Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and ‘special’ Q1 earnings season preview.

Friday’s Q1 earnings season next catalyst

Better earnings growth outlook the single biggest market support right now. Q1 season starts Friday. Profits growth forecasts are reassuringly low, and we see another ‘beat’. Idiosyncratic recovery driven by tech, profit margins, a low base, and held back by energy. Tech earnings to grow over 20% and lead S&P 500 +5% earnings growth. Europe set for a less-bad -11% quarter, led by heavy-weight financials sector, Denmark, and improved net profit margins. See Page 4

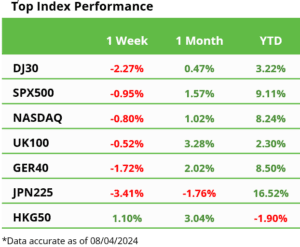

Stocks fall after big Q1 gains

S&P500’s worst week of year after huge Q1 gains and big US jobs report. Europe cushioned by another downside inflation surprise. US bond yields rose to 4.4% and commodities stealth rally accelerated. TSLA slumped as deliveries shocked. GOOG reported near buying HUBS. DIS saw off activists. GE finished its breakup. And EDR went private. See our new Q2 2024 Outlook HERE and twitter @laidler_ben. See Page 2

US valuation risks are building

US valuations above average and at a record 40% premium to fair-value as bond yields risen. Puts pressure on profits recovery & supports rotation to cheaper ‘insurance’ assets. See Page 2

Big oil makes a comeback

Oil hit $90 as OPEC squeeze supply and demand recovers with cheap big oil stocks leading gains. Yet higher Brent will sap OPEC unity and sector earnings hurt by natgas and refining. See Page 2

FOMO makes a return to markets

Our contrarian sentiment indicator surged to the highest in two years as flows have poured into equity funds from the sidelines. See Page 2

BEACH stocks are flying high

Travel stocks outpacing tech as industry see’ new normal of demand catchup & supply constrained pricing power, benefitting hotels to airlines and Mexico to Spain. See @TravelKit. See Page 2

Meme coins lead crypto down

Bitcoin (BTC) eased back as spot ETF inflows and Fed rate cut expectations both cool. Asset class weakness led by double-digit falls from meme coins DOGE and SHIBxM. Ripple announced plans for a USD stable coin. Bitcoin halving two weeks away. Etoro adds 12 altcoins to platform. See latest Weekly Crypto Roundup. See Page 3

Commodities have their best week of year

Commodities rallied over 3% as stealth catch-up rally broadens, helped by China PMI surprise and weaker US dollar. Brent broke $90 to a six-month high on OPEC+ supply squeeze and Mid-East tension. China-focused industrial metals, copper to zinc, boosted by its manufacturing PMI hitting 50. Silver led precious metal rally. See Page 3

The week ahead: Q1 earnings season, CPI, ECB

1) JPM starts global Q1 earnings season w/ low +5% S&P 500 growth expectations and -11% in Stoxx 600. 2) US inflation (Wed) world’s most important number stuck c.3.2%. 3) ECB meeting (Thu) outlook to first June rate cut. 4) IMF World Economic Outlook ahead of Spring meets. INTC Vision and GOOG 3-day cloud events. See Page 3

Our key views: Outlook for a different 2024

We see a stronger but very different 2024. Lower inflation and coming interest rate cuts as growth slows, and the earnings outlook idiosyncratically accelerates. Will drive an investor rotation from 2023 US and big tech winners to rate sensitive losers from Europe to real estate. See Page 5

,