. Whilst renewables investment needs to triple, and being incentivized by these fossil fuel prices.

- This helps the energy sector (ETFs like XLE, and @OilWorldwide), which is the cheapest in the market, with some of the highest dividend yields. These are enormous, multi-decade supports for renewables. See 31-stock smart portfolio @RenewableEnergy, from China Longyuan (0916.HK) to SolarEdge (SEDG).

Top-10 US consumer spending events ($/person)

Bitcoin rises to $60,000, approaching high

- Bitcoin (BTC) moved over $60,000, closing in on April’s $63,000 all-time-high. This is ahead of the launch of a bitcoin futures ETF, and November ‘taproot’ upgrade to boost efficiency and privacy. Scalable crypto proof-of-stake token Solana (SOL) was added to the eToro platform, taking the total number of available coins to 32.

- Eighth largest market capitalisation coin Polkadot (DOT) was biggest major gainer last week, as it set a November 11 date for its first hotly anticipated parachain auction. This price rise has taken its gains this year to near 400%.

Commodity rally is broadening

- Energy prices remain the focus, with Brent seeing further gains above $80/bbl. The International Energy Agency (IEA) raised its demand outlook. Surging coal and gas prices are boosting demand for cheaper energy substitutes, like oil. Also, leading producer Saudi Arabia has downplayed the chances of OPEC+ increasing its oil supply further.

- The commodity rally has been broadening out, well beyond the recent energy price spike. Commodities as diverse as uranium (to power nuclear reactors), zinc (to galvanise metals), palladium (for auto catalytic converters), soda ash (for glass), and lumber (for construction). All rose over 10% last week alone, as the asset class enjoys a growing ‘sweet spot’ of strong demand combined with tight supply.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 2.23% | -1.68% | 20.53% |

| Healthcare | 0.85% | -3.47% | 10.62% |

| C Cyclicals | 2.66% | 0.69% | 13.75% |

| Small Caps | 1.46% | 1.47% | 14.73% |

| Value | 1.54% | 1.69% | 18.23% |

| Bitcoin | 12.51% | 28.70% | 113.54% |

| Ethereum | 6.40% | 7.61% | 414.11% |

Source: Refinitiv

The week ahead: Earnings season accelerates

- This week focuses on tech and consumer earnings, after financials last week, to see if the strong start continues. Netflix (NFLX), Tesla (TSLA), and Johnson & Johnson (JNJ) are the focus. So far 10% of S&P 500 companies have reported, with growth 16% over expectations.

- Friday’s purchasing manager indices from Australia, Japan, UK, Europe, and US will give a timely global GDP growth snapshot. Expect some stability around the expansionary 55 level, to provide some investor relief, with Japan remaining the main country laggard.

- UK inflation, estimated +3.2% versus last year, as Bank of England prepares to become first of the top-5 central banks to hike interest rates.

- Corporate events include Apple (AAPL) event to show new MacBook’s, and Riot Blockchain (RIOT) tour of the largest US mining facility.

Our key views: Climbing the ‘wall of worry’

- A positive scenario of 1) global vaccine rollout and economic re-opening, 2) still large support of low interest rates and fiscal spending.

- The main risk is Fed policy tightening, which we see as gradual and well-flagged. Also. risks from 3rd virus wave, which has peaked already.

- We focus on cyclical assets that benefit most from the rebound: commodities, crypto, small cap, and value. We are more cautious on fixed income, the USD, defensive equities and China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 2.05% | 7.36% | 34.17% |

| Brent Oil | 3.07% | 12.22% | 63.94% |

| Gold Spot | 0.60% | 0.79% | -6.82% |

| DXY USD | -0.12% | 0.81% | 4.47% |

| EUR/USD | 0.19% | -1.09% | -5.05% |

| US 10Yr Yld | -3.79% | 20.37% | 65.58% |

| VIX Vol. | -13.16% | -21.67% | -28.35% |

Source: Refinitiv. * Broad based Bloomberg commodity index

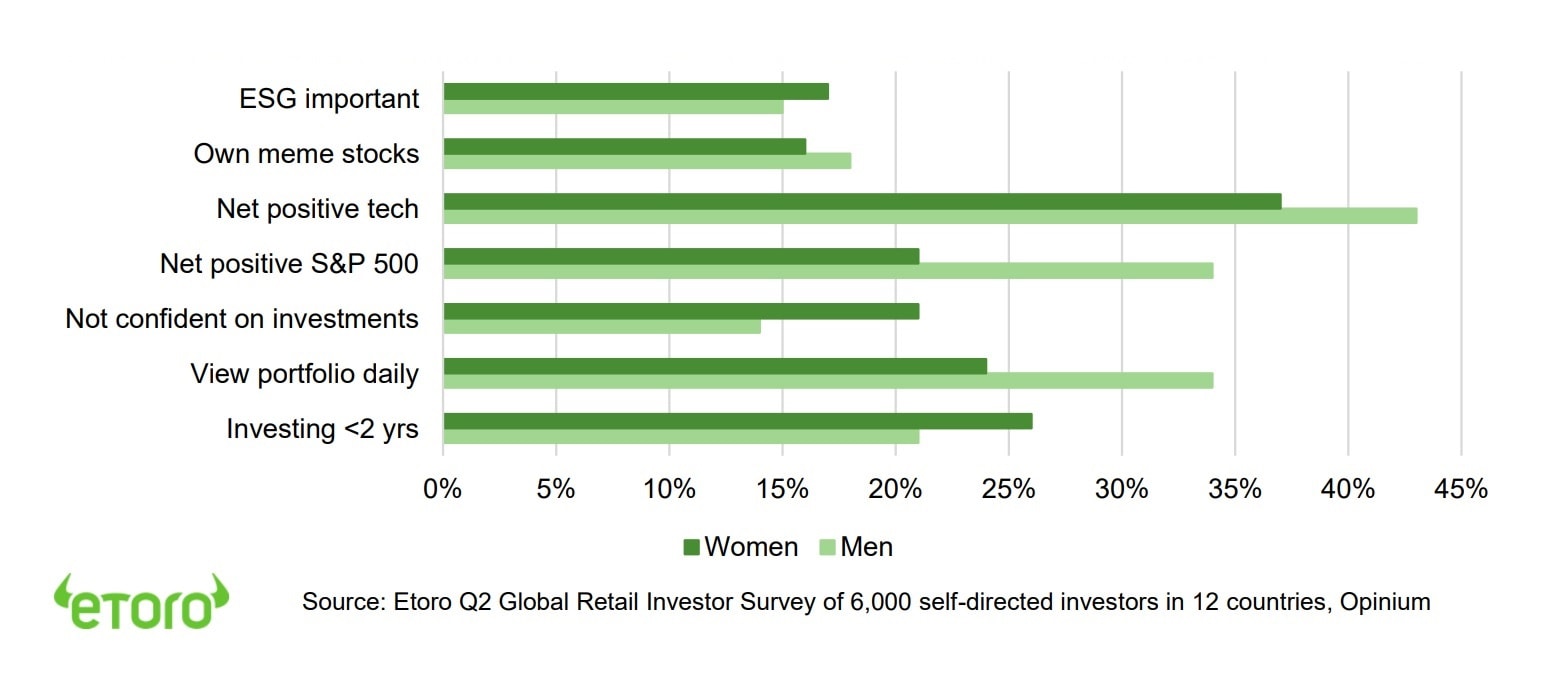

Focus of Week: The rise of the female investor

The rise of female investors is an under-appreciated financial markets driver

We are seeing a new generation of investors, with the rise of self-directed retail investors, and more younger investors. But we are also seeing a rise of female investors. Women’s economic influence has been rising, but is traditionally under-represented in the investing world, both as individual investors and especially in the asset management industry. This is beginning to change and has big market implications, as they demand more education, are more diversified, more focused on ESG – to name but 3 differences.

Female investors are under-represented today, but this is changing

Women dominate day-to-day family money decisions, and this is broadening to investments. In the US, women hold 60% of bachelor’s and master’s degrees, are the main breadwinners in 40% households (four times 50 years ago) and own a third of businesses. Younger affluent women are getting more financially savvy and leveraging new investment platforms. Two-thirds women now invest outside of their retirement accounts, according to Fidelity, and this number risen 40% in three years. McKinsey estimates $30 trillion assets will shift to women this decade, as spouses inherit. Any way you look at it, women’s impact is rising.

Women often invest differently. This has some key implications

Female investors are far from homogenous but have several different characteristics. Studies show women are better savers and generate better investment returns, by being more cautious and diversified. But also, are less confident in their investment decisions, and overall invest less. This is supported by the results of our quarterly global retail Investor survey (see chart). Among the many conclusions, are that women are:

- Investing more: 26% of self-directed female investors in our survey have been investing less than two years, starting since the start of the pandemic. This is a dramatic increase in new investors.

- Trade less frequently and look longer term: Only 5% of female investors trade daily. They are also less concerned about near term market corrections, and more focused on the longer term.

- Have a lower risk appetite: They are more cautious overall, whether on the outlook for markets, key sectors such as technology, or more volatile assets such as crypto. Fewer women invest in meme stocks.

- Exhibit less confidence: 21% of female investors are not confident in their investments. They are also more unsure of what assets to invest in. They research more for education than for new investment ideas.

- Have different priorities: Female investors have different concerns. For example, they are more focused on environmental, social, and governance issues when they analyse a company

Female investor characteristics. Select results from eToro Q2 global retail investor ‘beat’ survey

Stronger Q3 earnings could be a catalyst for analysts to raise their 2022 growth expectations, helping the market. These seem too low at only 9%, and not far above nominal GDP growth (4.2% real GDP + 3% inflation). Higher earnings is a key offset to lower valuations, but these risks have been falling. The 12- month forward S&P 500 P/E ratio is under 20x and closing in on the 5-year average 18x. Though still above the long term 16.5x, it compares to a peak last year over 23x. Our roadmap for the S&P 500 at 5,050 by end next year is for further earnings surprises combined with well-supported, and above-average, valuations.

Female investor characteristics. Select results from eToro Q2 global retail investor ‘beat’ survey

Key Views

| The eToro Market Strategy View | |

| Global Overview | Positive scenario of 1) global vaccine rollout and economic re-opening, 2) support from low interest rates and government spending. Main risk is from US Fed monetary policy tightening, but will be well-signalled and very gradual. Economies are increasingly resilient new virus case ‘waves’. Focus on most growth sensitive assets: equities, commodities, crypto, small cap and value. Relative caution on fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | A big beneficiary of the global growth rebound. Helped by 1) a greater weight of sectors most sensitive to the growth rebound, and lack of tech, 2) 25% cheaper valuations than the US, 3) a decade of under performance has made under-owned by global investors. Combination of lower-for-longer ECB plus multi-year €750bn ‘Next Generation’ government spending to drive European GDP and earnings growth more than the US, for the first time in a decade. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China has world’s strongest GDP growth, and benefitted from being ‘first in, first out’ of crisis, but its tech sector crackdown is hurting the market. LatAm and Eastern Europe have more upside to vaccine rollouts, global growth recovery and higher commodities. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | The broad ‘tech’ sector of IT, communications, and parts of consumer discretionary (Amazon, Tesla), dominates US and Chinese markets. Expect a more subdued 2021 after dramatic 2020 rally. But are structural stories with good growth, high profitability, and clean balance sheets that justify high valuations, and should continue to rise. |

| Defensives | Healthcare, consumer staples, utilities, and real estate sectors traditionally offer more defensive cash flows, less exposed to changes in economic growth. This has also made them more sensitive to rising bond yields. We expect them to relatively underperform in a more cyclicals focused environment with earnings strong and yields rising. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | We see modest USD weakness as the rest-of-world GDP growth recovery accelerates, and fears over a virus ‘third wave’ ease. A stable or weaker USD traditionally supports Emerging Markets, commodities, and large US foreign earners, such as the tech sector, and could be a modest headwind to large exporters, such as Europe. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Supported by GDP growth rebound, ‘green’ industry demand, years of supply under-investment. China GDP and property sector are short term concerns. Industrial metals and battery materials seem best positioned, whilst oil price supported by only slow return of OPEC+ supply. Gold hurt by outlook for higher bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Italy | Edoardo Fusco Femiano |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.