Summary

Compounding dividends and record buybacks

Compounding dividends, and share buybacks, are big and two overlooked ‘make money while you sleep’ drivers of equity investment returns. Dividends are 40% of long term US returns, and more elsewhere. Buybacks the single largest US equity buyer. Both are at record levels and set to grow more. See @DividendGrowth and @Utilities and ETF’ like HDV or IAPD.L. These compounding investments are an attractive complement to our bullish cyclical and value focus.

‘Triple relief’ boosts markets

Markets soared the most since 2020 with a ‘triple relief’ from the long-awaited start to Fed interest rate hikes, China’ pledge to support markets, and some Ukraine peace talks progress. Oil held over $100/bbl and US 10-yr bond yields over 2.1%. We are positive markets, with fundamentals stressed but secure. See latest presentation, video updates, and twitter @laidler_ben.

The dramatic China ‘equity put’

Chinese stocks surged as authorities came to rescue of its beleaguered markets. Seen a 70% fall vs US last year and valuations 50% cheaper. Policy ‘put’makes more attractive.

The building global food crisis

Ukraine crisis disruption to food set to be larger, more serious, and lasting than energy. Region 24% wheat supply and wheat 20% human calorie consumption. Hits EM and inflation.

Supply chain chaos returns

Commodity supply fears and China lockdowns rekindling supply chain chaos, from autos to tech and logistics. Are winners and losers. Our ‘pain’ index has rebounded 30% this year.

Currency contagions from the crisis

The closer the currency to Ukraine the more painful. See PLN, HUF, CZK, RON.

Bitcoin survives the Fed hiking start

Bitcoin (BTC) resilient to US Fed rate rise, easing fears that tighter liquidity could hurt asset class. Avalanche (AVAX) benefited from 50%+ staking rate. Ukraine signed ‘virtual assets’ law. Theta (THETA) and Fantom (FTM) coins added to the eToro platform, taking total to 57.

Another wild commodity week

A week of strong commodity market volatility. Oil held over $100/bbl. as the IEA warned of looming 30% Russia supply cut. Copper boosted by China policy stimulus. Wheat firm on Ukraine harvest disruption. Gold hurt by Fed rate hike. Nickel plunges on ‘short squeeze’ unwind.

The week ahead: How big is the growth hit?

1) Ukraine crisis focus on peace talks and high commodity volatility. 2) Monthly global PMI data (Thu.) gives first look at the growth and inflation hit from crisis. 3) Earnings from NKE, ADBE, CCL, GIS and NVDA, MRNA investor days. 4) UK spring budget and inflation rise (est. 6.1%).

Our key views: More reward than risk

Geopolitics has added to existing inflation and rate risks. But markets have shown are spring loaded for less uncertainty from Ukraine, China, or Fed. Would allow the growth and valuation fundamentals to reassert. We focus on cheap and cyclical assets that benefit from good growth and stubborn inflation: Commodities, Value, crypto. We are cautious on bonds.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 5.50% | 1.98% | -4.36% |

| SPX500 | 6.16% | 2.63% | -6.36% |

| NASDAQ | 8.18% | 2.55% | -11.19% |

| UK100 | 3.48% | -1.45% | 0.27% |

| GER30 | 5.76% | -4.18% | -9.27% |

| JPN225 | 6.62% | -1.09% | -6.82% |

| HKG50 | 4.18% | -11.98% | -8.48% |

*Data accurate as of 21/03/2022

Market Views

Triple relief boosts markets

- Markets saw best week since 2020 with triple boost from the long-awaited start to Fed’s rate hikes, China’s government commitment to support market, and some progress in Ukraine ceasefire talks. Oil held over $100/bbl. and US 10-yr bond yields over 2.1%. We are positive markets, with fundamentals stressed but secure. See Page 6 for our Resources guide of reports, presentations, videos, and twitter.

The dramatic China equity ‘put’

- Chinese stocks surged as authorities came to rescue of its beleaguered markets. This ‘equity put’ saw all-in attempt to clear concerns in one go, from ‘as soon as possible’ end to tech crackdown, to resolving property sector risks.

- After Chinese equities’ (MCHI) epic 70% fall vs US the past year, and now at bargain 50% off valuations, despite similarly large tech sectors. A government policy ‘put’, improving economy, and cheap valuations is an attractive mix.

- An improving China has positive impacts from north Asia to Europe, and to sectors like luxury.

The building global food crisis

- Ukraine crisis disruption to food may be larger, more serious, and lasting than the energy exposures. Wheat is 20% of total human calorie consumption. Both this and next year’s Ukraine harvests are hit, and Russia is seeing self sanctioning, financing, and logistics issues. They are 24% (12% each) of global wheat markets.

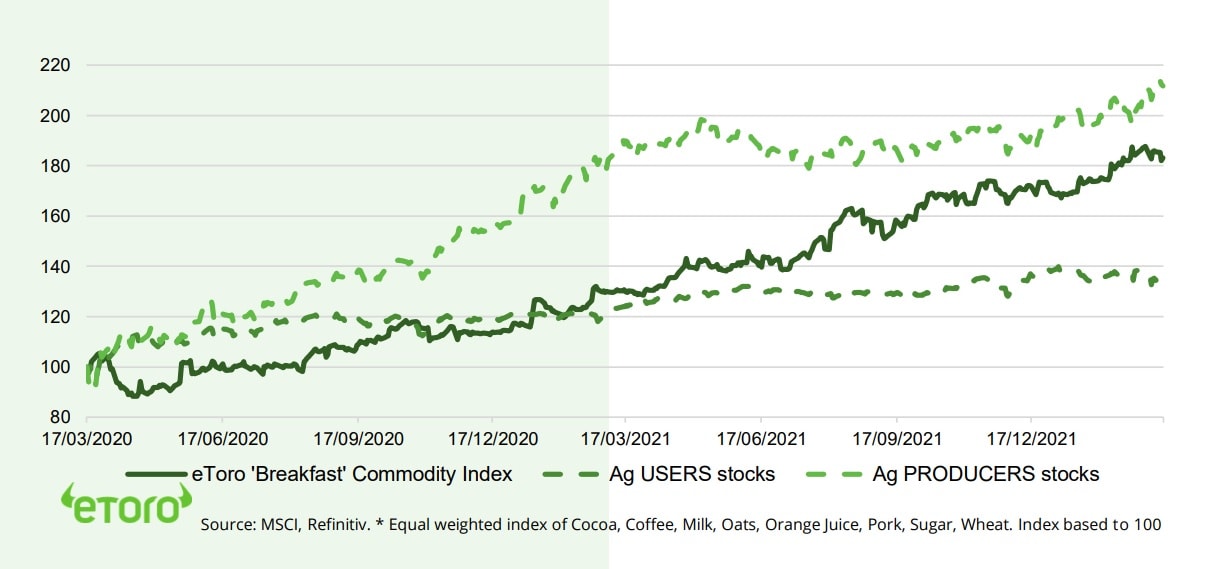

- Our ‘Breakfast’ index of food commodities has pushed higher. This helps ag producers and proxies like Deere (DE) and Mosaic (MOS), and innovators like @FoodTech. But hurts branded food stocks, like Nestle (NESN.ZU), Mondelez (MDLZ). They underperformed producers by 80pp, and are boosting prices to compensate.

Supply chain chaos returns

- Commodity supply fears and China covid lockdowns are rekindling supply chain chaos. 50% of neon for semi chips come from Ukraine. China tech hub Shenzhen was locked down.

- No.2 carmaker Volkswagen (VOW3.DE) sees more disruption from Ukraine than covid. Wire harness shortages saw new factory stoppages. Sanctions are also disrupting shipping. 15% sea farers are from the two protagonists. This means lower trade volumes and higher prices.

- This hurts consumers but helps inflation-proxy assets and those companies with pricing power.

Currency contagions from crisis

- FX closer to Ukraine the more painful. Poland’ zloty (PLN) 3rd worst performer this year behind only Russian ruble (RUB) and Turkish lira (TRY). Hungary’s forint (HUF), Czech koruna (CZK), Romanian Leu (RON) are not far behind.

- We see fundamentals stressed but secure. They have been aggressively raising rates to combat inflation. Rates average 3.5%. This is a anchor. GDP growth averages a high 5% today. A weak FX will boost export competitiveness. Defence and refugee spending will help support growth.

‘Breakfast’ Commodities Index* vs Agricultural Producers and Users (2-Years)

Bitcoin survives the Fed hiking start

- Bitcoin (BTC) prices were resilient to the US Fed interest rate rise, dispelling some investor fears that these tightening liquidity conditions could hurt investor interest in crypto assets.

- Avalanche (AVAX) among the better performers, continuing to benefit from its 50%+ staking rate and its high community participation. Ukraine signed a ‘virtual assets’ law to regulate the sector. This came even as European Union securities and banking regulators stepped up warnings to consumers on crypto risks.

- eToro added Theta (THETA) and Fantom (FTM) coins to the platform, taking total coins to 57.

Another wild commodity week

- Brent oil held above $100 as the International Energy Agency (IEA) warned Russian production could fall 30% within a month. This more than offset global efforts to increase supplies.

- Wheat prices rose as investors focused on the disruption to Ukraine’ harvest. Russia and Ukraine are 24% of global wheat exports.

- Copper prices were supported by Chinese authority’s commitment to resolve property sector issues and support the economy. China is the world’s largest copper importer.

- Gold prices were pressured by rising US 10-year bond yields after the Fed interest rate decision.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 7.96% | 1.90% | -12.47% |

| Healthcare | 6.45% | 7.09% | -4.82% |

| C Cyclicals | 8.63% | 0.89% | -10.44% |

| Small Caps | 5.38% | 3.82% | -7.09% |

| Value | 4.19% | 2.27% | -11.48% |

| Bitcoin | 8.84% | 4.93% | -11.41% |

| Ethereum | 16.30% | 6.41% | -20.76% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: How big is the growth hit?

- Markets will be focused on whether initial Russia-Ukraine peace talks progress can be sustained, whilst commodity markets continue to be focused on supply disruption fears.

- Monthly PMI data (Thu) from US, EU, UK, Japan to give first measure of growth and inflation impacts of Ukraine crisis and commodity price surge. Prior numbers were a resilient c.55.

- The earnings highlights include sportswear giant NKE, software ADBE, cruise ‘re-opener’ CCL, EV NIO, and consumer food stock GIS. Also the NVDA and MRNA investor updates.

- The UK will see its Spring budget and latest inflation (Wed) report that is expected to see prices rise near 6% after the BoE raised interest rates for 3rd time last week to 0.75%.

Our key views: More reward than risk

- Geopolitics has added to high inflation and interest rate risks. But markets showed spring loaded for any lower uncertainty, from Ukraine, China, or the Fed. To allow the stressed but secure fundamentals to reassert themselves.

- Economies are reopening and growth robust. Q4 company profits strong. Valuations more attractive. Fed hiking cycle well-priced. Investor sentiment now at attractive capitulation levels.

- Focus on cheap and cyclical assets that benefit from good growth and stubborn inflation: Value, commodities, crypto. Cautious on bonds.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -2.40% | 10.51% | 24.39% |

| Brent Oil | -3.50% | 15.59% | 38.82% |

| Gold Spot | -2.79% | 1.79% | 5.76% |

| DXY USD | -0.90% | 2.28% | 2.36% |

| EUR/USD | 1.44% | -2.21% | -2.65% |

| US 10Yr Yld | 15.53% | 22.54% | 63.95% |

| VIX Vol. | -22.37% | 10.66% | 13.94% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: The power of dividends and buybacks

Compounding dividends and big share buybacks are attractive and overlooked drivers

Both global company dividend payments and share buybacks are at record levels and set to move higher. Compounding dividends makes up an overlooked 40% of long-term US equity returns and is even higher in the rest of the world. They are the definition of Warren Buffett’s exhortation to ‘make money whilst you sleep’. Company share buybacks are the biggest single buyer of US equities, and a unique support during current volatility. The combined 4% US dividend and buyback yield is double the 10-year bond yield. This type of more defensive strategy is a complement to our current bullish cyclical and value equity focus. .

2021 saw a big recovery in dividends, and a huge rebound in share buybacks, both to new records

Global dividends saw a new record last year, rising 15% to $1.5 trillion. Australia, Europe and UK led the rebound, as had seen the deepest cuts, and most cyclical focused stock markets. Materials and bank sectors were 60% of the increase. BHP (BHP) was the largest global payer, followed by Microsoft (MSFT), Rio Tinto (RIO), and Samsung (SMSN.L). Banks boosted dividends by 40% as regulatory restrictions eased. The US lagged, up 6%, as more-flexible buybacks surged. Brazil dividends tripled, driving emerging markets.

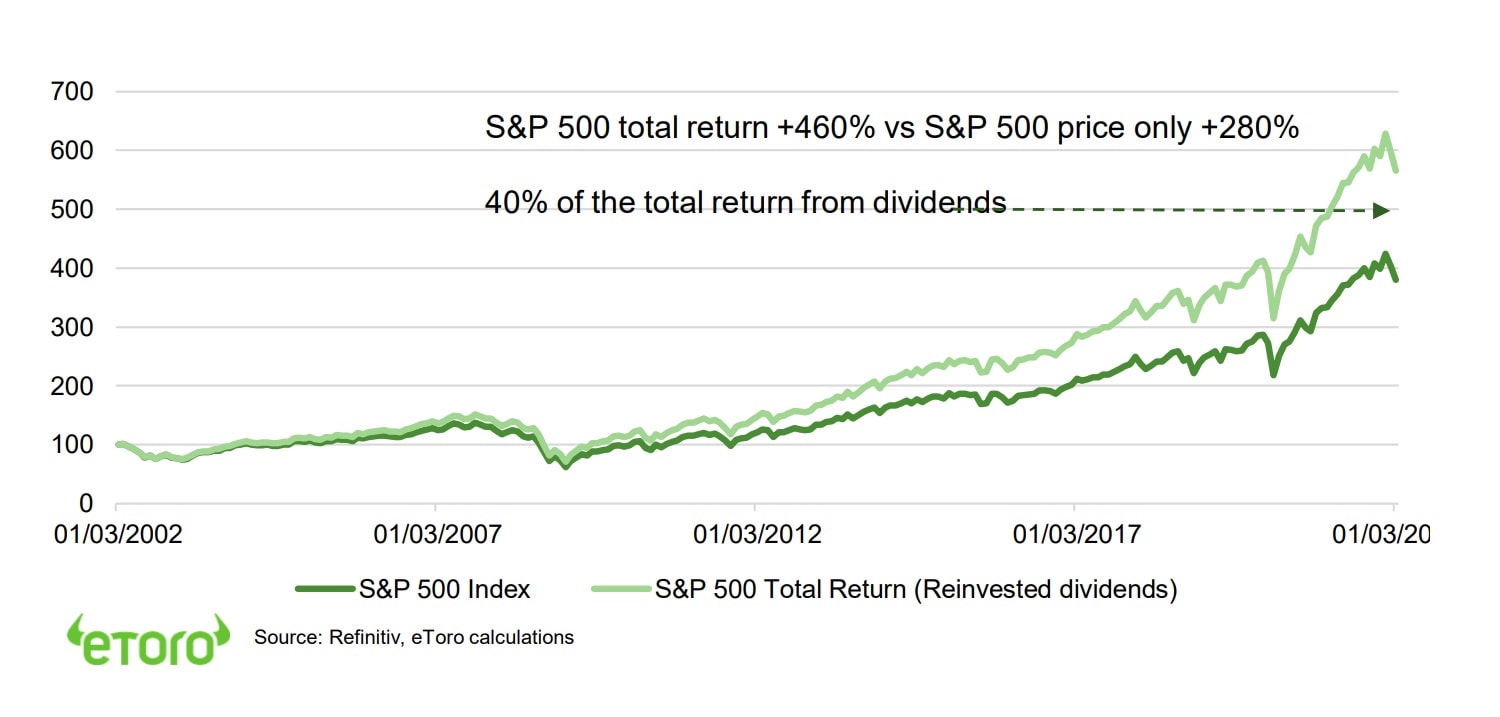

Dividends drive over 40% of long-term investor returns

40% of the long-term US equity total return comes from reinvested dividends (see chart). This is over 50% in the rest of world where buybacks are less common. This is due to the compounding from the reinvestment of dividends. Your dividend buys more shares, increasing your next dividend, and so on.

Buybacks are a unique US phenomenon, and the biggest buyer of equities

US share buybacks rebounded to $882 billion last year, up 70%. The split between buybacks and dividends is 50/50. Buybacks are indirect return of value to shareholders. By reducing the number of shares investors own a greater slice of the company. This practice makes US companies the largest buyer of US equities and is a key market support that does not exist to the extent elsewhere. The biggest buyers are tech (2.6% yield) and financials (4.6% yield), led by Apple’ (AAPL)massive $88 billion of share repurchases last year

Instruments to focus on dividends and buybacks

Dividend and buyback strategies have outperformed recently. The US Dividend Aristocrats and Buyback indices are both -5% vs -7% S&P 500 fall this year. Smart portfolios @DividendGrowth, a global set of 40 high dividend stocks, and @Utilities, a traditionally high-dividend yield sector, have done even better. There are other dividend focused ETFs for US (like HDV, VIG) and international, like Asia (IAPD.L).

S&P 500 price index vs Total return index (Reinvested Dividends, 20-years)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Geopolitical risks alongside the Fed hiking cycle is boosting uncertainty and weakening markets. We see this ultimately fading, and the global growth outlook secure, and valuations more compelling. Focus on reflation and cyclical assets: equities, commodities, crypto, small cap and value. Relative caution fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing strong c4% GDP growth and with room for more earnings upside surprises. Valuations have now fallen back to average levels, and are well supported by still-low bond yields and high company profitability. Fed interest rate risks are now well-priced. See cyclicals and value catch-up, after a decade of underperformance, whilst big-tech is supported by its structural growth outlook. Now see overseas markets leading. |

| Europe & UK | Region is being buffeted by proximity and exposure to the Ukraine crisis. See secure outlook with 1) Europe’s strong macro ‘buffers’ of rising fiscal spending (defence and refugees), zero-bound interest rates (‘dovish’ ECB), and a weak Euro (50%+ company sales from overseas). Equity markets helped by 2) a greater weight of cyclical sectors, and lack of tech, 3) 25% cheaper valuations vs US, 4) decade of underperformance make under-owned by global investors. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China outlook improving as cuts interest rates (opposite of rest of world) reducing slowdown and property sector risks, focuses on stability ahead of 20th Party Congress, and with valuations now 45% cheaper than US and market heavily out of favour. Will support EM, but is exposed to Fed tightening. China recovery also helps global sectors from luxury to materials. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Consumer staples, utilities, real estate offer more defensive cash flows, less exposed to economic growth. Makes them more sensitive to rising bond yields. Expect them to underperform in a more cyclicals focused environment with earnings strong and yields rising. Healthcare is more attractive, with cheaper valuations and more growth. |

| Cyclicals | We expect cyclicals – industrials, energy, and materials, to lead performance. Are most sensitive to re-opening economies, still strong GDP growth, and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and been out-of-favour for many years. Consumer cyclicals face commodity headwinds. |

| Financials | Financials will benefit from strong GDP growth, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators giving flexibility to pay large 8-10% dividend and buyback yields. Most have zero Russia exposure. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | In ‘sweet spot’ of robust GDP growth, ‘green’ industry demand, years of supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply and Russia 10% world supply problems. Gold helped by risk-aversion but held back by rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| Italy | Gabriel Dabach |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.