Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and ‘special’ on coming weaker seasonality.

‘Sell in May’ weaker seasonality coming early

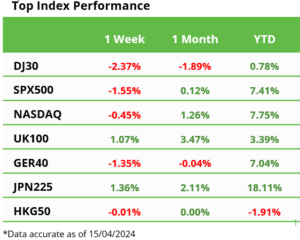

Markets had a great first quarter and now face US inflation reset headwinds, pulling forward overdue volatility and ‘Sell in May’ typical weak seasonality. This is a breather, and we remain in early bull market innings. Average global mid-year six-month returns are 0.1% monthly vs 1.2% rest of year, of 15 major markets the past 50 years. With weaker performance outside the US. With three seasonal constant drivers. See Page 4

Hot inflation drives a rate cut rethink

US stocks worst week in six months. 3rd straight hot inflation report cut 2024 rate cut outlook to just two. Bond yields and dollar rose, and rate sensitive real estate slumped. Geopolitical fears rose. ECB goes-alone with June cut plans, hitting EUR. BA saw new whistle-blower. BX bid for AIRC. SHEL.L considers leaving London. TSMC reported a sales rise. See our new Q2 2024 Outlook HERE and twitter @laidler_ben. See Page 2

A third US inflation surprise

US inflation most important number in markets rose to 3.5%, on shelter and gasoline, pushing back Fed rate cuts to Sept. and to just two this year, boosting bond yields and dollar. See Page 2

US banks kick off earnings. Europe the focus US banks start Q1 earnings and were weak, with focus on guidance. Europe’s banks are relatively bigger, more macro important, and now more profitable and a lot cheaper. See Page 2

Commodities coming in from cold

Rallies as see slow-burn supply/demand squeeze and investors now looking for inflation hedge and allocations low after big underperformance. It’s a better but not great outlook. See Page 2

Messages from crypto and its proxies

Is best performing, smallest, youngest, and most retail asset class with key halving and Ethereum ETF catalysts looming. Bitcoin led but Ethereum is the contrarian catch-up play. See Page 2

Bitcoin weak ahead of halving week

Bitcoin (BTC) & Ethereum (ETH) ease vs $70,000 and $3,500 highs. Uniswap (UNI) fell on SEC case. April 20th Bitcoin halving to cut supply growth for remaining 6% of BTC. Cumulative net spot BTC ETF inflows hit $12 billion. Blackrock (BLK) adds GS, UBS, C as participants for leading IBIT ETF. See latest Weekly Crypto Roundup. See Page 3

Commodity rally takes a breather

Commodities blistering catch-up rally paused as the US dollar soared and bond yields rose, ahead of key China economic data. Brent held near $90/bbl. on geopolitics. Platinum and silver led the precious rally, and gold hit a new all-time high. Cocoa also hit a new high at $10,600/t, and sugar fell on healthy Brazil harvest. See Page 3

The week ahead: Q1 earnings, Halving, China

1) 1st week of Q1 earnings w/ banks BAC, GS, healthcare JNJ, PG, and tech NFLX, TSM, ASML. 2) Four-year Bitcoin halving (Sat) slowing supply growth for remaining 6% of BTC. 3) China Q1 5% GDP growth stall (Tue). 4) IMF/World Bank spring meetings and new macro forecasts. US ‘tax day’ filing deadline stock overhang (Mon). See Page 3

Our key views: Outlook for a different 2024

We see a stronger but very different 2024. Lower inflation and coming interest rate cuts as growth slows, and the earnings outlook idiosyncratically accelerates. Will drive an investor rotation from 2023 US and big tech winners to soft landing losers from Europe to cyclicals. See Page 5