Summary

Winners and losers from rampaging USD

The US dollar has soared to 20-year highs this year as a ‘safer haven’ and with the hawkish Fed pivot, breaking key levels vs EUR, GBP, JPY. Have likely seen most of the US dollar strength, but any reversal will be slow. The strong dollar hurts emerging markets (EEM), commodities (DJP), and US tech (XLK) and exports, whilst is a support ‘buffer’ for Europe (EZU), Japan (EWJ), and welcome dampener for US inflation.

Central Banks drive markets lower again

Market whipsawed by Fed accelerating rate hike, and Bank of England’ stark ‘stagflation’ warning. 3% US 10-year bond yields pressured valuations, swamping strong US and European Q1 earnings. Plunging Chinese data showed global risk of its zero-covid lockdowns, whilst US expanded its delisting list. Potential ‘peak’ US inflation report key this week See latest presentation, video updates, and twitter @laidler_ben.

Big equity sell-offs in context

Investors panicked with global risks and sharp sell offs. But history shows positive risk/reward to buying ‘4% down days’ and average S&P 500 ‘corrections’ over the following year.

Not far from peak ‘Fed fear’

Markets now pricing 3.5% Fed interest rate peak and $95bn/month ‘quantitative tightening’ bond sales. We see easing of Fed ‘vice’ that pressuring valuation and rising recession fears.

Lessons from earnings season

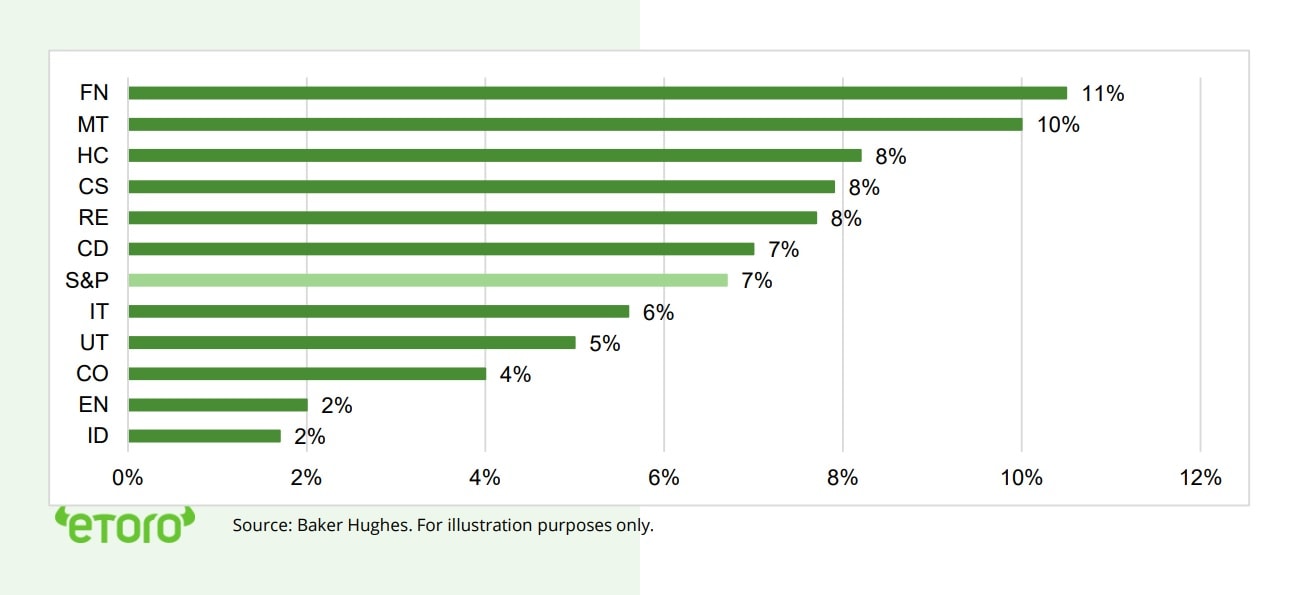

Despite individual big-tech weakness from NFLX to AMZN, Q1 earnings season has been strong so far, with all sectors beating forecasts, and profits up 10% in US and 35% in Europe.

The oil investment strike

Lack of new investment means ‘high-for-longer’ prices. New drilling activity is -50% from prior highs. See XLE and @OilWorldWide.

Contagion to crypto assets. TRON surge

Crypto driven lower in the sharpest sell-off since January, led by altcoins, on contagion from global equities. BTC and ETH well below key $40,000 and $2,900 levels. TRON (TRX) outperformed with stablecoin plans. eToro added UMA and API3 coins to platform, taking total to 64.

Commodities stay resilient, as oil rises

Commodities bucked the global markets weakness. Oil prices rose over $110/bbl. after EU announced a Russian oil ban plan and the OPEC+ meeting kept supply tight. US natgas soared to 14-yr high. Strong oil stock Q1 results, from BP.L and SHEL.L boosted ‘windfall tax’ talk.

The week ahead: Braced for Fed follow thru

1) Have we seen peak 8.5% US inflation (Wed), plus Fed speakers after FOMC.

2) Q1 earnings shifts to International, including SONY, NTDOY, TM, BABA.

3) China trade and inflation data as navigate covid lockdowns.

4) Google developer event and IEA renewables update.

Our key views: All about valuations now

Markets seeing biggest sell-off since 2020 covid crash, as bond yields crush valuations, and overwhelm decent earnings. Fundamentals stressed but secure. See relief from ‘peak’ inflation, and China stimulus. Focus on ‘barbell’ of cheap cyclicals and ‘defensives’: Value, commodities, alongside healthcare, and high dividends. We are cautious on bonds.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -0.24% | -5.25% | -9.46% |

| SPX500 | -0.21% | -8.13% | -13.49% |

| NASDAQ | -1.54% | -11.42% | -22.37% |

| UK100 | -2.08% | -3.67% | 0.05% |

| GER30 | -3.00% | -4.27% | -13.92% |

| JPN225 | 1.14% | -2.82% | -6.21% |

| HKG50 | -5.16% | -8.55% | -14.51% |

*Data accurate as of 09/05/2022

Market Views

Central Banks drive markets lower again

- Markets whipsawed by US Fed accelerating rate hikes to 0.5%, and Bank of England’ warning of Q4 ‘stagflation’ of 10% inflation and recession. Pushing valuations down, and swamping 10% and 35% US and European Q1 earnings growth. Plunging Chinese data showed global risks of its zero-covid lockdowns, whilst US expanded its delisting list. Potential ‘peak’ US inflation report key this week. See Page 6 for Resources guide of reports, presentations, videos, twitter.

Big sell offs in context

- Investors panicked by the Fed’s unprecedented double-barrelled hiking cycle and quantitative tightening, and Bank of England’s ‘stagflation’ forecast of 10% inflation and recession by end year in G7 economy. Risks manifold across US, Europe, China, and little valuation support yet.

- We see room for ‘less bad’ news from peaking 8.5% inflation and hawkish 3.5% rate cycle, with earnings resilient, sentiment depressed, and good risk/reward to buying ‘corrections’ or ‘4% down-days’ over 1-year. We focus on Value and cash-flow defensives. It’s too early for tech.

Not far from ‘peak Fed’ fear

- Markets saw first 0.5% Fed rate hike in over two decades, and are pricing a hawkish 3.5% interest rate peak next year, and $95 billion/mo run-down of Fed’s massive $9 trillion balance sheet as it catches up to inflation. It’s a double barrelled tightening of higher interest rates and balance sheet shrinkage raising bond yields.

- We could see relief in coming weeks from signs of peak inflation or fully priced Fed tightening expectations. This could ease the Fed vice, that pressuring valuation and rising recession fear.

Lessons from earnings season

- There has been more individual company drama than we would have liked in Q1 earnings season with ‘big tech’ disappointments from Netflix (NFLX) to Amazon (AMZN), and even Teflon-coated Apple (AAPL) not immune from supply-chain problems. Nervousness is clear in the strong asymmetric stock market reactions to profits ‘misses’ (-3%) versus ‘beats’ (+0.5%).

- But the overwhelming message has been one of resilient earnings growth, of 10% in US and over 30% in Europe. With sustainable profit margins, and the vast majority of stocks beating expectations. Earnings remain a key market anchor and at least a partial offset to the continued valuation pressure we are seeing.

The oil investment strike

- The greatest fundamental driver of oil prices is the very slow recovery of new investment, despite high oil prices. Global oil drilling activity is down 50% from prior peaks, and held back by environmental concerns and management focus on profits over volume. This underpins both our ‘high for longer’ oil price outlook.

- This helps oil equities (XLE, @OilWorldWide), with their low break-evens, valuations, and strong dividends. It will also accelerate the long term carbon transition (@RenewableEnergy). But also means stickier inflation for longer time.

S&P 500 sector earnings vs forecasts (Q1 2022, 65% reported)

Contagion to crypto. TRON surge

- Crypto markets driven lower in sharpest sell-off since January, led by altcoins, as the global equity and bond market rout deepened, and strong USD rally continued. Bitcoin (BTC) and ether (ETH) fell sharply below there prior key $40,000 and $2,900 respective price levels.

- TRON (TRX) was the standout performer after announcing plans for a decentralized DAO reserve to back the upcoming launch of the networks USDD ‘decentralised USD’ stablecoin.

- eToro adds two. smaller ‘workhorse’ Ethereum based coins Universal Market Access (UMA) and API3, taking total crypto assets offered to 64

Commodities apart from plunging markets

- Commodities again resilient to volatility across other asset classes. Broad-based Bloomberg commodity index is up over 30% this year, EU announced a six-month rundown of its oil imports from Russia, keeping prices well over $100/bbl. Whilst US natgas prices soared to a new 14-year high as continued strong demand worsened seasonal maintenance constraints.

- Oil majors from BP (BP.L) to Shell (SHEL.L) reported very strong Q1 results, driven by high oil and gas prices. This is stoking calls from politicians for a ‘windfall’ profits tax to help relieve consumers cost-of-living squeeze. This will put an increasing focus on oil companies to invest more to boost energy supply.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -1.04% | -11.16% | -22.54% |

| Healthcare | -1.03% | -8.66% | -11.46% |

| C Cyclicals | -3.15% | -13.61% | -23.93% |

| Small Caps | -1.32% | -8.79% | -18.07% |

| Value | 0.72% | -4.18% | -6.32% |

| Bitcoin | -6.19% | -17.70% | -24.19% |

| Ethereum | -3.90% | -16.81% | -28.22% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Braced for Fed follow through

- Will latest 8.5% US inflation (Wed) show more signs of peaking? Fed members are also back on the speaking circuit and could balance Powell’ recent less ‘hawkish’ commentary.

- US earnings season winding down, but international earnings accelerate, including Japan’s SONY, NTDOY, and TM, plus China’s BABA. DIS and COIN among the US highlights.

- World’s no.2 economy, China, focus as covid lockdowns worsen its slowdown. Low 1.5% inflation (Wed) gives room to cut interest rates, as data from trade to car sales likely struggle.

- See Google (GOOG) live developer conference. Focus on new Pixel phones and Android 13. International Energy Agency latest renewables update, as demand surges with high oil prices.

Our key views: All about valuations now

- Markets are seeing the biggest sell-off since the 2020 covid crash, driven by higher bond yields and lower valuations, and swamping decent earnings. We see fundamentals as stressed but secure. Look for support from Q1 earnings, and relief from ‘peak’ inflation, and China stimulus.

- Economies are reopening and growth robust. The aggressive Fed hiking cycle is increasingly well-priced and inflation starting to peak.

- Focus a ‘barbell’ of cheap cyclicals and select ‘defensives’: Value, commodities, and high dividends and healthcare. Cautious on bonds.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 0.66% | 3.11% | 31.44% |

| Brent Oil | 6.73% | 10.57% | 45.27% |

| Gold Spot | -0.74% | -3.47% | 2.86% |

| DXY USD | 0.68% | 3.87% | 8.01% |

| EUR/USD | -0.02% | -3.02% | -7.25% |

| US 10Yr Yld | 19.39% | 46.87% | 161.40% |

| VIX Vol. | -9.61% | 42.67% | 75.32% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Impacts of the rampaging USD

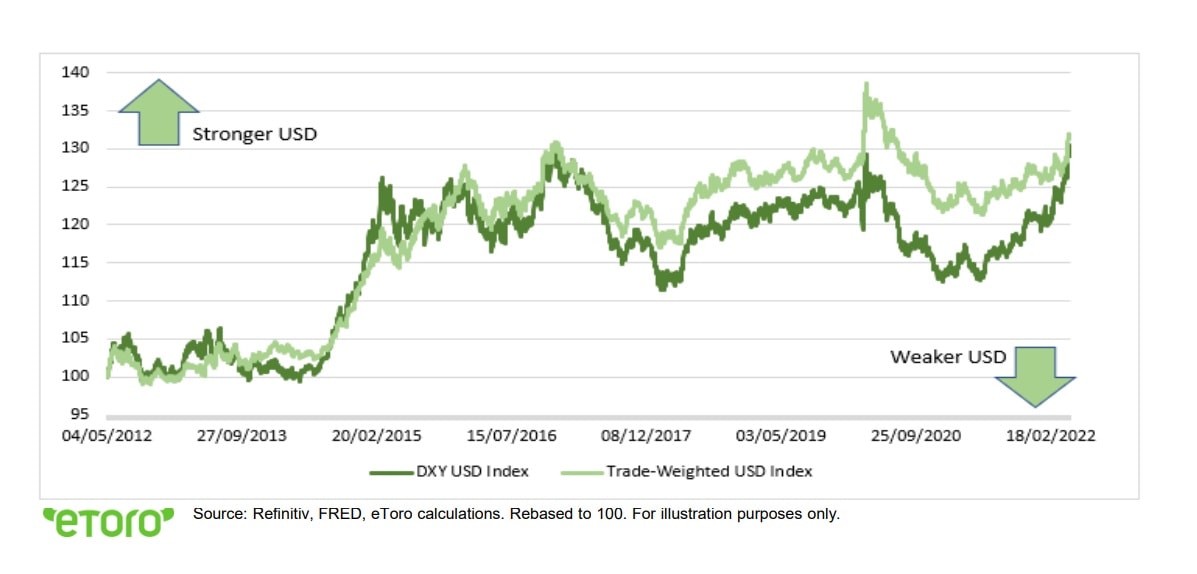

The US dollar has soared this year as a ‘safer haven’ and as Fed hikes interest rates

The hawkish Fed and risk aversion has driven the US dollar to a 20-year high against developed market currencies. It has soared through key levels against the Yen (130), Euro (1.05), and Pound (1.25), as they slumped 8-12% this year alone. Only the commodity driven Brazilian real, Russian ruble, and Colombian peso have outperformed. The strong US dollar has been a drag on emerging markets, commodities, tech, and US trade. But also, a needed buffer for European and Japanese exporters, and without it US inflation would have been even worse. We see a stabilizing USD later this year driving some relief in these assets.

Have likely seen most of the US dollar strength, as rest of world starts to catch up

We see US dollar strength staying for now, but easing somewhat in second half this year, as global risk aversion slowly eases, and the Fed rate hikes decelerate to 0.25% a meeting. The US economic growth lead versus global peers will start to narrow. Whilst the Fed will back off from its uber-aggressiveness. These moves will be modest though, with ECB and BOJ set to move slowly and global risks to stay above average.

The strong dollar impacts across EM, commodities, and US tech

(-) Emerging Markets: A stronger USD especially hurts emerging markets (EEM), by raising USD financing and debt pressures. The stronger the USD is, the more local currency a country needs to repay.

(-) Commodities: A stronger USD makes commodities (DJP), which are mostly priced in USD, pricier for foreign buyers. Commodities would likely have soared even more this year without the USD rally.

(-) US tech: The 60% of US tech sector sales from abroad become less competitive with a strong US dollar.

(+) Europe/Japan: Weaker local currencies are an important ‘buffer’ for the many global, and generally lower profit-margin, European (EZU) and Japanese (EWJ) companies. For example, over 50% of UK and European corporate sales come from abroad and become more profitable with a weaker EUR and GBP.

(+/-) US economy: The stronger dollar has hurt US export competitiveness, with trade a major drag in the recent Q1 GDP miss. But it also reduces imported inflation, stopping a bad situation getting even worse.

The details on measuring the US dollar rally

The chart shows the 10-year US dollar appreciation. The well-known DXY Dollar Index is heavily Euro (EUR) weighted, whilst the trade-weighted index more diverse, and better reflects US trade, such as China (CNH).

The dollar surge: US Dollar DXY & Trade-Weighted USD Indexes (10-years)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Geopolitical risks, the Fed hiking cycle, and China concerns have boosted uncertainty and weakened markets. We see this ultimately fading, the global growth outlook secure, and valuations now more compelling. This still supports a rare consecutive double-digit positive return outlook for the year despite the weak start. Focus on a ‘barbell’ of cyclical assets (Value equities, commodities, crypto) and select defensives (‘big tech’, healthcare). Cautious on fixed income. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing strong 3-4% GDP growth and with room for more earnings upside surprises. Valuations have now fallen back to 5yr average levels, but are being pressured by surging 3%+ 10-year bond yields, especially on expensive tech. Fed interest rate risks are now well-priced. See cyclicals and value catch-up, after a decade of underperformance. Now see overseas markets leading, with lower valuations and less tech. |

| Europe & UK | Region is being buffeted by proximity and exposure to the Ukraine crisis. See secure outlook with 1) Europe’s strong macro ‘buffers’ of rising fiscal spending (defence and refugees), zero-bound interest rates (‘dovish’ ECB), and a weak Euro (50%+ company sales from overseas). Equity markets helped by 2) a greater weight of cyclical sectors, and lack of tech, 3) 25% cheaper valuations vs US, 4) decade of underperformance make under-owned by global investors. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China outlook improving as cuts interest rates (opposite of rest of world) reducing slowdown and property sector risks, focuses on stability ahead of 20th Party Congress, and with valuations now 45% cheaper than US and market heavily out of favour. Will support EM, but is exposed to Fed tightening. China recovery also helps global sectors from luxury to materials. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | More attractive as macro risks rise and bond yields better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. But also sensitive to bond yields. Healthcare most attractive, with cheaper valuations, more growth, some cost protection. |

| Cyclicals | We expect some cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead performance. Are most sensitive to re-opening economies, resilient GDP growth, and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and out-of-favour for years. ‘WFH’ to lag. |

| Financials | Financials will benefit from resilient GDP growth, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech themes. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | In ‘sweet spot’ of robust GDP growth, ‘green’ industry demand, years of supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply and Russia 10% world supply problems. Gold helped by risk-aversion but held back by rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.