Summary

Surviving the more aggressive Fed

Markets seeing a double headwind from the US Federal Reserve, with ever higher interest rate and bigger bond sale ‘quantitative tightening’ expectations. We are still constructive, think a recession can be avoided, and we are near ‘peak Fed’ fear. Despite its hawkish pivot this interest rate cycle will likely be of average length and magnitude. Equities have been resilient. Cheaper sectors, like financials and energy, provide protection from lower valuations. Whilst ‘hedges’, like commodities and crypto, protect from a high-for-longer inflation outlook.

Markets resilient to more bad news last week

Markets pressured but resilient. Fed and ECB meeting minutes boosted rate rise concerns, Russia sanctions increased, and French election race tightened. The USD hit a 2-year high. Elon Musk bought 9% of TWTR and Warren Buffett 11% of HPQ. Week ahead focus on Q1 earnings season start. See latest presentation, video updates, and twitter @laidler_ben.

The better roadmap for the second quarter

We see markets primed to perform better in Q2 with the ‘less bad’ outlook we see. Rate hikes are better priced, valuations cheaper, and economic and earnings growth both resilient.

The low earnings bar

We see room for another positive surprise as Q1 earnings season starts. 5% US and 20% European earnings growth forecasts seem too low. Would reassure nervous equitymarkets.

The tightening French election

The April 10 and 24 French presidential election race is tightening, worrying nervous markets, with big implications for Europe’s economy, and sectors from luxury to industrials.

Playing with oil market fire

Dramatic US ‘strategic petroleum reserve’ sales a stop-gap only and could backfire.

Big bitcoin buys announced

Weaker week for cryptoassets with industry at Miami’ ‘Bitcoin 2022’. Bitcoin (BTC) supported by further big buys from Luna Foundation and MicroStrategy (MSTR). 20% the Bitcoin hashrate is now from listed miners, like RIOT and MARA. eToro.art NFT programme launched.

Coal and uranium prices in spotlight

Brent oil slipped back on unprecedented reserve sales plan. Coal prices, and related equities from ARCH to 1171.HK, rebounded with EU sanctions on Russia coal. Whilst nuclear fuel uranium was boosted by increasing global move to renewable fuels. This drove up the URA ETF.

The week ahead: Q1 earnings season start

1) JP Morgan kicks of a crucial Q1 global earnings season on Wed. S&P 500 earnings seen rising 5%. 2) Latest US and UK inflation set to surge to new highs. 3) European Central Bank meeting to inch towards tightening policy. 4) Short week in UK and Europe for Easter holidays.

Our key views: Sensitive to less ‘bad news’

Markets have already absorbed a lot of negative news this year, from the Fed and inflation to Ukraine and China. We believe this makes them sensitive to the ‘less bad’ news we see, starting with Q1 earnings reports. Focus on a ‘barbell’ of cheap cyclicals and select ‘defensives’: Value, commodities, crypto, alongside healthcare and ‘big tech’. We are cautious on bonds.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -0.28% | 5.39% | -4.45% |

| SPX500 | -1.27% | 6.75% | -5.83% |

| NASDAQ | -3.86% | 6.75% | -12.36% |

| UK100 | 1.75% | 7.18% | 3.86% |

| GER30 | -1.13% | 4.81% | -10.08% |

| JPN225 | -2.46% | 7.24% | -6.27% |

| HKG50 | -0.76% | 6.41% | -6.52% |

*Data accurate as of 11/04/2022

Market Views

Markets resilient to more bad news

- Markets pressured but resilient. Fed and ECB ‘meeting minutes boosted rate rise concerns, Russia sanctions increased, and French election race tightened. USD rose to 2-yr high, whilst oil slipped back on reserve sales plan. Elon Musk bought 9% of TWTR and Warren Buffett 11% of HPQ. Week ahead focus on Q1 earnings season start. See Page 6 for our Resources guide of reports, presentations, videos, and twitter.

The better roadmap for Q2

- There were few places to hide in Q1, with commodities the only asset class in the green. Nevertheless, equities and crypto have seen a rebound out of ‘correction’ territory in recent weeks and been impressively resilient in the face of surging inflation, a hawkish Fed pivot, war in Europe, and renewed China weakness.

- With markets now pricing a dramatic 2.5% of Fed hikes this year, valuations lower, and both economic and earnings growth still resilient, we see markets primed to perform better with the ‘less bad’ outlook we see in the second quarter.

The low earnings season bar

- Global first quarter earnings season unofficially starts Wednesday, with JPM starting US bank reports. Consensus has set a low bar for only 5% S&P 500 earnings growth, despite 10% revenue growth, with inflation and supply chain pressure seen eating into high 12% profit margins. European forecasts are stronger, with Stoxx600 revenue and earnings seen up 20%.

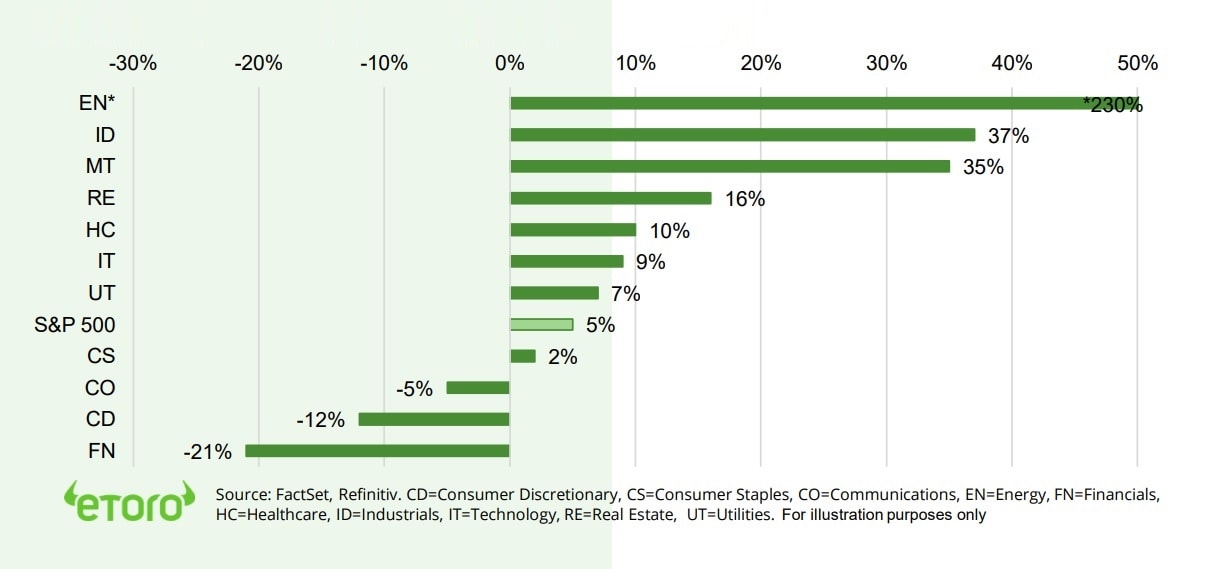

- Beating forecasts is harder every quarter, but we see room for more. Expectations have been cut into the quarter. Companies shown ability to pass on cost pressures. Whilst many benefit from reopening economies. A good earnings season is a needed support to pressured equity markets and an offset to still high valuations. Cyclical sectors seen leading growth (see chart).

The tightening French election

- Markets been nervously repricing the electoral odds in tightening French presidential election. The market has outperformed European peers since pro-business Macron’s 2017 surprise win.

- A still overwhelming consensus on a Macron April 24 2nd round win could see efforts to address rising consumer costs, the number one voter concern, with more restrictions on power prices and introduction of food vouchers. A Macron win could help the EUR. The market is dominated by luxury and industrial stocks, from LVMH (MC.PA) to Schneider (SU.PA).

Playing with oil market fire

- US and allies have big plans to sell oil from their emergency ‘strategic petroleum reserve’ (SPRs) to contain $100+ oil. US plans 1.0m barrel daily sales, equal to 1% global supply, for six months. This is easing prices now, but could backfire.

- It is insufficient to offset c3.0m barrel/day lower Russian production, will leave US reserves low, and its plan to buy back sold barrels will boost medium term prices. This supports our view of ‘high-for-longer’ oil prices, with equities (XLE and @OilWorldWide) especially attractive.

S&P 500 earnings growth forecast (Q1 2022 year-on-year %)

Big Bitcoin buys announced

- Down week for crypto assets, with global markets volatility and much of industry at the ‘Bitcoin 2022’ conference in Miami. Dogecoin (DOGE) among the few significant winners.

- Bitcoin (BTC) helped by Luna Foundation raising holding to $1.6bn, of $10bn target, to back its TerraUSD stablecoin. MicroStrategy (MSTR) also bought $200mmore, taking its stake to $6bn.

- Latest data shows 19% of the Bitcoin hash-rate is now from listed miners, like RIOT and MARA.

- Week saw launch of eToro.art, a programme supporting NFT collections and new creators.

Coal and Uranium prices in spotlight

- Brent oil prices slipped back for a 2nd week, to around $100/bbl. As US and allies detailed 120 million bbl. sales from their ‘strategic petroleum reserves’. Risk this stop-gap measure backfires.

- Coal prices rebounded as the European Union banned imports from Russia, the source of 45% of its needs. This helped the equities of alternative coal producers, from US’s Arch Coal (ARCH) to China’s Yanzhou Coal (1171.HK).

- Nuclear fuel uranium prices were also boosted by Russia restrictions and the increased global focus on more renewable energy sources, including the UK’s just announced energy review. The Global X Uranium(URA) ETF gained.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -4.11% | 2.30% | -13.98% |

| Healthcare | 2.59% | 9.16% | -1.16% |

| C Cyclicals | -3.20% | 5.02% | -12.47% |

| Small Caps | -4.62% | -1.08% | -11.17% |

| Value | 0.42% | 4.53% | -1.24% |

| Bitcoin | -7.17% | 2.11% | -9.55% |

| Ethereum | -5.87% | 20.49% | -12.99% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: the start of earnings season

- Global Q1 earnings season starts Wed. with JP Morgan (JPM) and US bank reports. Analysts are looking for an undemanding +5% S&P 500 profit growth and 20% from Europe’ Stoxx600.

- The inflation surge is set to continue, with US consumer price growth picking up further to 8.3%, and in UK to 6.3%. This is pilling pressure on central banks to boost interest rates more.

- European Central Bank (ECB) meets Thurs. and likely to signal a further ‘normalisation’ of its asset purchases as readies to raise interest rates later this year with inflation at high 7.5%.

- A shortened week across UK and Europe with Fri. April 15 and Mon. April 18 Easter holidays. LNG player Excelerate Energy (EE) to be IPO highlight. Also Elon Musk speaks at ‘TED2022’.

Our key views: Sensitive to ‘less bad’ news

- Markets have absorbed a lot of bad news this year. Stubbornly high inflation, more hawkish central banks, China weakness, Ukraine war. We believe his makes them sensitive to any ‘less bad’ news, starting with Q1 earnings reports.

- Economies are reopening and growth is robust. Valuations are now more attractive. The aggressive Fed hiking cycle well-priced. Investor sentiment has slumped – a contrarian positive.

- Focus a ‘barbell’ of cheap cyclicals and select ‘defensives’: Value, commodities, crypto, with ‘big tech’ and healthcare. Cautious on bonds.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 2.05% | 0.02% | 27.47% |

| Brent Oil | -2.24% | -8.67% | 31.38% |

| Gold Spot | 1.14% | -2.10% | 6.55% |

| DXY USD | 1.22% | 0.72% | 4.03% |

| EUR/USD | -1.54% | -0.36% | -4.37% |

| US 10Yr Yld | 33.02% | 71.75% | 120.17% |

| VIX Vol. | 7.79% | -31.19% | 22.88% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Navigating the more aggressive Fed

A double headwind from the US Federal Reserve, with higher interest rates and bigger bond sales

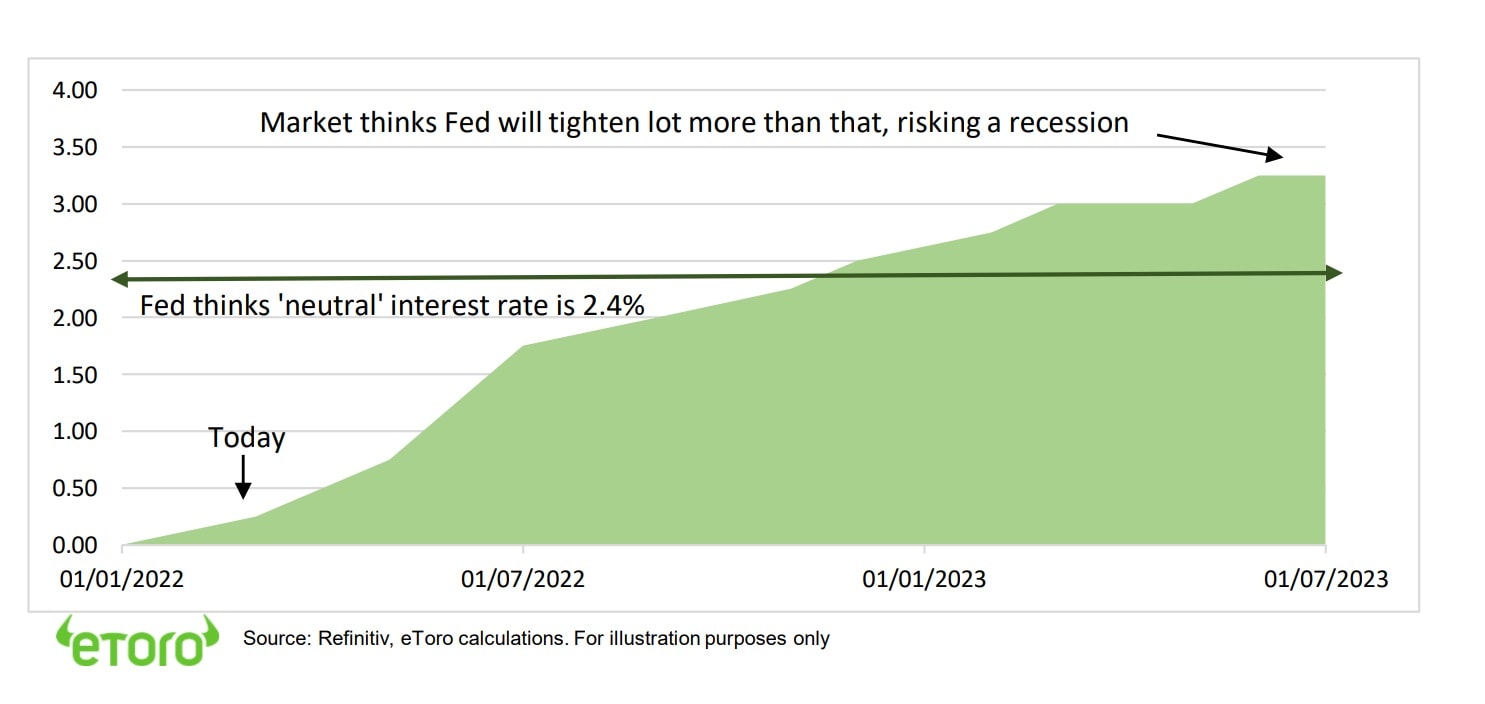

Expectations for Fed interest rate hikes have dramatically risen, alongside plans to reduce its $9 trillion of assets. Markets now expect 0.5% increases at each of the next three meetings, with this rate cycle ending at 3.25%. This is well above the Fed’s own estimate of a ‘neutral’ rate (see chart). This raises the risk of a sharp slowdown of the economy and is stoking recession fears. By contrast, the Fed thinks it can keep GDP growth around a healthy 2% in 2023 and 2024. This is a fine line to walk and is driving market volatility. We are constructive, think a recession can be avoided, and we are near ‘peak Fed’ interest rate fear.

Long term bond yields under pressure as Fed accelerates so-called ‘quantitative tightening’

The Fed also plans to shrink its massive $9 trillion balance sheet by $95 billion/month. With less treasury bond demand, and some active selling, bond prices will stay under pressure and yields rise even further from their current 3-year high over 2.6%. This could keep the pressure on ‘long duration’ assets, like tech.

Despite its hawkish pivot this interest rate cycle will likely be of average length and magnitude

The Fed started announcing its target interest rate and focus on the money supply in 1979. The seven rate hiking cycles since have averaged 3.2% over 15 months, similar to the current cycle. Equities rose in six of those rate cycles, by an annual average 13%. IT, Energy, and real estate sectors were the best performers.

Equities traditionally been resilient to the Fed, and we think we are new ‘peak Fed’ fear

Markets initially saw some contrarian relief after the first March 16th Fed interest rate hike. This was also boosted by signs of de-escalation in Ukraine and authorities in China moving to boost their equity market. Markets are venturing into the unknown, with the Fed raising rates from very low levels, whilst shrinking a never-bigger balance sheet, and with global debt levels making the economic sensitivity of all this a moving target. Nevertheless we think the GDP growth outlook is firm, and Fed rate cycle increasingly well-priced in.

Cheaper sectors provide protection from the Fed cycle, along with alternative ‘inflation-hedges’

We believe equities can weather the volatility as Fed raises rates. Cheaper sectors, such as energy (XLE) and financials (XLF), are less exposed to the downward valuation pressures driven by higher interest rates. Alternative ‘hard’ asset classes like commodities and real estate have traditionally been good inflation hedges. Crypto may also be, with bitcoins fixed 21-million-coin supply, and 90% already mined. Also, not all countries have high inflation or are raising interest rates. China (MCHI) is the only major country cutting interest rates. Similarly, inflation in Japan (EWJ) is low and its central bank with few pressures to raise rates.

US Federal Reserve getting aggressive. US interest rate outlook versus ‘neutral’ rate

Key Views

| The eToro Market Strategy View | |

| Global Overview | Geopolitical risks, the Fed hiking cycle, and China concerns have boosted uncertainty and weakened markets. We see this ultimately fading, the global growth outlook secure, and valuations now more compelling. This still supports a rare consecutive double-digit positive return outlook for the year despite the weak start. Focus on a ‘barbell’ of cyclical assets (Value equities, commodities, crypto) and select defensives (‘big tech’, healthcare). Cautious on fixed income. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing strong c4% GDP growth and with room for more earnings upside surprises. Valuations have now fallen back to average levels, and are well supported by still-low bond yields and high company profitability. Fed interest rate risks are now well-priced. See cyclicals and value catch-up, after a decade of underperformance, whilst big-tech is supported by its structural growth outlook. Now see overseas markets leading. |

| Europe & UK | Region is being buffeted by proximity and exposure to the Ukraine crisis. See secure outlook with 1) Europe’s strong macro ‘buffers’ of rising fiscal spending (defence and refugees), zero-bound interest rates (‘dovish’ ECB), and a weak Euro (50%+ company sales from overseas). Equity markets helped by 2) a greater weight of cyclical sectors, and lack of tech, 3) 25% cheaper valuations vs US, 4) decade of underperformance make under-owned by global investors. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China outlook improving as cuts interest rates (opposite of rest of world) reducing slowdown and property sector risks, focuses on stability ahead of 20th Party Congress, and with valuations now 45% cheaper than US and market heavily out of favour. Will support EM, but is exposed to Fed tightening. China recovery also helps global sectors from luxury to materials. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | More attractive as macro risks rise and bond yields better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. But also sensitive to bond yields. Healthcare most attractive, with cheaper valuations, more growth, some cost protection. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead performance. Are most sensitive to re-opening economies, resilient GDP growth, and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and out-of-favour for years. |

| Financials | Financials will benefit from resilient GDP growth, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech themes. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | In ‘sweet spot’ of robust GDP growth, ‘green’ industry demand, years of supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply and Russia 10% world supply problems. Gold helped by risk-aversion but held back by rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.