Summary

Housing key to inflation and the consumer

eToro housing ‘misery index’ soared, with high prices and mortgage rates. Market now cooling. This will help inflation, as biggest weight in inflation basket. But is also a consumer anchor, and very different from 2008 housing crash. A house is consumer’s largest asset. But housing slowdown just begun, pressuring ‘value chain’ from construction materials and homebuilders to brokers and mortgage specialists.

Markets fall under Fed pressures

Equities hurt, unwinding 60% June rally gains. Hit by hawkish Fed interest rate outlook, new China growth and covid fears, and 9.1% EU inflation. US 10-year bond yields surged. US dollar broke key levels vs GBP and JPY. Nvidia (NVDA) hit by China chip restrictions. Snap (SNAP) by 20% headcount cut. Tencent (0700.HK) $15 billion divestments. ECB rate hike the key this week see presentation, video updates, and twitter @laidler_ben.

Don’t sweat the seasonality

September famously seen worst S&P 500 returns of year, -1.0% since 1928. Adds to cautious market narrative. Yet nothing this year average. We don’t think seasonality is either.

Saving Europe’s winter

Europe’s natgas prices surged to 12 times the price last year. Guarantees 10%+ inflation and recession in Europe. But room to fall with 80% storage, lower demand, mild winter.

The impact of Apple

Apple (AAPL) world’s largest publicly traded stock in world. Focus on ‘Far Out’ product launch event, for 100+ company supply chain. But market breadth healthily growing.

Global drought makes water ‘blue gold’

US, Europe, and China all seeing big drought. Drives ag prices and water scarcity theme, from AWK to WTS and @Food-Tech.

Crypto assets under equity pressure

Crypto remains pressured by high correlation with equity market weakness. Was the worst performing asset class in August. Ethereum (ETH) resilient ahead of Sept. 6 Bellatrix upgrade, and then ‘merge’ to proof of stake. Polygon (MATIC) helped by positive NFT marketplace OpenSea and Robinhood (HOOD) supports.

Commodity slump on US dollar and China

Broad price slump as the US dollar rose and China growth fears returned. EU natgas prices fell as bloc reached 80% storage capacity fill, with impacts to ETS carbon and US natgas. Uranium (URA) rare standout as governments reconsider closures as energy crisis continues.

The week ahead: Agenda is heating up

1) ECB to raise rates (Thu) a big 0.75% as inflation surged to 9.1%. 2) OPEC+ talked supply cuts with Brent oil now under $95/bbl. 3) US earnings from GME, KR, CASY to PATH, ZS. 4) New UK prime minister to be announced (Mon). 5) US markets closed for labour day holiday (Mon).

Our key views: Inflation remains the focus

Easing US inflation key to sight of an end to Fed rate hikes and less recession risk. Supports from both resilient consumers and corporates, But recovery likely U not V shaped. Gradually lower inflation will be a bumpy ride but slowly de-risks market. Would allow higher-risk assets, big tech to crypto, alongside core defensives.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -2.99% | -4.53% | -13.81% |

| SPX500 | -3.29% | -5.33% | -17.66% |

| NASDAQ | -4.21% | -8.11% | -25.66% |

| UK100 | -1.97% | -2.13% | -1.40% |

| GER30 | 0.61% | -3.86% | -17.84% |

| JPN225 | -3.46% | -1.86% | -3.96% |

| HKG50 | -3.56% | -3.71% | -16.86% |

*Data accurate as of 05/09/2022

Market Views

Markets fall under Fed pressures

- Equities hurt, with S&P500 now unwound 60% June rally and now below 50-day moving average. Hit by hawkish Fed interest rate outlook, new China growth and covid fears, and 9.1% EU inflation. US 10-year bond yields surged. US dollar broke key levels vs GBP and JPY. Nvidia (NVDA) hit by China chip restrictions. Snap (SNAP) 20% headcount cut. Tencent (0700.HK) $15 billion divestments. ECB hike key this week.

Don’t sweat the seasonality

- September famously seen worst S&P 500 returns of the year. These average a -1.0% fall since 1928 (see chart), with a ‘down’ month 54% of the time. This adds to already cautious market narrative. Yet, nothing about this year has been average. So we don’t think seasonality should be either.

- More determinant to our half full view would be a cooling labour market, inflation and outlook for a less aggressive Fed. For those unconvinced on fundamentals, September is traditionally followed by a +0.4% positive October and a +7.5% average 1-year forward return.

Saving Europe’s winter

- Europe’s natgas prices surged to 12 times the price last year. After Russia cut its supply of 40% Europe’s needs. This near guarantees double digit inflation and a recession in UK and Europe this year. Authorities are now responding with significant spending support, gas price caps and regulatory change, rationing, and windfall taxes.

- Local natgas prices will stay well above long term averages but could fall sharply from recent peaks. Gas storage levels are above average, demand is falling, and a mild winter forecast. This would have impacts, from carbon ETS to US natgas.

The impact of Apple

- Apple (AAPL) is the largest publicly traded stock in the world. Its $2.5 trillion market cap is $300 billion ahead of no.2 Saudi Aramco (SAOC). The difference alone equals the value of Chevron (CVX) or Home Depot (HD). Apple has 7% weight in S&P 500. More broadly, the top-10 S&P 500 stocks represent 28% the index, one of highest concentrations ever.

- This makes next week’s new product event a must watch both for Apple and its massive global supply chain, from Amkor (AMKR) to Corning (GLW). Yet it is not the biggest stocks that have been leading the market recently. This is both a welcome victory for market breadth and for diversification.

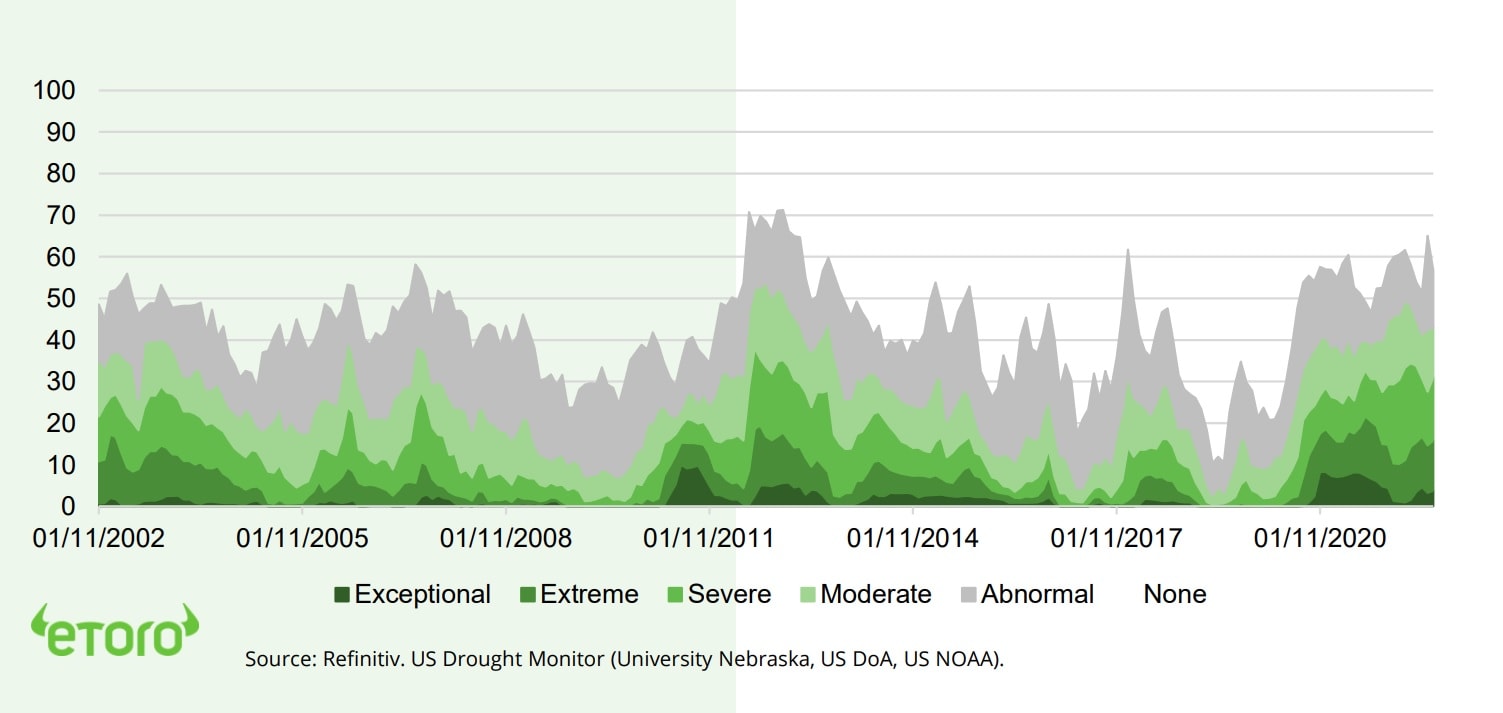

Global drought makes water ‘blue gold’

- 60% US is seeing drought, the most in a decade, and double average. Similarly, 64% UK and Europe is under a drought warning or alert. China is seeing its worst heatwave and drought in six decades.

- Investment impacts are widespread, from rising food prices (Wheat, Cotton) to a longer-term focus on water usage and pricing. Less than a estimated 0.5% of the world’s water is available fresh water, leading some to call it ‘blue gold’. See related water stocks AWK to WTS and @Food-Tech.

Percent of US in drought conditions (%, 20-years)

Crypto falls back with equity sell off

- Crypto assets remained under pressure, driven by high correlation to broader equity sell-off, and after earlier leading gains. Bitcoin was the worst performing major asset in August, falling 15% and now near the key $20,000 level again.

- Ethereum (ETH) was resilient, above $1,500, as it approaches the September 6th Bellatrix upgrade. This is a key precursor to the key ‘merge’ catalyst to proof-of-stake (PoS) later in the month.

- Polygon (MATIC) bucked the asset class downtrend, as OpenSea and Robinhood (HOOD) announced support initiatives. Meta (META) to allow NFT and collectibles posting on Facebook.

Commodities slump on US dollar and China

- Commodity prices broadly slumped under the double impact from continued US dollar strength and China growth concerns. PMI data their was weaker than feared and 21 million mega-city Chengdu saw a new covid lockdown.

- European natural gas prices fell back as the key 80% storage level was met. Came even as the Nord Stream I pipeline saw a total shutdown. This also drove a fall back in EU ETS carbon prices and a smaller fall in US natgas prices.

- Uranium (URA) prices were a rare positive standout, as authorities from California to Japan now look more positively on the nuclear industry as the global energy crisis deepens.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -4.61% | -9.12% | -27.66% |

| Healthcare | -2.06% | -5.77% | -13.81% |

| C Cyclicals | -2.96% | -6.57% | -24.98% |

| Small Caps | -4.74% | -5.20% | -19.40% |

| Value | -2.63% | -3.24% | -11.86% |

| Bitcoin | -3.77% | -15.28% | -57.99% |

| Ethereum | 0.35% | -5.62% | -58.05% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: agenda heating up again

- Likely hawkish 0.75% ECB 2nd interest rate hike (Thu) the highlight as battles 9.1% inflation, the swooning Euro, and a likely coming recession.

- Oil focus as OPEC+ considers a possible Saudi led supply cut to offset the weaker demand outlook and with Brent prices down at $95/bbl.

- Tech and consumer earnings from meme favourite GME, supermarket KR, convenience CASY, automation PATH, and cybersecurity ZS.

- New UK prime minister (Mon) with foreign secretary Truss expected to beat ex-chancellor Sunak, with an emergency budget then likely.

- End of summer US labour day holiday (Mon), in place since 1894, Financial markets closed.

Our key views: Inflation remains the focus

- Easing US inflation key to sight of end to Fed rate hikes and easing of recession risks. Market supports in the meantime from both resilient consumers and corporates, But recovery to be U not V shaped. Gradually lower inflation will be a bumpy ride but it would slowly de-risk markets and allow room for more higher-risk assets, from big tech to small cap and crypto.

- Focus on core cheap and defensive assets to be invested in this ‘new’ world, of higher inflation and lower growth, and to manage still high risks. Sectors, like healthcare, defensive styles like div. yield, and related UK to China markets.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -4.41% | 1.06% | 20.10% |

| Brent Oil | -5.73% | -0.34% | 19.68% |

| Gold Spot | -2.78% | -4.71% | -5.89% |

| DXY USD | 0.74% | 2.80% | 14.21% |

| EUR/USD | -0.12% | -2.26% | -12.48% |

| US 10Yr Yld | 15.61% | 36.46% | 168.52% |

| VIX Vol. | -0.35% | 20.43% | 47.91% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Housing market key to inflation and the consumer

Housing costs are the biggest portion of the inflation basket, and is also a big consumer support

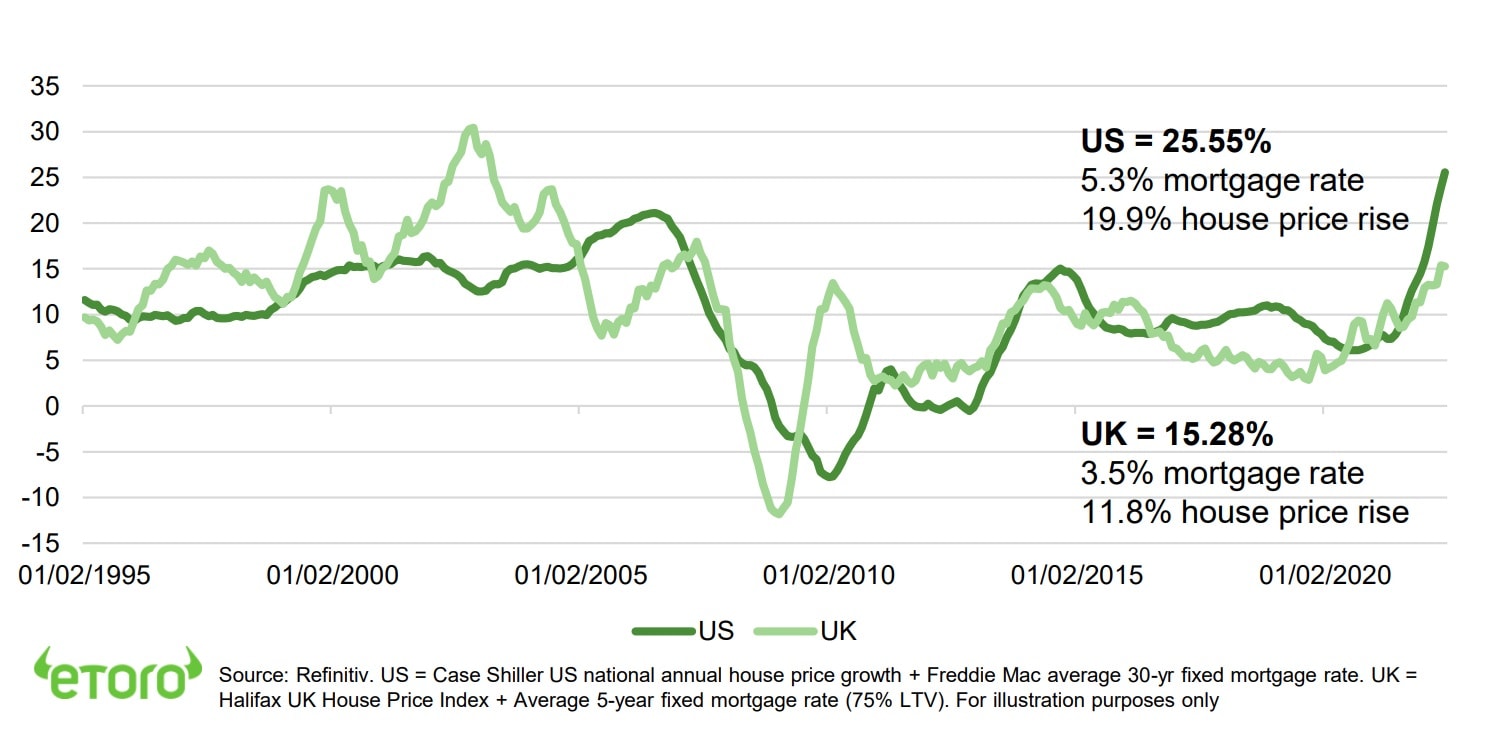

Housing market a linchpin of the inflation outlook, and the resilience of the consumer. Our housing ‘misery index’ is near records, with prices high and mortgage rates rising. We see a healthy cooling not a crash, with housing better supported than in 2008. It represents 30% the US inflation basket, by far its largest component. Lower house prices will pass into headline inflation (CPI) with an approximate six-month lag. CPI does not track house prices but ‘owners equivalent rent’, a polling of households for their rent data.

eToro housing ‘misery index’ has soared. Prices are high and mortgage rates rising

eToro’s housing ‘misery index’ is at multi-decade highs (see chart). This is a proxy for the difficulty facing new home buyers, key to the housing chain. Also, the pressure on the rental market. It is calculated by adding national housing price growth to the average mortgage rate. US growth is plateauing at a huge +20% year-over-year. A typical 30-year fixed mortgage rate has doubled off its 2021 low. In the UK, house price growth has started to ease, to 11.8%. Whilst a 5-year fixed mortgage rate has doubled from 2021 low.

Housing is a big deal for the whole economy, but unlikely to drag it down this time

The sector is a big portion of the economy, but without the imbalances that drove the 2008 global financial crisis. Housing is around 17% of US GDP. This is split between construction and remodelling at 5%, and housing services, which includes rental payments, at 12%. But we see a housing slowdown, not a crash rerun of the 2008 housing bust This precipitated the global financial crisis and saw average home prices fall 20%. Housing supply is lower now, consumer balance sheets better, and lending standards tighter.

A consumer’s largest asset is their house, with a strong impact on confidence

A housing slowdown will dampen consumer confidence, the ‘wealth effect’, and spending. The consumer drives 70% of US GDP, and a house is the largest asset at 25% of total. This is bigger than financial investments (20%), business interests (20%), or retirement accounts (15%). Country differences also matter. Home ownership ranges from 90%+ in eastern Europe, to 65% in US and UK down to 50% in Germany. Similarly, with financing. More exposed shorter-term variable rate mortgages are more common in Europe.

The housing ‘value chain’ stretches across the stock market, and is suffering

Lumber prices are down 65% from 2022 peaks, with 90% US houses timber built. Homebuilder stocks (like DHI, LEN, PHM) are down 30% this year. Impacted segments stretch from construction materials (VMC, MLM), to selling brokers (HOUS, RDFN), mortgage specialists (RKT, INTU), investors (EQR, NYMT), and more.

US and UK housing ‘misery index’ (annual price rise + mortgage rate) has surged

Key Views

| The eToro Market Strategy View | |

| Global Overview | Geopolitical risks alongside the Fed hiking cycle is boosting uncertainty and weakening markets. We see this as slowly fading, the global growth outlook secure, and valuations more compelling. Focus on cheap cyclical and defensive assets within equities, like Value, plus commodities, crypto. Relative caution on fixed income and the USD. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing GDP growth but still-resilient earnings growth. Valuations led market rout, and now at average levels, and are supported by peaked bond yields and high company profitability. Faster Fed hiking cycle is boosting recession risks. Focus on traditional cash-flows defensives, like healthcare and high dividend. Big-tech supported by structural growth outlook. See a gradual ‘U-shaped’ rebound as inflation falls. |

| Europe & UK | Favour defensive and cheap UK equities (‘Economies are not stock-markets’) over high risk/high return continental Europe. Recession risks high with Russia and energy crisis, threatening to overwhelm ‘buffers’ of rising fiscal spending (defence and refugees), low interest rates (slow to raise ECB), and weak Euro (50%+ sales from overseas). Equities partly cushioned by lack of tech, and 25% cheaper valuations vs US. Favour cheap and defensive UK over Continent. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. More cautious rest of EM on rising rates and strong USD. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Core positions as macro risks rise and bond yields are better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | Cyclical sectors, like consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, are cheap and attractive in a ‘slowdown not recession’ scenario. Are sensitive to re-opening economies, resilient GDP growth, and higher bond yields, with depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Benefits from higher bond yields, charging more for loans than pay for deposits. Also one of cheapest P/E valuations, and room for large dividend and buyback yields. But is being outweighed by rising recession risks, with lower loan demand and higher defaults. Banks most exposed. Insurance and Diversifieds (like Berkshire Hathaway) least. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech themes. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | In ‘sweet spot’ of robust GDP growth, ‘green’ industry demand, years of supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply and Russia 10% world supply problems. Gold helped by risk-aversion but held back by rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Clear supply rules a benefit as inflation high. Volatility still high, with the 16th -50% pullback of the last decade. Adoption and development continuing regardless. See Ethereum merge to Proof-of-Stake. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.