Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and a weekly ‘special’.

Opportunities from Millennials to Gen Z

Spending and company preferences differ widely across the generations. Millennials are the biggest and highest earning of all and set to inherit. Younger Gen Z the true digital natives and growing faster, Whilst youngest Generation A influencing their parents buying already. Some, like AAPL and AMZN, have hit the generational jackpot by appealing to all. Whilst Millennials prefer brands PINS to COST and DAL. Whilst Gen Z prefer VFC to SONY and SPOT. See Page 4

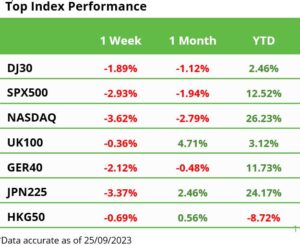

Fed reality-check hits markets hard

Fed ‘hawkish pause’ of interest rate hikes hit all markets hard, pushing up bond yields to new records, in seasonally the weakest weeks of year. The UK and Switzerland surprisingly joined those global central banks on pause, hitting their currencies. CSCO offered $28bn for SPLK. CART and KVYO publicly listed. Trade giant FDX beat and raised whilst EU bank leader SOGN downplayed the future. See Q3 Markets Outlook HERE and at twitter @laidler_ben. See Page 2

Quantifying the wall-of-worry

There is a long list of US market concerns: bond yields, UAW strike, Federal shutdown, student repayment restart. The only one that worries is surging oil, and that will self-correct. See Page 2

Global soft-landing health check

World seeing stronger growth now, but some payback tomorrow, as US and Japan cool and Germany rebounds. A soft-landing supports our positive but long-duration view. See Page 2

The buyback tax temptation

Companies are biggest buyers of US stocks, with buybacks pillar of S&P 500 performance and high valuation. We fear politicians won’t resist the temptation to raise the buyback tax. See Page 2

Why rate hikes hurt more in Europe

Europe more sensitive to higher rates than US given higher debt, reliance on bank lending, and floating rate debt. economies. See Page 2

Crypto long-term holders and overhang ease

Crypto resilient to strong volatility across other assets, with XLM and AVAX leading crypto losses, whilst XRP and LINK resilient. BTC helped by long-term holder’s proportion rising near record 76% and Mt. Gox repayment delay easing overhang sale risks. C launched token service. See latest Weekly Crypto Roundup. See Page 3

Brent oil stays above $90/bbl.

Macro fear and strong dollar drove commodities lower, including proxy ‘Dr. copper’, whilst cereals fell on raised harvest supply outlook, and lithium slump continued on EV demand fears. But brent oil held over $90/bbl. as Russia temporarily suspended diesel and gasoline exports, and Uranium surged to new highs. See Page 3

The week ahead: Oct. 1 risks, inflation, Nike

1) The Oct. 1 US Federal budget deadline and the student loan repayment restart. 2) Macro focus on China PMIs, EU falling inflation, and Fed-favourite PCE. 3) NKE, COST, MU earnings + BIRK IPO roadshow. 4) End of weak Sept. and Q3 with look ahead to typically better Q4. See Page 3

Our key views: A positive markets breather

Market seeing breather after strong 1H, with weaker seasonality, low volatility, and coming growth slowdown. But fundamentally positive on lower inflation and coming rate cuts. Focus on defensive growth and long duration assets from healthcare to big tech. Cautious growth exposed cyclicals, commodities, and banks. See Page 5

,