Summary

Buckling up for another volatile quarter

Q1 saw a January surge but later Fed and banks headwinds. 2022 losers led recovery, from crypto to tech, as commodities and dollar lagged. In Q2 see renewed inflation fall, peaked interest rates, still smouldering bank crisis, looming US debt ceiling, and usually worse seasonality. We are positive. Our 2023 playbook turbocharged by a sharper slowdown but nearer recovery. Focus on defensives and big tech. Cautious earnings and growth sensitive cyclicals, commodities, small caps. We think Oct. 2022 was the low.

Stocks resilient to Bank and Fed concerns

Stocks resilient to more bank contagion after UBS bought CS. Whilst Fed and BoE ‘dovish hikes’ showed near end of rate upcycle. Dollar fell and US 10-yr bond yields under 3.5%. More cuts from AMZN to CAN. TSLA soared on debt upgrade. And GME on strong results. Hindenburg targeted SQ. See our 2023 Year Ahead HERE. See video updates, twitter @laidler_ben.

Tighter lending conditions do the Fed’s work

Bank sector concern individual not systemic. But US and Europe lending standards tightened and will accelerate now. Equal to big rate hike, doing Fed’s work for it by other means

No comeback for Quantitative Easing (QE)

Fed’s balance sheet growing again. Is temporary $300 billion bank support and not a QE restart. Fed is compartmentalizing and policy tightening. Similar to BoE in October 2022.

No one’s riding to oil’s rescue

Brent oil has borne brunt of financial contagion fear. Focus now on China reopening demand as neither US petroleum reserve rebuild nor new OPEC+ supply cuts coming soon.

Bitcoin shines again

Bitcoin (BTC) soared 70% this year and our related equity basket 45%. Best performing asset class for 11th time in 14 years.

Crypto holds onto gains above $27,000

Bitcoin (BTC) firm near recent highs as digested 1) huge 70% YTD gains, leading all asset classes. 2) Benefit of the Fed’s 0.25% ‘dovish hike’. 3) Impact of latest SEC crackdown on asset class, as it sued TRON (TRX) related parties and warned COIN again. XRP (XRP) led gains on perceived progress in its long-running lawsuit.

Commodities stabilise after growth shock

Commodity prices saw some stability as global growth fears eased and the US dollar fell. Natgas weak on higher supply and unseasonally good weather. Etoro added European natgas to the platform. Copper rallied as leading buyer China cut bank reserve requirements. Timber was helped by better US housing data.

The week ahead: Q1 end, Inflation, and Banks

1) March and Q1 ends (Fri) as bitcoin leads most assets up whilst commodities fall. 2) Smouldering financials scare on show at US Senate hearings (Tue). 3) Hope for 5th fall in EU inflation, and US PCE (Fri). 4) Earnings from MU, CCL, LULU, BNTX, WBA, ahead of April 14th Q1 kick off.

Our key views: Accelerated macro outlook

Banking fears individual not systemic. But doing Fed’s job for it. Accelerating GDP and inflation slowdown and interest rate peak. See gradual recovery with bumps in road. Slowdown hurts earnings. Less yields help valuation. Focus cheap and defensive assets, from healthcare to big tech More cautious on cyclicals and banks.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 1.28% | -1.66% | -2.74% |

| SPX500 | 1.39% | 0.02% | 3.42% |

| NASDAQ | 1.66% | 3.76% | 12.97% |

| UK100 | 0.96% | -6.01% | -0.62% |

| GER30 | 1.28% | -1.66% | 7.42% |

| JPN225 | 0.19% | -0.25% | 4.95% |

| HKG50 | 2.03% | -0.47% | 0.68% |

*Data accurate as of 27/03/2023

Market Views

Stocks resilient on Bank and Fed concerns

- Stocks stayed resilient on more bank contagion fear, after UBS bought CS. Whilst the Fed and BoE ‘dovish hikes’ show near end of the interest rate upcycle. The Dollar fell and US 10-yr bond yields stayed under 3.5%. Saw more tech job cuts from AMZN to CAN. TSLA soared on debt upgrade. And GME after its strong results. Hindenburg targeted SQ. See our 2023 Year Ahead View HERE.

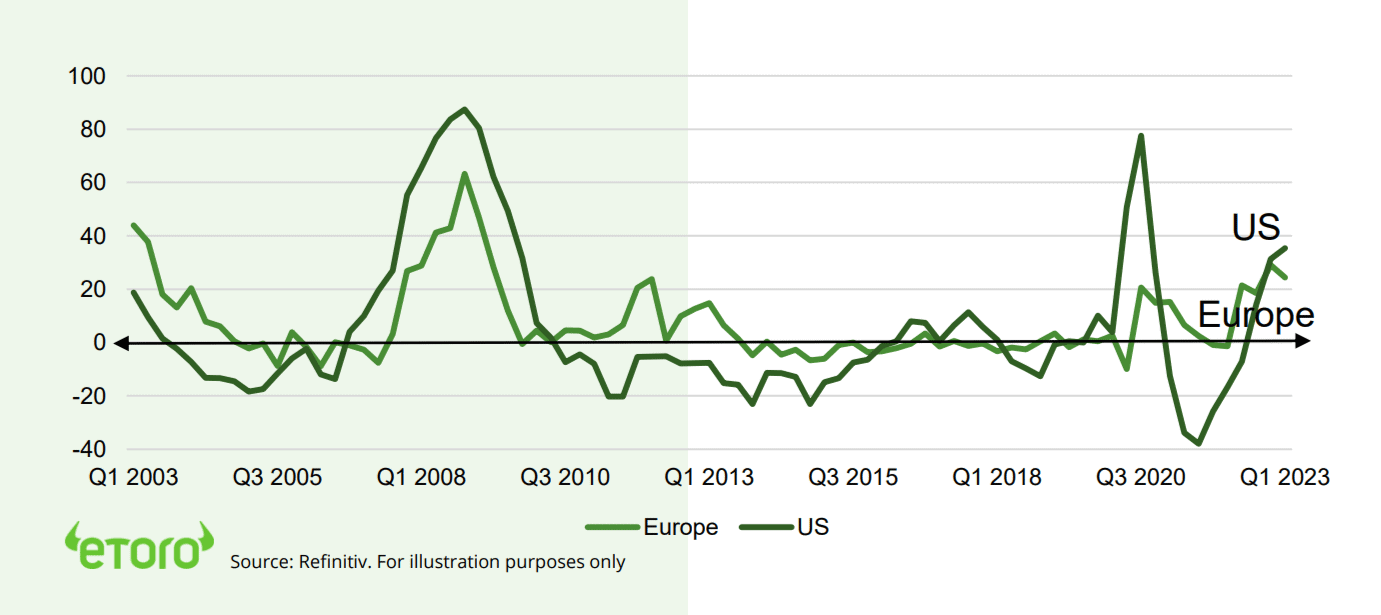

Tighter lending conditions do the Fed’s work

- Current bank sector concerns are individual not systemic. But lending standards on both sides of the Atlantic have tightened a lot, and this will accelerate now. As banks rein back risk and regulators boost their oversight. This tightening of financial conditions is equal to a significant interest rate hike. It effectively does some of the Fed’s work for it but by other means.

- The economy and inflation will now slow faster. Fed’s big rate hiking cycle will end sooner, and cuts start earlier. This week’s 0.25% was near the last. This turbo charges our 2023 view of rising earnings pressure but valuation relief.

No comeback for Quantitative Easing (QE)

- Fed’ balance sheet is growing again. Is temporary, not a QE restart, and policy still tightening. Fed set up in 1913 to prevent bank collapses. Has only set interest rates since 1982. This dual role to keep financial stability and to set monetary policy can conflict. Fed’s $300bn emergency liquidity to financial system seen as a restart of Quantitative Easing (QE), and boost to risk assets. It’s not.

- See UK crisis bond buying example from October 2022. On the contrary, US financial conditions tightening and economic growth and inflation to slow down quicker. Yesterday’s 0.25% Fed hike was another step in this direction. Our 2023 investment view is now being turbo-charged.

No one’s riding to oil’s rescue

- Brent oil borne brunt of global financial contagion fear. Its double-digit percentage price slump nearly matched the stricken banking sector. Contagion fanned GDP slowdown and oil demand fears. This has made commodities the worst performing asset class this year, after leading up in 2021 and 2022.

- We see tighter bank lending accelerating the global growth slowdown. But also the inflation fall and interest rate cuts. This may keep Brent in a new, lower price range. Help from a US strategic reserve rebuild or further OPEC+ supply cuts are unlikely. With hopes pinned on China’s reopening and the continued tepid supply response.

Bitcoin shines again

- Bitcoin (BTC) soared 70% this year and our related equity basket 45%. Crypto world’ best performing asset class, for 11th time in 14 years of existence. Surge came as scare on centralized banking system drove interest in decentralized crypto.

- Also as risk assets helped by outlook for quicker fall in inflation and interest rates. Short covering also played a part. We continue to expect macro to be more important than micro and asset class remain one of the positive wild cards of 2023.

Bank lending standards* to tighten further (Net % tightening)

Crypto holds onto gains above $27,000

- Bitcoin (BTC) held near highs above $27,000 as investors digested 1) the recent huge rally that took YTD gains near 70%. 2) Impact of the latest 0.25% Fed interest rate hike. 3) Impact of most recent SEC crackdown moves in the asset class.

- TRON (TRX) fell as the SEC sued founder Justin Sun and the Tron foundation, amongst others, for fraud in unregistered sale of crypto assets. Whilst XRP (XRP) led gains on Ripple’s perceived progress in its long running SEC lawsuit.

- The SEC also warned exchange Coinbase (COIN) over its exchange and staking services.

Commodities stabilise after growth shock

- Commodity prices stabilised, along with global markets. GDP and demand-related fears from the recent banks scare eased, and the US dollar DXY index fell. The broad based Bloomberg Commodity index is still down 9% this year, and remains worst of all main asset classes.

- Weak natural gas prices a focus. US prices near 2020 lows around $2.3/MMBTU on continued supply increases alongside unseasonal warm weather lowering demand. Whilst in Europe, storage levels are at 56% and well-above average. Etoro added European natgas to the platform.

- Copper rallied as leading buyer China cut bank reserve requirements, boosting growth outlook. Timber soared on less-bad US housing data.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 2.09% | 7.26% | 17.31% |

| Healthcare | 1.26% | -1.14% | -6.04% |

| C Cyclicals | 0.58% | -1.14% | -6.04% |

| Small Caps | 0.52% | -8.23% | -1.49% |

| Value | 0.90% | -4.97% | -5.26% |

| Bitcoin | 3.38% | 19.34% | 67.61% |

| Ethereum | 0.42% | 8.59% | 46.68% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Month end, Banks, Inflation

- Friday marks the end of a March to remember, with the global banks scare, and a volatile but overall positive Q1. With Bitcoin and tech stocks soaring, dollar weaker and commodities plunging.

- The global banking scare is still smouldering as the US authorities consider a further backstop to depositors, and US Senate Banking Committee meets (Tue) to look at causes and Fed response.

- Sticky inflation in focus on both sides of Atlantic. Headline EU price rises est. to ease for 5th time to 7.8% (Fri). While Fed’ favourite PCE prices measure seen falling from its prior 5.4% upside surprise.

- See earnings from chipmaker MU, cruise line CCL, athleisure LULU, biotech BNTX, and drug retailer WBA. Focus shifting to April 14th start of global Q1 earnings season. S&P 500 EPS est. at -6% YoY.

Our key views: An accelerated macro outlook

- Banking sector fears are likely individual not systemic. Bank buffers are bigger now and the authorities response stronger. But this is doing the Fed’s job for it. By accelerating the GDP and inflation slowdown and the interest rate peak.

- See a gradual market recovery with plenty bumps in road. Faster slowdown hurts earnings. But lower bond yields helps valuation. Focus on cheaper and more recession defensive assets, from healthcare to derated big tech. More cautious on assets most exposed to recession risk, like cyclicals, small caps, and commodities. Or lower yields, like banks.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 0.42% | -2.39% | -8.67% |

| Brent Oil | 2.95% | -9.95% | -13.23% |

| Gold Spot | -0.64% | 8.97% | 8.25% |

| DXY USD | -0.57% | -1.99% | -0.39% |

| EUR/USD | 0.87% | 2.04% | 0.55% |

| US 10Yr Yld | -5.42% | -57.68% | -50.33% |

| VIX Vol. | -14.78% | 0.32% | 0.32% |

Source: Refinitiv. * Broad Bloomberg index. * Basis point

Focus of Week: A roadmap for a positive Q2

Buckling up for another volatile, but hopefully positive, quarter as accelerating macro cycle helps

The modest positive stocks performance in Q1 masked plenty of volatility under the hood. With resilient growth, sticky inflation, and a banks scare. We saw a big performance divergence across asset classes, with crypto up over 60% and commodities down 10%. Our 2023 investment playbook has been accelerated by recent bank sector stresses. This will hasten the economic and earnings growth slowdown. Challenging related assets from small caps to commodities. But will also pull forward the inflation and eventual interest rate fall. A benefit for valuations and long duration assets, from bonds to crypto to traditional defensives and ‘big tech’. We remain fully invested, well diversified, and believe October 2022 was the market low.

What happened in Q1: The losers of 2022 rebounded even as macro volatility continued

The modest equity gains seen in Q1 masked a dramatic January rally, driven by less-bad fundamentals and very negative investor positioning. The US consumer stayed strong, Europe’s gas prices plunged, and China reopened. Company earnings stayed resilient in US and saw a big positive surprise in Europe. The reality check came in February as the inflation fall stalled, with services and wages sticky. Before the failure of Silicon Valley Bank kicked off bank crisis fears and pushed economic growth and inflation expectations lower. The quarter saw a big ‘reversal rally’ of the losers of 2022. Bitcoin and tech led performance, as bond yields fell, with commodities lagging, as recession risks rose. Bonds rebounded from 2022 dramatic losses.

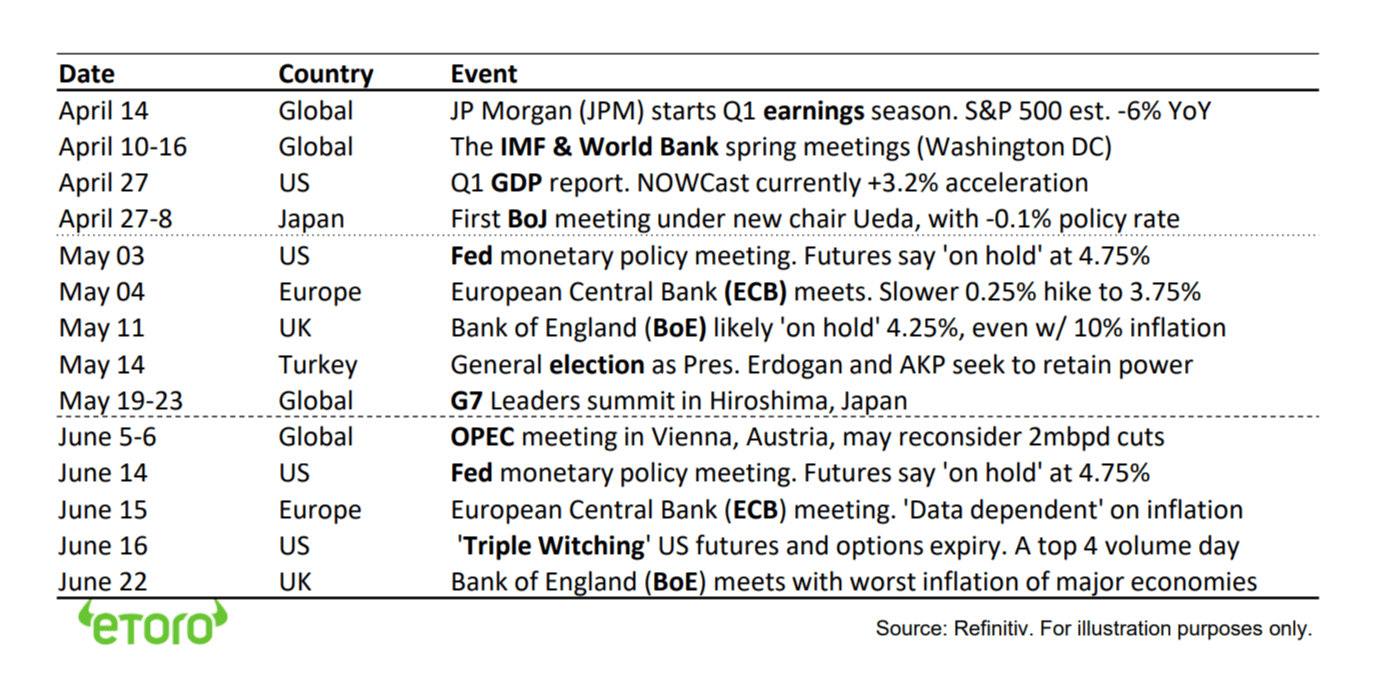

What’s coming in Q2: rate peak, falling inflation, smouldering bank crisis, debt ceiling, seasonality

We expect the Fed, BoE, and maybe even the ECB, to halt their dramatic interest rate rises. This is the necessary first step before eventual rate cuts as soon as the end of this year. The Bank of Japan and its new governor will remain a global outlier. US rate cut hopes will hang on the speed of the inflation decline. We expect this to accelerate as economies and corporate earnings weaken faster with the vice of sharply higher interest rates and now less bank lending. Event risk comes from the still smouldering bank crisis and looming July US debt ceiling deadline. Market seasonality will turn negative (‘sell in May and go away’).

Our 2023 investment playbook is turbocharged. Growth and inflation slowdown to come faster

Further interest rate hikes and now bank sector stresses are likely to accelerate the growth and inflation slowdown and pull forward eventual interest rate cuts. This could be a net positive for forward-looking markets. It will pressure company earnings and sectors most exposed to growth, from cyclicals and small caps to commodities. Whilst restraining bond yields and relatively benefitting traditional defensives, like healthcare and high dividend, and ‘big tech’. Crypto and long duration bonds should be well supported.

The key events to watch in Second Quarter 2023

Key Views

| The eToro Market Strategy View | |

| Global Overview | Aggressive Fed interest rate hiking cycle and stubborn inflation boost uncertainty, recession risk, and hurt markets. We see this gradually fading in 2023, with global growth stressed but resilient, inflation pressure slowly easing, and valuations now more attractive. Focus on cheap and defensive assets for a gradual ‘U-shaped’ market recovery. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing but resilient GDP and earnings growth. Valuations led the market rout, and now at average levels, and are supported high company profitability and near peak bond yields. Focus on cash-flows defensives, like healthcare and high dividend. Big-tech supported by defensive growth. See gradual ‘U-shaped’ rebound as inflation slowly falls and de-risks market and tech/small cap/crypto appetite. |

| Europe & UK | Favour defensive and cheap UK (‘Economies not stock-markets’) and continental European equities. Recession risk easing with lower natgas prices amd reopening China with high ‘buffers’ of rising fiscal spending (defence and refugees) and weak Euro (50%+ sales overseas). Even as ECB hikes aggressively. Equities cushioned by lack of big tech sector and 30% cheaper valuations vs US. Banks better capitalised and regulated but loans/GDP much higher. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. Broader EM needs weaker USD and peak US rates catalyst. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, if global growth resilient and bond yields risen. Japanese equities among worlds cheapest but threatened by tightening monetary policy and stronger Yen with rising inflation and new BoJ governor. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Hurt by higher bond yields and above average valuations. But structural stories with good growth, high margins, fortress balance sheets support some. ‘Big-tech’ attractive new recession defensives. ‘Disruptive’ tech is much more vulnerable. |

| Defensives | More attractive as macro risks rise and bond yields better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | High risk cyclical sectors – like discretionary (autos, apparel, restaurants), industrials, energy, materials, and small caps – have cheap valuations, many with depressed earnings, and have been out-of-favour for many years. But they are significantly exposed to rising recession risks. Some especially cheap (energy) or see growth recovery (airlines). |

| Financials | Current stresses likely individual not systemic. Post GFC reforms boosted capital and size/speed of authorities response. But outlook for 1) less GDP growth, 2) lower bond yields and interest rates, and 3) valuation sensitivity after recent surprises, worsens outlook. Insurance and Diversifieds (like Berkshire Hatheway) more defensive. |

| Themes | Dividends and buyback themes attractive with resilient cash flows, rising pay-outs, and investor search for defensives. Power of compounding dividends under-estimated, at up to 1/2 of total long term return. Small caps pressured by rising recession risk. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ driven by Fed interest rates and ‘safer-haven’ bid. DM currencies hurt by still low interest rates and struggling growth. Strong USD hurt EM, commodities, US foreign earners like tech. But helps big EU and Japan exporters. See a stabler USD outlook in 2023 as near top of the Fed cycle and global risks remain high. |

| Fixed Income | US 10-yr bond yields supported around 4% by higher Fed rate hike and stickier inflation expectations. Set to ease as recession risks slowly build and inflation expectations gradually fall. US has wide spread to other market bond yields, and headwinds of high debt, poor demographics, and low productivity. 5% bill yields an attrative cash alternative. |

| Commodities | Strong USD and rising recession fears hit commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, Russia supply crisis. Oil helped by slow return of OPEC+ supply and Russia 10% world oil supply problems. But commodities not to repeat their 2022 performance leadership. |

| Crypto | Potential ‘surpsise’ after dramatic and early asset class sell-off and later specific risk events from Luna to FTX. See long term asset class development with small size $1 trillion, correlations low, regulation growing, development/catalysts continuing – Ethereum merge to proof-of-stake and coming BTC halving. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Nordics |

Jakob Westh Christensen |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

eToro CLUB members can join our live Weekly Outlook webinars every Monday at 1pm GMT. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.