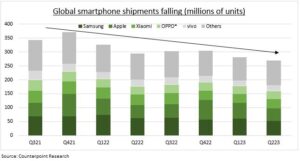

CATALYST: Apple’s (AAPL) Sept. 12th iPhone 15 launch has big implications far beyond the world’s largest stock, where phones are half of sales. Revitalizing the falling smartphone market would be felt across its 200-company supply chain, lagging US mobile giants, and the coming ARM IPO. Global phone shipments have been falling for two years, with penetration high, replacement cycles lengthening, and differentiation difficult. Apple’s premium segment has been the sole exception and dominates industry profits. Hope is a new product combined with lower inventories may drive an upgrade and replacement growth cycle. @5GRevolution, @Fin-Tech.

AAPL & ARM: Apple is second in global smartphone shipments, with a 17% share (see chart), between Samsung (SMSN.L) and Xiaomi (1810.HK). But its c.$1,000 average price allows it to dominate the industry, with 45% of sales and 85% of profit. Driven by increased premiumisation trends and more financing options. ARM was formed in 1990 as a joint venture between Apple and UK’s Acorn Computers. Now owned by Japan’s SoftBank it has nearly 100% of the global smartphone processor market. This gives it a huge market but also searching for future growth drivers from AI (it’s in NVIDIA’s new ‘super-chip’) to self-driving cars and cloud data centers.

TELECOMS: There are 5.6 billion mobile users globally, representing 70% the world population. Subscriber growth will now be young and rural, with half from India and Africa. Whilst developed markets are saturated with growth focused on expansion of current 20% 5G penetration, that drives take up of mobile services and data growth. Traffic is seen surging by 3x over the next five years as 5G take up drives video streaming and online gaming. US mobile giants Verizon (VZ), AT&T (T), and T-Mobile (TMUS) have suffered from these high capex needs and falling subs growth, making them the cheapest US industry (8x P/E) and the worst performer this year.

All data, figures & charts are valid as of 31/08/2023.