Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and ‘special’ focus on cash on the sidelines.

Pullbacks will come, but have no fear

Market pullbacks come with the rally territory and shouldn’t be feared. Especially now. The S&P 500 averages 2-3 modest pullbacks a year and an average 14% intra-year drop. There is significant cash on the sidelines to buy into any significant pullback, and the twin rally pillars of rate cuts and recovering profits remain firm. Bigger risks are a stumble from the super-sized US and tech or end of immaculate disinflation. See Page 4

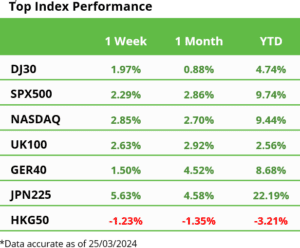

Fed drives restart of stocks rally

US stocks rally resumed after two week pause w/ FOMC’s ‘dovish hold, in a huge week for central banks. JPY weakened even as BoJ raised interest rates for the first time since 2007. Whilst SNB became first major bank to cut. China Jan/Feb growth data positively surprised. AAPL sued by the DoJ. TSLA raised prices. RDDT IPO surged. KER.PA luxe miss likely one-off. See 2024 Outlook HERE and twitter @laidler_ben. See Page 2

Buybacks and dividends coming back to style

2023 underperformance to narrow as profits recover and rate cuts near. Co’s biggest buyer of US stocks and dividends driving cash returns in the rest of world. @DividendGrowth. See Page 2

Spin offs return to fashion

Unilever to Holcim look to create value by de-merging, following GE’s success, even as spinoffs have mixed record and conglomerates, big tech to private equity, make comeback. See Page 2

Turnarounds are difficult

Charlie Munger complained how hard company turnarounds are, and data backs, despite their popularity with investors. Buying bond ‘fallen angels’ is more profitable. See Page 2

Winners and losers from cereal’s rout

Wheat, corn, soybeans that third of global calorie consumption plunged as harvests rebounded, Is a relief to consumers and inflation, but problem for farmers and their suppliers. See Page 2

Crypto succumbs to profit taking

Bitcoin (BTC) below $70,000 on profit taking after asset-class leading rally. Spot Bitcoin ETF inflow cooled. 30 dys until 4-year Bitcoin supply halving event. SOL driven by Slerf boom. DOGE by COIN plan to list futures. Blackrock (BLK) to launch first tokenised fund on the Ethereum (ETH) network. See latest Weekly Crypto Roundup. See Page 3

Stealth commodities recovery slows

Commodities are up 5% from Feb. low on China stimulus, lower interest rate outlook, and stabler US dollar. Gold rallies on macro relief. Brent oil firm at a 4-month high of $85/bbl. on lower US inventories. Epic cocoa surge breaks $8,500/t, near twice prior high. Uranium a weaker outlier as utilities push back on high prices. See Page 3

The week ahead: PCE, Q1/Q2, Easter

1) Fed-favourite Feb. US PCE inflation (Fri) stall, Fed speakers wk. after FOMC reiterated 3-cuts. 2) Slow earnings week ahead of April 12th Q1 start. HM-B.ST, MKC, FLTR.L, CTAS, PAYX, BYD, ANTA. 3) Fri end of strong March and Q1, and Q2 start. 4) Short week of Fri/Mon Easter holidays in US UK, EU. UPS investor day. ADBE event. See Page 3

Our key views: Outlook for a different 2024

We see a stronger but very different 2024. Lower inflation and coming interest rate cuts as growth slows, and the earnings outlook idiosyncratically accelerates. Will drive an investor rotation from 2023 US and big tech winners to rate sensitive losers from Europe to real estate. See Page 5

Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and ‘special’ focus on cash on the sidelines.