Summary

The Fed set for historic interest rate ‘lift-off’

The Fed will start a new interest rate upcycle this week. This could give nervous investors some certainty and relief, as seen in other countries. But we are venturing into the unknown with interest rates so low, a huge balance sheet, and record debt. Investors already expect 6 rate hikes this year, and some asset sales. We are positive global markets, with fundamentals under pressure but still secure.

Ukraine and stagflation downward drivers

Equities whipsawed by escalating Ukraine war, high commodity prices, and rising stagflation risks. US inflation hit new 7.9% high, ahead of Fed rate ‘lift-off’, and 10-year bond yield 2%. ECB cut GDP outlook to 3.7%, and its asset purchase support. Energy and defensives like utilities and REITs outperformed. China slashed GDP target to 5.5% and saw rising ADR-listing risks. We are positive markets. See latest presentation, video updates, and twitter @laidler_ben.

Stagflation fears are back

Commodity shock and Russia uncertainty drives fears of a toxic combination of inflation and less growth. Fears are real but overdone. Hedges real estate (XLRE) and ‘defensives’ (XLV).

Revenge of the old economy

Long-forgotten commodities (DJP) are surging. Tighter sanctions may boost prices short term, before demand destruction brings them lower. Food risks seem even higher than oil.

The commodities equity buffer

Commodities are driving many smaller equity markets higher, from Brazil (EWZ) to UK (ISF.L). Equities offer better risk/reward than physical commodities at these high prices.

Why so few stocksplits?

Amazon (AMZN) first stock split in 22yrs shines light on why others not also doing.

Bitcoin boost from US executive order

Bitcoin (BTC) prices were buffeted by the cross currents of high equity volatility and a positive US executive order on the crypto industry. This saw some XRP (XRP) relief. Whilst smart contract platform Polkadot (DOT) was helped by its rising institutional investor popularity.

Road to energy independence

Oil prices slipped back toward a still very high $110/bbl. on potential for new OPEC supply and Europe’s plans to cut energy dependence. Came despite the US ban on Russia energy imports. Stainless-steel ingredient nickel saw prices near double on a huge ‘short squeeze’.

The week ahead: Fed to raise interest rates

1) Ukraine to dominate markets, with focus on peace talks and escalating sanctions. 2) Fed will raise interest rates for first time since 2015. BoE for the 3rd time since Nov. 3) Earnings from FDX, CAN, and GME. 4) Friday’s ‘quadruple witching’ futures and options volume surge

Our key views: Spring-loaded for certainty

Geopolitical risks has added to high inflation and interest rate outlook risks. Markets seem spring loaded for lower uncertainty – from Ukraine or central banks – to allow the still resilient fundamentals to reassert. We focus on cheap and cyclical assets that benefit from good growth and still stubborn inflation: Value, commodities, crypto. We are cautious on bonds.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -1.99% | -5.16% | -9.34% |

| SPX500 | -2.88% | -4.85% | -11.79% |

| NASDAQ | -3.53% | -6.87% | -17.90% |

| UK100 | 2.41% | -6.60% | -3.10% |

| GER30 | 4.07% | -11.65% | -14.21% |

| JPN225 | -3.175% | -9.15% | -12.60% |

| HKG50 | -6.17% | -17.48% | -12.15% |

*Data accurate as of 14/03/2022

Market Views

Ukraine and stagflation risks whipsaw markets

- Equities whipsawed by the escalating Ukraine war, soaring commodity prices, and rising stagflation risks. US inflation hit new 7.9% high, ahead of the Fed’s interest rate ‘lift-off’ this week, and 10-year bond yields hit 2% again. The ECB cut its GDP growth outlook to 3.7%, and its asset purchase support. Energy and defensives, like real estate and utilities, outperformed. Chinese equities fell after the authorities slashed GDP growth target to 30-year low 5.5%. See Page 6 for our Resources guide of reports, webinars, presentations, videos, and twitter.

Stagflation fears are back

- The Ukraine crisis and spikes in economic uncertainty and commodities have rekindled ‘stagflation’ fears. Of a toxic combo of sharp economic slowdown and higher inflation. US growth proxies are falling sharply and inflation proxies moving higher. Google trends shows ‘stagflation’ searches at decade high.

- Consensus US GDP growth is 3.7% with 5% inflation. Both will worsen, but worst-fears may be overdone. Growth should be resilient, policymakers flexible, and markets adjusting quickly. Discretionary and Banks will bear brunt.

Revenge of the old economy

- Russia crisis compounded a tight commodity market and boosted inflation-hedge demand, after decade in investment wilderness. Tighter sanctions may boost prices short term, before demand destruction brings them lower.

- Russia and Ukraine are big cereal and fertilizer producers, and impact could be more severe than better-known energy dependence. Food security even more fundamental, and difficult. Harvests less frequent. Storage more complex. Emerging markets (EEM) are especially exposed.

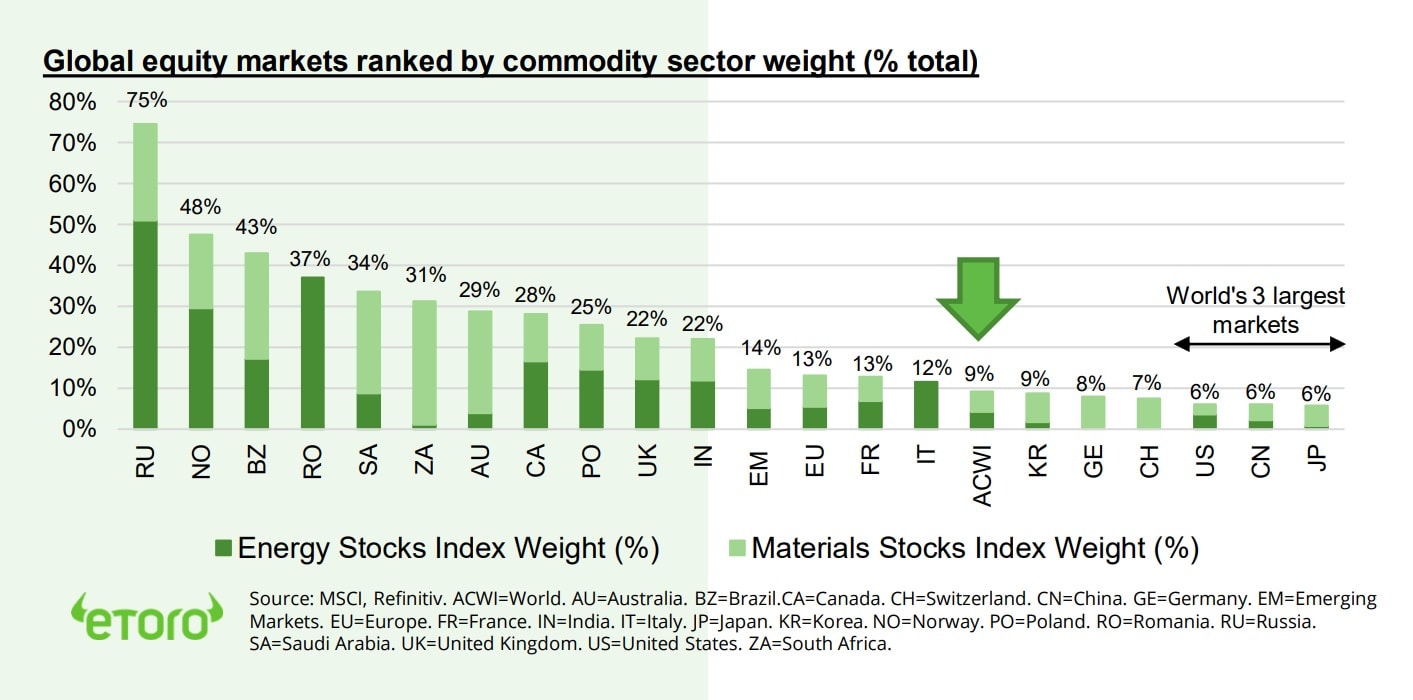

Global equity markets ranked by commodity sector weight (% total)

The commodities equity buffer

- The world’s best (or least bad) performing equity markets this year, from Brazil (EWZ) to UK (ISF.L), have one common denominator. A big commodity stock weight (see chart). These have followed commodities up. Global equities missed this as the world’s 3 largest markets (US, Japan, China) have low commodity exposures.

- We see high-for-longer commodity prices, but more volatility at these very high prices. Related stocks have better risk/reward than physical, with low valuation and break-even buffers.

Why so few stocksplits?

- Amazon (AMZN) announced a 1:20 stock split, its first since 1999, and investors responded by bidding its stock up 5%. They follow other mega caps like Alphabet (GOOGL) last month, and both Apple (AAPL) and Tesla (TSLA) in 2020.

- But these are rare exceptions. Despite soaring average prices of S&P 500 stocks in the past decade the number of them doing splits has plunged. We think this reflects an over-focus on institutional investors and further overlooks the rising importance of individual retail investors.

- A stock split helps broaden the investor base, and boost tradability, amongst advantages.

Bitcoin boosted by US executive order

- Bitcoin slipped back below $40,000 as crypto assets were buffeted by the cross-currents of heightened correlation with a weak equity markets versus a constructive US crypto industry executive order. This boosted the US crypto regulation and CBDC outlook. XRP (XRP) seen to benefit from this constructive US view.

- Smart contract platform Polkadot (DOT) was resilient as fund analysis data showed it the most commonly held altcoin by institutional investors. In Q4 it was held by 42% of venture capital and hedge funds. Institutional adoption is a key medium term crypto asset driver given the already high retail investor ownership.

Road to energy independence

- Brent oil prices slipped towards a still-high $110 as key OPEC member UAE mooted a potential group production increase and the EU outlined plans to reduce its Russian energy dependence. This offset a US ban on Russian energy imports, equal to 8% of US consumption. Brent oil prices are up over 60% in the past year.

- Nickel prices near doubled last week on a huge ‘short-squeeze’, exacerbated by Russia supply disruption fears. It is largely used to make stainless steel, but also batteries and coinage.

- We think commodities remain in a ‘sweet spot’ of robust demand, tight supply, and increased investor demand for inflation-hedge assets.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -3.74% | -7.73% | -18.92% |

| Healthcare | -2.70% | -2.02% | -10.58% |

| C Cyclicals | -2.88% | -7.66% | -17.55% |

| Small Caps | -1.06% | -0.07% | -10.89% |

| Value | -0.05% | -2.49% | -11.83% |

| Bitcoin | -2.24% | -9.04% | -18.60% |

| Ethereum | -2.32% | 13.35% | -31.86% |

Source: Refinitiv

The week ahead: Fed to raise interest rates

- The escalating Ukraine crisis, the still building sanctions response, and the lack of peace talks progress. Commodity prices are the key market barometer. Global risks are two-sided.

- Global central banks are in focus. The US Fed is set to raise interest rates (Wed.) by 0.25%, in its first hike since 2015. Also its new ’dot plot’ of macro expectations. Whilst the Bank of England will raise rates for the 3rd time (Thu.). Dovish Bank of Japan to stand pat on Friday.

- The earnings are light, with trade proxy Fedex (FDX), professional services giant Accenture (CAN), originalmeme stock GameStop (GME).

- Third Friday in March see’s one of the highest market volume days of year with ‘quadruple witching’ futures and options expiry.

Our key views: Spring-loaded for certainty

- Escalating geopolitics added to risks from high inflation and a interest rate outlook. Markets seem spring-loaded for lower uncertainty – from Ukraine or March 16th Fed meeting – to allow the fundamentals to reassert themselves.

- Earnings are key focus. Q4 results were strong and economies are reopening. This should offset valuation pressures. They have fallen significantly, and Fed risks are better priced.

- Focus on cheap and cyclical assets that benefit from good growth and stubborn inflation: Value, commodities, crypto. Cautious on bonds.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -0.50% | 15.01% | 27.45% |

| Brent Oil | -5.02% | 17.90% | 43.85% |

| Gold Spot | 0.88% | 7.08% | 8.84% |

| DXY USD | 0.48% | 3.17% | 3.29% |

| EUR/USD | -0.18% | -3.83% | -4.03% |

| US 10Yr Yld | 26.54% | 5.46% | 48.42% |

| VIX Vol. | -3.85% | 12.39% | 78.57% |

Source: Refinitiv. * Broad based Bloomberg commodity index

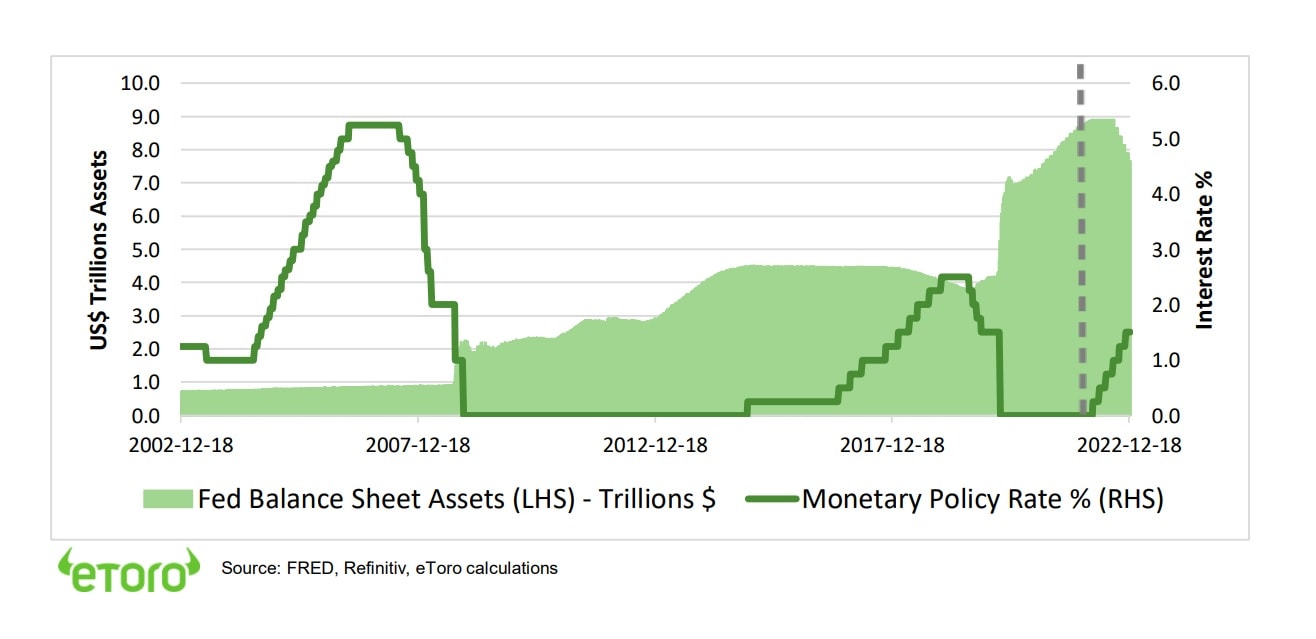

Focus of Week: An unprecedented Fed rate hike

March 16th start of Fed interest rate upcycle could give the market certainty and relief

The US federal reserve is to raise interest rates on March 16 for the first time since 2015. This could be a contrarian relief, after the constant debate of recent months, and with expectations well-adjusted. Futures are pricing six hikes this year, versus none as recently as September. But the risks are high, with Ukraine ‘stagflation’ uncertainties, the extraordinary low-rate level, and huge size of the Fed balance sheet. We are positive markets, with fundamentals pressured but secure, valuations cheaper, and sentiment terrible.

Venturing into unknown with low interest rates, huge balance sheet, and record debt

The Fed is walking a tightrope of tightening already-tightening US financial conditions and cooling the already cooling economy to ease inflation. This is difficult at the best of times. But unprecedented this time. Interest rates are at zero, a level rarely seen before. The Fed balance sheet is a gargantuan $9 trillion. Whilst global debt levels – and therefore the sensitivity to higher interest rates – has never been higher.

What to expect. Six rate hikes this year, and a smaller balance sheet

Futures are expecting six 0.25% hikes this year from the remaining seven Fed meetings. Then a further two hikes in 2023, with this cycle ending at 2.0%. That would make it one of the shallowest and shortest in history. The Fed will then begin to shrink its huge $9 trillion balance sheet, of treasury and mortgage bonds. All-else equal this will push up bond yields, as the Fed sells rather than buys. They will be eager for this. An inverted yield curve, with long term yields below short term, has been a strong recession indicator.

Expect to see some relief. Lessons from over 20 banks that have already started

Global central banks are on track to raise interest rates over 250 times this year, on top of the 113 times last year. Only China is cutting rates globally. So, the Fed has plenty of company. Market reaction to other central banks starting the cycle has been of relief. The hike was expected to hike. It reduces uncertainty.

We are positive global markets, with fundamentals pressured but secure.

We believe global economic fundamentals are pressured but secure. The most impacted, like Europe, have unique support buffers. The hit to growth is coming when it is already high, and economies reopening from omicron. The US economy grew 7% last year and company profits by 31% in the fourth quarter. Inflation risks are already high and central banks are already responding in many markets. Growth impacts on Europe will be buffered by the weak Euro, more fiscal spending, and a zero-bound ECB. We are focused on cheaper and faster growing segments like UK, Europe, and China, as well as commodities and financials.

US Federal Reserve interest rate (%) and balance sheet assets ($) outlook

Key Views

| The eToro Market Strategy View | |

| Global Overview | Geopolitical risks alongside the Fed hiking cycle is boosting uncertainty and weakening markets. We see this ultimately fading, and the global growth outlook secure, and valuations more compelling. Focus on reflation and cyclical assets: equities, commodities, crypto, small cap and value. Relative caution fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing strong c4% GDP growth and with room for more earnings upside surprises. Valuations have now fallen back to average levels, and are well supported by still-low bond yields and high company profitability. Fed interest rate risks are now well-priced. See cyclicals and value catch-up, after a decade of underperformance, whilst big-tech is supported by its structural growth outlook. Now see overseas markets leading. |

| Europe & UK | Region is being buffeted by proximity and exposure to the Ukraine crisis. See secure outlook with 1) Europe’s strong macro ‘buffers’ of rising fiscal spending (defence and refugees), zero-bound interest rates (‘dovish’ ECB), and a weak Euro (50%+ company sales from overseas). Equity markets helped by 2) a greater weight of cyclical sectors, and lack of tech, 3) 25% cheaper valuations vs US, 4) decade of underperformance make under-owned by global investors. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China outlook improving as cuts interest rates (opposite of rest of world) reducing slowdown and property sector risks, focuses on stability ahead of 20th Party Congress, and with valuations now 45% cheaper than US and market heavily out of favour. Will support EM, but is exposed to Fed tightening. China recovery also helps global sectors from luxury to materials. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Consumer staples, utilities, real estate offer more defensive cash flows, less exposed to economic growth. Makes them more sensitive to rising bond yields. Expect them to underperform in a more cyclicals focused environment with earnings strong and yields rising. Healthcare is more attractive, with cheaper valuations and more growth. |

| Cyclicals | We expect cyclicals – industrials, energy, and materials, to lead performance. Are most sensitive to re-opening economies, still strong GDP growth, and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and been out-of-favour for many years. Consumer cyclicals face commodity headwinds. |

| Financials | Financials will benefit from strong GDP growth, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators giving flexibility to pay large 8-10% dividend and buyback yields. Most have zero Russia exposure. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | In ‘sweet spot’ of robust GDP growth, ‘green’ industry demand, years of supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply and Russia 10% world supply problems. Gold helped by risk-aversion but held back by rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| Italy | Gabriel Dabach |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.