HEAT: Temperatures have soared as climate change is boosted by a growing El Nino. Weather seasonality has long been a driver for some. Like travel stocks or pool supplies (POOL) in the summer. And ski resorts (MTN), road salt (TORO), and warm jackets (MONC.MI) in the winter. Newer is the steady rise and regularity of extreme weather events. This is a structural boost to renewable energy themes, like solar and wind. See @RenewableEnergy. But also to seasonal stocks that benefit from weather extremes. Like natgas, HVAC, generators, home improvement, and auto repair. Our related 18-stock basket has significantly outperformed, led by solar. Whilst perceived short term losers, like ag and insurance, benefit from longer term higher prices.

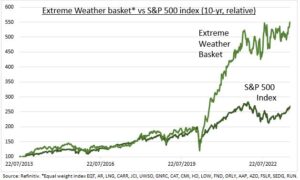

BASKET: We made a simple-weighted basket of six stock segments seen as beneficiaries of extreme hot or cold weather. Like natgas for cooling and heating (EQT, AR, LNG), HVAC air conditioning and heating (CARR, JCI, UWSO), back-up generators (GNRC, CAT, CMI), home improvement (HD, LOW, FND), auto repairs (ORLY, AAP, AZO), and demand for renewables like solar (FSLR, SEDG, RUN). Solar led the basket’s big outperformance since the pandemic trough (see chart). This has continued as this year’s weather disruption has taken centre-stage.

IMPACT: The world is on track for new temperature records this year. Whilst half the most costly weather catastrophes have come in the past five years, and the number of high-impact events is steadily rising. The effects of this are manifold. From the difficulty of working outside and healthcare costs all the way to lower stock market volumes for the desk-bound. From pressures on electrical grids and hydro and nuclear availability to travel and tourism disruption. To supply impacts from cocoa to orange juice commodities, to their inevitably higher prices.

All data, figures & charts are valid as of 25/07/2023.