Summary

Europe’s crisis buffers in focus

European equities are seeing worst impact of the Ukraine crisis. Yet Europe has several unique buffers that ease the inevitable growth hit. There are also silver linings for defence, renewable, and oil stocks. Even hard-hit banks are secure. UK and Europe are attractive markets with cheap valuations and robust fundamentals. The more risk-averse should ‘dollar-cost averaging’ to manage volatility yet capture upside.

Escalating Ukraine crisis dominates markets

The escalating crisis drove sharply weaker global markets, led by Europe. Russia is isolated by sanctions and company pull-outs. Its financial markets closed. USD, bonds, gold were havens from rising uncertainty. Oil soared over $110 on supply disruption concern. We believe global fundamentals remain secure, but need an easing of uncertainty to reassert themselves. We are positive markets. See latest presentation, video updates, and twitter @laidler_ben.

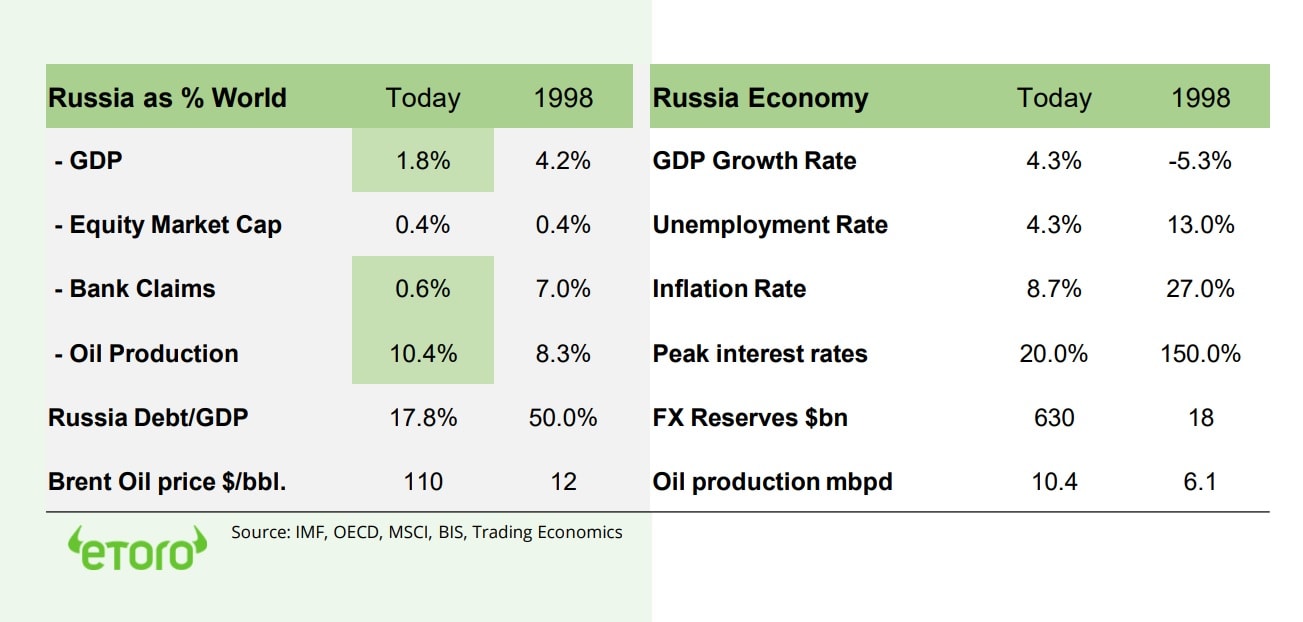

This is not 1998 economic contagion

Russia impacts global markets via risk aversion and commodities only. It’s economy is smaller and financial linkages tinier than the last time it hurt the world economy in 1998.

The green ‘silver-lining’ to the crisis

Renewable equities are a green ‘silver-lining’ to market weakness, as governments refocus on energy security and $110 oil drives substitution. See @RenewableEnergy portfolio.

The perils of earnings disappointments

Earnings season has been strong but with high profile misses, from Netflix (NFLX), to Meta (FB). Markets are unforgiving with uncertainty and valuations high. Prefer Value stocks.

High foreign equity ownership impacts

The high 56% foreign ownership of UK equities (ISF.L) shows the globalisation of investment, but also the risks of increased volatility.

Bitcoin see’s new demand

Bitcoin (BTC) was boosted by stronger eastern Europe demand as traditional financial systems were disrupted. Whilst soaring commodities also stoked demand for inflation-hedges like bitcoin with its fixed 21 million supply. 17% of investors says this is their reason for owning.

Soaring commodities stoke inflation fears

Russian-centric commodities soared on rising supply disruption risks. This in-turn stoked global inflation fears. Brent oil spiked to near $120/bbl., an 8-year high. European natgas prices doubled on the week. Wheat rose 70% and palladium by 20%. ‘Safer-haven gold rose by 3%.

The week ahead: Ukraine in the spotlight

1) Ukraine will continue to dominate markets. 2) US inflation seen rising to 7.7%, and ECB meeting to stay dovish as risks rise. 3) Earnings focus on US tech’s ORCL, CRWD, MDB, and big consumer stocks ADS.DE, ULTA, WOOF. 4) Major tech exporter Korea elects new President.

Our key views: Need for less uncertainty

Geopolitical risks have added to those from high inflation and a tightening interest rate outlook. Markets need to see lower uncertainty – from Ukraine or the March 16th Fed meeting – to allow strong fundamentals to reassert. Focus on cheap and cyclical assets that benefit from good growth and stubborn inflation: Value, commodities, crypto. We are cautious on bonds.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -1.30% | -4.20% | -7.497% |

| SPX500 | -1.27% | -3.81% | -9.18% |

| NASDAQ | -2.78% | -5.57% | -14.90% |

| UK100 | -6.71% | -7.04% | -5.38% |

| GER30 | -10.11% | -13.68% | -5.93% |

| JPN225 | -1.85% | -5.30% | -9.75% |

| HKG50 | -3.79% | -10.86% | -6.38% |

*Data accurate as of 07/03/2022

Market Views

Escalating Ukraine crisis dominates markets

- The escalating Ukraine crisis drove sharply weaker global markets, led by closest Europe. The Russian economy is increasingly isolated by sanctions and company pull-outs, and its financial markets closed. The USD, bonds, and gold were havens from the rising uncertainty. Oil soared over $110 and drove commodity rally on more supply disruption concerns. We believe global fundamentals remain secure, but need an easing of high uncertainty to reassert. See Page 6 for our Resources guide of reports, webinars, presentations, videos, and twitter.

This is not 1998 contagion

- The channels by which the surging conflict with Russia impacts global markets are limited. This is highlighted by comparison with the 1998 Russia financial crisis (see table), the last time Russia had a big impact on global markets.

- Contagion is focused on 1) global risk aversion, which likely eases over time and 2) higher commodities that slows not derails the inflation fall outlook. We think global fundamentals are secure. Russia’s economy is small and its equity market tiny. Global banks have little exposure and few own Russia’ small amount of debt.

The green ‘silver-lining’

- Renewable equities have been a rare equity crisis-performer, a green ‘silver-lining’ to the volatility, as governments refocus on energy supply and $100 oil drives substitution. This is needed to reverse the prior sector weakness.

- The Ukraine crisis has 3 renewable catalysts. 1) Focus on fuel security risks, and diversification, especially in Europe. 2) Faster government carbon transition plans, like Germany’s 2 new LNG plants and accelerated 100% renewable target date. 3) $100+ oil incentivises renewables substitution and makes more cost competitive.

Russia today versus its 1998 financial crisis

The perils of earnings disappointments

- A strong Q4 earnings season saw S&P 500 profits up 31% and Euro Stoxx600’ +67%, a key market support. But we also saw many high profile misses and big stock falls. Netflix (NFLX), Meta (FB), Paypal (PYPL), Roblox (RBLX), and on.

- ‘Beats’ were less rewarded and ‘misses’ more punished than usual. We have seen a strong profits run, so they are ‘expected’. US valuations are still high 19x P/E. Uncertainty reigns, from Fed to Russia. This makes misses painful and underpins our focus on cheaper assets.

All about foreign ownership

- The latest official analysis of who owns UK equities, the world’ no.3 market, has global lessons. Foreign investors now own 56% of UK equities as markets internationalize and it becomes easier to diversify internationally.

- But this can add to volatility in uncertain times, like now. With a smaller local ‘captive’ investor base and greater sensitivity to the currency.

- Individual ownership fell to 12%, and the 3rd largest holders, focused on small caps. This was before the recent retail investor boom. Meanwhile other traditional investors like pension funds, insurance companies, and banks have become increasingly less relevant.

Bitcoin boosted by new demand

- Another volatile week saw initial strong crypto asset gains, with bitcoin (BTC) regaining the key $40,000 level, before seeing renewed weakness. Cosmos (ATOM) was amongst the strongest performers of major coins. Higher-risk meme coins like Dogecoin (DOGE) and Shiba Inu (SHIBxM) lagged on high global risk-aversion.

- Crypto assets were seen as boosted by stronger eastern Europe demand as traditional financial systems were disrupted. Soaring commodities also stoked demand for inflation-hedges like bitcoin with its fixed 21 million supply. 17% of investors says this is their reason for owning.

Oil prices soar on Russia disruption

- Brent oil prices soared to near $120 bbl. on the increased disruption of Russian oil supply. Sanctions have ‘carved out’ energy but other restrictions are hitting financing and logistics, and the market is buying less Russian oil. Russia pumps 10% world’s oil, and 40% Europe’ natgas needs. An imminent US-Iran nuclear deal could allow Iran to export more oil, and ultimately offset around 20% of current Russia supply.

- Other Russia-centric commodities also rose. Wheat prices have soared near 50% the past month. Whilst palladiumhas risen by 20%.

- We think commodities remain in a ‘sweet spot’ of robust demand, tight supply, and increased investor demand for inflation-hedge assets.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -3.85% | -6.88% | -15.77% |

| Healthcare | 0.61% | -0.35% | -8.10% |

| C Cyclicals | -3.01% | -6.19% | -15.11% |

| Small Caps | -1.96% | -0.07% | -10.89% |

| Value | -0.05% | -1.69% | -4.06% |

| Bitcoin | 1.67% | -2.94% | -16.74% |

| Ethereum | -3.08% | -11.92% | -30.24% |

Source: Refinitiv

The week ahead: Ukraine remains in spotlight

- Russia’s invasion of Ukraine will dominate markets. Fighting escalated, Russia became increasingly isolated, and oil prices soared. Focus on a potential peace talk catalyst.

- US inflation seen rising to new 40-yr high 7.7% (Thur.) ahead of March 16 Fed meet that expected to hike rates for first time since 2015. Europe’ ECB (Thu) to keep policy unchanged in face of rising Ukraine growth risks to region.

- The earnings focus is US tech ORCL, CRWD, MDB and consumers ADS.DE, ULTA, WOOF. US Q4 earnings rose 31% and by 67% in Europe.

- Top-10 economy South Korea elects a new President (Thu) for a single 5-yr term. Former Prosecutor General Yoon Suk-yeol of conservative People Power party is favoured.

Our key views: Need for less uncertainty

- Escalating geopolitics has added to risks from high inflation and a tightening interest rate outlook. Markets need to see lower uncertainty – from Ukraine or March 16th Fed meeting – to allow the fundamentals to reassert themselves.

- Earnings are key focus. Q4 results were strong and economies are reopening. This should offset valuation pressures. They have fallen significantly, and Fed risks are better priced.

- Focus on cheap and cyclical assets that benefit from good growth and stubborn inflation: Value, commodities, crypto. Cautious on bonds.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 13.02% | 15.93% | 28.09% |

| Brent Oil | 24.84% | 27.59% | 51.46% |

| Gold Spot | 4.49% | 9.18% | 7.89% |

| DXY USD | 1.96% | 3.17% | 2.65% |

| EUR/USD | -3.00% | -4.49% | -3.85% |

| US 10Yr Yld | -23.62% | -18.07% | 21.88% |

| VIX Vol. | 15.91% | 37.73% | 85.71% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Europe crisis impacts

European markets have borne brunt of the Ukraine crisis. Will create opportunities for risk tolerant

European equities have borne brunt of Ukraine crisis. The Stoxx 600 index is -9% the last month, whereas the S&P 500 is -4%. European Financials are -22%, whereas US Financials are -2%. This makes sense. The closer you are to the crisis the worse. Russia is only 1.8% of global economy and 0.8% of bank lending but its relevance rises the closer you get. It supplies 40% of Europe’s gas and is its 5th largest export market.

Yet Europe has several unique buffers that defend against the inevitable growth hit

The crisis is still escalating, but Europe’s economic outlook the best in years. Growth seen at 3.9%, a good starting point and more than US. Companies just posted 67% Q4 earnings growth, double the US. Russia’s isolation and extended energy crisis will drive a hit to GDP growth, of c0.5%, with higher-for-longer inflation vs current 5.8%. But the region has several unique buffers to part-offset: EUR, fiscal policy, ECB, valuations.

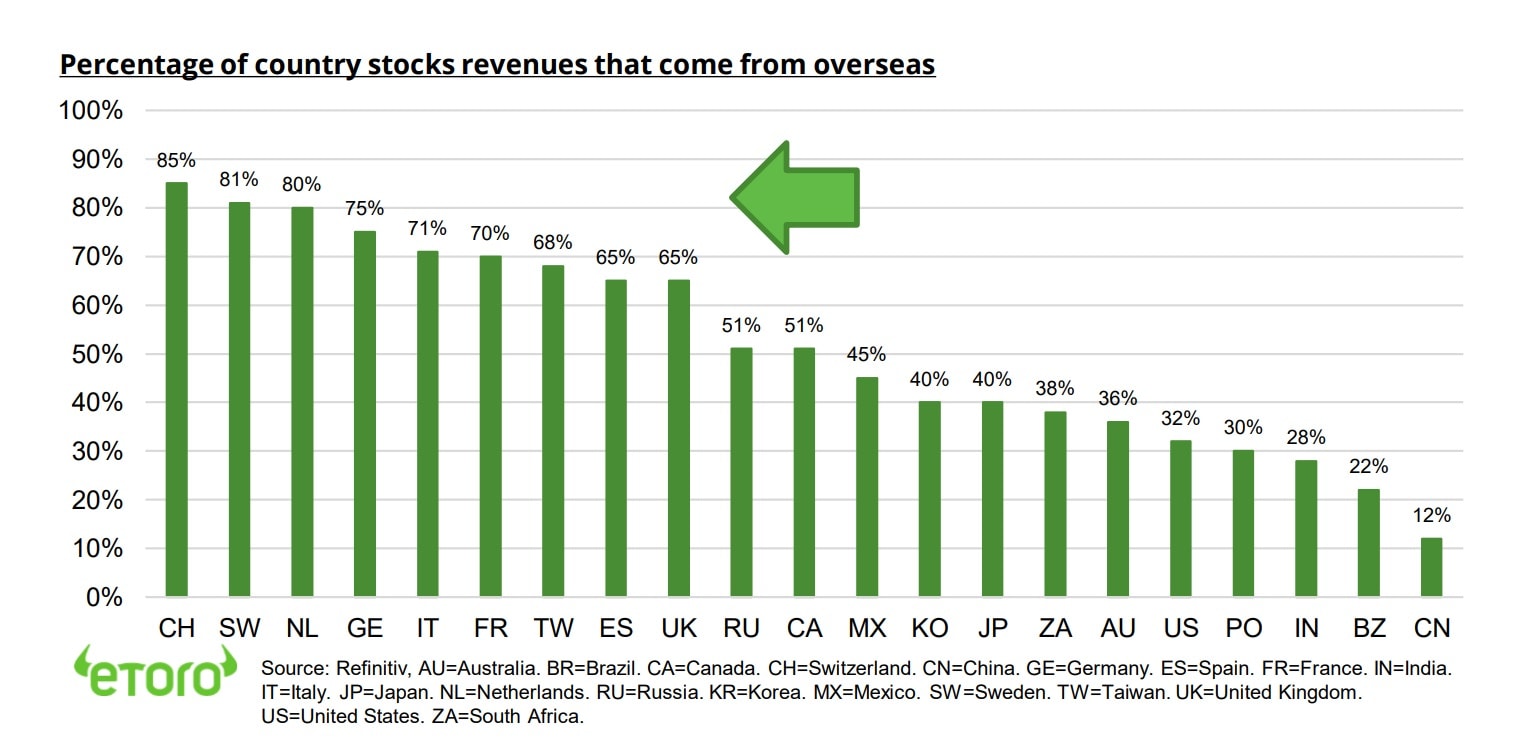

1) The Euro has slumped and is a buffer for Europe’s globalised economies and companies (see chart). It makes them more price competitive and helps growth. 2) Much the rest of the world has a ‘fiscal cliff’ as last year’s government spending eases. Europe is the opposite. It has EUR750 billion ‘next gen’ spending, plus the Ukraine crisis boost to defence spending and refugee support. UNHCR says 4 million could flee. 3) ECB is among world’s most dovish central banks, with rates at zero, and unlikely to increase this year. 4) European stock valuations are amongst cheapest in world, at c25% discount to US, limiting downside risks.

Silver lining for defence, renewables, and oil. Banks are secure

Oil stocks benefit from high oil prices. This dwarfs Russia impacts. The extreme case is BP (BP.L), with a $25 billion hit abandoning its 20% Rosneft stake. But it stands to see more than this in extra sales with oil over $100. The impacts on the few European banks with exposure, like UniCredit (UCG.MI) and Societe Generale (GLE.PA), is manageable, given the draconian post-2008 financial crisis regulatory capital and risk-limits. Renewables, from Orsted (ORSTED.CO) to Vestas (VWS.CO), see a much-need benefit from governments new focus on energy security and renewables. Defence stocks, like Rheinmetall (RHM.DE) and Leonardo (LDO.MI), benefit from Germany’ commitment to spend 2% GDP on defence. Italy and Spain may follow.

UK/Europe long term attractive with cheap valuations and secure growth. Average in if concerned

Europe’s growth outlook is secure and valuations cheap. Earnings have been strong. Economies seeing a post-covid reopening. Valuations are cheaper. Concerns on US Fed ‘lift-off’ well priced. Investor sentiment is very poor, a contrarian positive. See UK (ISF.L) and Eurozone (EZU) ETF’s and @EuropeEconomy smart portfolio. The more risk-averse should ‘dollar-cost average’ to manage the volatility yet capture the upside.

Percentage of country stocks revenues that come from overseas

Key Views

| The eToro Market Strategy View | |

| Global Overview | Geopolitical risks alongside the Fed hiking cycle is boosting uncertainty and weakening markets. We see this ultimately fading, and the global growth outlook secure, and valuations more compelling. Focus on reflation and cyclical assets: equities, commodities, crypto, small cap and value. Relative caution fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing strong c4% GDP growth and with room for more earnings upside surprises. Valuations have now fallen back to average levels, and are well supported by still-low bond yields and high company profitability. Fed interest rate risks are now well-priced. See cyclicals and value catch-up, after a decade of underperformance, whilst big-tech is supported by its structural growth outlook. Now see overseas markets leading. |

| Europe & UK | Region is being buffeted by proximity and exposure to the Ukraine crisis. See secure outlook with 1) Europe’s strong macro ‘buffers’ of rising fiscal spending (defence and refugees), zero-bound interest rates (‘dovish’ ECB), and a weak Euro (50%+ company sales from overseas). Equity markets helped by 2) a greater weight of cyclical sectors, and lack of tech, 3) 25% cheaper valuations vs US, 4) decade of underperformance make under-owned by global investors. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China outlook improving as cuts interest rates (opposite of rest of world) reducing slowdown and property sector risks, focuses on stability ahead of 20th Party Congress, and with valuations now 45% cheaper than US and market heavily out of favour. Will support EM, but is exposed to Fed tightening. China recovery also helps global sectors from luxury to materials. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Consumer staples, utilities, real estate offer more defensive cash flows, less exposed to economic growth. Makes them more sensitive to rising bond yields. Expect them to underperform in a more cyclicals focused environment with earnings strong and yields rising. Healthcare is more attractive, with cheaper valuations and more growth. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Remain in ‘sweet spot’ of above-average GDP growth, ‘green’ industry demand, years of supply under-investment, and increased investor ‘inflation-hedge’ demand. Industrial metals and battery materials well positioned as China growth stabilizes. Oil helped by slow return of OPEC+ supply and Russia risks. Gold hurt by higher bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| Italy | Gabriel Dabach |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.