Summary

Focus: Looking through the volatility

We look through the current market weakness to an eventual year-end ‘Santa rally’ in seasonally strongest November and December. We see growth re-accelerating, as virus cases fall, and the long-list of short term markets concerns easing – from US debt ceiling and Fed tapering to Chinese growth. Value stocks, like financials and energy, will continue to come in from cold, along with small caps, as bond yields rise. Whilst ‘bond proxies’ utilities and real estate suffer, with tech resilient as was ultimately seen in Q1.

Markets buffeted from all sides

Markets fell sharply as bond yields and oil prices surged and a US government shutdown was only temporarily avoided. September saw the S&P 500 down 4.8%, in its worst month since the March 2020 covid-crash, but manage a 0.2% gain for Q3, its 6th consecutive quarterly rise. The market is now 6% off it’s last all-time-high, in its first pullback of the year, versus an annual average three pullbacks. See our global markets presentation here for background.

Temporary pain from higher yields

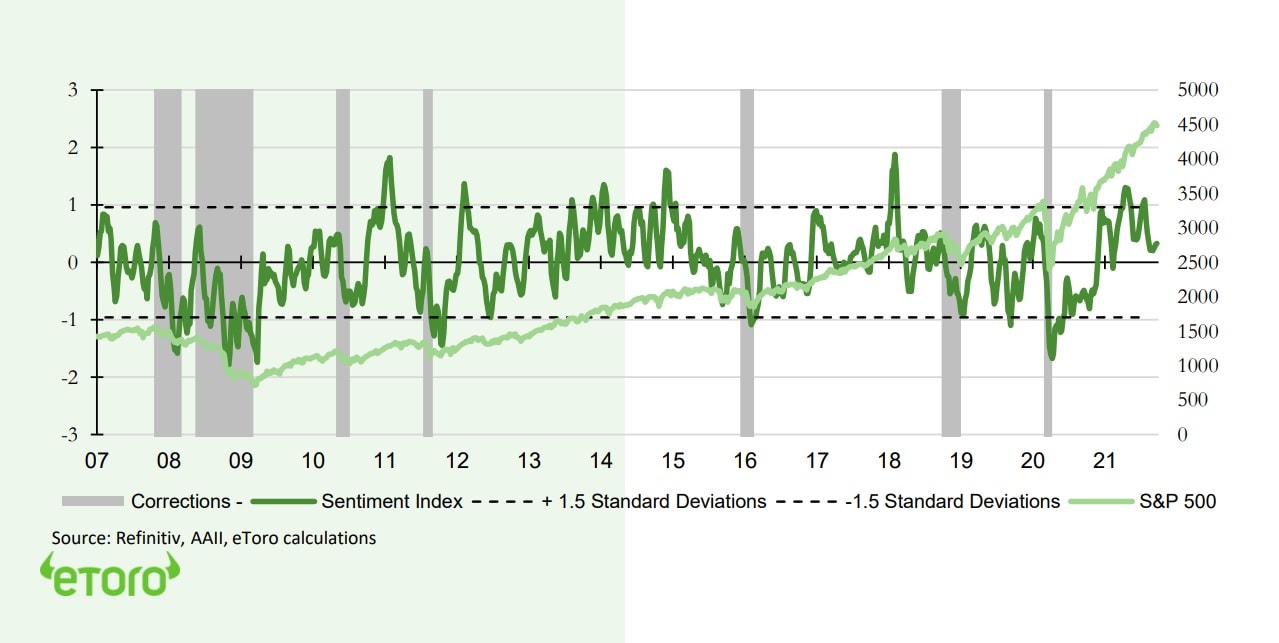

US 10-year bond yields spiked. The speed, not level, unnerved equities, as in Q1. This supports some sector rotation into more growth-sensitive and cheaper Value sectors, such as financials and energy. Meanwhile, our proprietary investor sentiment indicator shows sentiment back down at average levels, a contrarian market support. If everyone is bullish there would be no marginal buyer to help take markets higher.

The buyback rebound in US and Europe

US companies share buybacks surged 50% last quarter, a big market support as the largest buyer of US equities. Buybacks were led by Apple (AAPL) and Alphabet (GOOG), with a large rebound from financials, led by JP Morgan (JPM). We expect a similar bank buybacks rebound in Europe, as regulators end their restrictions. We look to the best capitalised banks, from SEB (SK.PA) to Credit Agricole (ACA.PA).

DeFi tokens in focus

Crypto assets stabilised, shrugging of USD strength and China’s latest crackdown, helped by SEC chair Gensler’s support for a bitcoin futures ETF. Exchange protocol Uniswap (UNI) led major coin gains. Bitcoin (BTC) closed Q3 up 35%, with Q4 historically its strongest quarter.

Oil rally and palladium collapse

Brent oil briefly rose over $80/bbl., a 3-year high, as the broad Bloomberg Commodity index closed September +4.1%, and a strong +6.3% for Q3. Precious metals weakness masked a continued palladium, and related equities, price collapse on auto industry disruption.

The week ahead: Looking for some comfort

1) A heavy Washington DC agenda to focus on looming Oct. 18 federal debt ceiling deadline. 2) Look for Friday’ US employment report rebound to set scene for Fed tapering. 3) Monday’ OPEC meeting under pressure to raise output further as prices soar. 4) Consumer earnings from Pepsi (PEP) and Constellation Brands (STZ) ahead of the Oct. 13 earnings season start.

Our key views: Staying the course

We see a positive outlook of 1) vaccine rollout and economic re-opening, and 2) still huge policy support, offsetting virus third wave and Fed tightening risks. We like assets helped by this growth: equities, commodities, crypto, and are cautious fixed income, and the USD.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -1.36% | -2.95% | 12.15% |

| NASDAQ | -2.21% | -3.93% | 16.00% |

| SPX500 | -3.20% | -5.19% | 13.02% |

| UK100 | -0.35% | -1.56% | 8.77% |

| GER30 | -2.42% | -3.96% | 10.48% |

| JPN225 | -4.89% | -1.23% | 4.83% |

| HKG50 | 0.26% | -5.81% | 4.76% |

*Data accurate as of 04/10/2021

Market Views

Buffeted from all sides

- Another weak and volatile week, with the S&P 500 down 2.2%. US bond yields surged on Fed tapering and higher oil price concerns. A US government shutdown was avoided, for now, but a debt ceiling crisis looms. This boosted the USD and hurt global equities. Healthcare and IT led sectors down, over 3%. See our global markets presentation here for background.

A weak September closes a modest Q3

- September saw the S&P 500 fall 4.8%, its worst performance since the March 2020 covid-crash. Energy (+9.3%) was the only rising sector. Best performing stock was Cabot Oil (COG), up 37%, and worst, Las Vegas Sands (LVS) -18%. Third quarter saw S&P 500 eke out a 0.2% gain, its six straight rise. Financials led sectors (+2.3%). The best stock performance was from Moderna (MRNA), +64%, and the worst GAP (GPS), -32%.

Temporary pain from higher yields

- US 10-year bond yields spiked 0.2% on outlook for tighter monetary policy, with Fed’s tapering coming soon, and a firming growth and inflation outlook, with global virus cases -30% the last month and oil prices at 3-year highs.

- The speed of the yield spike, not its level, worried equities and drove a tech (XLK) led sell off, as in Q1. As then, we see yield concerns easing and equities resilient, led by Value sectors, like financials (XLF) and energy (XLE). Better growth helps earnings, and yields are a fraction of prior recoveries, helping valuations.

Poorer sentiment a positive

- Our proprietary investor sentiment indicator has been falling, and is now nearing the long-term average. Fewer retail investors are now bullish, strong fund inflows have eased back, and VIX volatility index has risen. This is not surprising given the depressing headlines, from China’s Evergrande (0333.HK) to US debt ceiling and shutdown talks, Fed tapering, and virus cases.

- But it is not bad news. If ‘everyone’ is bullish there is no marginal buyer to help take markets higher. The index lows have been a strong ‘contrarian’ market buy signal, whilst the highs have signalled somewhat lower returns ahead.

The buyback rebound

- US companies spent a huge $200 billion on share buybacks last quarter, a near 50% rebound from Q2 last year, and on track to challenge the 2018 annual record of $800 billion. They are a major market support, with companies historically the biggest buyers of US equities. With corporate profits surprising on the upside, and cash levels near all-time high $1.8 trillion, we see room for more buybacks.

- 20 stocks make up over 50% of total US buybacks, led by Apple (AAPL) and Alphabet (GOOG). Banks buybacks have surged after the Fed relaxed buyback restrictions, with JP Morgan (JPM) now 6th, and Bank of America (BAC) 8th.

- European bank buyback restrictions have just been removed, opening up buybacks at the best capitalised banks, such as Scandinavia’ SEB (SK.PA), DNB (DNB.OL), Dutch lender ABN Amro (ABN.NV), and France’ Credit Agricole (ACA.PA).

eToro Investor Sentiment Indicator vs S&P 500

Defi tokens focus

- Bitcoin (BTC) and Ethereum (ETC) led a broad crypto stabilisation last week after China’s latest ban, shrugging off USD strength and equity weakness, helped by SEC chair Gensler support for a bitcoin futures ETF. DeFi tokens led in anticipation of more Chinese usage. Exchange protocol Uniswap (UNI) rose near 20%. It is also included, with ETH, ALGO, LINK, and MATIC in the recently launched DeFi Smart Portfolio.

- Bitcoin closed September -11%, but up 35% for Q3. Of top-10 coins, Solana led in Q3, +300%, and Dogecoin (DOGE) lagged, falling over 10%. Historically Q4 has seen the best quarterly BTC performance, averaging +64% since 2014.

Oil rally and palladium collapse

- Brent oil prices briefly rose above $80/bbl., a 3- year high, and the Nat gas rally continued, on rebounding demand and still tight supply. The broad-based Bloomberg commodity index rose a strong 4.1% in September, and 6.3% for Q3.

- Precious metals weakness has masked crashing palladium prices, down over a third from May highs, and equity proxies from Sibanye (SBSW) to Norilsk (MNODL.L). 80% demand is for auto catalytic converters, under pressure now from factory shutdowns driven by chip shortages. And long term from switch to electric vehicles (EV’s) which do not need palladium. The bull case is for a sharp re-stocking when factories re-open, but before EV substitution dominates.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -3.31% | -4.57% | 17.72% |

| Healthcare | -3.41% | -6.63% | 10.42% |

| C Cyclicals | -2.08% | -2.42% | 10.35% |

| Small Caps | -0.29% | -2.71% | 13.51% |

| Value | -1.09% | -3.21% | 14.94% |

| Bitcoin | 13.15% | -2.92% | 66.78% |

| Ethereum | 13.69% | -12.75% | 340.03% |

Source: Refinitiv

The week ahead: Looking for some comfort

- US politicians voted to temporarily prevent a government shutdown, but must still raise the federal debt ceiling by Oct. 18th, and are struggling to pass a $1 trillion infrastructure plan and a $3.5 trillion spending bill. We also await a decision on the next Fed Chair, with Powell’s re-nomination odds falling to c70%.

- Friday’s US employment report is likely to see a rebound from August’s 235,000 jobs shocker, boosting growth outlook, but setting scene for the Fed to announce its bond buys tapering.

- Monday’s OPEC meeting with soaring prices pressuring OPEC+ to raise its 400k/bpd, 0.4% of global supply, monthly production increase.

- Three US consumer stocks earnings: Pepsi (PEP), Constellation (STZ), ConAgra (CAG), as Oct. 13 ‘official’ Q3 earnings season start nears. China’s markets are closed for Golden Week.

Our key views: Staying the course

- A positive scenario of 1) global vaccine rollout and economic re-opening, 2) still large support of low interest rates and fiscal spending.

- The main risk is Fed policy tightening, which we see as gradual and well-flagged. Also. risks from 3rd virus wave, which has peaked already.

- We focus on cyclical assets that benefit most from the rebound: commodities, crypto, small cap, and value. We are more cautious on fixed income, the USD, defensive equities and China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 1.97% | 3.92% | 29.30% |

| Brent Oil | 3.62% | 8.79% | 53.21% |

| Gold Spot | 1.06% | -2.78% | -7.38% |

| DXY USD | 0.80% | 2.21% | 4.60% |

| EUR/USD | -1.06% | -2.37% | -5.07% |

| US 10Yr Yld | 0.90% | 13.77% | 54.54% |

| VIX Vol. | 19.15% | 28.88% | 40.35% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Looking through the volatility

Focusing on the outlook for an eventual Santa rally, as growth re-acceleration builds

Last week we laid out a roadmap for a positive Q4, as the drivers of recent weakness fade. That lower global virus cases support a better growth outlook and more earnings surprises – starting with Q3 earnings in ten days, where consensus +27% growth versus last year is too low. Along with a well-telegraphed start of Fed tapering this pushes up US 10-year bond yields, but they remain a fraction of prior recoveries, and support high valuations. We see a ‘Santa rally’ as current concerns ease. November and December are usually the best S&P 500 months, with average 1.7% returns, as investors re-position for the coming year.

….and the long list of near-term risks, from debt ceiling, to Fed and China, are overcome

Our bullish outlook needs to overcome a long list of near-term concerns that are driving overdue volatility, This includes a heavy Washington DC agenda of debt ceilings, stimulus bills, and tax hikes, in addition to China’s growth headwinds and the Fed tapering lift-off. This is unlikely to derail the market. A government shutdown has been avoided. Congress will get a last-minute debt ceiling deal, and Democrats converge on a smaller stimulus bill with smaller tax rises. Powell is likely re-appointed to the Fed, but any successor will have similar views. Whilst China has plenty of policy room to support its economy and property sector.

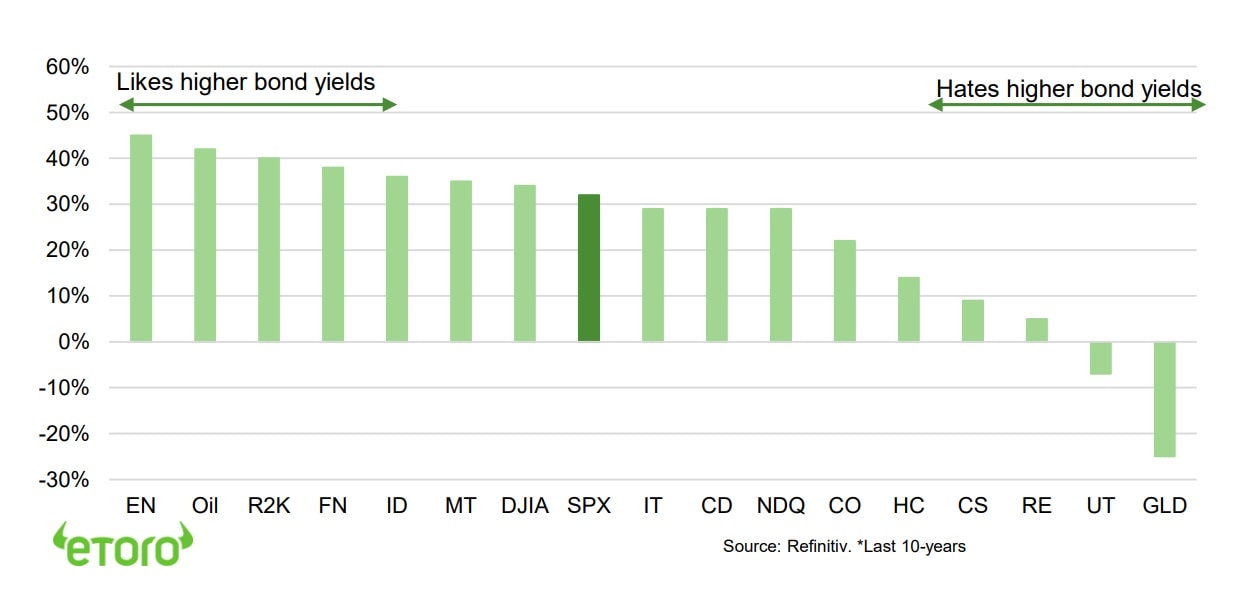

Value stocks to return from the cold, focused on financials, small caps, and energy

We see a strengthening growth outlook and Fed tapering driving somewhat higher US bond yields, in a modest repeat of Q1. Looking at the long-term relationship between US 10-year bond yields and equity sectors (see chart) shows the tightest correlation with the energy (XLE) and financials (XLF) sectors, and small caps (IWM) – all segments we favour. This relationship is unsurprising. Yields normally move up with stronger growth and inflation, which also boost energy demand. Similarly, higher yields help banks, who can charge higher rates. This supports a period of Value (IWD) style outperformance versus Growth (IWF), given their higher earnings sensitivity to better GDP, and current very attractive valuation discounts.

Bond proxies such as utilities and real estate to lead underperformance. Tech to do fine.

By contrast the one absolute loser is utilities (XLU), a traditionally heavily indebted sector, and real estate (XLRE), with its long-duration cash flows. These are the traditional ‘bond proxy’ sectors, along with other traditional defensive sectors such as consumer staples (XLP) and healthcare (XLV). An environment of stronger growth and high bond yields should see them lag. The big question is over tech (XLK), the largest market sector. The knee-jerk market reaction on tech has been negative when bond yields rise – see the 10% NASDAQ correction in Q1 – but the long-term relationship is more modest. This is supported by the sectors robust growth and fortress balance sheets. We expect it to underperform Value but not by much.

Sector & other asset correlation* with the US 10-Year bond yield

Key Views

| The eToro Market Strategy View | |

| Global Overview | Positive scenario of 1) global vaccine rollout and economic re-opening, 2) support from low interest rates and government spending. Main risk is from US Fed monetary policy tightening, but will be well-signalled and very gradual. Economies are increasingly resilient new virus case ‘waves’. Focus on most growth sensitive assets: equities, commodities, crypto, small cap and value. Relative caution on fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | A big beneficiary of the global growth rebound. Helped by 1) a greater weight of sectors most sensitive to the growth rebound, and lack of tech, 2) 25% cheaper valuations than the US, 3) a decade of under performance has made under-owned by global investors. Combination of lower-for-longer ECB plus multi-year €750bn ‘Next Generation’ government spending to drive European GDP and earnings growth more than the US, for the first time in a decade. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China has world’s strongest GDP growth, and benefitted from being ‘first in, first out’ of crisis, but its tech sector crackdown is hurting the market. LatAm and Eastern Europe have more upside to vaccine rollouts, global growth recovery and higher commodities. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | The broad ‘tech’ sector of IT, communications, and parts of consumer discretionary (Amazon, Tesla), dominates US and Chinese markets. Expect a more subdued 2021 after dramatic 2020 rally. But are structural stories with good growth, high profitability, and clean balance sheets that justify high valuations, and should continue to rise. |

| Defensives | Healthcare, consumer staples, utilities, and real estate sectors traditionally offer more defensive cash flows, less exposed to changes in economic growth. This has also made them more sensitive to rising bond yields. We expect them to relatively underperform in the current cyclicals focused environment with growth and earnings strong. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | We see modest USD weakness as the rest-of-world GDP growth recovery accelerates, and fears over a virus ‘third wave’ ease. A stable or weaker USD traditionally supports Emerging Markets, commodities, and large US foreign earners, such as the tech sector, and could be a modest headwind to large exporters, such as Europe. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Supported by GDP growth rebound, ‘green’ industry demand, years of supply under-investment. China GDP and property sector are short term concerns. Industrial metals and battery materials seem best positioned, whilst oil price supported by only slow return of OPEC+ supply. Gold hurt by outlook for higher bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Italy | Edoardo Fusco Femiano |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.