Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and a weekly ‘special’.

The December and positive Q1 outlook

Markets have surged, pulling some returns forward, but been largely fundamentally driven. The rest of December will likely see Fed push-back vs too-soon investor interest rate cut pricing, and Dec. 19th BoJ meet is an important wild-card. First quarter is front loaded with events from +5% Q4 earnings recovery and key Taiwan and US presidential politics. We are positive 2024 with interest rate cuts, stronger earnings, and a big stocks rotation. See Page 4

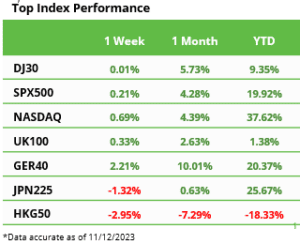

‘Everything’ rally pauses for breath

The big cross-asset rally paused; even as the underlying cyclical rotation continued. US 10-yr bond yields fell to 4.1%, BTC hit $44,000, whilst DAX and Gold hit all-time-highs. The oil plunge deepened, and surging JPY hit the Nikkei. GOOG and AMD boosted by AI progress; SPOT slashed jobs; BAT.L did a huge write-down; fast fashion SHEIN readied its IPO. See Q4 Markets Outlook HERE and at twitter @laidler_ben. See Page 2

Market taking on the Fed again

Market quickly loosened financial conditions and priced five rate cuts for 2024, setting up a Fed showdown. But stage set for mid-2024 cuts and big country, sector, style rotation. See Page 2

The earnings growth contradiction

S&P 500 EPS growth accelerating to 12% next year, despite slower GDP and analysts usual cuts during year, as AI adoption, less inflation margin pressure, and a lower base offset. See Page 2

The strange anatomy of global debt

Understanding differences across world’s huge debt goes long way to understanding Europe’s weak growth, China’s property woes, US and EM resilience, and Japan rate constraints. See Page 2

Where to find most ‘ten-bagger’ stocks.

They are holy grail, but a rare 2.7% of global stocks. Whilst tech and US are well represented it is Australian miners that lead. See Page 2

Bitcoin hits $44,000 as rally resumes

BTC dramatic YTD rally hits 160% with combo of Fed rate cut hopes and imminent spot ETF approval. AVAX and SHIBxM lead all crypto, with TRX lagging. MSTR to El Salvador now in green on recent investments. HOOD reports strong crypto pick up, and ARKK trims COIN position. See latest Weekly Crypto Roundup. See Page 3

Commodities big slump deepens

Broad commodities fell 4%, continuing worst asset class performance of year. Led by Brent <$80 as US supply surge and recession fear trumped OPEC+ voluntary cuts. Lithium plunge hit 80% vs last year on supply build. Breakfast commodity YTD leaders’ sugar and coffee eased back. WDS and STO.ASX merger talk. See Page 3

The week ahead: Inflation, FOMC, TripleWitch

1) US inflation most important markets number See decline toward 3% on lower oil (Tue). 2) FOMC to hold rates and push back on early rate cut talk (Wed), like ECB and BoE (Thu). 3) Results from ADBE, ORCL, ITX.MC, COST, LEN, and DRI. 4) Triple-witching US futures and options expiry (Fri) a top-four volume day of year. See Page 3

Our key views: Outlook for a different 2024

See a stronger but very different 2024. Lower inflation and coming interest rate cuts as growth slows, and the earnings outlook idiosyncratically accelerates. Will drive a investor rotation from 2023 US and big tech winners to rate sensitive losers from Europe to real estate. See Page 5