Summary

Focus: Investing in the climate boom

The 26th U.N. Climate Conference starts this weekend. It has important investment impacts. Expect to see greater net-zero commitments, more investment, and more financing solutions. This will counter-intuitively see higher-for-longer fossil fuel prices, as well as surging renewables investment, a higher cost of carbon for most companies, and greater ESG adoption outside of Europe. To benefit themes from @OilWorldWide to @RenewableEnergy and more.

Earnings to the rescue

US equity markets were back at all-time-highs driven by investor relief on strong Q3 earnings (so-far), resilient global growth purchasing manager indices (PMIs), and lower China risks (Evergrande debt payment). US bond yields rose, to 1.65%, along with new inflation expectation highs. This was a drag on defensive sectors and a boost to financials. Bitcoin saw a new high and the commodity rally continued. See our latest global markets presentation.

Dealing with our Fed obsession

The market has moved quickly to bring forward expectations for the first Fed rate hike to mid next year, as inflation expectations have risen. But our analysis shows, from the 10 big global interest rate hikes this year, that when they come, equities often react with relief.

It’s the Dow Jones, stupid!

The S&P 500 (SPY) is a better reflection of US equities, with more money tracking ($11 trillion). But 30-stock Dow Jones Industrial (DIA) is better known, with 125-yr age and four times the eye balls. It’s our current preference: more growth sensitive and cheaper valuations.

Why energy stocks should do better

We think oil stocks should do better, even as the top performer this year. They have uniquely lagged oil prices 10%, futures are backwardated (lower), and valuations the cheapest.

Bitcoin see’s new all-time high

Bitcoin (BTC) hit a new high of $67,000 on futures ETF launch, rising inflation, and the upcoming ‘taproot’ upgrade. Has focused attention on ways to get crypto-equity investment exposure. From miners (RIOT, MARA) to exchanges (COIN). Four new tokens were added to the eToro platform, taking to 36: ATOM, GRT, CRV, 1INCH

Energy and nickel in the spotlight

Brent crude rose to over $85bbl despite a warmer winter outlook, whilst coal fell as China cracked down. Nickel (NICKEL), used for stainless steel and batteries, rose sharply as top-2 producers Indonesia and Philippines disrupted. This benefits companies from Brazil’s Vale (VALE), to Russia’s Norilsk Nickel (MNODL.L).

The week ahead: Big week ahead

1) ‘Big tech’ stocks from Facebook (FB) to Amazon (AMZN) will lead the busiest Q3 earnings week. 2) US Q3 GDP growth report is due, after slumping expectations. We look for a Q4 rebound. 3) In Europe, the ECB is set to stay ‘dovish’ whilst its Q3 GDP growth is set to lead the US.

Our key views: The parting clouds

We see a positive outlook of 1) vaccine rollout and economic re-opening, and 2) still huge policy support, offsetting ‘stagflation’ and Fed risks. We see the ‘wall of worry’ giving way to a ‘Santa rally’. We like equities, commodities, crypto, and are cautious fixed income, and the USD.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 1.08% | 2.53% | 16.57% |

| NASDAQ | 1.64% | 2.01% | 21.00% |

| SPX500 | 1.29% | 0.28% | 17.08% |

| UK100 | 0.41% | 2.17% | 11.52% |

| GER30 | -0.28% | 0.07% | 13.30% |

| JPN225 | -0.91% | -4.77% | 4.96% |

| HKG50 | 3.14% | 8.00% | -4.05% |

*Data accurate as of 25/10/2021

Market Views

Earnings to the rescue

- US equity markets were back at all-time-highs driven by investor relief on strong Q3 earnings (so-far), resilient global growth purchasing manager indices (PMIs), and lower China risks (Evergrande debt payment). US bond yields rose, over 1.6%, along with new inflation expectation highs. Real estate led performance, +3.2%, whilst communications fell 0.8%. Bitcoin saw a new high and the commodity rally eased. See our globalmarkets presentation here.

Dealing with our Fed obsession

- The market has moved quickly to bring forward expectations for the first Fed rate hike to mid next year, as inflation expectations have risen. But our analysis shows, from the 10 big global interest rate hikes this year, that when rate hikes come, equities often respond with relief.

- We see only a small US interest rate cycle by historical standards. This means only modestly lower valuations. The S&P 500 P/E has fallen a lot already and deserves to stay above average with its high tech weight and low bond yields.

It’s the Dow Jones, stupid!

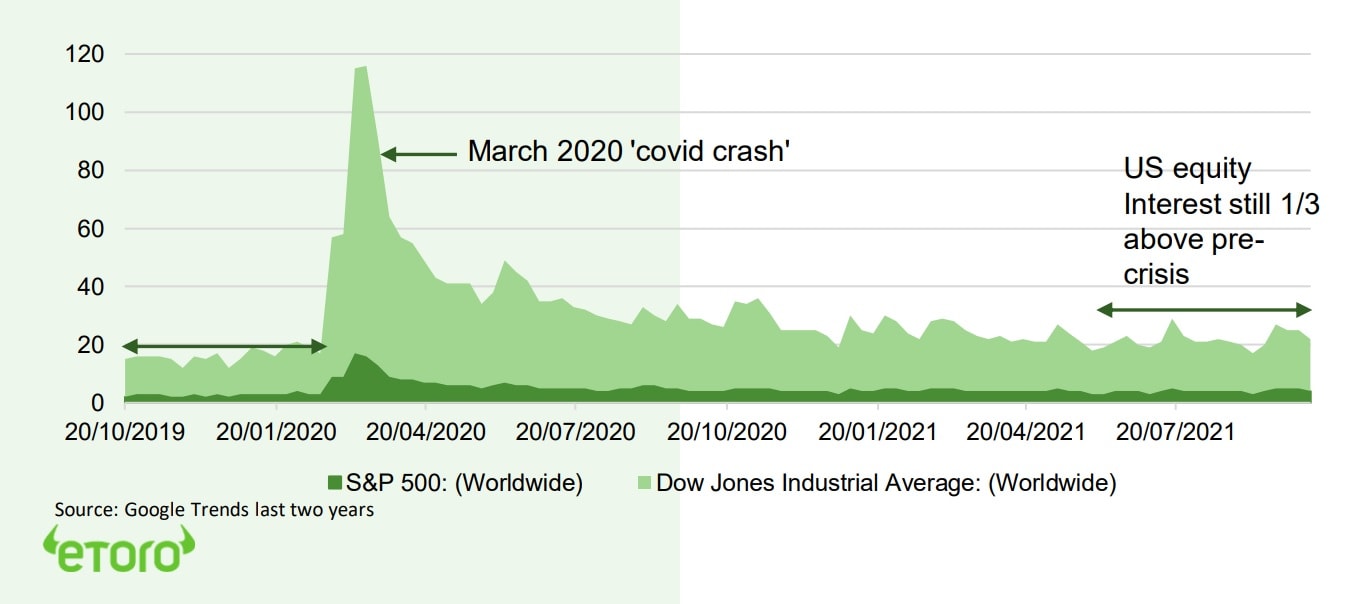

- S&P 500 (SPY) and Dow Jones Industrial Average (DIA) are the two iconic US indexes. The 500- stock S&P seems a better reflection of US equities, and has much more money tracking it ($11 trillion). But the 30-stock DJIA is much better-known (see chart), reflecting its 125-year age and simplicity. It has four times the Google Trends eye-balls, and is ‘go-to’ index in crisis.

- The chart also highlights that interest in US stocks remains well-above pre-crisis levels. Our current index preference is for the more growth-sensitive and much cheaper DJIA.

Why energy stocks should do better

- We think energy stocks should do better, even as the top sector performer this year. They have uniquely lagged physical oil by 10%, and futures backwardated (lower). They should outperform with their operating leverage, as steel, copper, agriculture have, by 50%. Valuations are already the cheapest of any sector, as investors grapple with the ‘terminal value’ problem. How to value an industry that may not exist in the future. See opportunity in smart portfolio @OilWorldWide.

- he commodity rally is under-stated. Materials and energy are two of the smallest global equity sectors. This is held back by the ‘big 3’ markets. US, Japan and China are 70% of global equities but have the lowest commodity index weights.

The crypto-equity rally

- The sharp crypto price rebound has focused attention on ways to get investment exposure. The small number of crypto-exposed equities is seeing a boost from surging equity ETF launches and traditional investors like Fidelity and Capital.

- US bitcoin miners, from Riot Blockchain (RIOT) to Marathon Digital (MARA), have also benefited from China’s crackdown. Our broadest 16-stock composite crypto-index, from Coinbase (COIN) to Nvidia (NVDA), has healthily outperformed the S&P 500 the past year. Smart portfolios also give broader options, like @BitcoinWorldWide, @FuturePayments, and @Chip-Tech.

Comparing worldwide Google searches index: DJIA vs S&P500

Bitcoin see’s new all-time high

- Bitcoin (BTC) hit a new all-time-high $67,000 last week, only six months after its prior high, and after rebounding from a 50% correction. The latest move was fuelled by the launch of the first bitcoin futures ETF (BITO). Alongside rising inflation fears, with long term market US expectations rising to a 7-year high 2.4%. Also, the upcoming bitcoin ‘taproot’ upgrade.

- Four new tokens added to the eToro platform, taking the total to 36. ‘Internet of Blockchains’ Cosmos (ATOM), indexing protocol The Graph (GRT), decentralized stablecoin exchange Curve (CRV), and governance token 1Inch (1INCH).

Coal and nickel in the spotlight

- Energy market remained in the spotlight with Brent crude rising further, to near $84bbl. Whilst coal prices fell after China, the world’s largest producer and consumer, signalled it would intervene to ease surging prices that have triggered a domestic power crisis. Coal prices are up near 200% so far this year.

- Nickel (NICKEL) soared 10% last week, taking the rise this year to 27%. It is used primarily for stainless steel and increasingly for batteries. Production in top 2 producers Indonesia and Philippines has been disrupted by Covid and heavy rains, respectively. Reserves are limited, but it is highly recyclable. The biggest listed producers include Brazil’s Vale (VALE), Russia’s Norilsk (MNODL.L), and UK’s Glencore (GLEN.L).

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 1.09% | 1.45% | 21.84% |

| Healthcare | 2.50% | -0.58% | 13.39% |

| C Cyclicals | 1.21% | 3.57% | 15.13% |

| Small Caps | 1.13% | 3.28% | 16.02% |

| Value | 1.86% | 5.12% | 20.43% |

| Bitcoin | -1.29% | 39.89% | 110.79% |

| Ethereum | 2.70% | 31.07% | 428.01% |

Source: Refinitiv

The week ahead: Big week all around

- ‘Big tech’ leads the busiest Q3 earnings week: Facebook (FB), Alphabet (GOOG), Microsoft (MSFT), Apple (AAPL), Amazon (AMZN). But also everyone from Coke (KO) to Exxon (XOM). So far 25% of S&P 500 companies have reported, with earnings growth 14% over expectations.

- Thursday Q3 US GDP growth. Expectations collapsed under high covid cases and supply chain bottlenecks. The Atlanta Fed ‘NOWcast’ is +0.5% versus last quarter, down from 6% two months ago. We see a rebound from here.

- The European Central Bank (ECB) meets on Wednesday, and to stay ‘dovish’ as supply chain and energy headwinds mount. Q3 EU GDP on Friday forecast to see a 3.2% recovery from last quarter, even as headwinds mount.

- A big IPO week with $25 billion semiconductor GlobalFoundries (GFS), online education stock Udemy (UDMY), and Rent the Runway (RENT).

Our key views: The parting clouds

- A positive scenario of 1) global vaccine rollout and economic re-opening, 2) still large support of low interest rates and fiscal spending.

- The main risk is Fed policy tightening, which we see as gradual and well-flagged.

- We focus on cyclical assets that benefit most from the rebound: commodities, crypto, small cap, and value. We are more cautious on fixed income, the USD, defensive equities and China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -0.93% | 4.83% | 32.93% |

| Brent Oil | 1.00% | 11.10% | 65.84% |

| Gold Spot | 1.41% | 2.43% | -5.71% |

| DXY USD | -0.37% | 0.30% | 4.09% |

| EUR/USD | 0.41% | -0.63% | -4.66% |

| US 10Yr Yld | 6.13% | 18.17% | 71.71% |

| VIX Vol. | -5.34% | -13.07% | -32.18% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Investing in the climate transition

26th U.N. Climate Conference starts this weekend and has important investment impacts

The 26th two-week UN climate conference starts in Glasgow on October 31 with an estimated 25,000 expected to attend. It has been billed as ‘the last best chance’ of saving the planet. The goal is to reach a carbon neutral world by 2050. To reach this governments need to significantly expand the legally-binding climate commitments they first made with the Paris Agreement six years ago. The ‘COP26’ outcomes remain uncertain, and politically difficult. But the direction of travel is clear: fewer fossil fuels, less carbon emissions,more renewables investment. And the investment implications are correspondingly large.

Expect to see greater commitments, more investment, more financing solutions

Countries are not on-track to meet the 2050 goals and need to strengthen their carbon commitments. This will drive a swathe of new policy and investment announcements at ‘COP26’. Much focus will be on emerging markets, which contain some of the largest polluters (such as no.1 China, and India), but will also be the most impacted by climate change. Focus will also be on major commodity producers, such as Australia and Russia, who have not tightened existing Paris commitments yet. Coal will remain a big focus, as the world’s largest source of electricity, and biggest cause of pollution. Climate financing needs to be expanded to boost private sector incentives to cut pollution, likely accelerating carbon tax adoption. Richer countries will also be asked for more financial support, which remains well below prior commitments.

Investment implications from higher-for-longer fossil fuel prices, to renewables and carbon prices

The investment implications from this are significant, and include:

- higher-for-longer fossil fuel prices, as continued low fossil fuel investment supports near term prices at high levels until it can be replaced by new renewables capacity later in the decade. This is positive for oil majors and @OilWorldWide. These high prices in turn only further incentivise renewables investment.

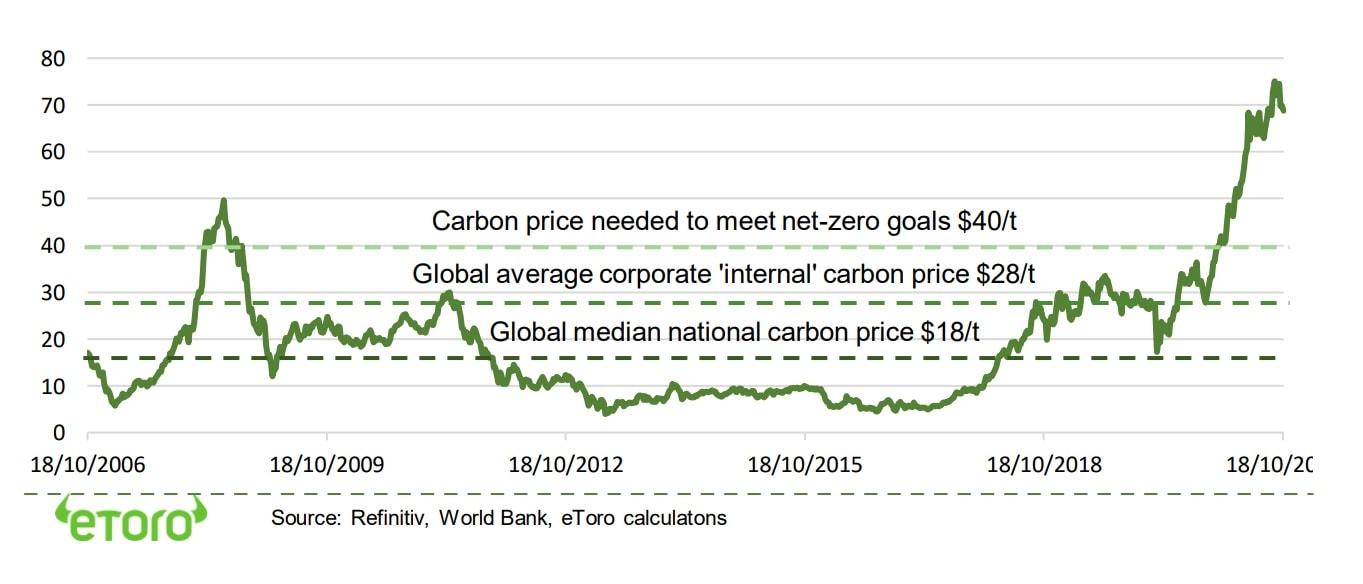

- an expansion of carbon pricing and reduction of companies implicit $1 trillion carbon subsidy – with the under-pricing of carbon today. There is a long way to go here with only an estimated 5% of global emissions covered by a realistic carbon price. Carbon pricing is well-established in Europe, and just launched in China. This represents over $1 trillion re-distribution of company profits, away from polluters.

- renewables investment boom, with International Energy Agency outlining why renewables investment needs to triple today to meet net-zero goals, focused on batteries, fuel cells, wind, and solar. Expect more official commitments to phase out coal and abandon the internal combustion engine. @RenewableEnergy.

- more fund flows to so-called ESG. Assets in sustainable investment funds stood at $1.8 trillion at the middle of this year, up 75% versus the same period last year. 80% of these assets are in Europe. Also expect more pressure on companies for climate disclosure, engagement, and less fossil fuel investment.

Female investor characteristics. Select results from eToro Q2 global retail investor ‘beat’ survey

Stronger Q3 earnings could be a catalyst for analysts to raise their 2022 growth expectations, helping the market. These seem too low at only 9%, and not far above nominal GDP growth (4.2% real GDP + 3% inflation). Higher earnings is a key offset to lower valuations, but these risks have been falling. The 12- month forward S&P 500 P/E ratio is under 20x and closing in on the 5-year average 18x. Though still above the long term 16.5x, it compares to a peak last year over 23x. Our roadmap for the S&P 500 at 5,050 by end next year is for further earnings surprises combined with well-supported, and above-average, valuations.

European ETS carbon price (US$tCO2) vs global average carbon prices

Key Views

| The eToro Market Strategy View | |

| Global Overview | Positive scenario of 1) global vaccine rollout and economic re-opening, 2) support from low interest rates and government spending. Main risk is from US Fed monetary policy tightening, but will be well-signalled and very gradual. Economies are increasingly resilient new virus case ‘waves’. Focus on most growth sensitive assets: equities, commodities, crypto, small cap and value. Relative caution on fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | A big beneficiary of the global growth rebound. Helped by 1) a greater weight of sectors most sensitive to the growth rebound, and lack of tech, 2) 25% cheaper valuations than the US, 3) a decade of under performance has made under-owned by global investors. Combination of lower-for-longer ECB plus multi-year €750bn ‘Next Generation’ government spending to drive European GDP and earnings growth more than the US, for the first time in a decade. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China has world’s strongest GDP growth, and benefitted from being ‘first in, first out’ of crisis, but its tech sector crackdown is hurting the market. LatAm and Eastern Europe have more upside to vaccine rollouts, global growth recovery and higher commodities. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | The broad ‘tech’ sector of IT, communications, and parts of consumer discretionary (Amazon, Tesla), dominates US and Chinese markets. Expect a more subdued 2021 after dramatic 2020 rally. But are structural stories with good growth, high profitability, and clean balance sheets that justify high valuations, and should continue to rise. |

| Defensives | Healthcare, consumer staples, utilities, and real estate sectors traditionally offer more defensive cash flows, less exposed to changes in economic growth. This has also made them more sensitive to rising bond yields. We expect them to relatively underperform in a more cyclicals focused environment with earnings strong and yields rising. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | We see modest USD weakness as the rest-of-world GDP growth recovery accelerates, and fears over a virus ‘third wave’ ease. A stable or weaker USD traditionally supports Emerging Markets, commodities, and large US foreign earners, such as the tech sector, and could be a modest headwind to large exporters, such as Europe. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Supported by GDP growth rebound, ‘green’ industry demand, years of supply under-investment. China GDP and property sector are short term concerns. Industrial metals and battery materials seem best positioned, whilst oil price supported by only slow return of OPEC+ supply. Gold hurt by outlook for higher bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.