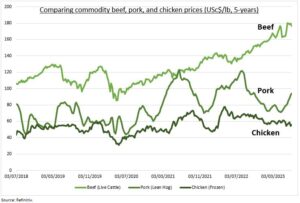

LIVESTOCK: Live cattle (beef) and lean hogs (pork) prices are up double digits this year. Alongside the rally in smaller ‘breakfast’ commodities and in contrast to the 10% fall in the broad Bloomberg commodities index. Cattle prices are at an all-time-high $1.80/lb, up a third in a year, whilst lean hogs are closing on a one year high $1.00/lb. This has stretched the cattle price premium versus hogs to a high 80%, and to a record 200% vs its competition nemesis chicken (see chart). High prices are hurting beef demand among cost-conscious consumers. But helping demand for cheaper pork, whose own supply problems may just be starting. These commodities have performed better than the related stocks, from Tyson (TSN) to JBS and China’ WH Group.

CATTLE: Prices have surged to record levels as US plains drought conditions saw both higher feed costs and lower herd sizes, heading into the peak summer ‘grilling’ season. The US Department of Agriculture (USDA) forecasts a 4% fall in beef production this year, and more for consumption. The market may be set to slowly rebalance as drought and feed conditions ease back. But alternative proteins like cheaper pork and especially chicken are gaining further ground. Per capita chicken consumption continues to soar, and is more than double that of declining beef, even as the threat from struggling plant and lab-grown protein seemingly eases.

HOGS: Pork prices have also risen and could go higher as supply tightens. US supply is being pressured by higher corn feed costs and the increased slaughter of breeding sows today is storing up future shortfalls. New California welfare regs are adding to cost pressures. Demand is helped by the widening price discount to beef driving substitution for mixed products like sausages and hot dogs. There is also increased demand from the biggest pork importer China.

All data, figures & charts are valid as of 05/07/2023.