Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and a weekly ‘special’.

Q4 low expectations and growth recovery

A positive Q4 earnings season is coming with low expectations and a likely consecutive US and EU recovery. Even as banks initially lag. Q3 saw end of US ‘earnings recession’ and was ‘trough’ in Europe. Tech to keep leading for now, with focus on outlook for cyclicals. Q4 focus on AI spend, margin recovery, overseas lag, and punishment of misses. 2024 is set for an idiosyncratic, low-quality, but decent profits recovery. See Page 4

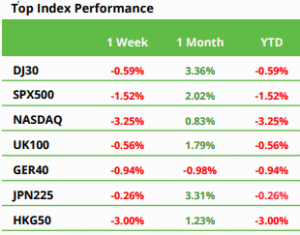

Reality check to start the year

A nervous start to year for stocks and bonds, falling after record 9-week gains. Less-dovish Fed minutes, payrolls, and EU inflation gave a reality check, as look to US inflation and Q4 earnings start. Oil and container rates rose on mid-east tensions, and BTC ahead of the SEC ETF decision. TSLA deliveries beat. MBLY to JD.L plunged on weaker guidance. See our 2024 Outlook HERE and twitter @laidler_ben. See Page 2

Four ways the 2024 rally may be different

We see a smaller S&P 500 rally than last’s 26% year, that is likely to be back-ended, and with lagging cyclicals and international markets now leading versus the US and big-tech. See Page 2

Chances of going from zero-to-hero

Picking rebounds popular but tough. Momentum is a powerful strategy, and many assets stay down. But low expectations and valuation favour Yen, VIX, Renewables, Healthcare. See Page 2

Summarising our positive 2024 view

We see a positive but different year. Lower global inflation to drive interest rate cuts and a return to double-digit earnings growth. The style rotation is the biggest call of year. See Page 2

Recapping 2023’s strong performance

Global stocks confounded sceptics, surging 20%, driven by crypto assets and big-tech. But this concentration tough for investors. See Page 2

Bitcoin hits $45,000 ahead of spot ETF decision

BTC built on its 155% asset-class leading 2023 rally as nears the key Jan. 10 SEC spot Bitcoin ETF deadline. Approval could boost investor access to the asset class and comes ahead of April’s ‘halving’. GBTC’s NAV discount narrowed to near zero. Whilst MSTR bought $615m more BTC. See latest Weekly Crypto Roundup. See Page 3

Oil bucks continued commodity slump

Commodities continued their 2023 fall, as the US dollar strengthened, and China demand concerns extended. Brent crude outperformed as rising mid-east tensions offset the 2nd largest ever US inventory build. Natgas rose on forecast for a cold weather return. US shale consolidation continued with APE $4bn buy of CPE. See Page 3

The week ahead: Q4 earnings, inflation, BTC

1) JPM start global Q4 earnings (Fri) with low but improving +5% and -4% forecasts for S&P 500 and Stoxx 600. 2) US Dec. inflation to inch lower from 3.1% (Thu). 3) Deadline for SEC to decide on a spot BTC ETF (Wed). 4) Las Vegas Consumer Electronics Show (Tue) and key Taiwan presidential election (Sun. 13th). See Page 3

Our key views: Outlook for a different 2024

See a stronger but very different 2024. Lower inflation and coming interest rate cuts as growth slows, and the earnings outlook idiosyncratically accelerates. Will drive a investor rotation from 2023 US and big tech winners to rate sensitive losers from Europe to real estate. See Page 5

Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and a weekly ‘special’.