‘The out-of-synch global economy

The global economy base case is a ‘goldilocks’ soft landing with reassuring balanced risks. With stable 3.2% global growth and outlook for 2% developed market inflation next year, allowing rate cuts. But divergence is seen between an accelerating Europe, cutting interest rates, and weakening US with high-for-longer rates. May drive 1) higher volatility, 2) demand for inflation hedges, and for 3) cheaper cyclicals. See Page 4

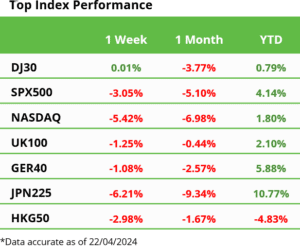

Powell pivot drives 1st pullback of year

US stocks fell below their 50-day moving average as strong retail sales and a Powell speech ‘pivot’ cut the rate cut outlook this year to just one and drove bond yields and the dollar higher. Oil fell below $90/bbl. and Bitcoin slumped ahead of its halving. ASML’s miss drove semis angst. LVMH’s luxury relief. And UAL soared on summer demand outlook. See our new Q2 2024 Outlook HERE and twitter @laidler_ben. See Page 2

Overdue pullback arrives

S&P 500 typically see three -5% pullbacks a year. We have just entered one now. Its overdue, and not to be feared, with twin earnings growth and rate cut pillars and cash on sidelines. See Page 2

Magnificent-7 doing earnings heavy-lifting

Four the ‘Magnificent 7‘ US big tech stocks report this week, and key to needed earnings surprise, Are 29% of S&P 500 market cap and est. to grow profits 37% vs -3% fall for ‘S&P 493’. See Page 2

The currency volatility comeback

US dollar surge driven by macro exceptionalism and geopolitical safer haven demand. Triggering a return of FX volatility, with heavy costs for EM and carry trade currencies. See Page 2

Gold’s chameleon-like rally

Gold at highs on unstable mix of geopolitical and inflation drivers, with few of traditional supports, like weak dollar or stronger ETF flows. Silver has traditional beta and relative value. See Page 2

Crypto weakens into Bitcoin halving

Crypto prices fell back sharply on cross-asset volatility, slowed bitcoin ETF inflows, ahead of the Sat. four-yearly Bitcoin halving. Meme coins led weakness. Hong Kong approved spot Bitcoin ETF’s. MSTR slumped from NAV premium high. eToro added 10 new coins to platform. See latest Weekly Crypto Roundup. See Page 3

Oil falls back whilst ‘Dr. Copper’ rallies on

Commodity prices fell back given the stronger dollar and higher bond yields. Brent fell below $90/bbl. on easing mid-East tension. Copper led broadening industrial metals strength after China’s 5.3% Q1 GDP growth surprise. Ag in focus as coffee and cocoa rose on weather disruption and sugar price fell below $20/lb. See Page 3

The week ahead: Big tech, Q1 GDP, PMIs

1) 40% of S&P 500 market cap. report earnings led by big tech GOOG, META, MSFT, TSLA. 2) US economic ‘exceptionalism’ w/ est. 2.9% Q1 GDP growth (Thu) and PCE inflation pick up (Fri). 3) April flash PMI global macro health check (Tue). 4) Reaction to Sat. four-yearly Bitcoin supply growth halving, and Earth Day (Mon). See Page 3

Our key views: Outlook for a different 2024

We see a stronger but very different 2024. Lower inflation and coming interest rate cuts as growth slows, and the earnings outlook idiosyncratically accelerates. Will drive an investor rotation from 2023 US and big tech winners to soft landing losers from Europe to cyclicals. See Page 5

,