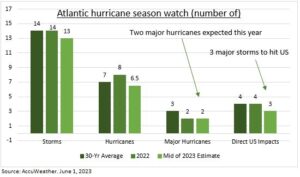

SEASON: El Niño weather conditions are expected to strengthen into the winter. This typically brings widespread weather and agricultural commodities disruption. But one silver lining is an often weaker-than-average Atlantic hurricane season. This runs from June-November, and three major storms are expected to hit the US this year (see chart). It’s an annual threat to US gasoline, LNG, and insurance markets especially. Refiners (MPC to VLO) and LNG exporters (LNG to NFE) are overwhelmingly clustered on the exposed gulf coast. Reinsurers (SREN.ZU to MUV2.DE) are watching Florida, a $1.5 trillion state economy similar in size to Spain or Mexico.

HISTORY: This is after a rare 3-year La Niña drove more active and unpredictable seasons. 2020 saw an all-time-record 30 storms, 2021 a busy 21, whilst 2022 was unusually back-ended on November and outside the usual end August to early October peak. The Louisiana gulf coast accounts for 40% of US refining capacity and was hit by Category 4 Hurricanes Laura in 2020 and Ida in 2021. The gulf coast accounts for three quarters of US LNG export terminals. Whilst Florida is the 4th biggest US state by GDP and worst hit last year. 8 of the 10 costliest global natural disasters by insured losses are US hurricanes. 2022’s Ian ranked second at $53 billion.

IMPACTS: US gasoline, LNG, and insurance markets are the investor focus. 1) The gasoline market is tight and exposed to any disruption, with its price premium to WTI over 50% and more than double its long-term average, reflecting low inventories and strong consumption. Jet fuel prices are also pressured by peak travel season. 2) Natgas has been very weak but recently shown signs of life. The US is the world’s 2nd largest LNG exporter and volumes seen growing 15% this year. 3) The world’s biggest reinsurers have seen rising rates alongside the increased frequency and severity of natural catastrophes and climate change effects. @InsuranceWorld.

All data, figures & charts are valid as of 28/06/2023.