Summary

China recovery to have global impacts

Chinese equities (MCHI) again performed poorly this year. We see a better outlook, with global implications. Valuations are low, covid-lockdowns loosening, monetary and fiscal policy easing, and tech-sector pressures well known. Global sectors would benefit, from commodities to luxury. China GDP is to grow equivalent to an economy the size of Switzerland just this year.

Markets building a bottom

A shortened week showed international markets lead a resilient S&P 500 after ‘violently flat’ May. Saw growth cross-currents with strong US ISM, payrolls and a reopening China, but MSFT cut outlook and TSLA flagged job cuts. US 10-yr bond yields rose back near 3% and oil soared as new EU sanctions on Russia offset small OPEC supply rise. We see markets building a U-shaped bottom ahead of the needed stronger signs of easing inflation pressure. See latest presentation, video updates, and twitter @laidler_ben.

Fed won’t let markets rally too far

Tighter financial conditions, like lower equities, have helped the Fed lower GDP and inflation expectations. They won’t allow a rally to unwind this yet. We see a U-shaped recovery.

The energy price threat

Energy prices are on the rise again, threatening inflation and record profit margins, but helping oil stocks (XLE). Rising energy efficiency shielded the world from recession so far.

The electric vehicle gap

Electric vehicles booming and sales seen 10x by 2030, or 30%/yr. China leads, and dominates batteries, and US lags. See opportunity in stock weakness. @Driverless, @ChinaCar.

Implications of the Ethereum ‘merge’

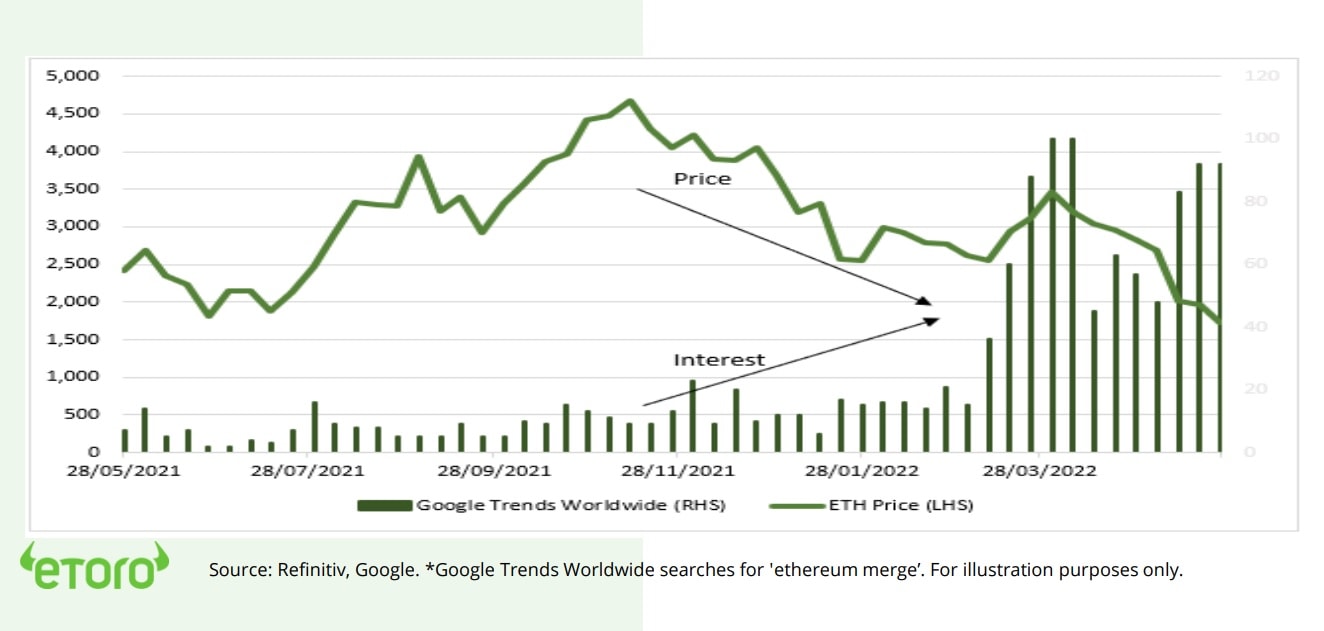

Ethereum (ETH) unprecedented ‘merge’ to Proof of-Stake set for August, and a potential catalyst after 60% price fall. @DeFiPortfolio

Crypto assets finding their feet

Crypto helped by equity market stabilising, even as Bitcoin (BTC) ‘dominance’ rising. Cardano (ADA) led up on Vasil upgrade and stablecoin plans. NY Fed digital innovation event latest to highlight mainstreaming of crypto assets. eToro adds six new coins to the platform.

Fear of a gasoline price spike

Energy focus as new EU Russia sanctions and re opening China offset small and temporary boost to OPEC supply. US gasoline price spike fears rise as enter summer ‘driving season’ with low capacity and inventories. Asset class ‘sweet spot’ of strong demand and tight supply.

The week ahead: Inflation focus

1) ECB meet (Tue) as cut bond buys and prep to raise rates for 1st time in decade. 2) US inflation seen easing for 2nd month, from 8.3%, ahead of Fed June 15 meet. 3) US consumer earnings CPB, SJM, CASY and foreign ITX.MC, BATS.L, NIO, and the AAPL developer conference.

Our key views: Growth risks the focus

Markets seeing biggest sell-off since 2020 covid crash. Risks switched from valuation to earnings. We see fundamentals as stressed but secure, and ‘less bad’ outlook of peaked inflation and a slowdown but not recession. Focus on ‘barbell’ of cheap Value cyclicals and ‘defensives’: Value, commodities, alongside healthcare, and high dividends. We are cautious on bonds.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -0.94% | 0.00% | -9.46% |

| SPX500 | 1.20% | -0.36% | -13.80% |

| NASDAQ | -0.98% | -1.09% | -23.22% |

| UK100 | 0.14% | 0.53% | 2.01% |

| GER30 | -0.01% | 5.75% | -8.97% |

| JPN225 | 3.66% | 2.81% | -3.58% |

| HKG50 | 4.80% | 1.39% | -9.90% |

*Data accurate as of 06/06/2022

Market Views

Markets building a bottom

- Shortened week showed S&P 500 more resilient after the ‘violently flat’ May. Saw growth cross currents with strong US ISM data and reopening China, but MSFT cut guidance and TSLA flagged job cut plans. Oil firm as new EU Russia sanctions offset small OPEC supply rise. See markets building a bottom ahead of needed stronger signs of easing inflation. Page 6 for Resources guide of reports, presentations, videos, twitter.

The Fed won’t let markets rally too far

- We don’t think a ‘Fed put’, of measures to limit the equity market decline, exists today or at these levels. The tightening of financial conditions is doing much of the Fed’ heavy lifting, cutting inflation expectations and reducing the eventual size of this hiking cycle.

- A big equity rally risks this, at a time when inflation is peaking but not sharply declining yet. We see a Fed ‘call’, of messaging to contain a continued sharp equity rally, and a U not V shaped rebound. Credit, not equity markets, are the ones to watch for a unlikely Fed ‘put’. Stay invested, for the rebound, but remain defensive.

The energy price threat

- Brent oil back over $115/barrel, as OPEC keeps supply tight, Russian sanctions extend, and China growth fears ease. Futures are bullishly heavily backwardated. Fear of a US gasoline spike are rising. It’s a threat to a quick inflation fall, to the resilience of near-record corporate profit margins, but good for oil equities (XLE).

- That $100+ oil has not tipped world into recession, as in 1970’s, speaks to the huge rise in energy efficiency in recent decades, with production efficiencies and the shift to services. This efficiency more than doubled in China, US, Germany. Europe has the lowest energy intensity, a crisis buffer.

The electric vehicle gap

- IEA data shows Q1 global electric car (EV) sales up 75%, taking fleet to 18.5m, with support of subsidies and mandates, and industry action on new models and ever longer ranges. China dominates, selling 3.3 million cars last year, vs Europe’ 2.3 million, and US’ with only 0.6 million. Constraints range from lack of charging infrastructure to few EV heavy-duty vehicles, and sharply rising battery material prices.

- Volumes seen growing 10x by 2030 to 200m, or 30%/year, under current policies. This is a big long term prize amidst sharp sector weakness. Smart portfolios @Driverless, @ChinaCar, @BatteryTech.

Implications of the Ethereum ‘merge’

- Ethereum (ETH) is the 2nd largest crypto asset at 18% of total market cap, and the first (2015) and largest smart contract ‘software’ platform. It’s the native token of this blockchain, taking its value from its success and development.

- Ethereum is transitioning from energy-intensive Proof-of-Work (PoW) to Proof-of-Stake (PoS), in an unprecedented initiative called Ethereum 2.0, to boost scalability and cut energy usage. A successful August ‘merge’ would boost the platform, and uses from gaming to finance, after 60% price plunge from highs and DeFi concerns. See @DeFiPortfolio

Ethereum ‘merge’ Google searches vs price (1-year)

Crypto prices begin to find their feet

- Crypto assets modestly higher, after 60% price slump from highs. Benefitted from more stable equity markets, but nerves reflected in continued rise in Bitcoin (BTC) ‘dominance’ to 46%.

- NY Fed ‘monetary policy and digital Innovation’ event on the acceleration of digital currency and payments innovations, highlights how these are now mainstream, including work on central bank digital currencies (CBDC’s) and the USD impact.

- Cardano (ADA) best performing top-20 coin, with optimism on coming Vasil upgrade, to speed and scalability of platform. Additionally, with imminent launch of Djed, Cardano’ stablecoin.

- eToro adds six new coins to investment platform.

Fear of a gasoline price spike

- Commodity prices boosted by EU’s partial and phased ban on Russian oil and as China ended its covid lockdown in largest city Shanghai. This offset the small Saudi boost to OPEC+ production of 0.65mbpd for the next two months. This falls short of offsetting the Russian production fall.

- US gasoline prices been outpacing oil on fear chronic refining capacity shortages and low inventories could boost prices to $6/gallon, from current $4.4 and 2020 low of $1.6, as the summer ‘driving season’ starts and boosts demand. Would be another blow to consumer confidence and a drain on other spending.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -0.81% | -3.86% | -23.32% |

| Healthcare | -2.84% | -0.58% | -11.15% |

| C Cyclicals | -0.24% | -5.89% | -25.16% |

| Small Caps | -0.26% | -0.83% | -16.13% |

| Value | -1.58% | 0.12% | -6.11% |

| Bitcoin | 3.40% | -21.54% | -37.80% |

| Ethereum | 1.02% | -36.92% | -53.27% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Inflation focus

- Central Bank focus shifts to ECB meeting (Tue) as wind down asset buys and ready to raise rates from -0.5% next month for first time in a decade, with inflation now running at 8.1%.

- May US inflation set to ease down for second straight month, from 8.3% versus last year, as the Fed has successfully tightened financial conditions across the US economy.

- Latest company earnings from US consumer stocks CPB, SJM, CASY, MTN, HQY, plus overseas giants ITX.MC, BATS.L, and NIO.

- Tech’ Apple (AAPL) Worldwide Developer event with op. system, and maybe new hardware. Amazon (AMZN) 20:1 stock splits (Mon).

Our key views: Growth risks the focus

- Markets saw the biggest sell-off since the 2020 covid crash. Concern switched from bond yields and valuations, to recession risk and earnings. See fundamentals stressed but secure, with a growth slowdown not a recession. GDP supported by corporates and consumer and peaked inflation. But recovery U, not V, shaped.

- Economies are reopening and growth robust. The aggressive Fed hiking cycle is increasingly well-priced and inflation starting to peak.

- Focus a ‘barbell’ of cheap cyclicals and select ‘defensives’: Value, commodities, and high dividends and healthcare. Cautious on bonds.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -0.04% | 2.67% | 34.94% |

| Brent Oil | 4.99% | 6.94% | 55.35% |

| Gold Spot | 0.18% | -1.53% | 1.28% |

| DXY USD | 0.49% | -1.44% | 6.46% |

| EUR/USD | -0.16% | 1.62% | -5.75% |

| US 10Yr Yld | 19.46% | -19.04% | 142.60% |

| VIX Vol. | -3.62% | -17.89% | 43.96% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Implications of China’s recovery

Opportunity as China lockdowns ease and economic stimulus builds. Accelerating as world slowing

China equity markets have underperformed again this year, and this is throwing up opportunity. Low valuations and depressed markets at the beginning of the year were not enough to offset a renewed zero covid lockdown hit to the consumer and supply chains, and only a slow-moving fiscal and monetary policy response. Chinese GDP is set for an eye-watering Q2 fall and to likely miss its 5.5% growth target this year. We see ‘less-bad’ news ahead, with covid lockdowns easing and policy response building, from interest rate cuts to more government spending. The latest 5-year plan focuses on improving self-sufficiency, common prosperity, and environmental protection – all powerful investment drivers. This has global implications.

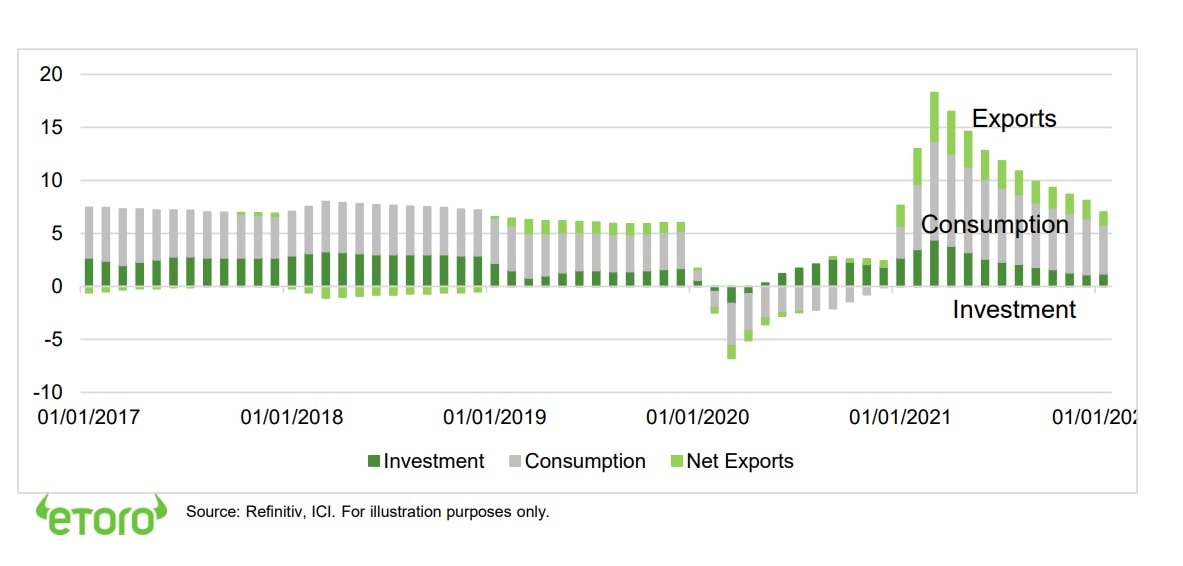

Local concerns, from lockdowns to consumption, are starting to reverse

Authorities have cut interest rates for 3rd time this year, with room for more as inflation only 2%. Consumption and services are taking over from manufacturing as the engine of growth (see chart) and have room to rebound as lockdowns ease. Regulatory restrictions on the huge tech sector have stabilised and we see room for the US Securities and Exchange Commission (SEC) and Chinese counterparts to reach a deal preventing delisting of c280 Chinese stocks under the 2020 Holding Foreign Companies Accountable Act (HFCAA). Chinese growth has further to catch up, with GDP/capital ¼ of Europe, and already leading sector development from electric vehicles to solar. The biggest risk remains new zero-covid lockdowns.

Global impacts, from commodities to luxury. Adding a ‘Switzerland’ of GDP every year

China is the world’s largest manufacturer and commodity importer, and second largest economy, equity market, and venture capital target. The combo of this sheer size and still high c5% GDP growth rate adds activity equivalent to the size of the Swiss or Saudi economy every year, or two Irelands or Israel’s. The fact it is on the cusp of accelerating, as the rest of the world slows, is a key global growth anchor. It has become the dominant market for everyone from miners to luxury brands, and economies from Chile to Australia.

Be diversified as see multiple recovery drivers. China tech sector at least as large as in US

We see the China equity risk-reward attractive with valuations low (<10x P/E ratio), lockdowns easing, and policy stimulus picking up. We focus on diversified exposure with the broad recovery drivers. China is dramatically under-represented in global markets, with an 18% weight in global GDP but only 3% in major global equity indices. But its stocks are very ‘local’. Near 90% of equity revenues come from China, amongst the lowest levels globally and making its stocks very exposed to domestic drivers. China’s listed tech sector (CQQQ) is even bigger than US, at 50% the index. Investor focus will likely be on local China (ASHR) or Hong Kong (EWH) shares than US ADRs (KWEB). See thematic smart portfolios from @ChinaCar to @ChinaTech.

Consumption now leads: Breakdown of Chinese GDP growth (%)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Geopolitical risks alongside the Fed hiking cycle is boosting uncertainty and weakening markets. We see this as slowly fading, the global growth outlook secure, and valuations more compelling. Focus on cheap cyclical and defensive assets within equities, like Value, plus commodities, crypto. Relative caution on fixed income and the USD. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing strong c4% GDP growth and resilient earnings growth outlook. Valuations have now fallen back to average levels, and are supported by peaked bond yields and high company profitability. Fed interest rate risks are now well-priced. See cyclicals and value catch-up, after lagging for a decade, whilst big-tech supported by structural growth outlook. See overseas markets leading in global ‘U-shaped’ rebound. |

| Europe & UK | Pressured lower by proximity and exposure to Ukraine crisis. Recession risks rising with Russia impacts and energy crisis. But 1) macro ‘buffers’ of rising fiscal spending (defence and refugees), zero-bound interest rates (‘dovish’ ECB), and weak Euro (50%+ sales from overseas). Equities helped by 2) greater weight of cyclical sectors, and lack of tech, 3) 25% cheaper valuations vs US, 4) decade of underperformance made under-owned. UK favoured over continent. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China outlook improving as cuts interest rates (opposite of rest of world) reducing slowdown and property sector risks, focuses on stability ahead of 20th Party Congress, and with valuations now 45% cheaper than US and market heavily out of favour. Will support EM, but is exposed to Fed tightening. China recovery also helps global sectors from luxury to materials. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | More attractive as macro risks rise and bond yields better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. But also sensitive to bond yields. Healthcare most attractive, with cheaper valuations, more growth, some cost protection. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead performance. Are most sensitive to re-opening economies, resilient GDP growth, and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and been out-of-favor for many years. |

| Financials | Financials will benefit from resilient GDP growth, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech themes. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | In ‘sweet spot’ of robust GDP growth, ‘green’ industry demand, years of supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply and Russia 10% world supply problems. Gold helped by risk-aversion but held back by rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.