Summary

Retail investors under pressure but resilient

We get into the investing minds of 10,000 retail investors in 13 countries. Their resilience is a big positive given their new size. 24% US household total assets are in equities, 8pp over average. Global DIY investor confidence falling as inflation bites, and focus is more on bills and emergency reserves. They are raising cash and turning more defensive. But are still looking for opportunities, from FX to crypto, and well prepared to ride out bear market with a long term view.

Pressure from higher inflation and bond rout

Investors whipsawed by a new 6.6% US core inflation high and a broadening global bond rout. Markets now expect another 1.75% of Fed hikes. Equities have retraced half of 2020 bull market gains. Q3 earnings off to a ‘less-bad’ start, from PEP to JPM. KR and ACI set for big supermarket merger. INTC plans layoffs given tech slowdown. Earnings, China, UK this week’s focus. See video updates, twitter @laidler_ben.

Gathering global economic storm clouds

Sobering IMF global deep-dive of slowing growth, downside risks now reality, and worse to come. Only good news is global inflation peaked and Asia keeping world out of recession.

All inflation lead indicators now falling

Thursday’s 6.6% US core inflation high the latest big test for markets and a data dependent Fed. But all forward looking indicators show an easing of price pressures, giving some hope.

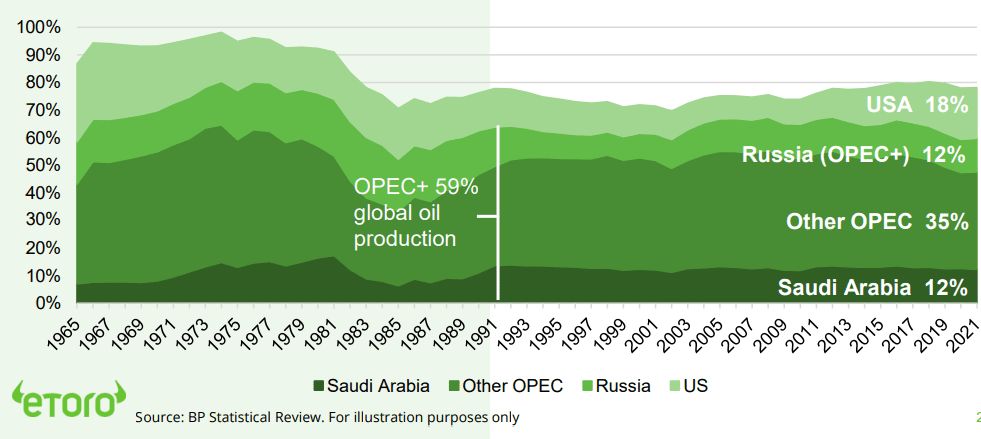

OPEC+ holds the whip-hand

OPEC+ controls 59% of global oil markets supply and its latest big quota cut shows its intent to support ‘high for longer’ prices. Is very little the US can do about it. @OilWorldWide.

Cannabis industry growing pains

US decriminalization hope to cannabis sector. Is <1/20 tobacco size. @CannabisCare

Crypto whipsawed by equity volatility

ETH outperformed crypto sell off driven by volatile equity markets. But they broke their $19,000 and $1,300 levels. ‘Ethereum killer’ ADA among leaders down, with little positive impact from September’s Vasil hard fork. Solana-based platform Mango Markets hack undermined SOL, after its own three outages this year.

Commodities hit by macro concerns

Prices sapped by dollar strength and high bond yields. Warnings that OPEC’s big supply cut could tip the world into a recession. Natgas eased on the mild autumn weather. Macro headwinds hit precious metals hard, whilst coffee fell on Brazil rains. Grains supported by Russia threatening an end to the Black Sea export deal.

The week ahead: Q3 earnings in full swing

1) Q3 earnings from banks (BAC, GS), consumer (JNJ, PG) and ‘big tech’ (TSLA, NFLX). 2) 20th China Party Congress focus Xi 3rd term, new Politburo and possible growth ‘pivot’. 3) Reaction to UK end of BoE gilt support, government tax U-turn, and latest 10% inflation print pressure.

Our key views: Fed risking a policy mistake

Fed is risking a policy mistake, spreading its hawkish rate stance globally even as inflation pressures fall. This raises risks but also takes us nearer a market inflection point. But recovery to be U-shaped only. Focus on cheap and defensive assets like healthcare, and styles like dividend yield, and related markets like UK.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 1.15% | 3.85% | -18.45% |

| SPX500 | -1.55% | -7.49% | -24.82% |

| NASDAQ | -3.11% | -9.84% | -34.03% |

| UK100 | -1.89% | -5.22% | -7.12% |

| GER30 | 1.34% | -2.38% | -21.70% |

| JPN225 | -0.09% | -1.73% | -5.91% |

| HKG50 | -6.50% | -11.59% | -29.11% |

*Data accurate as of 17/10/2022

Market Views

Pressure from higher inflation and bond rout

- Investors whipsawed by a new 6.6% high for underlying US inflation and a broadening global bond rout. Markets now expecting another 1.75% of Fed hikes. Equities have retraced half of their 2020 bull market gains. Q3 earnings are off to a ‘less-bad’ start, from PEP to JPM. Whilst KR and ACI set for big supermarket merger. INTC plans big layoffs on tech slowdown. Earnings, China Congress, and UK this week’s focus.

The gathering global economic storm clouds

- The International Monetary Fund (IMF) published its latest global deep-dive. It’s a sobering picture of slowing growth, with many downside risks now reality, and worse still to come. The only good news is global inflation seemingly peaked at 9.5% and is seen near halving by end of next year, whilst recession is not quite inevitable,

- Falling price pressures may allow an ease back on big interest rate hikes, and hence valuations. This could give markets relief even as economic growth and earnings fall more.

All inflation lead-indicators now falling

- Thursday’s US inflation report was latest big test for nervous markets and a data dependent Fed. Core inflation has set a new 6.6% high. But this is backward looking. All forward looking indicators are showing easing of pressures. This is crucial. High inflation has driven the most aggressive Fed rate cycle in recent history, crushing valuations, and stoking both recession and earnings risk.

Anatomy of global oil production (% of total, 1965 – )

- This should give comfort that inflation pressures have peaked and the top of the Fed rate cycle is on the horizon for Q1. Some valuation relief would offset continued earnings pressures.

OPEC+ holds the whip-hand

- OPEC+ holds a whip-hand over global oil markets. It accounts for 59% of world oil supply (see chart) and 80% of its reserves. Its recent decision to slash oil production quotas by 2mbpd signals its intent to support ‘high for longer’ oil prices as rising recession risks threaten demand. @OilWorldWide.

- This OPEC quota cut has inflamed relations with the US, which is struggling to lower inflation and faces looming midterm elections. But with global drilling activity half prior peak levels the US policy options – from ‘NOPEC’ legislation to US oil export restrictions – to try and lower oil prices are few.

Cannabis industry growing pains

- President Biden gave deregulation hope to hard pressed cannabis sector saying it ‘makes no sense’ marijuana to have same restriction as heroin under federal law. Was long-awaited step towards federal decriminalization. But still long way to untangling patchwork of state laws and conflicting federal law that dramatically raises production, transport, financing, tax costs in world’ largest market.

- The Alternative Harvest ETF (MJ) is still down 58% this year, and the industry is a tiny fraction of the size and profitability of the related tobacco and alcohol sectors. See @CannabisCare.

Crypto markets whipsawed by equity markets

- Crypto markets whipsawed by continued volatile equities. Bitcoin (BTC) and Ethereum (ETH) outperformed broader crypto assets but were temporarily pushed below their own respective key $19,000 and $1,300 price levels.

- ‘Ethereum killer’ Cardano (ADA) was among the bigger weekly losers. It has seen little immediate positive follow through from its big September Vasil hard fork upgrade boost to capability.

- Solana (SOL) was also held back as Solana-based platform Mango Markets fell victim to a $100 million hack. This comes after Solana itself has seen three major outages this year and.

Commodities hit by macro concerns

- Commodities weakened as the US dollar and bond yields surged after worse-than-feared US inflation. This stoked global recession fears and hurt the demand outlook for basic materials.

- Brent oil fell as International Energy Agency (IEA) warned that OPEC’s recent dramatic quota cuts could cause global recession. Natural gas was an exception as mild autumn weather eased prices.

- Precious metals silver, platinum, and gold fell on macro headwinds. Coffee was hit by Brazil rains.

- Grain prices were well supported with Russia threatening to block an extension of the Black Sea export deal until its grievances are met.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -3.50% | -11.75% | -36.15% |

| Healthcare | 0.39% | -3.51% | -15.29% |

| C Cyclicals | -3.77 | -14.26% | -34.28% |

| Small Caps | -1.16 | -8.49% | -25.07% |

| Value | -0.24 | -6.98% | -17.54% |

| Bitcoin | -1.25% | -3.63% | -59.55% |

| Ethereum | -1.82% | -18.07% | -64.24% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Full swing for Q3 earnings

- Q3 earnings season is in full swing with rest of US banks BAC, GS, BK, first of ‘big tech’ NFLX, TSLA, and consumers JNJ, PG, and PM. Outlook for ‘less-bad’ 3% S&P 500 earnings growth. Look for NFLX new ad-supported plan details, and TSLA results after weaker Q3 deliveries.

- 20th 5-year China Communist Party Congress. Focus on President Xi unprecedented 3rd term, the new ruling Politburo Standing Committee members, and a possible more ‘pro-growth’ policy for the struggling domestic economy.

- he UK in global bond rout spotlight after end of BoE emergency gilt buying, and latest government tax plan U-turn. Inflation (Wed) next test as holds near 10% highs with weak GBP, high energy prices, low unemployment.

Our key views: Fed risking a policy mistake

- The Fed is risking a policy mistake, spreading its hawkish interest rate stance globally even as inflation pressures fall. This both raises risks but also takes us nearer a market inflection point. Recovery to be U-shaped only. Gradually lower inflation will be a bumpy ride but will eventually start to de-risk markets and allow risk assets, like equities to perform better.

- Focus on core cheap and defensive assets to be invested in this ‘new’ world, of higher inflation and lower growth, and to manage still high risks. Sectors, like healthcare, defensive styles like div. yield, and related UK to China markets.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -2.96% | -2.64% | 14.62% |

| Brent Oil | -7.10% | -0.12% | 17.35% |

| Gold Spot | -3.03% | -2.04% | -9.85% |

| DXY USD | 0.45% | 3.22% | 18.06% |

| EUR/USD | -0.18% | -2.94% | -14.54% |

| US 10Yr Yld | 13.40% | 57.02% | 250.99% |

| VIX Vol. | 2.10% | 21.75% | 85.95% |

Source: Refinitiv. * Broad based Bloomberg commodity index

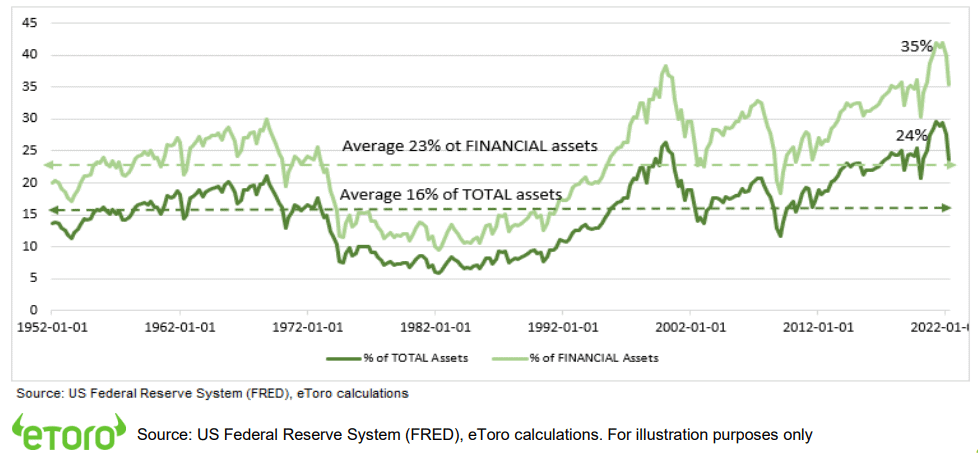

Focus of Week: Retail investors bending not breaking

Retail investors under pressure but resilient. A key markets positive given their significance

Our Q3 global survey of DIY investors shows falling but still firm confidence. Moving to de-risk portfolios alongside an openness to taking select bear market opportunities. This is a rare good news story for global markets, with newly important retail investors (see chart) resilient despite market and macro storm clouds.

DIY investor confidence falls as impact of surging inflation bites

Retail investor confidence continues to fall across their investments, job security, and living standards as inflation worries bite. Despite this 64% remain confident in their investments, led by the young (73%) and the Dutch (77%). A silver lining is that slumping investor confidence is often a contrarian market indicator.

They are focusing on the here-and-now, but still looking for opportunities

Many (41%) investors have reduced the amount they invest, in order to prioritise paying household bills or building up emergency cash reserves as the cost-of-living crisis has increasingly hit hard. A significant minority (26%) are also building cash now to use when uncertainties ease and they re-enter the market.

Raising cash levels and turning more cautious as recession risks rise

Cash has become the second most held asset, by 46% of DIY investors, and almost twice as high as a year ago. This level is behind only domestic equities. Here investors have been cutting back on the sectors seen most sensitive to the rising recession risks, like consumer discretionary, industrials, and banks. But they have not given up scouting for opportunities, raising allocations to areas like currencies and crypto.

Prepared to ride out the bear market storm with a long-term view

Two thirds (63%) of DIY investors look to hold their investments for years or decades. Very few (10%) for weeks or days, in contrast to the myths around retail investor. The more experienced the investor, the longer this investment horizon. This is driven by the main reasons they invest: for long term financial security (43%) and to fund retirement (33%). Time really is the DIY investors greatest investment ally.

Getting into the investing minds of 10,000 retail investors across 13 countries

There are scores of surveys tracking institutional investors thoughts. But shockingly few for DIY investors, especially globally. Our Retail Investor Beat polls 10,000 in 13 countries from Australia to US and Europe.

US Households equity ownership still high (% of assets)

Key Views

| The eToro Market Strategy View | |

| Global Overview | The aggressive Fed interest rate hiking cycle and stubborn inflation has boosted uncertainty, recession risk, and hit markets hard. We see this gradually fading, with global growth stressed but resilient, inflation pressure slowly easing, and valuations now more attractive. Focus on cheap and defensive assets for a gradual ‘U-shaped’ market recovery. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing GDP growth but still-resilient earnings growth. Valuations led market rout, and now at average levels, and are supported high company profitability and near peaked bond yields. Faster Fed hiking cycle boosting recession risks. Focus on cash-flows defensives, like healthcare and high dividend. Big-tech supported by structural growth outlook. See gradual ‘U-shaped’ rebound as inflation slowly falls. |

| Europe & UK | Favour defensive and cheap UK equities (‘Economies are not stock-markets’) over high risk/high return continental Europe. Recession risks high with Russia and energy crisis, threatening to overwhelm ‘buffers’ of rising fiscal spending (defence and refugees), low interest rates (slow to raise ECB), and weak Euro (50%+ sales from overseas). Equities partly cushioned by lack of tech, and 25% cheaper valuations vs US. Favour cheap and defensive UK over Continent. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. More cautious rest of EM on rising rates and strong USD. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, if global growth resilient and bond yields rising. Japanese equities among cheapest of any major market, benefit from weaker JPY and with low inflation, offsetting structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Hurt by higher bond yields and above average valuations. But structural stories with good growth, high margins, fortress balance sheets support some. ‘Big-tech’ attractive new recession defensives. ‘Disruptive’ tech is much more vulnerable. |

| Defensives | Core positions as macro risks rise and bond yields are better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | Higher risk cyclical sectors, like discretionary (autos, apparel, restaurants), industrials, energy, and materials, are cheap and attractive if see a ‘slowdown not recession’ scenario. Are select but high risk opportunities from energy to financials stocks. With often depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Benefits from higher bond yields, charging more for loans than pay for deposits. Also one of cheapest P/E valuations, and room for large dividend and buyback yields. But is being outweighed by rising recession risks, with lower loan demand and higher defaults. Banks most exposed. Insurance and Diversifieds (like Berkshire Hathaway) least. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ surge driven by rising Fed interest rates and ‘safer-haven’ bid. Whilst many developed markets currencies hurt by their still low interest rates and struggling growth. ‘Reverse currency war’ interventions ineffective. Strong USD hurts Emerging Markets, commodities, US foreign earners like tech. But helps big EU and Japan exporters. |

| Fixed Income | US 10-year bond yields risen above prior 3.5% peak, as Fed hikes continue aggressively and balance sheet runoff accelerates. Set to ease as recession risks rise and inflation expectations fall. Additionally US has a wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, low productivity. |

| Commodities | Strong USD and rising recession fears hitting commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil by slow return of OPEC+ supply and Russia 10% world supply problems. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Clear supply rules a benefit as inflation high. Volatility still high, with the 16th -50% pullback of the last decade. Adoption and development continuing regardless. See Ethereum merge to Proof-of-Stake. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.