Summary

What to track for a market recovery

Markets are under pressure and rebounds been false dawns. Our ‘bear market recovery’ tracker shows we may have bottomed but a sustained recovery will take time. The four markers to track are improving but mixed. An interest rate peak, the worst of growth fears, low valuations, terrible sentiment. We are fully invested but defensive and look for select opportunities. Bear markets are a quarter size and length of bulls.

US inflation surprise derails markets

Equities biggest fall since June 2020 as core US inflation negatively surprised and in turn stoked recession fear. Bitcoin and tech led down, with dollar and bond yields surging. Ukraine made land gains, EU announced energy crisis plans, and China data firmed a bit. ADBE unveiled huge $20bn acquisition. FDX cut profits outlook, whilst SBUX raised. Big Fed hike next focus. See video updates, and twitter @laidler_ben.

The world’s different inflation realities

The drivers of inflation differ a lot, and matter. US situation most difficult, with core pressures. Energy-driven Europe could be positive surprise. Whilst low inflation Asia the haven.

European recession the world’s problem

UK/EU set for recession. Only question how big. This has global implications for 80 countries and stocks from BKNG to COO. But macro blow to be softened and markets adjusted a lot.

At the mercy of the weather gods

Another La Niña weather phenomenon forecast, plus a busier hurricane season. These threaten more commodity market disruption.

Porsche tests the IPO winter thaw

Been terrible year for stock market listings, with their number down 80%, easing market supply pressures. The massive upcoming Porsche IPO by VOW3.DE will be a key test.

Crypto under pressure after Ethereum merge

Crypto assets hurt by renewed equity volatility, with BTC back below $20,000. Long-awaited ETH ‘merge’ successfully happened but its price fell after its recent strong performance incorporated some of bullish outlook. Cosmos (ATOM) more resilient as transaction and developer activity high. Elsewhere MSTR Chairman Saylor made the case for BTC’s energy efficiency.

Commodities resilient to US dollar

Commodities firm even as US dollar surged to 20-year highs. Industrial metals helped by easing China lockdowns and more property support. Grains by more cuts to supply outlook on lower yields. SHEL.L naming renewables head as the CEO a further carbon transition step.

The week ahead: Fed interest rate week

1) Fed (Wed) and BoE to hike aggressive 0.75%, with BoJ unchanged but watching JPY. 2) Flash global PMI’s (Fri) to slip to <50 recession territory. 3) AZO, COST, GIS, DRI, LEN, FDX earnings. 4) UK Queen funeral holiday (Mon) and emergency budget. 5) Sunday’s key Italy election.

Our key views: Sticky inflation raises risks

Sticky US inflation is delaying end to Fed rate hikes and raising recession risk. Offsets still from resilient consumers and corporates, Recovery U shaped and take time. Gradually lower inflation will be a bumpy ride but would de-risk market. And allow higher-risk assets, big tech to crypto, do better, alongside core defensives.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -4.13% | -8.56% | -15.18% |

| SPX500 | -4.77% | -8.40% | -18.73% |

| NASDAQ | -5.48% | -9.89% | -26.82% |

| UK100 | -1.56% | -4.15% | -2.00% |

| GER30 | -2.65% | -5.93% | -19.79% |

| JPN225 | -2.29% | -4.71% | -4.25% |

| HKG50 | -3.10% | -5.11% | -19.81% |

*Data accurate as of 21/09/2022

Market Views

US inflation surprise derails markets

- Equities saw their biggest fall since June 2020, with the S&P 500 falling below key 3,900 level, as core US inflation negatively surprised. Bitcoin and tech led down, with US dollar and bond yields surging higher. Also, Ukraine made land gains, EU announced energy crisis plans, and China macro data firmed a bit. ADBE unveiled a huge $20 bn acquisition. FDX cut profits view, while SBUX raised. Big Fed rate hike next focus.

The world’s different inflation realities

- World has seen common covid and energy inflation shocks. But level and drivers of inflation still differ a lot, with big implications for central bank policy, recession risks, and also currencies.

- US inflation problem hardest to solve. Underlying drivers, from housing to wages, are frustratingly sticky, and latest report showed a core inflation rise to 6.3%. More energy-focused European inflation could decline surprisingly fast, boosting depressed markets. Whilst Asia is the prices outlier and current market haven.

European recession the world’s problem

- UK and Eurozone set for a recession later this year, with BoE and ECB leading a drumbeat of lower forecasts. Only question is how big will be.

- Has global implications with Europe largest trade partner for 80 economies, and from Booking (BKNG) to Cooper (COO). At tough time with US growth slowing and China’s recovery stop-start.

- But Europe’s blow will be softened. By stepped up government spending and a competitiveness boost from weaker currencies. And equity valuations, earnings forecasts, and investor allocations are already low. See @EuropeEconomy.

At the mercy of the weather gods

- Weather gods set to keep having an outsize impact on markets. La Niña weather phenomenon is now forecast for a third straight northern hemisphere winter. Only the third ‘three-peat’ on record and threatening even more disruption to global ag supply. High-for-longer commodities a challenge to lower inflation and EM consumers. But a positive from fertilizer (MOS) to ag equipment stocks (DE).

- Similarly, Atlantic hurricane season likely picks up after quietest start in decades. Remains threat to tight US refined markets, like gasoline. Higher prices could help refiners, from Marathon (MPC) to Valero (VLO), but also hurt consumers.

Porsche tests the IPO winter thaw

- Been terrible year for new stock market listings and their performance as equities plunged into a bear market. Number of US IPOs down 80% this year. Renaissance IPO index down 45%, double S&P 500 fall. But IPO winter curbed new supply even as largest buybacks source of demand near records.

- The IPO winter is now thawing a little. We saw the biggest US listing of the year last week, and Volkswagen (VOW3.DE) owned Porsche now trying one of Europe’s largest ever listings.

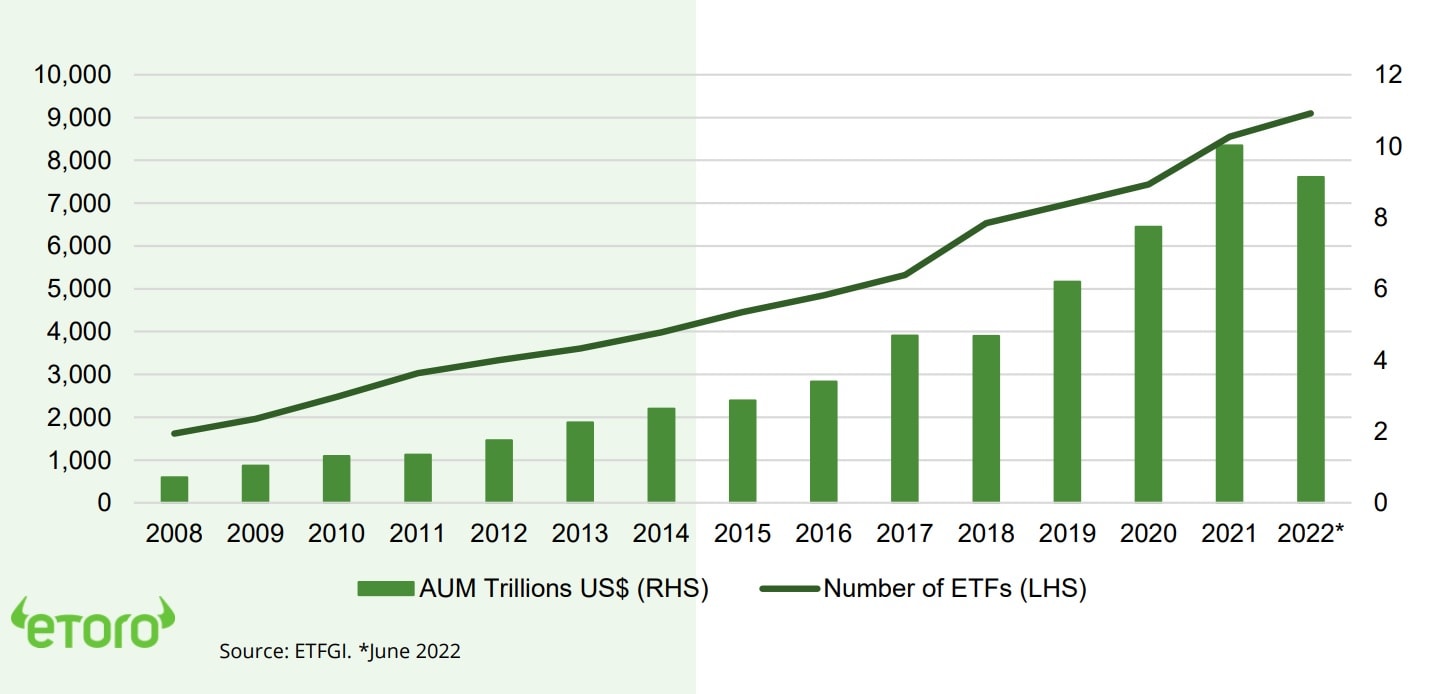

Global ETF industry: Assets and Number of funds (15-years)

Crypto under pressure after Ethereum merge

- Crypto assets hit by the renewed slump in equities, with bitcoin (BTC) trading back below $20,000. Cosmos (ATOM) was one of the few resistant to downtrend, as transaction volumes and developer activity continued to grow.

- The long-awaited Ethereum (ETH) ‘merge’ to PoS successfully happened Thursday. Price sold-off. As recent near 50% outperformance versus other crypto assets priced much of near term benefits.

- Michael Saylor of MicroStrategy (MSTR) made the contrarian case for bitcoin (BTC) energy usage and improving efficiency. Whilst South Korea issued an arrest warrant for Terra/Luna founder.

Commodities resilient to US dollar

- Commodity prices proved resilient to a new dollar surge that took the US dollar DXY index over 110 to a twenty year high.

- Industrial metals saw some support from China, with mega-city Chengdu easing its covid lockdown and the government moving further to support the massive property sector.

- Soybeans and Corn given some support as US Dept. of Agriculture report (WASDE) slashed the supply outlook on back of drought hitting yields.

- Oil major Shell (SHEL.L) named its natgas and renewables head Sawan as the new CEO in latest sign of its ESG and carbon transition ambitions.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -6.31% | -14.58% | -29.79% |

| Healthcare | -2.61% | -5.54% | -12.25% |

| C Cyclicals | -4.36% | -10.15% | -24.56% |

| Small Caps | -4.50% | -11.00% | -19.91% |

| Value | -3.78% | -7.47% | -12.50% |

| Bitcoin | -8.38% | -18.10% | -58.74% |

| Ethereum | -16.85% | -23.67% | -61.75% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Fed week

- US Fed to hike interest rates 0.75% (Wed) and publish new forecasts. BoE set for a similar 0.75% move (Thu). BoJ to remain the global outlier, with focus possible Yen intervention.

- Flash US, EU, UK, Japan, Australia September PMI’s (Fri) set to slip further into <50 recession territory, but with price pressure easing again.

- Latest earnings from consumer stocks AZO, COST, DRI, homebuilder LEN, and shipper FDX.

- Sunday Sept. 25 Italy election, with right ahead in polls. EU’s 3rd largest economy faces recession and bond market fragmentation.

- UK holiday (Mon) for Queen’ funeral, followed by an emergency energy and tax budget (Fri).

Our key views: Sticky inflation raises risks

- Sticky US inflation is delaying end to Fed rate hikes and further raising recession risk. Market supports in the meantime from both resilient consumers and corporates, Recovery to be U shaped only. Gradually lower inflation will be a bumpy ride but would slowly de-risk markets and allow more higher-risk assets, from big tech to small cap and crypto to do better.

- Focus on core cheap and defensive assets to be invested in this ‘new’ world, of higher inflation and lower growth, and to manage still high risks. Sectors, like healthcare, defensive styles like div. yield, and related UK to China markets.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -1.50% | -4.56% | 17.72% |

| Brent Oil | -0.92% | -4.70% | 17.49% |

| Gold Spot | -2.49% | -4.31% | -7.98% |

| DXY USD | 0.59% | 1.36% | 14.25% |

| EUR/USD | -0.31% | -0.24% | -11.93% |

| US 10Yr Yld | 13.88% | 48.03% | 193.97% |

| VIX Vol. | 15.40% | 27.67% | 52.73% |

Source: Refinitiv. * Broad based Bloomberg commodity index

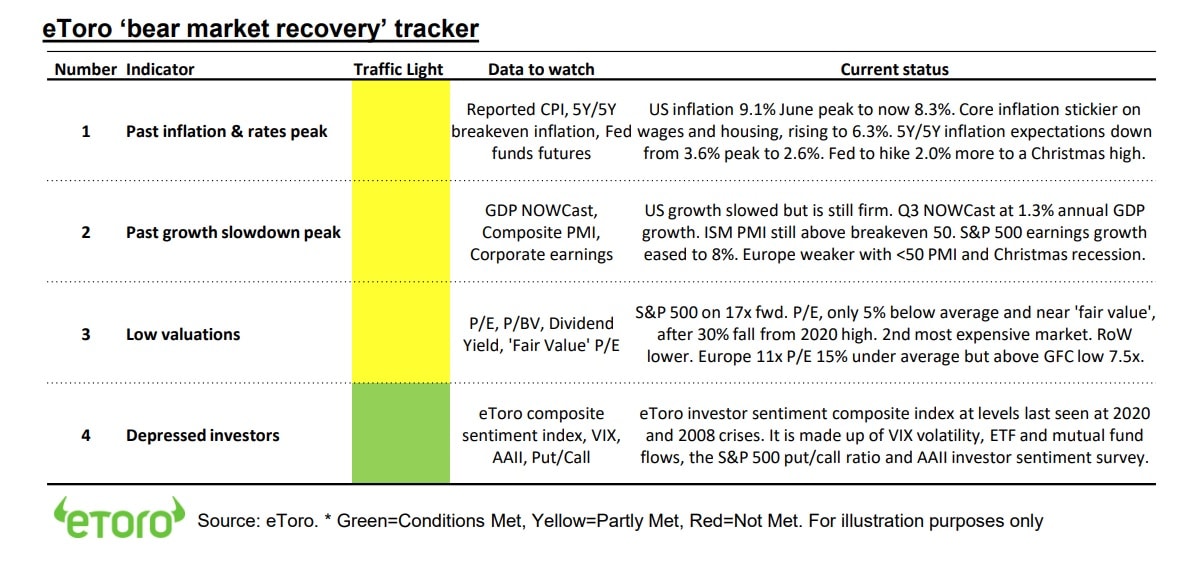

Focus of Week: The bear market recovery tracker

Recoveries have many false dawns but our ‘bear market recovery’ tracker says we are on our way

Last week’s disappointing US inflation drove more market volatility. It came after investors fourth attempt to rally off the bottom of this bear market. This is completely normal. The S&P 500 has seen three rallies of over 5% this year. Previous downturns saw as few as four or as many as eleven before the one that started the next bull market. These false dawns can be big, averaging 8% and ranging up to 18%. Tracking progress through this bear market and telling a bear rally apart from the real-deal recovery is the focus of this piece. We’ve seen enough progress to build a market bottom but not – yet – enough for the sustainable recovery.

Bull markets last much longer and are much bigger than bear markets

Markets will recover and taking the long view matters. It is time in the market, not timing the market as Warren Buffett wisely says. The average bull market is near 180% over 60 months. This is almost four times bigger and longer than a typical bear market downturn. Here declines average 38% over 19 months.

The four markers to track – interest rate peak, worst of growth, low valuations, terrible sentiment

Every cycle is different, but recoveries typically need to see most of 1) a peak in inflation and interest rate worries, 2) a trough in growth fears, 3) low equity valuations, and 4) terrible investor sentiment. Our typical traffic lights (see table) show the view today. In sum, enough to support a market bottom, but not start of a new bull market. This is our ‘U-shaped’ recovery view. Investor sentiment is already terrible. We have some visibility on a Christmas end to the Fed hiking cycle as inflation slowly eases. Valuations are only average in the US, but cheaper elsewhere. Whilst GDP and earnings growth is easing but far from collapsed. It’s a glass-half-full, but enough to be investable, especially with disproportionate returns at turning points.

Having it each way. Invested but defensive and looking for opportunities.

- We are fully invested, believing we saw the market low in June. Inflation has peaked. Valuations down significantly. Corporates and consumers still robust. Sentiment already terrible, a contrarian positive. Whilst lower macro imbalances than prior makes this a typical ‘cyclical’ not ‘crisis’ downturn.

- But defensive. Economic risks remain high, with inflation sticky and central banks ever more aggressive. Consumer and corporate resilience is not open ended. A recession very possible. We focus core positions from healthcare to high dividend and less correlated markets like UK and Japan.

- Open to select opportunities in ‘quality risk’ as volatility gives attractive opportunities. Including big tech (with its defensive earnings), small caps (at historic valuation discounts), and crypto (adoption).

eToro ‘bear market recovery’ tracker

Key Views

| The eToro Market Strategy View | |

| Global Overview | Geopolitical risks alongside the Fed hiking cycle is boosting uncertainty and weakening markets. We see this as slowly fading, the global growth outlook secure, and valuations more compelling. Focus on cheap cyclical and defensive assets within equities, like Value, plus commodities, crypto. Relative caution on fixed income and the USD. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing GDP growth but still-resilient earnings growth. Valuations led market rout, and now at average levels, and are supported by peaked bond yields and high company profitability. Faster Fed hiking cycle is boosting recession risks. Focus on traditional cash-flows defensives, like healthcare and high dividend. Big-tech supported by structural growth outlook. See a gradual ‘U-shaped’ rebound as inflation falls. |

| Europe & UK | Favour defensive and cheap UK equities (‘Economies are not stock-markets’) over high risk/high return continental Europe. Recession risks high with Russia and energy crisis, threatening to overwhelm ‘buffers’ of rising fiscal spending (defence and refugees), low interest rates (slow to raise ECB), and weak Euro (50%+ sales from overseas). Equities partly cushioned by lack of tech, and 25% cheaper valuations vs US. Favour cheap and defensive UK over Continent. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. More cautious rest of EM on rising rates and strong USD. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Core positions as macro risks rise and bond yields are better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | Higher risk cyclical sectors, like discretionary (autos, apparel, restaurants), industrials, energy, and materials, are cheap and attractive in a ‘slowdown not recession’ scenario. Are sensitive to re-opening economies, resilient GDP growth, and higher bond yields, with depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Benefits from higher bond yields, charging more for loans than pay for deposits. Also one of cheapest P/E valuations, and room for large dividend and buyback yields. But is being outweighed by rising recession risks, with lower loan demand and higher defaults. Banks most exposed. Insurance and Diversifieds (like Berkshire Hathaway) least. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech themes. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Lower but above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil by slow return of OPEC+ supply and Russia 10% world supply problems. Gold helped by risk-aversion but held back by rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Clear supply rules a benefit as inflation high. Volatility still high, with the 16th -50% pullback of the last decade. Adoption and development continuing regardless. See Ethereum merge to Proof-of-Stake. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.