HEALTHCARE: S&P 500’s second largest sector is down this year, held back by ‘big pharma’ after its large 2022 outperformance. The Inflation Reduction Act hastened pricing worries in the world’ largest market and many are seeing a Covid sales boom payback. A growth bright spot is a new generation of effective weight loss drugs to tackle the global obesity epidemic (see chart). Led by diabetes leaders Novo Nordisk (NVO) and Eli Lilly (LLY), but with others following. It’s a reminder of the sector’s improving growth outlook, from mRNA to AI. As it trades on just a 16x P/E valuation, similar to global equities, but alongside its strong balance sheets and dividends.

GLP-1: Novo and Lilly have built off their diabetes leadership to pioneer the market for ‘GLP-1 agonists’, with brands like Wegovy and Mounjaro. They have been rewarded with outperforming stock prices and premium valuations. These treatments are injected weekly and slow hunger signals to the brain. They are effective in cutting weight especially when combined with diet and exercise. Other big names with products in the market or in late trials include Amgen (AMGN), AstraZeneca (AZN), Pfizer (PFE) and Sanofi (SNY). The category will keep growing as new products are launched, alongside regulatory approvals and broader insurance acceptance.

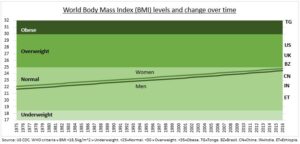

OBESITY: The average adult has a body mass index (BMI) near the World Health Organisation (WHO) definition of overweight at 25. This has been inexorably rising for years alongside global incomes and living standards. The Pacific, Middle East, US, UK, and Australia already have well-above average BMI levels, with Africa and Asia rising but still below average. Estimates are that over 2.6 billion people worldwide can be defined as overweight today. This is set to rise to 4 billion over the next decade, and drive a $4 trillion annual economic cost, equal to 3% of GDP.

All data, figures & charts are valid as of 16/05/2023