Summary

DIY investors more important than ever

Our global survey shows DIY investors leaning against bull market narrative, in their latest contrarian move, as recession fears now outpace both inflation and interest rate risks. They own a ‘barbell’ of tech winners and cheap energy and bank laggards. Their numbers have grown 23% the past two years, and own c50% more equities than average. They are young, tech savvy, and are investing for the long term, but differences across the 13 countries are big.

Markets regain their footing

Markets regained traction and closed a big June. As Russia mutiny fizzled and investors ignored hawkish ECB’ Sintra central banker meet. 1H saw NASDAQ-100 surge +38% and S&P 500 +16%. AAPL hit a record $3 trillion market cap., and US banks gained after passing annual ‘stress tests’. Semis hurt by coming new US-China curbs. RIDE bankruptcy filed.See Q2 Outlook HERE. Video updates, twitter @laidler_ben.

The path of least resistance

Look for positive but cooler returns. July tests are a rally validation from Q2 earnings and final Fed rate hike, with eye also on potential wild cards from commodities and Japan.

VIX has been a ‘widow-maker’

Equity volatility plunged to a post-covid low with VIX ‘fear gauge’ down 40% this year. Been a ‘widow-maker’ trade so far, but we see as a cheap hedge with upside risks.

Crypto moving to its own beat

Crypto surged again, with Bitcoin to $30,000 and up 80% this year. Helped by BLK spot ETF filing and EDX launch. @CryptoPortfolio.

Hurricane season silver lining

El Niño to strengthen, bringing weather and ag disruption But silver lining may be a weaker Atlantic hurricane season, a relief to gasoline, LNG, and reinsurer markets.

Bitcoin holds on to its big gains

BTC held on to its $30,000 level, up 80% this year, as MSTR added to position and Fidelity latest to consider spot ETF. Memes DOGE and SHIBxM and altcoins ADA and MATIC saw profit taking, as Binance crackdown spread to Europe. Saw more reg progress with UK finance bill signed and the EU ‘digital euro’ framework launched.

Commodities hit from all sides

Saw a triple-whammy of more China growth disappointment, Russia mutiny fizzle, and dollar strength. Grain prices led weakness, with wheat down 10%. But live cattle hit an all-time-high on smaller herds and higher costs. Energy in focus ahead of the OPEC global seminar and Buffett increasing BRK stake in OXY to 25%.

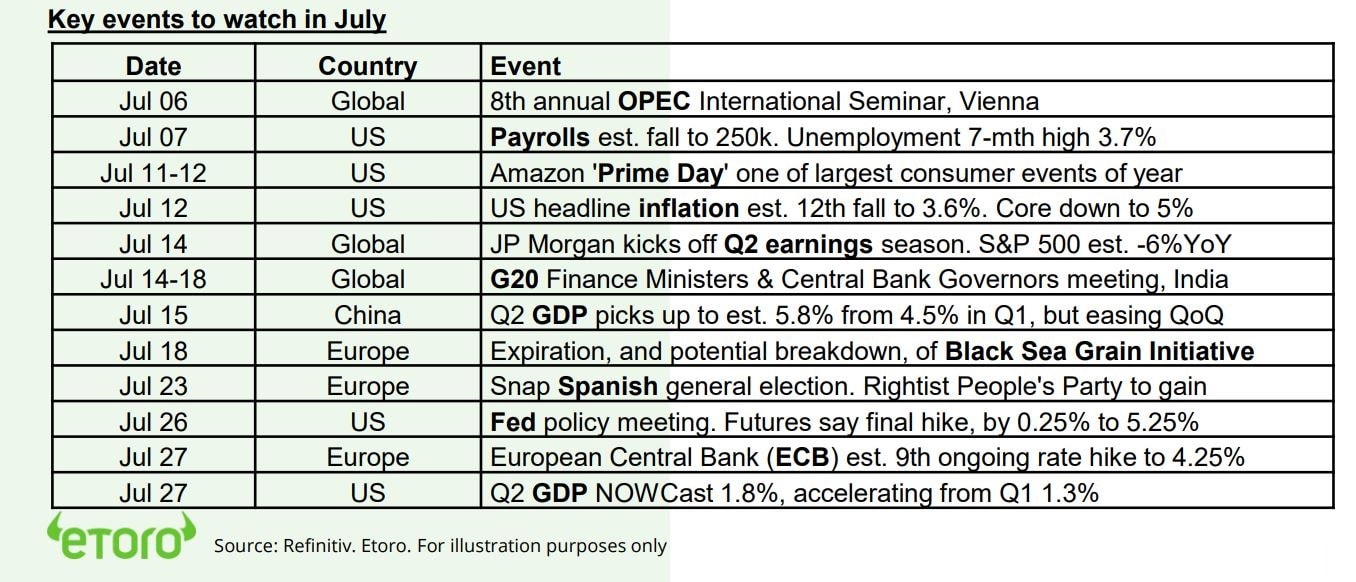

The week ahead: July 4th, jobs report, Fed

1) US Independence Day holiday (Mon/Tue).

2) US focus on FOMC meeting minutes and Friday’s jobs report.

3) Globally on weak China PMIs, Australia RBA rate hike, and OPEC energy seminar.

4) Quiet earnings led by LEVI and SZU.DE ahead of July 14 Q2 kick off.

Our key views: A goldilocks moment

Markets boosted by resilient economic growth and gradually easing inflation pressure, and now capitulating investor sentiment. Coming growth slowdown hurts earnings. But low yields help valuations. Focus on cheap and defensive assets from healthcare to big tech. More cautious on growth exposed cyclicals and banks.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 2.02% | 1.91% | 3.80% |

| SPX500 | 2.35% | 3.92% | 16.91% |

| NASDAQ | 2.19% | 4.13% | 31.73% |

| UK100 | 0.93% | -1.00% | 1.07% |

| GER30 | 2.01% | 0.60% | 15.98% |

| JPN225 | 1.24% | 5.28% | 27.19% |

| HKG50 | 0.14% | -0.18% | -4.37% |

*Data accurate as of 03/07/2023

Market Views

Markets regain their footing

- Markets regained traction and closed out a very strong June, Q2, and 1H. As the Russia mutiny fizzled and investors ignored more hawkish talk from ECB’ Sintra global central banker meet. AAPL hit a record $3 trillion market cap., and US banks gained after passing annual ‘stress tests’. Semis held back by coming new US-China curbs, and RIDE filed for bankruptcy. See our Q2 Outlook HERE.

The path of least resistance

- We see cooler Q3 returns. As markets digest big gains and prep for strong finish to year. Summer seasonality is weaker, volatility low, and growth slowdown to come. Are positive as fundamentals ‘less-bad’ and sentiment cautious. Path of least resistance is up, and any weakness be bought.

- July tests are a rally validation from Q2 earnings and a possible final Fed rate hike, with half an eye also on potential wild cards from commodities and Japan. We focus on long duration and defensive growth assets from tech to healthcare to bonds and crypto, and clear of ‘value-trap’ cyclicals, small caps, commodities.

VIX has been a ‘widow-maker’

-

- Equity volatility plunged to a post-covid low on both sides of the Atlantic. VIX ‘fear gauge’ is down near 40% this year, well under its own long term average levels, and diverging from fixed income volatility This reflects both the equity rally and less-bad macro environment. Many have seen it as a source of ‘cheap’ downside protection as global growth and inflation risks stay elevated.

- Has made short VIX positions a ‘widow-maker’ trade all year as volatility kept falling despite US banks scare and debt ceiling showdown. We expect some VIX reversal. The economic slowdown remains ahead of us, summer seasonality poor, and VIX futures at a record premium to spot.

Crypto moving to its own beat

- Crypto surged again, with Bitcoin back to $30,000 and up 80% this year. BTC led as SEC crackdown on altcoin ‘securities’ drove performance wedge in asset class and took market cap dominance to two year high near 50%. Crypto’s $1 trillion market cap is by far world’s smallest asset class but led all year.

- The crypto correlation with tech stocks has recently collapsed, making the latest gains all crypto. Driven by institutional adoption hope, with BlackRock’s spot ETF application, and new exchange from TradFi heavyweights. This is positive after 2022’s ‘winter’ and ahead of next’s bitcoin halving and coming regulatory clarity, including EU’s MiCA implementation. @CryptoPortfolio.

Hurricane season silver lining

- El Niño likely to strengthen into winter. Typically brings weather and ag commodities disruption But silver lining often weaker Atlantic hurricane season. Only three major storms are expected.

- It’s threat to gasoline, LNG, and insurance markets . Refiners (MPC to VLO) and LNG exporters (LNG to NFE) clustered on exposed gulf coast. Reinsurers (SREN.ZU to MUV2.DE) watch Florida, a $1.5 trillion state economy similar in size to Spain.

Bitcoin holds on to its big gains

- BTC held on to the $30,000 price level and its asset class leading 80% gains this year. Sentiment helped by MSTR further increasing its holding, and by asset management giant Fidelity also considering a spot BTC ETF application.

- Memes DOGE and SHIBxM, and newly designated ‘securities’ (by SEC) ADA and MATIC saw profit taking. Whilst regulatory crackdown on Binance exchange seemingly spread from US to Europe.

- Regulatory progress with UK finance bill signed, classifying crypto as a regulated activity, and EU publishing a legal framework for a ‘digital euro’.

Commodities hit from all sides

- Broad commodity markets fell sharply, taking their YTD fall back over 10%. Hurt by a triple whammy of continued China reopening demand disappointment, fizzling of Russia’s mercenary mutiny, and renewed US dollar strength.

- Grain prices were especially hurt, with wheat falling over 10%, as chances of ag supply disruption from the key Black Sea area of southern Russia and Ukraine eased quickly.

- Live cattle prices hit a new all-time-high, up 35% in the past year on the combination of shrinking herd sizzes and higher input and feed costs.

- Energy focused on the upcoming 8th OPEC energy seminar and BRK latest OXY stake raise, to 25%.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 2.50% | 5.14% | 39.34% |

| Healthcare | 0.52% | 5.00% | -1.26% |

| C Cyclicals | 2.77% | 9.89% | 26.86% |

| Small Caps | 3.68% | 6.87% | 7.24% |

| Value | 2.64% | 5.34% | 0.71% |

| Bitcoin | -1.47% | 9.20% | 83.66% |

| Ethereum | 1.31% | 0.73% | 60.79% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Independence Day, Fed minutes

- It’s a holiday shorted trading week with the US stock exchanges closed from 1pm Monday (July 3rd) until 9am Wednesday (July 5th) to celebrate the July 4th, 1776, US declaration of independence.

- The US data focus is latest FOMC minutes (Wed), when Fed paused its rate increases after 10 hikes, and latest non-farm payrolls (Fri), est. to fall to an 18-month low 200,000 and curb inflation fears.

- Global focus latest China PMI’, with the composite est. 55, as reopening rebound disappoints, and authorities forced to cut interest rates. Also est. RBA hike (Tue), after June’s unexpected raise.

- Company earnings reports are light, with LEVI, SZU.DE, CHR.CO, and FABG.ST. Comes ahead of the soon June 14th start of Q2 reporting season with S&P 500 earnings est. to fall 6% vs last year.

Our key views: A goldilocks moment

- Markets being boosted by combination of resilient economic growth, helping earnings, and slowly easing inflation, helping valuations. The capitulation of very bearish investor sentiment is an additional, and recent, big technical driver.

- See a V-shaped market recovery with plenty bumps in road. Faster slowdown hurts earnings. But lower bond yields helps valuation. Focus on cheaper and more recession defensive assets, from healthcare to derated big tech. More cautious on assets most exposed to recession risk, like cyclicals, small caps, and commodities. Or lower yields, like banks.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -0.85% | 1.66% | -10.04% |

| Brent Oil | 0.86% | -1.58% | -12.56% |

| Gold Spot | -0.13% | -1.86% | 5.34% |

| DXY USD | 0.02% | -1.05% | -0.58% |

| EUR/USD | 0.17% | 1.90% | 1.79% |

| US 10Yr Yld | 10.20 | 14.41 | -3.60 |

| VIX Vol. | 1.12% | -6.92% | -37.29% |

Source: Refinitiv. * Broad Bloomberg index. * Basis point

Focus of Week: Retail investors contrarian again

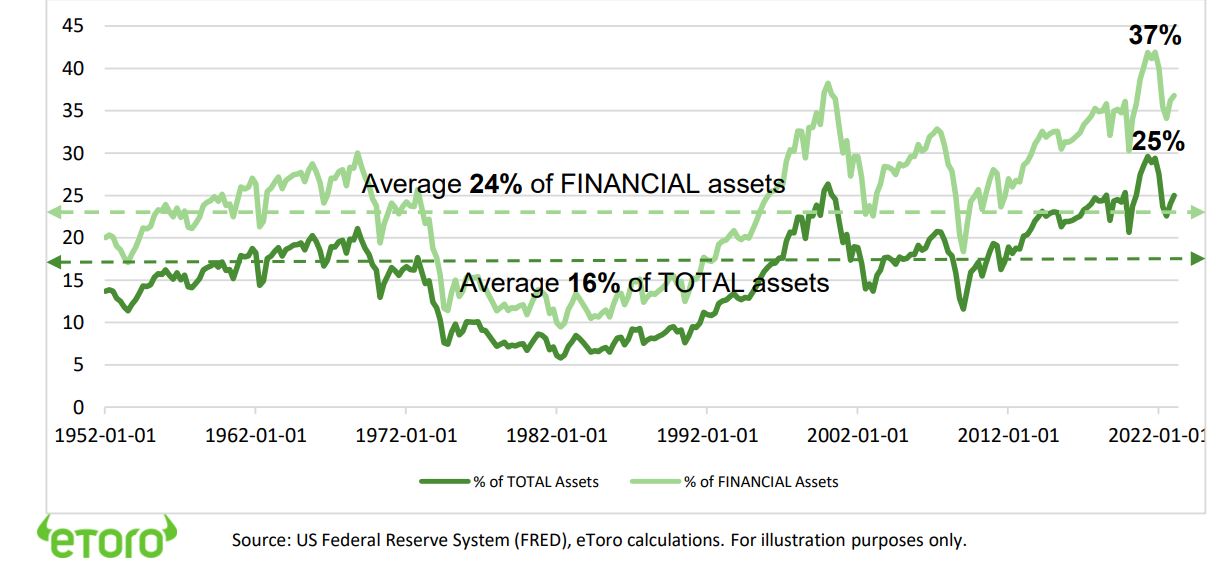

Retail investors more important than ever, and now leaning against the bull market narrative

Our latest global survey shows DIY investors now more worried about recession than anything else, leaning against the building consensus bull market narrative, and being contrarian again after being early buyers of the October 2022 low. There are now many more of them, they are more important than ever to markets, but are not homogenous! We again surveyed 10,000 investors from US to Australia and across Europe to fill the yawning gap in understanding of retail investors. 23% of them are new to markets in just the past two years. Whilst US household investments in equities are 50% above long-term average levels.

Investors now worrying most about the coming economic slowdown, not recession or rates

They were early into the stocks rebound from October low but are now turning more cautious, with just 11% believing we have entered a new bull market. We are seeing confidence fall from high levels across the board, from confidence in their investments, to the economic outlook, and job security. Most starkly the greatest perceived risk is no longer inflation, or higher interest rates, it’s a home market recession. Just as markets start to worry less about a big economic slowdown, DIY investors are worrying more.

Favouring a ‘barbell’ investment strategy of tech winners and cheap cyclical laggards

They are running a two-pronged ‘barbell strategy’ in response to this. Of still-riding the tech winners that worked so well in 1H, but also looking to scoop up some of the commodity and bank stock laggards. Tech is the most owned sector, by 30% of investors. But the underperforming and cheaper ‘real-economy’ sectors such as banks (favoured by 15%), energy (15%), and real estate (12%) are still popular. The same goes for many regions. With the UK (favoured by 15%) and emerging markets (15%) still very popular.

And there are a lot of country differences! Romanians are most serious investors; Dutch the least

Our survey across 13 markets shows big national differences. For example, Italians first ever investment is typically in bonds, double the global average. Whilst 48% of Australians bought stocks first, the highest proportion globally. Germans (35%) are surprisingly most bullish on tech stocks. Whilst greatest perceived risks vary a lot by country. From inflation in UK (23%), to recession in Germany (28%), and interest rates in Denmark (23%). Romanians are the most serious investors (only 3% invest for fun) versus Dutch (at 29%).

Anatomy of the average investor – young, tech savvy, and investing for the long term

The typical DIY investor is young, tech savvy, and investing for the long term. The average retail investor age is 33 years old, much younger than the median population age that is nearer 40. This is an advantage with time in the market key to compounding gains. 45% of people believe they are on track to achieve their main investing goals of building long term wealth and security, versus only 12% who don’t. Whilst men (48%) are more confident than women (42%), but this does not always equal investment success.

The rising proportion of US household assets in stocks (% of total)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Aggressive Fed interest rate hiking cycle, stubborn inflation, financial sector and debt ceiling concerns accelerating our 2023 view. Of a quicker GDP slowdown, lower inflation, and a peaking Fed interest rate cycle. Will pressure earnings further but also lower bond yields and take pressure off de-rated valuations. We are invested, believing Oct 2022 was the low, and focus on cheap and defensive assets for a faster ‘V-shaped’ market recovery.See our Q2 Outlook HERE |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing but resilient GDP and earnings growth. Valuations led the rebound this year and are supported high company profitability and peaked bond yields. Focus on cash-flows defensives, like healthcare and high dividend. And Big-tech supported by defensive growth, cost cutting, and AI. See gradual ‘U-shaped’ rebound as inflation slowly falls and de-risks market and boosts tech and crypto appetite. |

| Europe & UK | Favour defensive and cheap UK (‘Economies not stock-markets’) and continental European equities. Recession risk easing with lower natgas prices and reopening China with high ‘buffers’ of rising fiscal spending (defence and refugees) and weak Euro (50%+ sales overseas). Even as ECB hikes aggressively. Equities cushioned by lack of big tech sector and 30% cheaper valuations vs US. Banks better capitalised and regulated but loans/GDP much higher. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive China as economy reopens, supports property sector, eases tech regulation pressure. Valuations 30% cheaper than US and markets out of favour. Recovery helps global sectors from luxury to materials. EM needs weaker USD and peak US rates catalyst. |

| Other International (JP, AUS, CN) | Canada and Australia have benefitted from strong equity market weight in commodities and financials, as global growth resilient and bond yields risen. Now could be becoming headwinds. Japanese equities among worlds cheapest with own and China-proxy growth and governance improving but threats of tighter monetary policy and stronger Yen. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Expect better performance as 1) lower bond yields take pressure off valuations and 2) high profit margins and fortress balance sheets make defensive to recession risks. 2) Cost cuts and AI add to growth. ‘Disruptive’ tech much more vulnerable. |

| Defensives | More attractive as recession risks rising and bond yields have peaked. Consumer staples, utilities, (some) real estate attractive with defensive cash flows, less exposed to rising economic growth risks, and with robust dividends. Healthcare is the most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | High risk cyclical sectors – like discretionary (autos, apparel, restaurants), industrials, energy, materials, and small caps – have cheap valuations, many with depressed earnings, and have been out-of-favour for many years. But they are significantly exposed to rising recession risks. Some especially cheap (energy) or see growth recovery (airlines). |

| Financials | Current stresses likely individual not systemic. Post GFC reforms boosted capital and size/speed of authority’s response. But outlook for 1) less GDP growth, 2) lower bond yields and interest rates, and 3) valuation sensitivity after recent surprises, worsens outlook. Insurance and Diversifieds (like Berkshire Hathaway) more defensive. |

| Themes | Dividends and buyback themes attractive with resilient cash flows, rising pay-outs, and investor search for defensives. Power of compounding dividends under-estimated, at up to 1/2 of total long-term return. Small caps pressured by rising recession risk. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ driven by Fed interest rates and ‘safer-haven’ bid. DM currencies hurt by still low interest rates and struggling growth. Strong USD hurt EM, commodities, US foreign earners like tech. But helps big EU and Japan exporters. See a stabler USD outlook in 2023 as near top of the Fed cycle and global risks remain high. |

| Fixed Income | US 10-yr bond yields supported around 4% by higher Fed rate hike and stickier inflation expectations. Set to ease as recession risks slowly build and inflation expectations gradually fall. US has widespread to other market bond yields, and headwinds of high debt, poor demographics, and low productivity. 5% bill yields an attractive cash alternative. |

| Commodities | Strong USD and rising recession fears hit commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, Russia supply crisis. Oil helped by slow return of OPEC+. But commodities not to repeat their 2021 and 2022 performance leadership. Gold benefits from safer haven demand. |

| Crypto | Potential ‘surpsise’ after dramatic and early asset class sell-off and later specific risk events from Luna to FTX. See long term asset class development with small size $1 trillion, correlations low, regulation growing, development/catalysts continuing – Ethereum merge to proof-of-stake and coming BTC halving. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Nordics |

Jakob Westh Christensen |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

eToro CLUB members can join our live Weekly Outlook webinars every Monday at 1pm GMT. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.