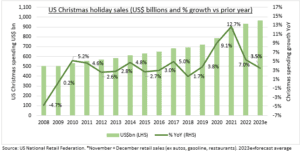

The key Christmas consumer spending test is about to start, and looking positive

The resilience of the US consumer has been the biggest positive surprise of the year, and single-handedly squashed near-term recession talk. We are now entering the strongest spending period of the year when retailers make most of their profits. At a time when pressures on the consumer have been mounting. The economy is cooling not collapsing. Consumers estimated to spend an average $875 on Christmas, up a solid 3-4% on last year, but more focused on sales and promotions and cutting back elsewhere. That’s good enough for now. Gift cards and online the Christmas winners. @ShoppingCart, @FashionPortfolio.

Consumer spending is the biggest driver of the economy, and staying resilient

Private consumption is the biggest driver of the economy. Accounting for 68% of US GDP, 60% in UK, 53% in Japan, 51% in Germany, with China the global laggard. The combo of tight labour markets, now falling inflation, and residual pandemic savings has kept them firmer-for-longer. Even as headwinds mount, from creaking labour markets to resetting mortgages and student loan repayments. The recent 12% fall in US gasoline prices has come at the right time, equal to an annualised $60 billions of consumer savings.

Christmas spending focused on gift cards and clothing, totalling $875 each in US

The US National Retail Federation see’s Christmas season spending growth easing to 3-4%. This is slightly below the long-term average 4.9% rate. US shoppers are starting early, but the long Nov. 23rd Thanksgiving weekend is the traditional kick off, where 200 million shopped last year. An estimated 70% of Christmas spending is on presents. This is surprisingly led by gift cards, with 55% aiming to buy. This will be music to the ears of many retailers, with history showing around 10% are never cashed. Whilst card processors like Fiserv (FI), PayPal (PYPL), and Square (SQ) may benefit. Next most popular presents are clothes/accessories (49%), books/media (28%), and then personal care (25%). Electronics ranks a surprisingly low 5th, jewellery 7th, and sporting goods 8th. The remaining 30% of spending is on festive decorations, candy, and food.

Online is leading growth, with penetration low and consumers becoming more cost conscious

The most popular Christmas spending venues is online (58%), where spending is seen growing double the Christmas average, and US penetration remains a third the level of China, This is followed by department store (49%), and discount stores (49%). All a potential tailwind for segment leaders like Amazon (AMZN), Macys (M), and Dollar General (DG). Consumers are prioritising Christmas spending but showing signs of pulling back. 62% are now focused on sales and promotions this year, and 36% plan on cutting back in other areas to compensate. This is consistent with recent retail sales trends showing more price sensitive and down trading consumers. Pulling back from many bigger ticket and credit sensitive.