Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and a weekly ‘special’.

Stocks and crypto vs cash and dollar in 2024

Stocks, crypto, and bonds seem best positioned asset classes for 2024. With cash and US dollar losing ground and commodities still depressed. Crypto and big-tech led rally in 2023, with record 3-year bond losses and commodities the worst. Lower inflation and interest rates to cut cash attraction and boost long duration bonds. Dollar hurt by lower rates and higher risk tolerance, helping others from commodities to JPY. Crypto sensitive to long list of 2024 catalysts. See Page 4

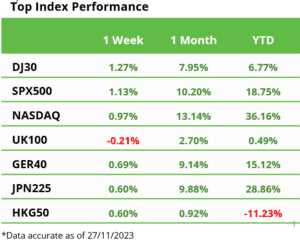

On track for historic November performance

Stocks higher in holiday-shortened Thanksgiving week, on track for one of best month’s past 3-years, with 10-yr yields <4.5%, oil $80/bbl., VIX <13. Ignored election quakes from Argentina to Netherlands and Taiwan. EU PMI’s stabilised and UK cut taxes. NVDA results surged again, MSFT navigated OpenAI AI turmoil, and crypto Binance’ criminal settlement. See Q4 Markets Outlook HERE and at twitter @laidler_ben. See Page 2

Nearing the all-time-high

S&P 500 has sights on regaining high from two years ago after one of the longer waits in history. These technicals important to many, and new-highs historically drive new-highs. See Page 2

Emerging Markets better in 2024

This perennial laggard may start to reflect its stronger economic growth and population dominance, as China’s economy now stabilizes, interest rates cut, US dollar weakens. See Page 2

The weight-loss stock market bust

GLP-1 drug boom seen more market losers than winners, with our basket underperforming by 30pp this year. Impact overdone as use gradually ramps and as companies adjust. See Page 2

Bracing for peak El Niño

Weather disruption to last into 2024 with impacts from surging cocoa to Panama Canal capacity cuts. See warm winter on energy. See Page 2

ETH plays catch up amidst crypto rally

BTC neared $38,000, with all-time-high hash rate, whilst ETH sees a performance catch up, as Blackrock files spot ETF application. DOGE and SHIBxM the laggards. Binance fined $4.3 billion in criminal settlement and CZ steps down. GBTC discount to NAV hits singles digits and ARK sells. See latest Weekly Crypto Roundup. See Page 3

Smaller commodities shine as oil struggles

Oil prices struggled around $80/bbl. as OPEC disagreements delayed its scheduled meeting. Whilst smaller commodity rally resumed, with Uranium (SRUUF) regaining pre-Fukishima levels, cocoa hitting 46-yr price high, and OJ twice prior all-time-high. Argentine ag exports are paralysed ahead of a feared FX devaluation. See Page 3

The week ahead: Shopping, COP 28, December

1) Data focus Thanksgiving shopping results and EU and US PCE inflation fall. 2) COP 28 climate event starts (Thu) as divided OPEC try to stabilise oil fall. 3) Earnings from CRM, CRWD, INTU, DELL, DLTR. 4) Santa rally may have come early as start seasonally strongest December (Fri). See Page 3

Our key views: Stronger Q4 and 2024

See a stronger Q4 and 2024 as summer breather and tall wall-of-worry fades, and investors look ahead to lower inflation and coming rate cuts as growth slows, and earnings outlook firms. Focus defensive growth and long duration assets from healthcare to big tech. Cautious growth exposed cyclicals, commodities, and banks. See Page 5

,